Short-term holders greater threat to Bitcoin stability than Mt. Gox payouts

Short-term holders greater threat to Bitcoin stability than Mt. Gox payouts Quick Take

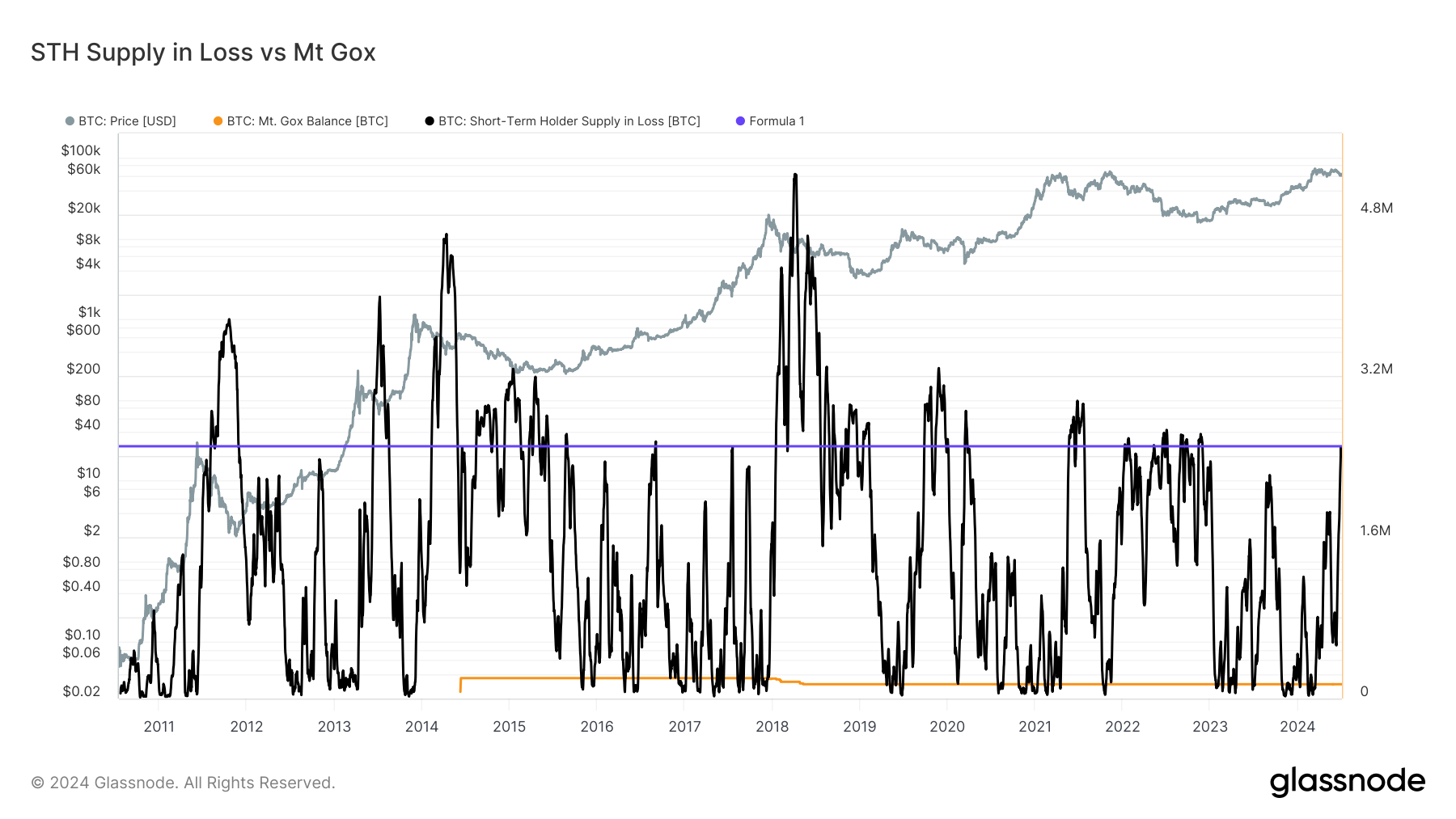

Mt. Gox is set to begin reimbursing creditors in July 2024, a narrative contributing to the recent Bitcoin price correction. However, analysts predict the impact will be limited. Currently, Mt. Gox holds roughly 140,000 BTC, a fraction compared to the 2.5 million Bitcoin sitting at a loss held by short-term holders (STHs) who have owned Bitcoin for less than 155 days and are prone to react to short-term price fluctuations.

STHs, who are more likely to sell quickly, hold a significantly larger portion of Bitcoin at a loss compared to the Mt. Gox balance, approximately 18 times greater. This group held 2.6 million Bitcoin at a loss during the FTX collapse in November 2022 and now holds 2.5 million Bitcoin at a loss, highlighting the extent of their underwater position, according to Glasssnode data.

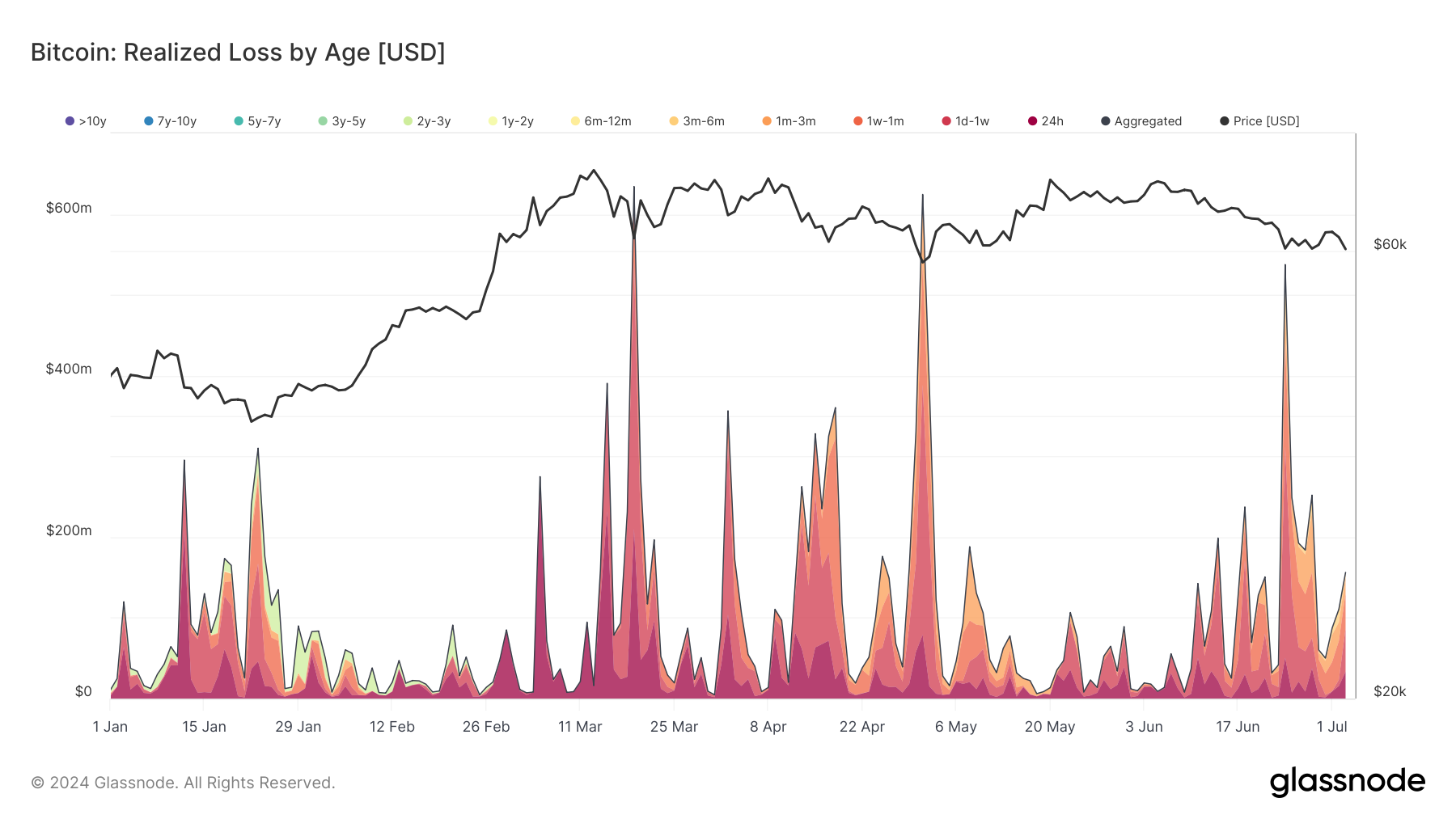

On July 3, realized losses in Bitcoin hit $131 million, with long-term holders selling at a loss of just $103,160, indicating that STHs were responsible for the bulk of the selling. While the Mt. Gox reimbursements will add some selling pressure, the more significant factor is the 2.5 million Bitcoin held by STHs at a loss, which poses a greater risk to market stability.

One reason I believe the impact will be limited is due to Bitcoin’s current price, which is 22% off its all-time high. Many creditors may prefer to hold onto their Bitcoin, hoping for future price increases, rather than selling at lower prices.