Lido adoption surges with 10,000 new stakers despite Ethereum’s price struggles

Lido adoption surges with 10,000 new stakers despite Ethereum’s price struggles Lido adoption surges with 10,000 new stakers despite Ethereum’s price struggles

Lido detailed how the Curve Finance exploit impacted its project.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

More than 10,000 new stakers joined Lido (LDO) in July, according to the latest report from the liquid staking protocol, indicating its continued adoption and growth despite the current market situation.

In July, Lido’s TVL briefly exceeded $15 billion for the first time since May 2022 but fell below the benchmark due to Ethereum’s (ETH) price struggles.

Over the preceding month, the value of Ether underwent a modest decline of approximately 3% to $1,815 as of press time, according to CryptoSlate’s data. This price correction emerged as the initial enthusiasm within the crypto market, fueled by a bullish streak in June primarily driven by institutional investors, gradually subsided.

Even though Lido’s TVL experienced a decline from its impressive $15 billion benchmark, it retains its position as the foremost DeFi protocol. Notably, Lido continues to command a substantial 36% share of the aggregate TVL encompassing all DeFi projects.

Predicts staked Ether to grow beyond 8M

The DeFi protocol predicted that the total number of staked Ethereum via its platform will surpass eight million in August, as it has consistently experienced large monthly net inflows despite the activation of withdrawals.

DeFillama data shows that this prediction has come to pass with the total value of assets locked on Lido in terms of Ethereum currently at 8.08 million ETH, an all-time high. However, Lido’s website places the number at around 7.9 million as of press time.

Curve Finance exploit impact Lido

In the wake of the recent exploit of Curve Finance, several liquidity providers withdrew their assets from the platform’s stETH-ETH pool.

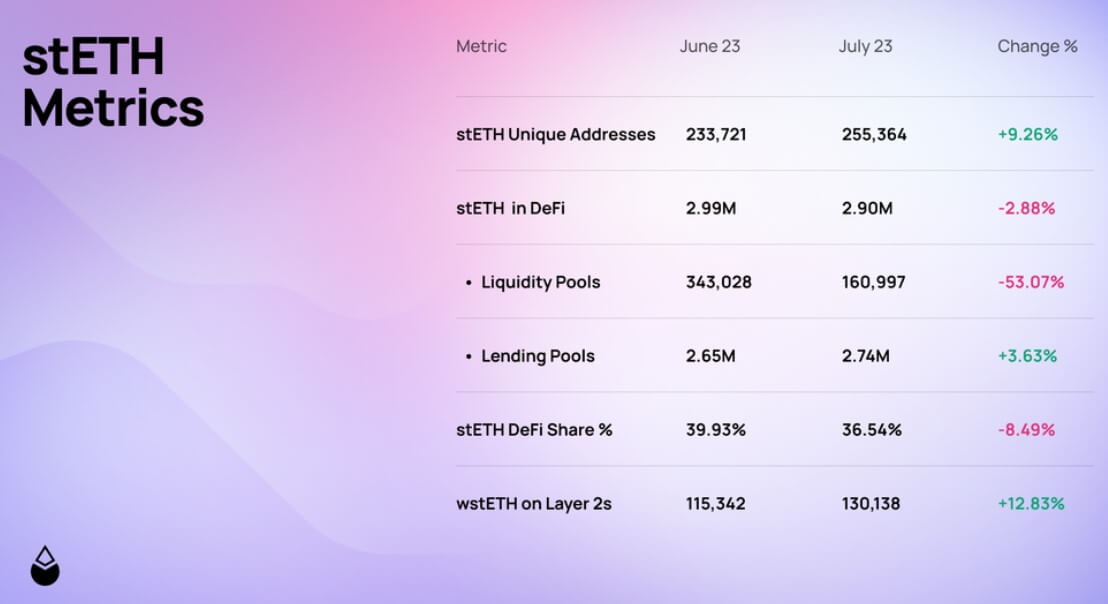

Despite the fact that this specific pool remained untouched by the exploit, stETH’s usage in DeFi experienced a decline of 2.88% compared to the previous month of June. Consequently, the overall share held within the liquidity pools also underwent a substantial contraction, plummeting by 53.07%.

Other metrics

Lido’s increasing adoption has also translated into the growing adoption of its staked ETH. The number of unique addresses holding stETH increased by 9.26% from June to 255,000. The amount in lending pools also increased by 3.63%, while wstETH in Layer-2 networks jumped by 12.83%.

The demand for wrapped staked ETH on the layer-2 networks has also increased, with Arbitrum and Optimism bridges witnessing more wstETH deposits.

However, Lido’s LDO token struggled considerably in July, falling 7% amid the contagion fears that gripped the DeFi market.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass