U.S. Banking turmoil halts NFT hype as DeFi thrives

U.S. Banking turmoil halts NFT hype as DeFi thrives U.S. Banking turmoil halts NFT hype as DeFi thrives

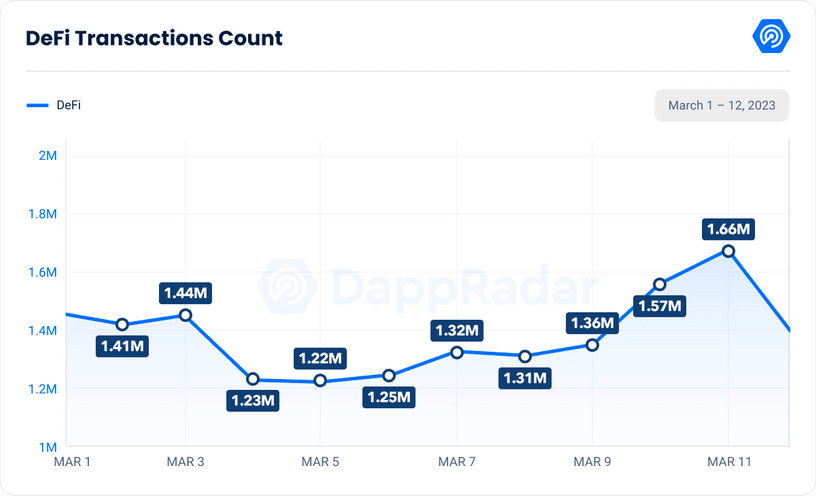

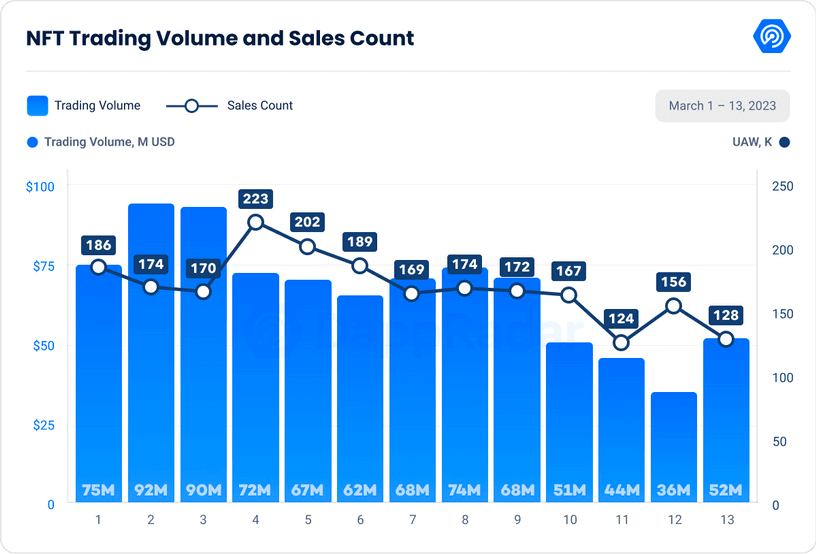

During Mar. 11-12, Defi's transaction volume exceeded $58B, while Mar. 11 recorded least active NFT traders since November 2021.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The recent collapse of the Silicon Valley Bank (SVB) and the USD Coin (USDC) de-peg halted the hype around Non-Fungible Tokens (NFTs) while benefitted the activity on Decentralized Finance (DeFi), as the recent DappRadar report revealed.

During the weekend of Mar. 11-12, DeFi’s transaction volume surpassed $58 billion across all platforms — while Mar. 11 recorded the lowest number of active NFT traders since November 2021, according to the DappRadar report.

DeFi surge

On Mar. 11, after the SVB crash and the USDC de-peg, the Total Value Locked (TVL) in DeFi fell to $71.61 billion from $79.28 billion — marking a 9.6% decrease. The transaction count also increased by 23%, to 1.6 million from 1.3 million.

After the SVB’s USDC reserves were made available to the public on Mar. 13, the DeFi market also stabilized and led the DeFi TVL to grow to $81.15 billion, marking a 13% spike.

The number of unique active wallets (UAW) interacting between DeFi protocols has also recorded a 13% increase between Mar. 8 to Mar. 11, growing to 477,094 from 421,026.

DeFi winners

Among all DeFi protocols, Uniswap (UNI) became the one that recorded the most significant increase in the UAW counts — while 1inch Network (1INCH) won on the trading volume front.

Uniswap’s UAW increased to 67,000 on Mar. 11 from 54,000 on Mar. 10, marking a 24% increase. Its trading volume also recorded a 96% increase, growing to $14.4 billion on Mar. 11 from $7.34 billion on Mar. 10.

1inch Network, on the other hand, recorded a 304% growth in its trading volume, increasing to $3.46 billion on Mar. 11 from the $855 million recorded on Mar. 10. The UAW count of the exchange also grew to 24,100 from 21,600 in one day — marking an 11% increase.

NFTs

The NFT market has been growing at an impressive rate over the past few months. The NFT sphere maintained its resilience during the coldest winter in crypto history and managed to fully return to its pre-Luna crash levels in February.

However, the NFT sphere took a hit from the US banking turmoil. The NFT trading volume recorded a 51% decrease since the beginning of March, falling to the current 128,000 from February’s 156,000.

The number of active NFT traders was recorded as 12,000, which marks the lowest since November 2021. It also recorded the lowest trade count in a single day of the year, with 33,112 transactions.

Interestingly, the banking turmoil didn’t affect the NFT trading volume as much as the trader activity. The report justified this contradiction by stating that Ethereum (ETH) NFT whales have been continuing to farm on Blur Season 2.

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass

Blockchain.com

Blockchain.com

Farside Investors

Farside Investors