1. Solana Wallet

Connect a Solana self-custody wallet (Phantom, Solflare or Torus).

A weekly recap of key Bitcoin metrics and the macro factors affecting its price performance in the market, published every weekend.

Cover art/illustration via CryptoSlate

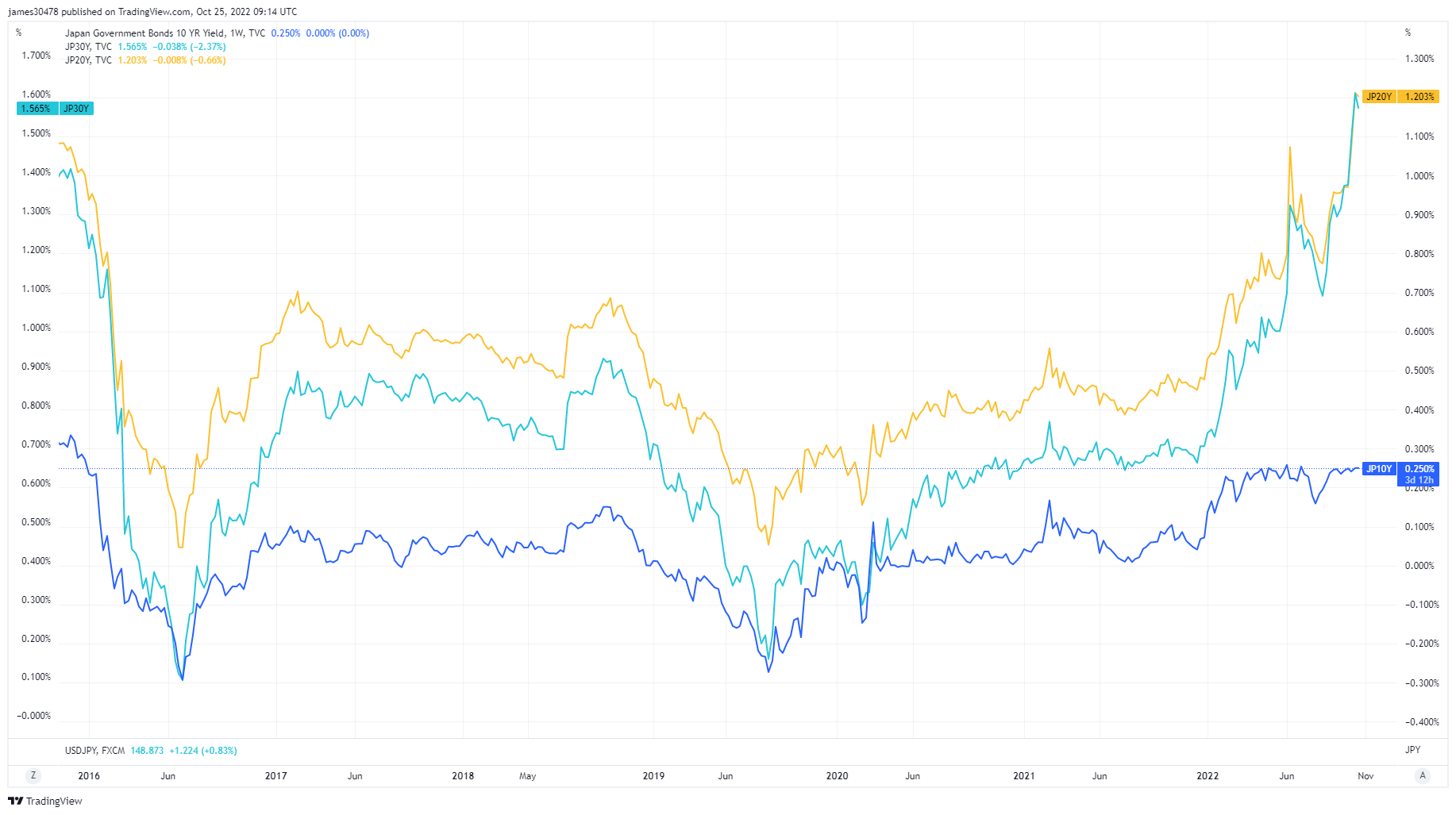

In previous MacroSlate reports, Japan has been at the front and center of discussion and controversy regarding its fiscal and monetary policy.

On October 28, Japan’s CPI inflation rose to 3.5% (YOY) for October, a 31-year high, making life more difficult for the BOJ. The yen sank to a 32- year low against the U.S dollar ¥152 before another round of intervention from the BOJ.

The ten-year JGB yield remains firmly at .25%, but the long end of the yield curve remains unsupported and continues to climb to almost a ten-year high.

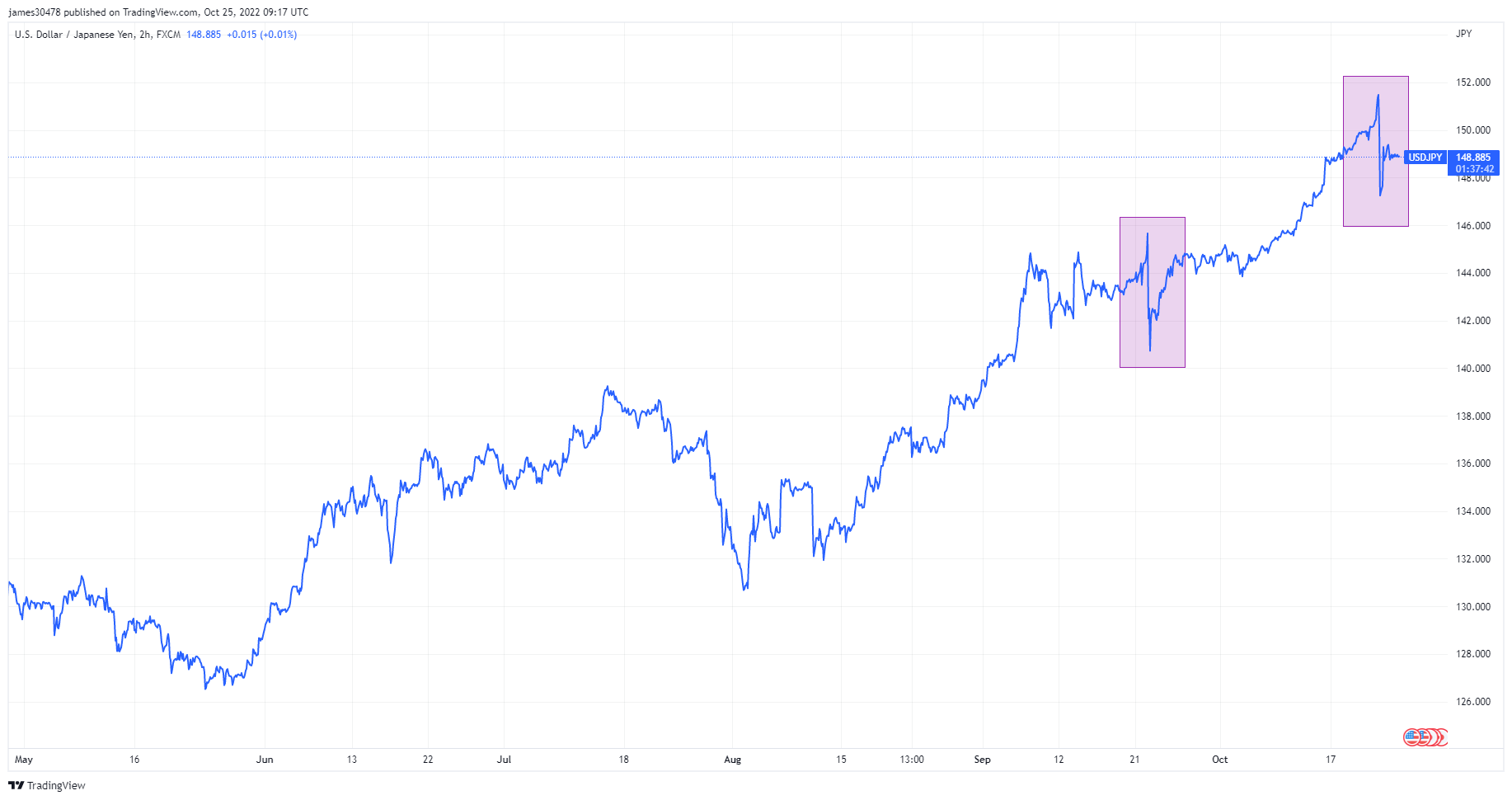

The U.S dollar is up 29% against the Japanese Yen so far in 2022. However, it has been more complex than you might think. The BOJ has thrown $50bn at the JPY to defend its peg, but it doesn’t seem to be doing much good. The above chart highlights where the BOJ has conducted their intervention; back in September, they used $20bn, and on Oct. 21, BOJ used $30bn. Japan currently has $1.2T in currency reserves. Will they continue to deploy resources and continue to witness the failed YCC experiment a failure?

To quantify this experiment, the BOJ has 24 more shots of $50 bn twice a month for one year, and then they’re out of ammo.

Chinese economic data got published the week commencing Oct. 24, while President Xi Jinping achieved a power grab extending his tenure for an unprecedented third term. The yuan continued its slide against the dollar, 7.3 and climbing. The worst daily decline for Hong Kong-listed Chinese stocks since 2008, coupled with a 7% collapse of the HSCEI index.

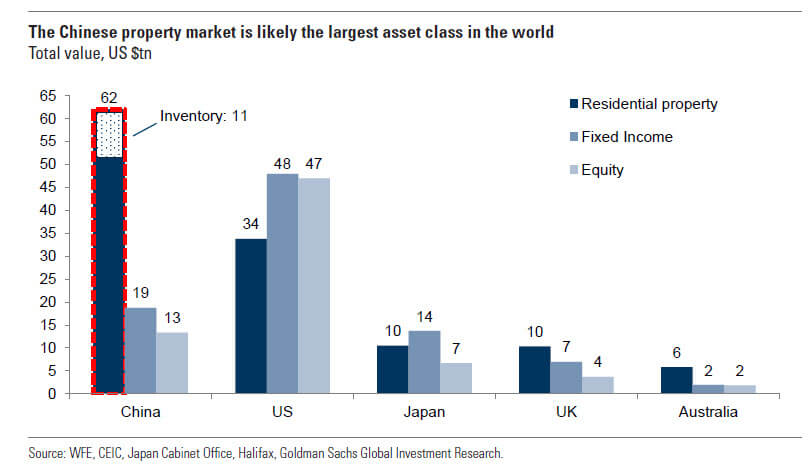

The Chinese real estate market continued its crisis as it still wrestled with covid lockdowns. Real estate collapsed a 29% drop in property sales for year-to-date compared to the same period as last year. However, China will not be able to achieve full-year GDP growth of 5.5%, as they stall at just under 4%.

The Chinese property market is the largest asset class in the world, $62tn, which dwarfs all other asset classes, including the U.S. fixed-income and equity markets. When China’s real estate sneezes, the whole world will feel it.

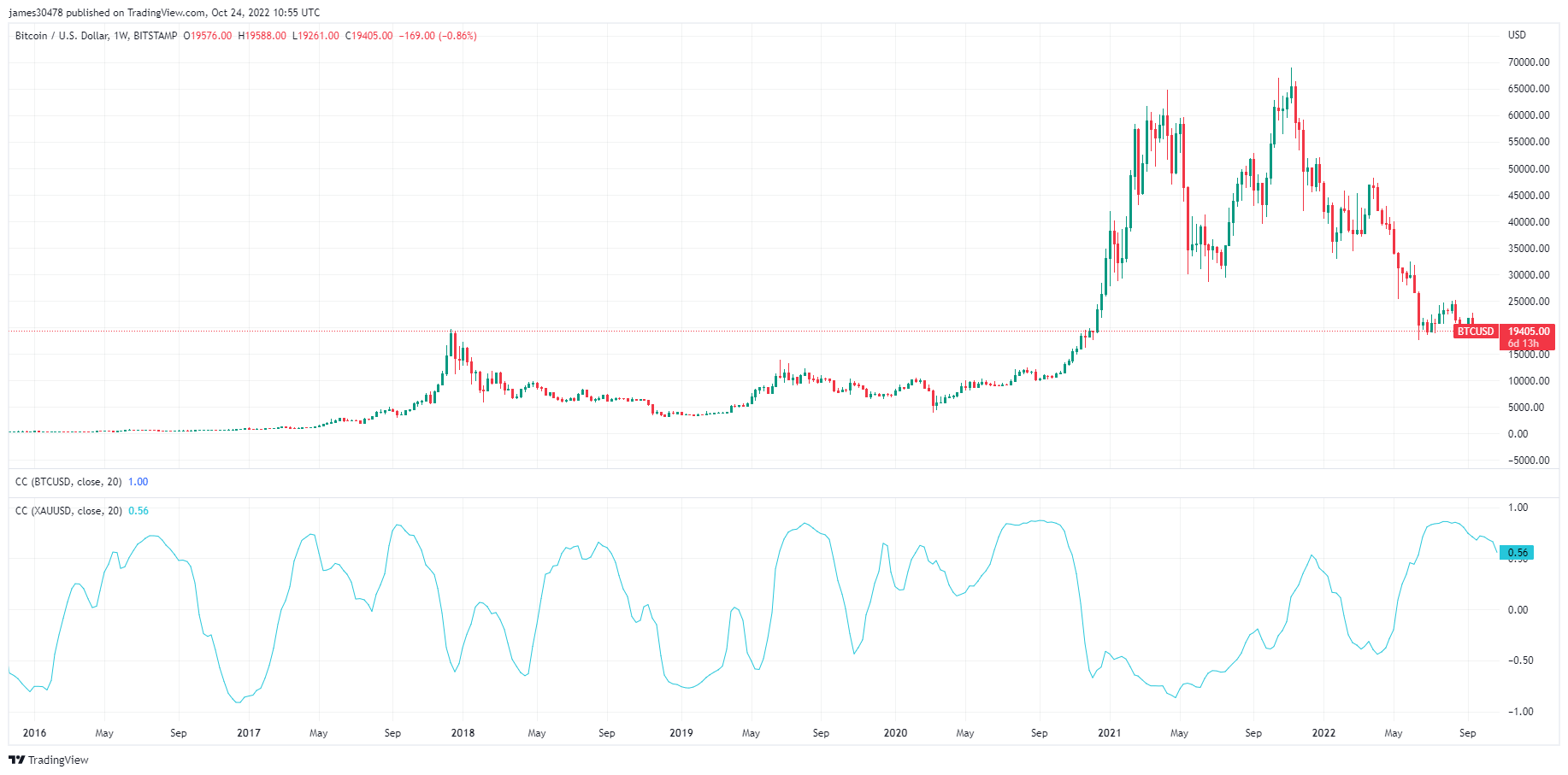

Historical data on the Bitcoin and gold correlation suggests that times of high correlation presage a price bottom for Bitcoin.

The chart below shows Bitcoin’s price against the U.S. Dollar since 2018 and demonstrates the blue line’s correlation rate between gold and Bitcoin.

The chart’s sections showing the price movements in late 2017, July 2018, September 2018, August 2019, January 2020, March 2020, July-October 2020, December 2021, and July 2022 correspond with a relatively high price correlation between gold and Bitcoin.

It was big tech earnings season, the week commencing Oct. 24, and to put it mildly, it didn’t go well. Meta shares plunged 20% after hours after missed earnings, and its fourth-quarter forecast was at the lower end of expectations. Meta was currently 72% down from its all-time high at similar price levels back in 2016.

Meta’s market value has collapsed by $520 billion in the past year and is on the brink of dropping out of the top 20 largest U.S. companies.

Alphabet and Microsoft shares fell 5% and 7% after failing to meet expectations after posting its weakest quarterly revenue growth in five years. While Amazon’s share price plummeted 20% after hours as they had a poor Q3 and saw over $200bn of value wiped out in 5 minutes.

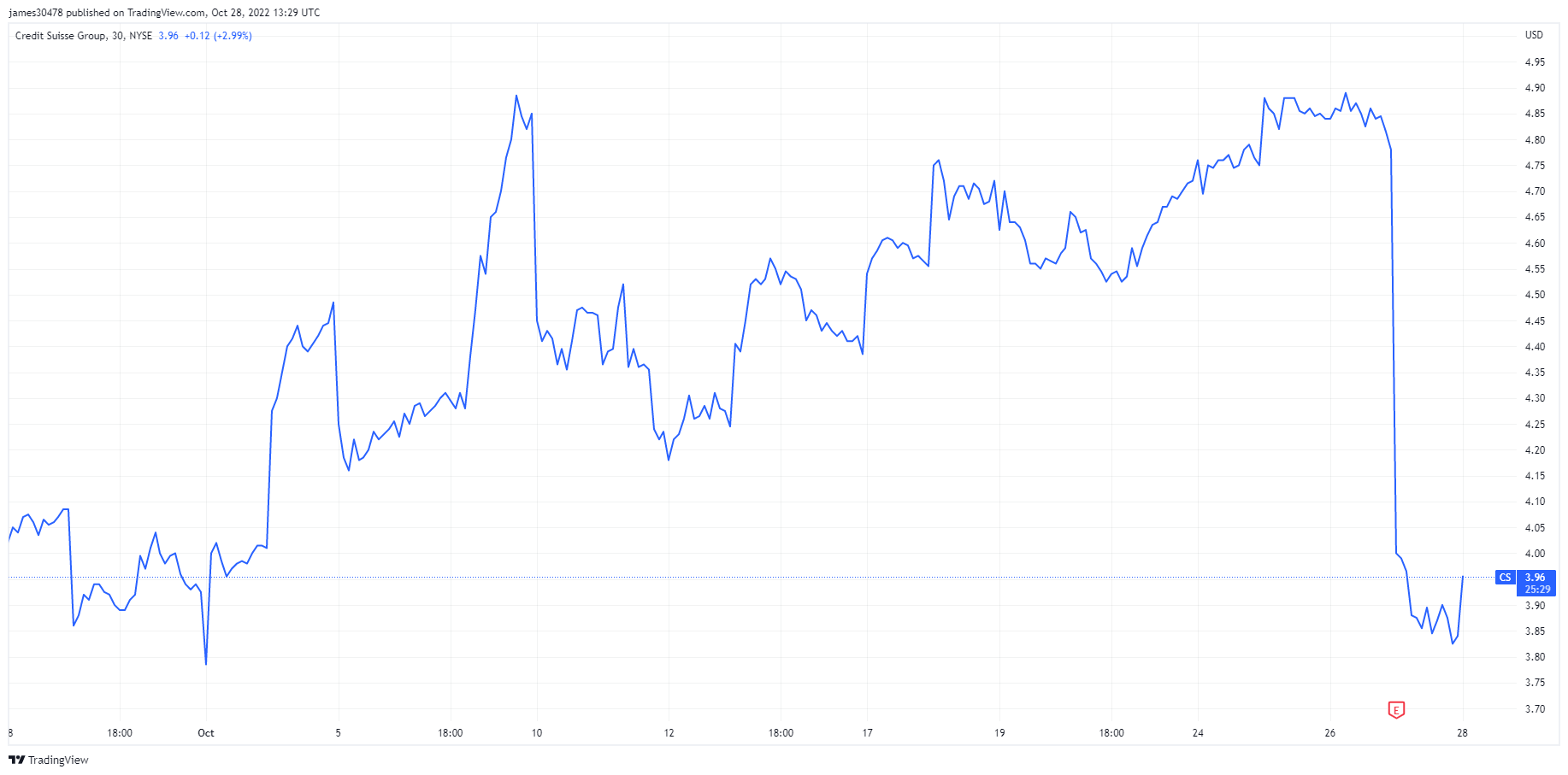

Credit Suisse’s share price tanked 19% on Oct. 27 after a poor Q3 performance. The “radical” and “decisive” senior management proposals for restructuring the bank – which include a capital raise and firing 9,000 employees (17%) of the workforce, had a detrimental effect on the share price, down 19%.

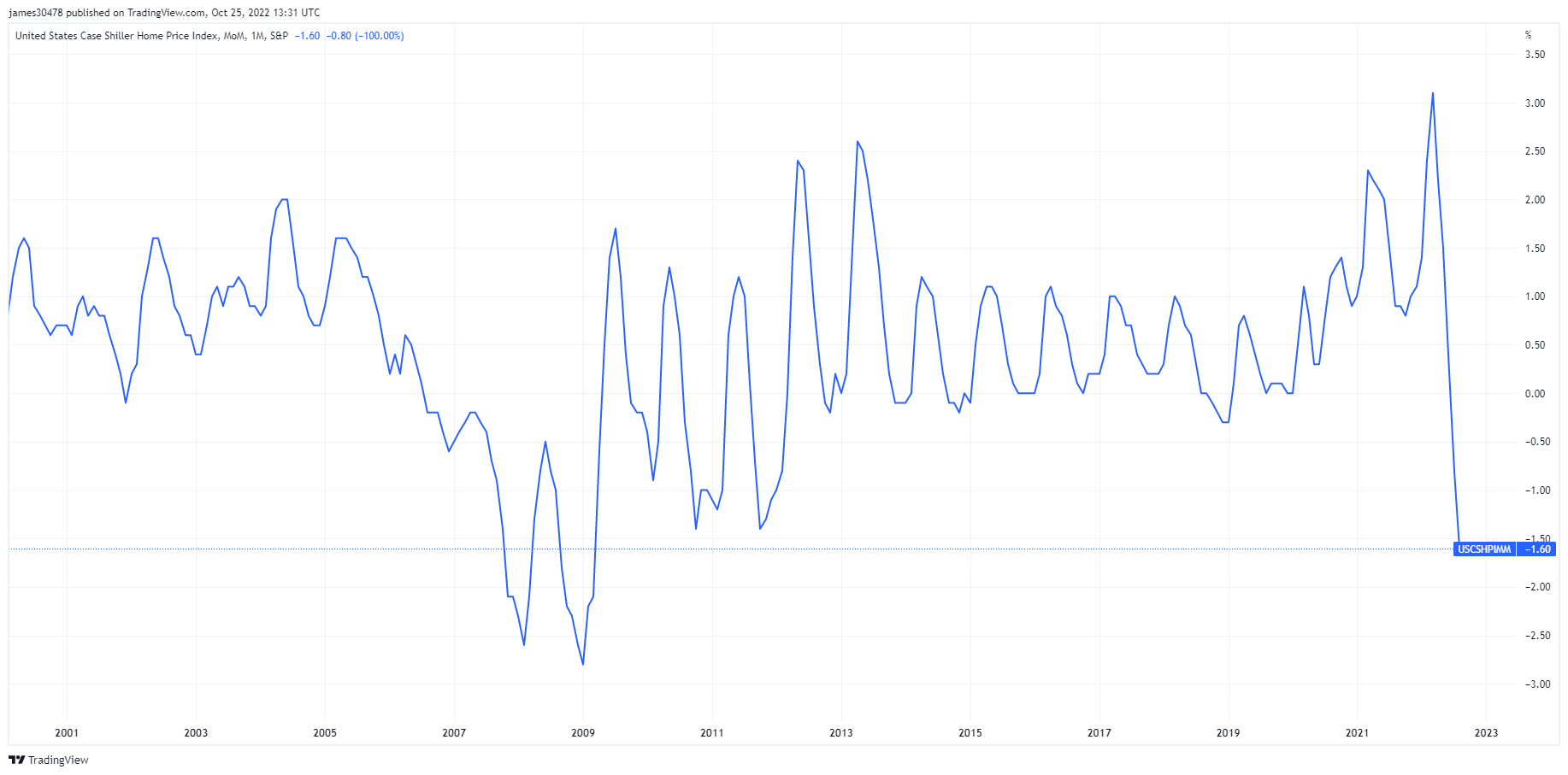

U.S. home prices continue to get hammered and have fallen for the second straight month in August. The Case-Shiller Index suggests that house prices fell by 1.3% in August, the most significant decline since 2009. However, the index is still up +13% YOY, subsequently;

The Case-Shiller data is a lagging indicator, assuming more significant declines are to come.

Rishi Sunak became the U.K prime minister on Oct.24, and some form of stability has been formed in the U.K markets. Significant decline in gilt yields, especially in the longer end of the yield curve, which had many pensions margin called at the beginning of October due to a rise in subsequent years’ tax increases.

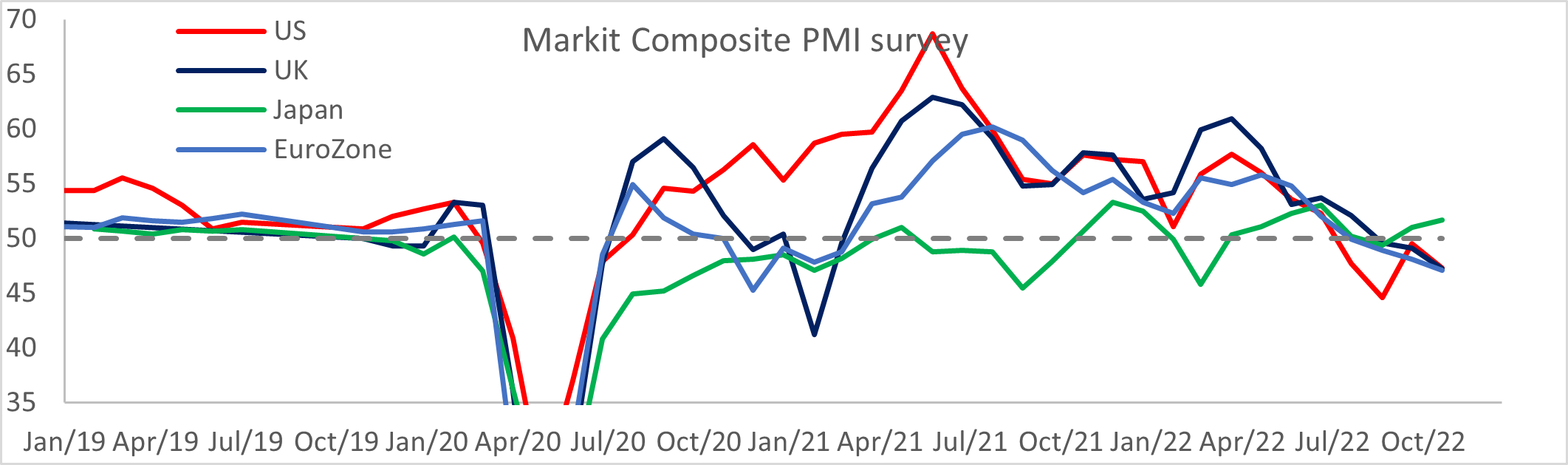

The slump continued in the S&P composite PMI fell to 47.2, signaling a significant contraction for the first time since February 2021, which also sees U.S and Eurozone in contraction.

Markets expect a 75 bps hike for the BOE next week, increasing the base rate to 3%.

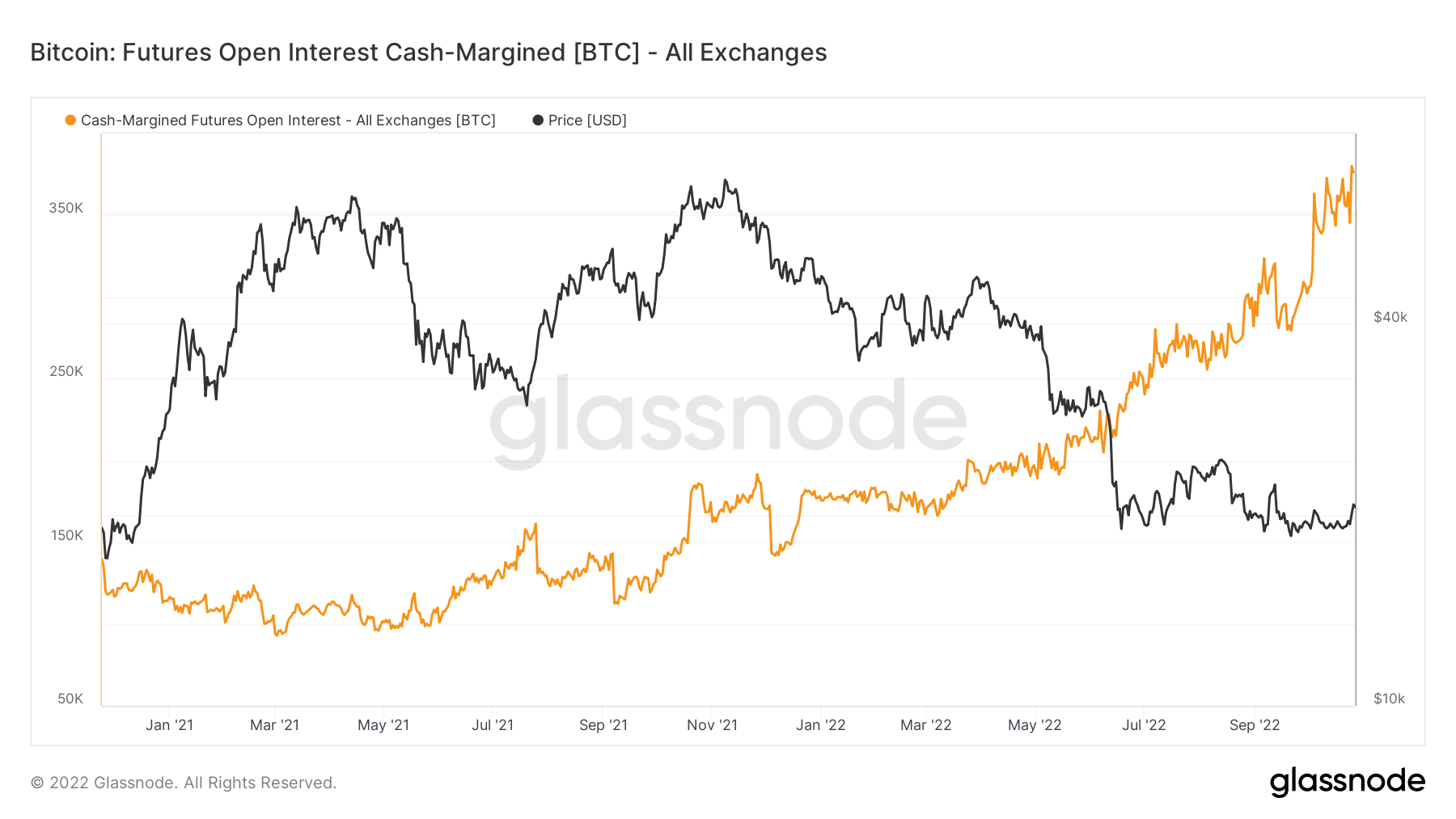

Since the end of September, futures open interest in cash margin (total amount of futures contracts open interest that is margined in USD or USD-pegged stablecoins. Stablecoins include USDT and BUSD) continues to make all-time highs, 380k BTC denominated. Investors are using cash instead of crypto as the underlying collateral is a safer play due to less underlying volatility.

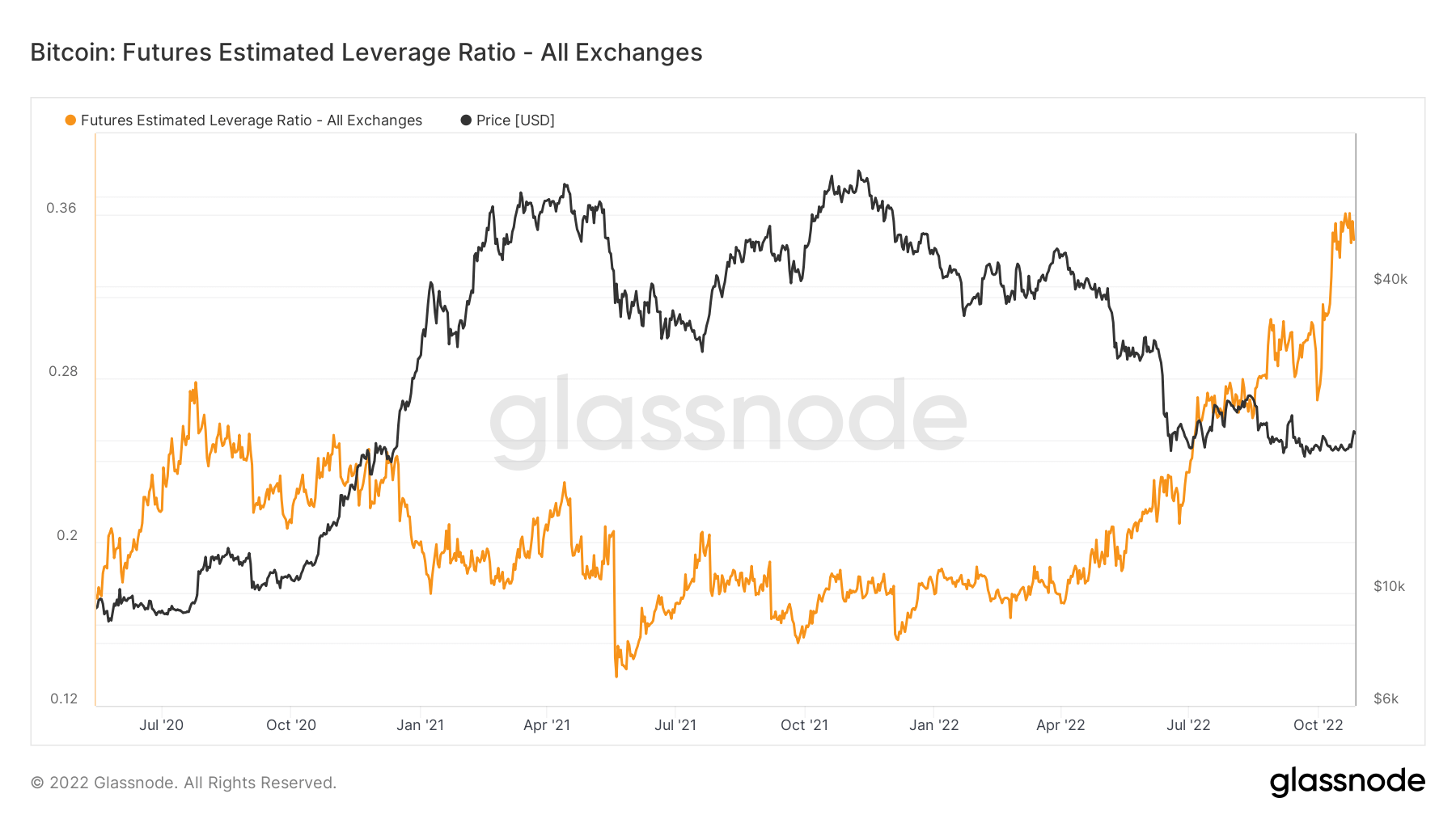

However, this has caused the futures estimated leverage ratio to climb to an all-time high of 0.34, defined as the ratio of the open interest in futures contracts and the balance of the corresponding exchange. A lot of leverage is sitting in contracts that need to be unwound.

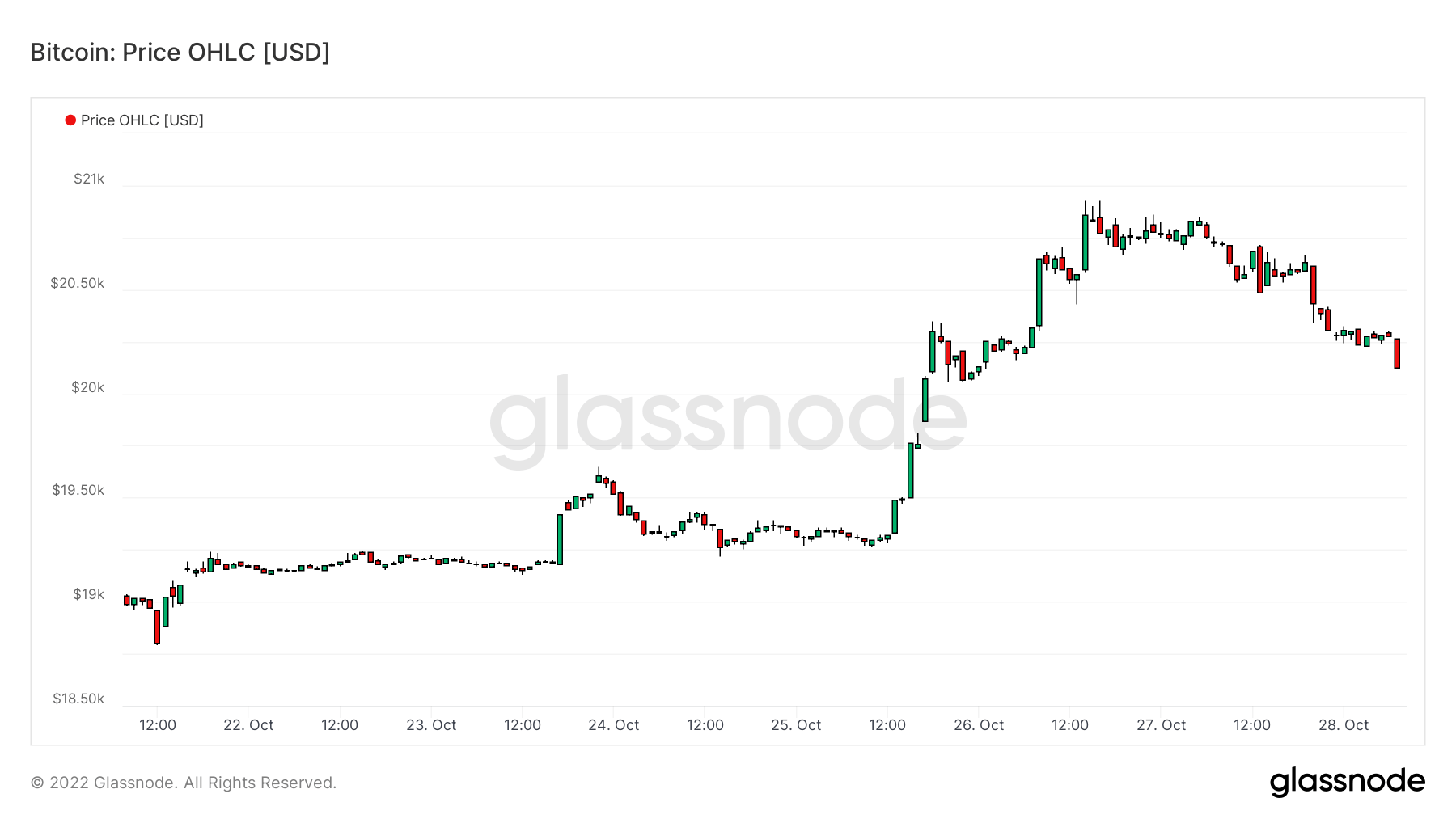

As a result, FTX saw the two largest liquidations in its history. Low volatility and a high-leverage market pushed bears to the worst liquidation event of this current bear market cycle. As of Oct. 25 and 26, the number of liquidations short and long Bitcoin jumped to over $776m in 48 hours, but adding other coins; it saw a total of over $1.5bn.

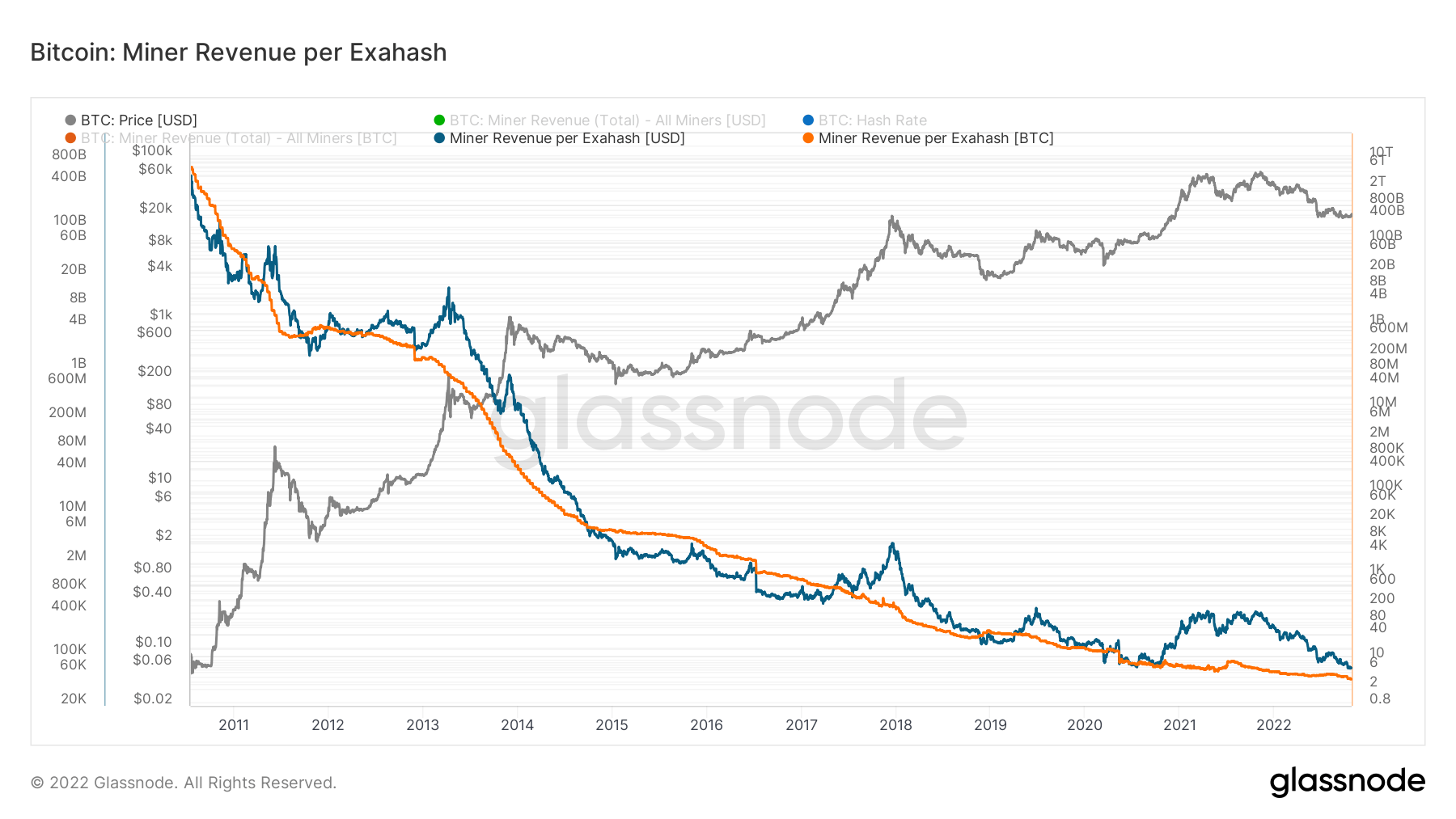

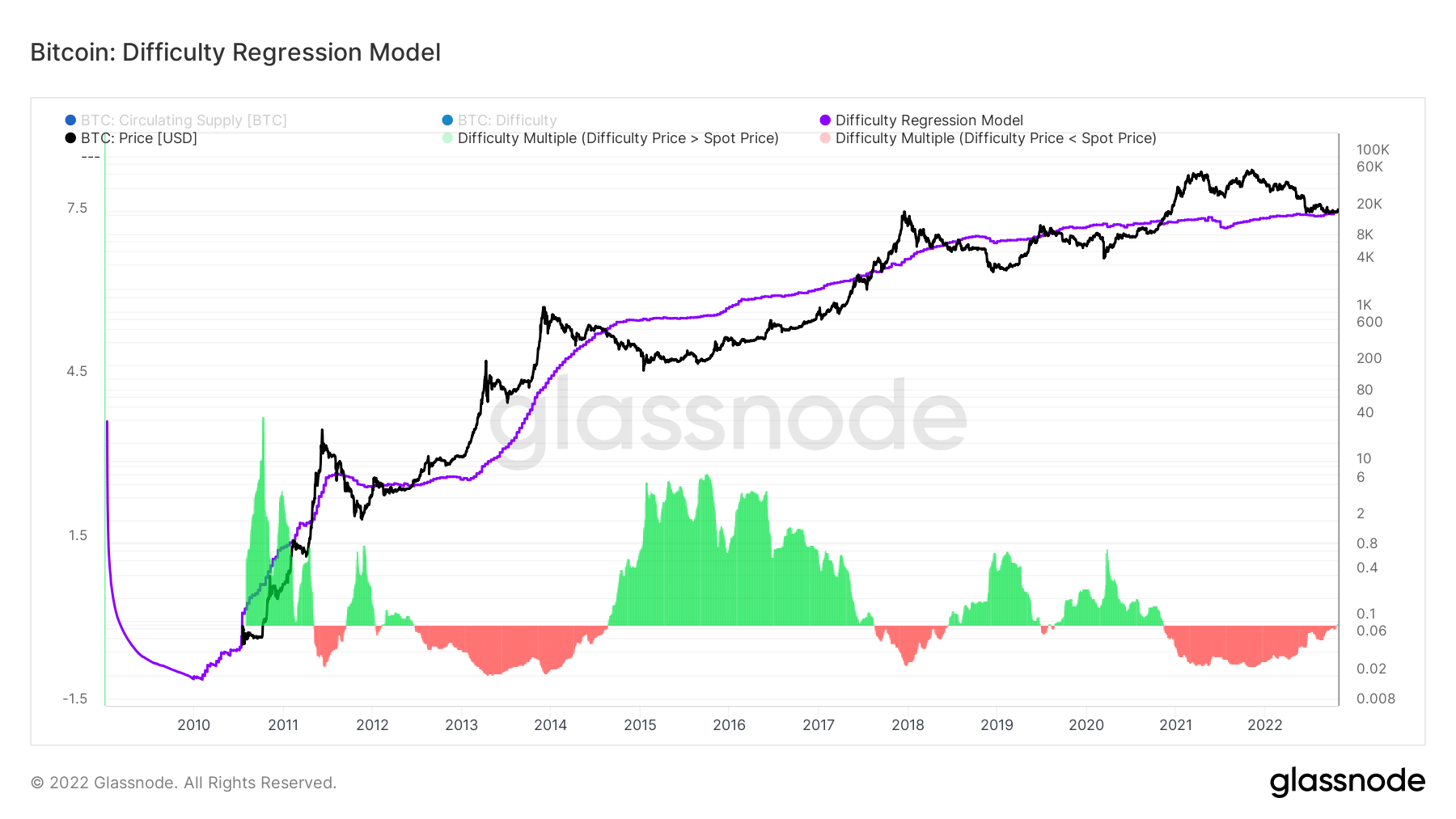

For the past few months, Bitcoin hash rate and difficulty have been soaring, which puts further pressure on miners and their revenue. The hash price is miner revenue divided by hash rate, is at a similar low compared to the 2020 cycle even though BTC is trading roughly double in price it shows that hash rate competition is fierce, and mining is a zero-sum game, survival of the fittest.

To further reinforce the issue for miners, the cost of producing one Bitcoin is becoming more expensive, with hash rate and difficulty continuing to hit all-time highs. The difficulty regression model created by glassnode breaks down all the costs for producing one Bitcoin. Currently, the cost of production is just over $19k. It is similar to 2018, when the price and regression models overlapped, coinciding with a mining capitulation that lasted almost several months.

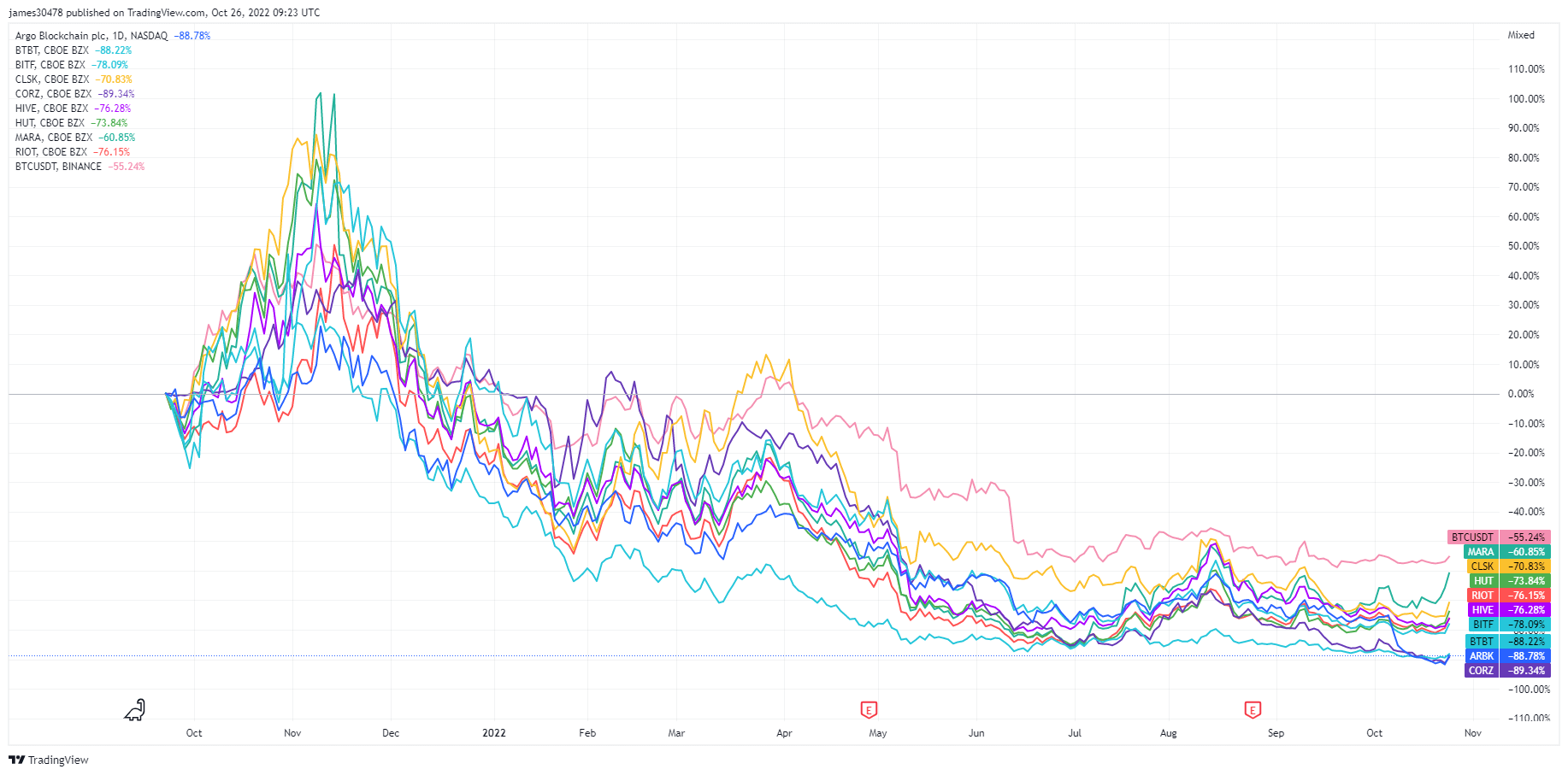

According to an SEC Filing, Core Scientific, one of the world’s largest Bitcoin mining firms, halts all debt financing payments.

“The Company anticipates that existing cash resources will be depleted by the end of 2022 or sooner….” “Given the uncertainty regarding the financial condition, substantial doubt exists about the Company’s ability to continue as a going concern for a reasonable period.”

As of Oct. 26, the company holds just 24 BTC and approximately $26.6 million in cash. This contrasts with September, when it had over 1,000 BTC and $29.5 million in cash.

In its 8-K filing, the company said its board has decided not to make payments due in late October and early November. The prices include equipment purchases, financings, and two bridge promissory notes.

Core Scientific said it explored several potential strategies to resolve insolvency issues. These strategies include hiring additional strategic advisors, raising additional capital, and restructuring its existing capital structure. It will also explore liability management transactions, including exchanging its current debt for equity. Bankruptcy remains a viable option as well, the company said in the filing.

Core Scientific is roughly 90% down from its all-time high; this won’t be the last we hear of distressed miners.

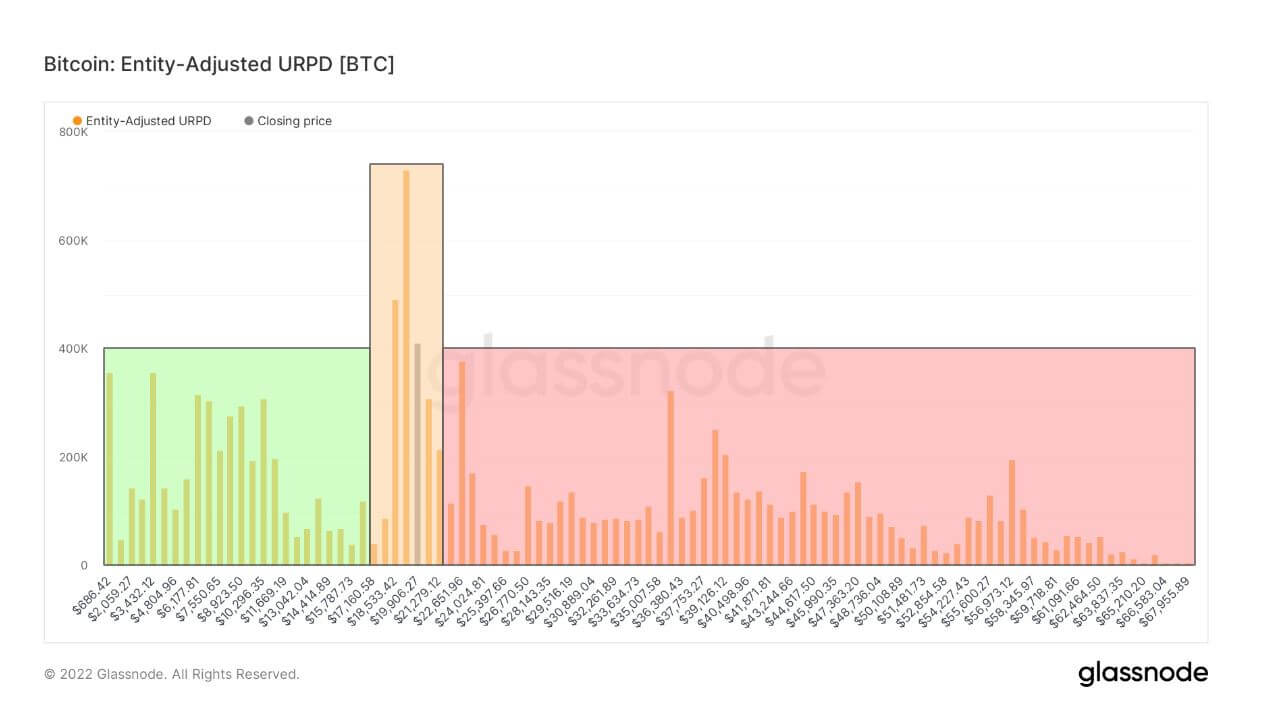

The UTXO Realized Price Distribution (URPD) metric shows the prices at which the current set of Bitcoin UTXOs were created.

Each bar in the chart below represents the number of existing Bitcoins that last moved within the respective price bucket. Being entity-adjusted, the average purchasing price is used for each entity to determine its balance within the specific bucket.

To derive a more representative chart, coin movements between addresses controlled by the same entity are disregarded. Similarly, exchange supply is excluded as a single averaged price for many multiple users would misrepresent the data giving rise to unwanted artifacts.

Investors who purchased Bitcoin at $17,600 or below represent only 25% of token holders, with 14% buying between 17.6k and 22K. Meanwhile, a staggering 61% of token holders were underwater at the market bottom.

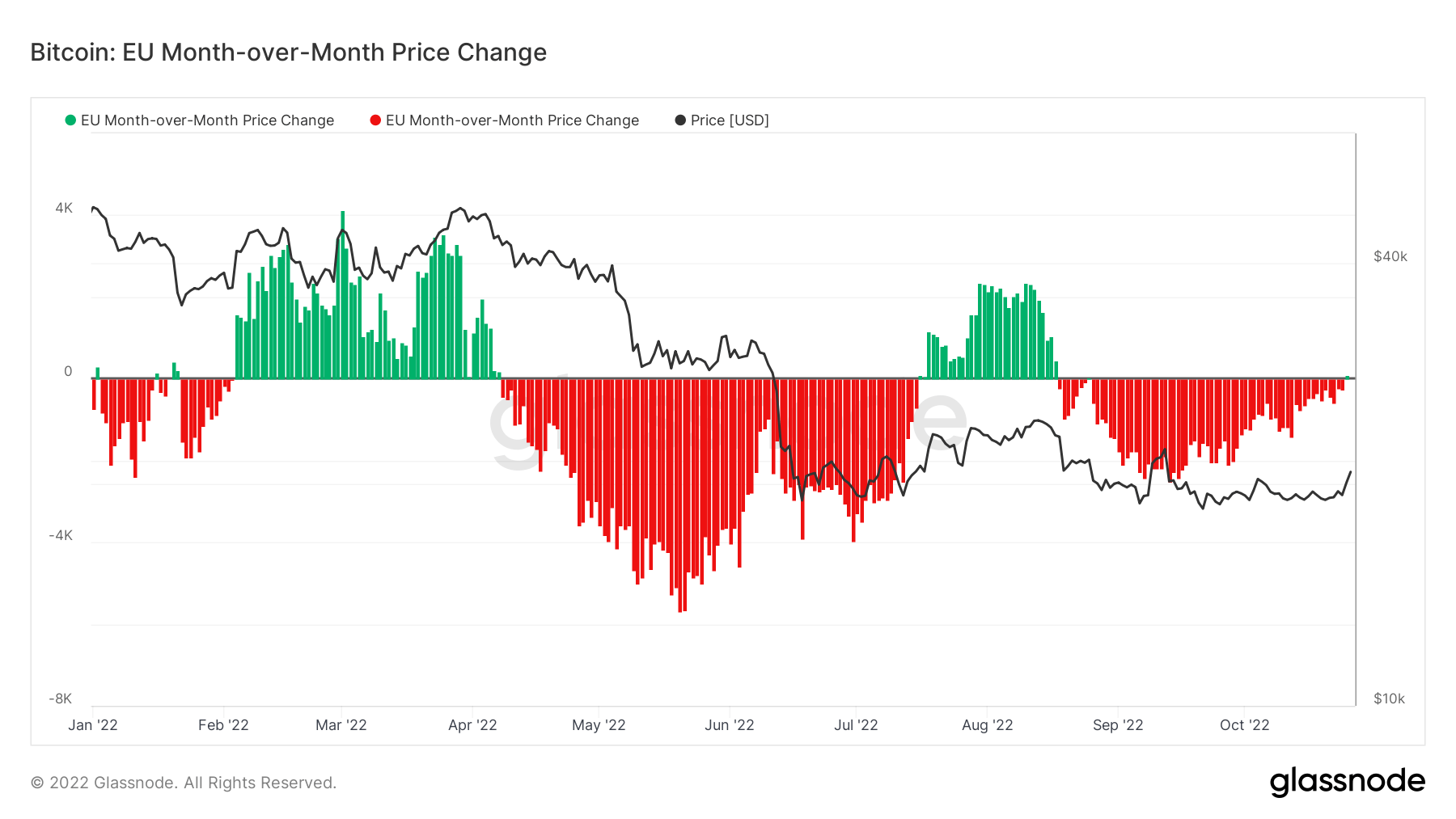

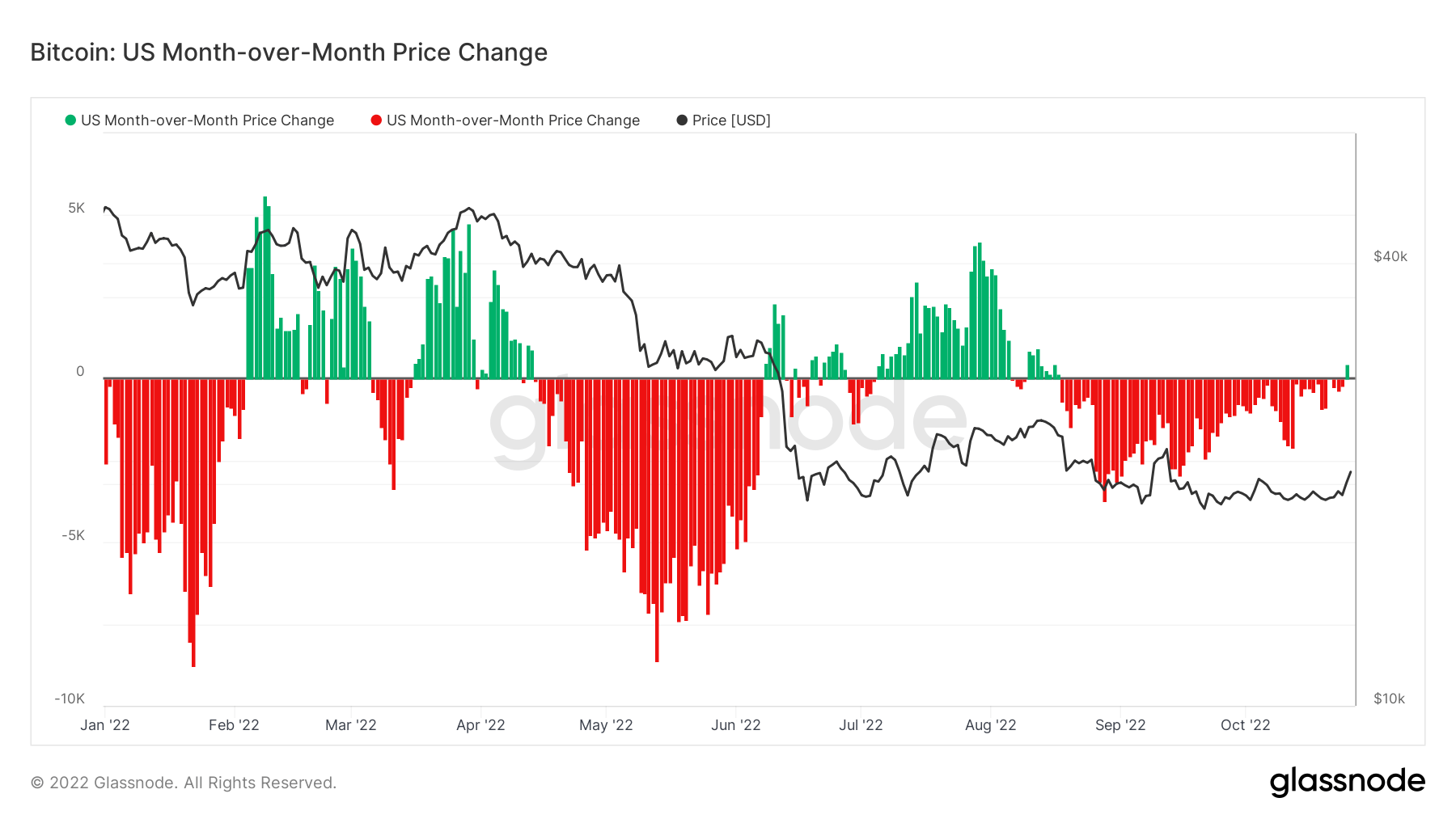

To determine when a market has been “buying” Bitcoin, Glassnode uses its month-over-month price change metric for Bitcoin. This metric shows the 30-day change in the regional price set during U.S. and E.U. working hours.

Regional prices are constructed by assigning regions based on working hours in various markets, such as Europe, Asia, and the U.S. The cumulative sum of the price changes over time is then calculated for each region to show whether traders have been buying or selling Bitcoin.

Bitcoin’s rally could have been a result of a significant increase in buying pressure from the U.S. and E.U. markets, which showed little interest in BTC in the past months. According to data from Glassnode, this is the first time since Aug. 16 that the U.S. and E.U. have bought BTC.

Historically, increased buying pressure in these two markets has correlated with price rallies.

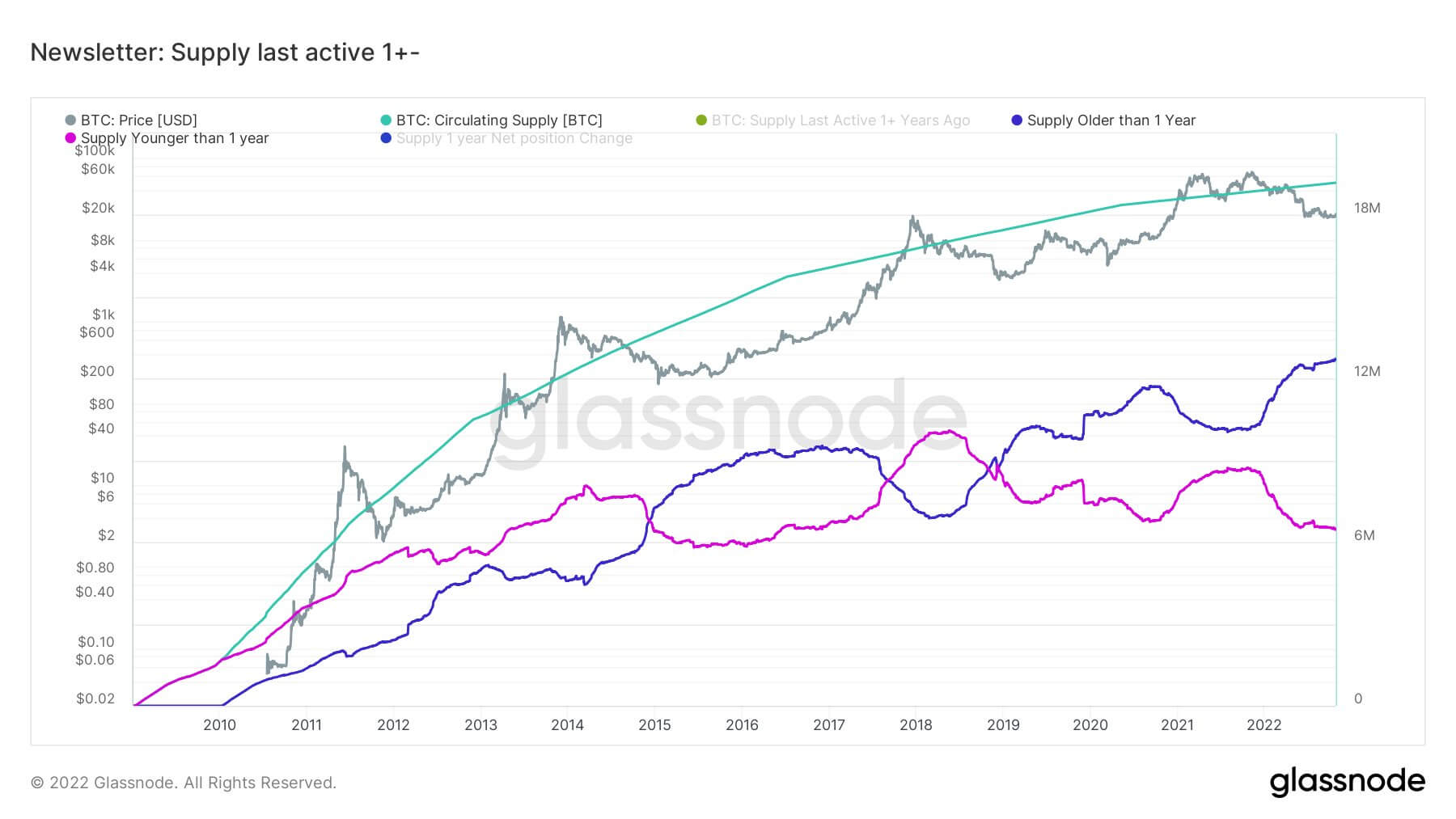

During bear market cycles, long-term holders are the smart money of the Bitcoin ecosystem; they accumulate while Bitcoin is deemed good value. As you can see, during bear markets, long-term holder supply grows while short-term holder supply diminishes as they usually come for number go up technology.

The peak of 2021 was slightly different from the blow-off top of 2013 and 2017, as Bitcoin didn’t get a blow-off top as short-term holder supply didn’t go above long-term holder supply. This could be due to the fed artificially intervening in the market during covid to distort this cycle, and if the fed were to reverse course and start with QE again, we could see a blow-off top. Notice the gap between LTHs and STHs is growing, which occurs in every bear market cycle.