Tron partners with turbulent Curve Finance to launch stUSDT pool amid market chaos

Tron partners with turbulent Curve Finance to launch stUSDT pool amid market chaos Tron partners with turbulent Curve Finance to launch stUSDT pool amid market chaos

Tron and Curve Finance partner amid market turbulence to launch first real-world asset protocol on Tron network.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The founder of Tron, Justin Sun, has established a strategic partnership with the decentralized finance protocol Curve Finance. This partnership will introduce a stUSDT pool on Curve, marking a significant milestone for both parties.

This partnership occurs amidst considerable market turbulence that Curve Finance is currently facing. In the past 24 hours, the total value of assets locked on Curve Finance saw a drastic drop, falling nearly by half from $3.26 billion to $1.731 billion.

As Justin Sun stated in his tweet,

“Our joint efforts will introduce a stUSDT pool on Curve, amplifying user benefits. Together, we aim to empower the community and forge a decentralized finance!”

The stUSDT pool is touted as the first real-world asset protocol on the Tron Network, adding a significant milestone to their ledger.

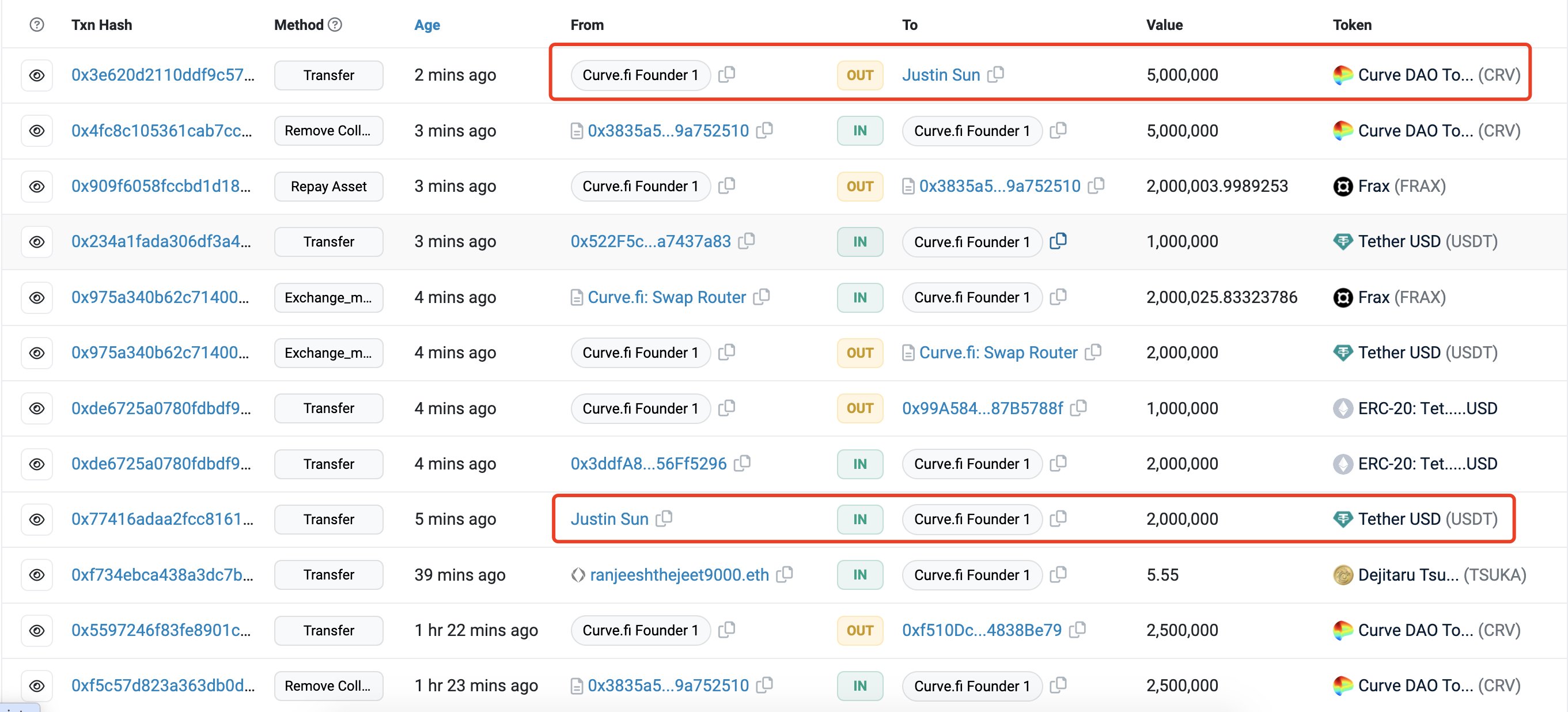

The partnership announcement came shortly after an on-chain deal, as revealed by PeckShield and Lookonchain. Sun procured 5 million CRV tokens, valued at around $2.9 million, from Curve founder Michael Egorov for $2 million in an OTC transaction.

Curve Finance exploit contagion.

The drastic drop in the asset value on Curve was attributed to an exploit of the protocol, leading to a fear of liquidation and bad debt among community members. Delphi Digital had identified this precarious position of Curve Finance and its founder, Egorov, early on Aug. 1.

Egorov holds a substantial loan worth approximately $100M, backed by almost half of the entire circulating supply of CRV. With the CRV value declining by 10% in the past 24 hours, the health of Curve Finance is in jeopardy.

In response to the exploit, Egorov managed loans to avoid liquidation while making several vital transfers, including repaying a 5.13 million FRAX stablecoin loan and reclaiming 12.5 million CRV tokens as collateral.

Market volatility remains a significant concern, nonetheless. As reported by CryptoSlate, the price of the CRV token experienced a 15% drop to $0.64707. The contagion risk may increase if hackers who hold a significant amount of CRV start selling.

However, it’s worth noting that market volatility also remains a significant concern. The CRV token’s price dropped around 15% to $0.64707, as reported by CryptoSlate. The contagion risk may further be heightened if hackers holding a significant amount of CRV start selling.

The partnership between Tron and Curve Finance could potentially open new opportunities for both parties, easing further liquidation fears.