Staking frenzy pushes 0x (ZRX) to highest user activity since April, price jumps 14%

Staking frenzy pushes 0x (ZRX) to highest user activity since April, price jumps 14% Staking frenzy pushes 0x (ZRX) to highest user activity since April, price jumps 14%

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The recent infatuation for most in the cryptocurrency market is with DeFi tokens and staking, with the sectors seeing strong growth in both technology and price values since the past month.

Buoyed by the interest is 0x protocol, the open, permissionless protocol that enables the peer-to-peer exchange of assets on the Ethereum blockchain.

Surge in active ZRX wallets

Recent data shows active wallets reached an all-time high in two months since April 2020, while ZRX—0x’s native token—has jumped 14 percent at press time.

On-chain analytics firm Santiment tweeted Friday on 0x’s wallet addresses and the corresponding price bump:

$ZRX is seeing its highest amount of unique addresses interacting on its network in nearly two months as the price has jumped +14.7% in the past 24 hours. When a nearly identical DAA level hit back on May 7th, 2020, the price jumped ~+39% two days later. https://t.co/88SmWfgxsy pic.twitter.com/6nA1IJ8jZx

— Santiment (@santimentfeed) July 3, 2020

The metrics indicate wallet activity on the protocol has bolstered, presumably as public interest in staking application and passive incomes from cryptocurrency holdings grow.

Protocols like Compound and Balancer are leading the pack. The former returned over 800 percent to holders within two days of COMP issuance on June 18, eventually falling to $185-$190 level as on June 4.

Up for the taking is “risk-free” returns of 10-120%. While 0x is nowhere close to such returns—it’s a project not governed by complex eternal factors, such as MakerDAO’s zero-fee DAI sales in March.

After 0x’s beta staking launch in early-2020, holders have three main ways to lend their tokens. Previously, this was possible using some third-party protocols.

Staking frenzy catches on

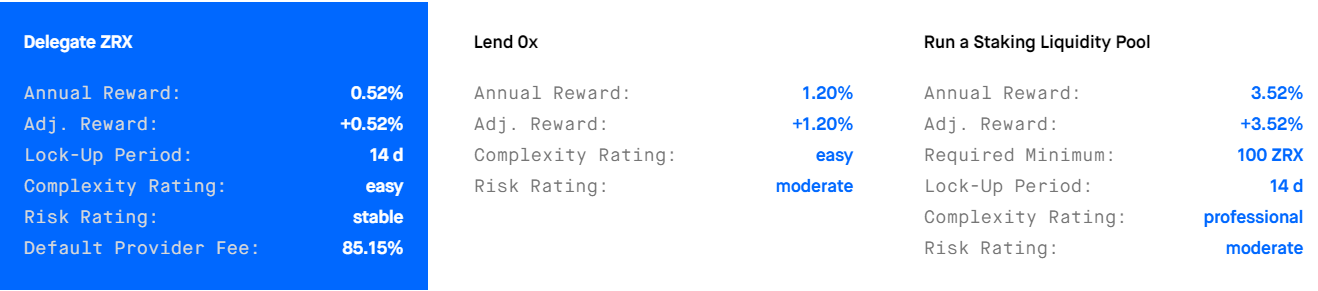

Data on Staking Rewards shows ZRX “delegates” stand to gain an annual reward of 0.51% with a lockup period of 14 days. “Liquidity pool” owners get 3.45% on a similar lockup, with a risk rating of “moderate.”

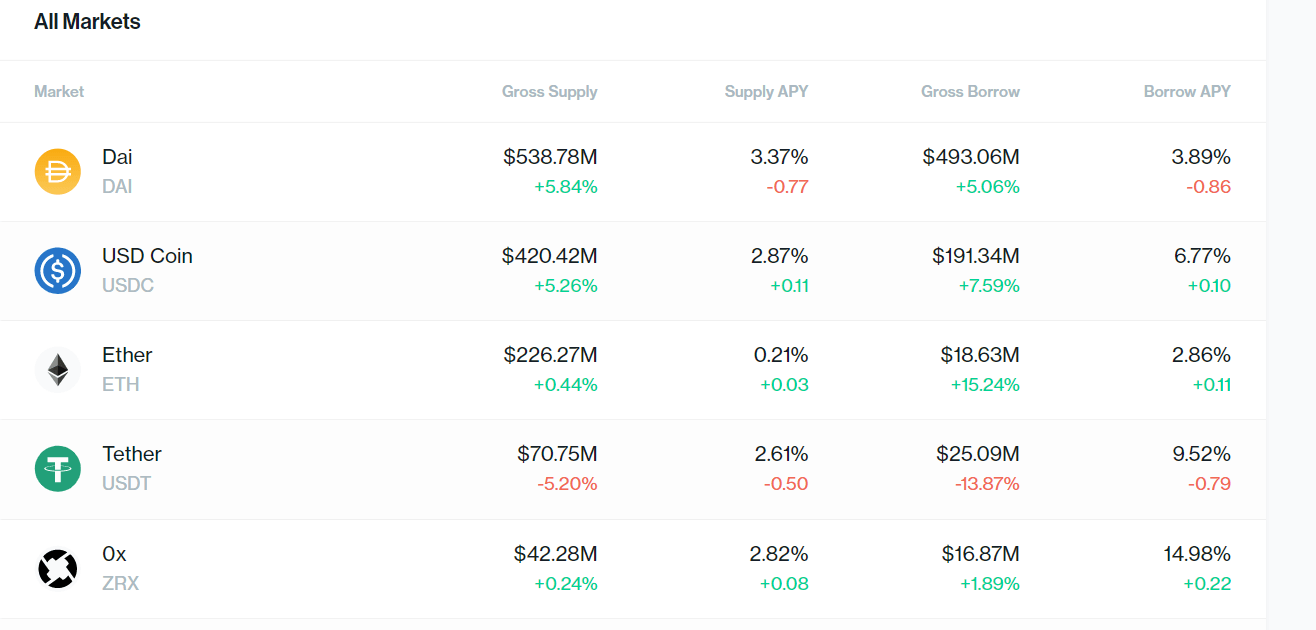

On Compound, ZRX’s gross supply is over $42 million, up 0.4% since Friday. Gross borrow is $16 million, with borrowers charged 14% per annum. The table below shows:

Developers can use 0x as a platform to build exchange applications on top of (0x.js is a Javascript library for interacting with the 0x protocol), as the project notes.

For end-users, 0x will be the infrastructure of a wide variety of user-facing applications i.e. 0x Portal, a decentralized application that facilitates trustless trading of Ethereum-based tokens between known counterparties.

Meanwhile, ZRX is seeing some token selling after a rip above the 34-EMA on July 3. Sellers sold at the $0.42 level, but charts show there might be buyers waiting on the $0.37-$0.38 price band.

0x Protocol Market Data

At the time of press 11:48 pm UTC on Jul. 24, 2022, 0x Protocol is ranked #36 by market cap and the price is up 13.09% over the past 24 hours. 0x Protocol has a market capitalization of $288.9 million with a 24-hour trading volume of $116.44 million. Learn more about 0x Protocol ›

Crypto Market Summary

At the time of press 11:48 pm UTC on Jul. 24, 2022, the total crypto market is valued at at $259.61 billion with a 24-hour volume of $48.3 billion. Bitcoin dominance is currently at 64.31%. Learn more about the crypto market ›