Fidelity and BlackRock ETFs lead massive Bitcoin inflow day

Fidelity and BlackRock ETFs lead massive Bitcoin inflow day Quick Take

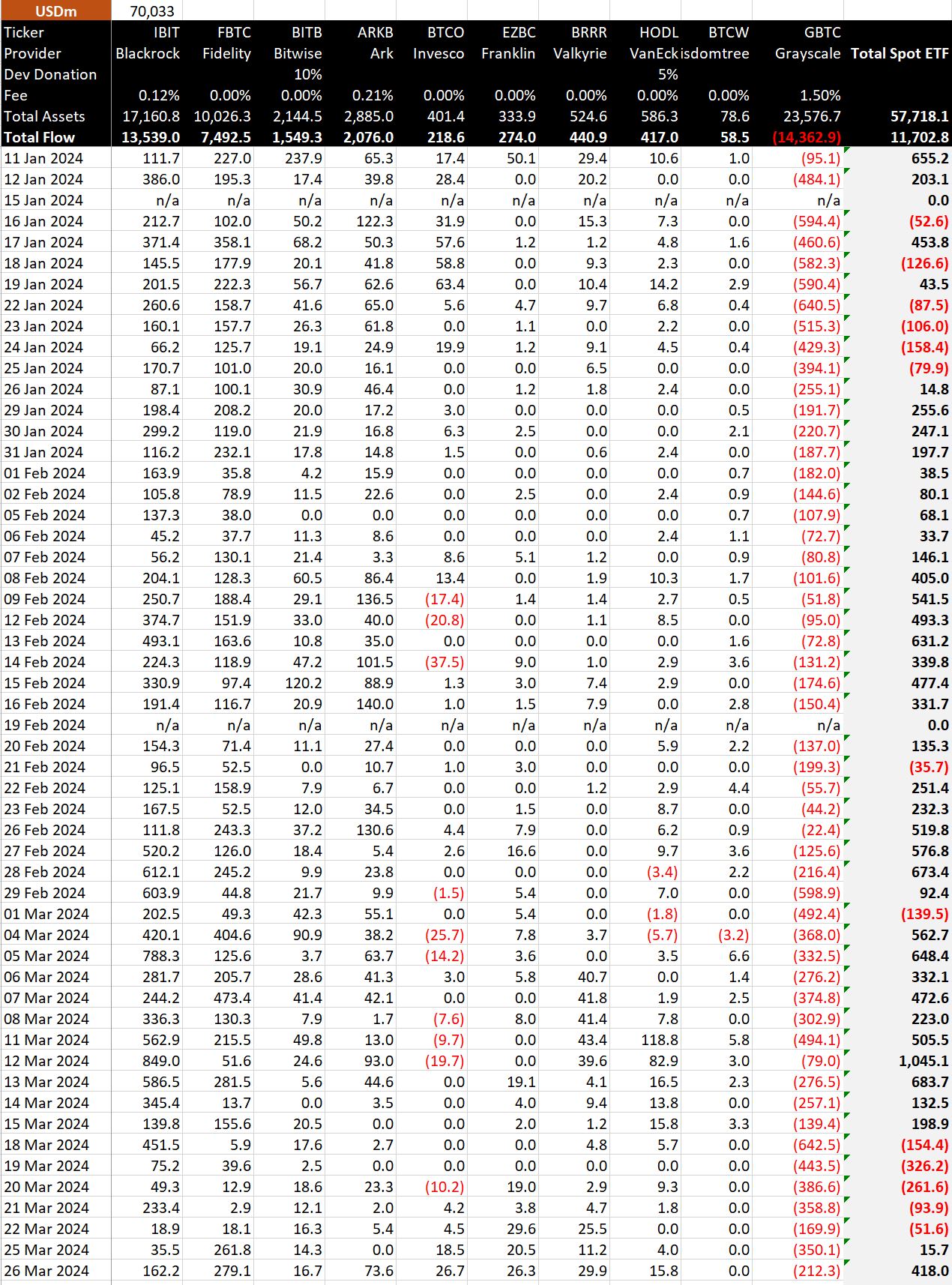

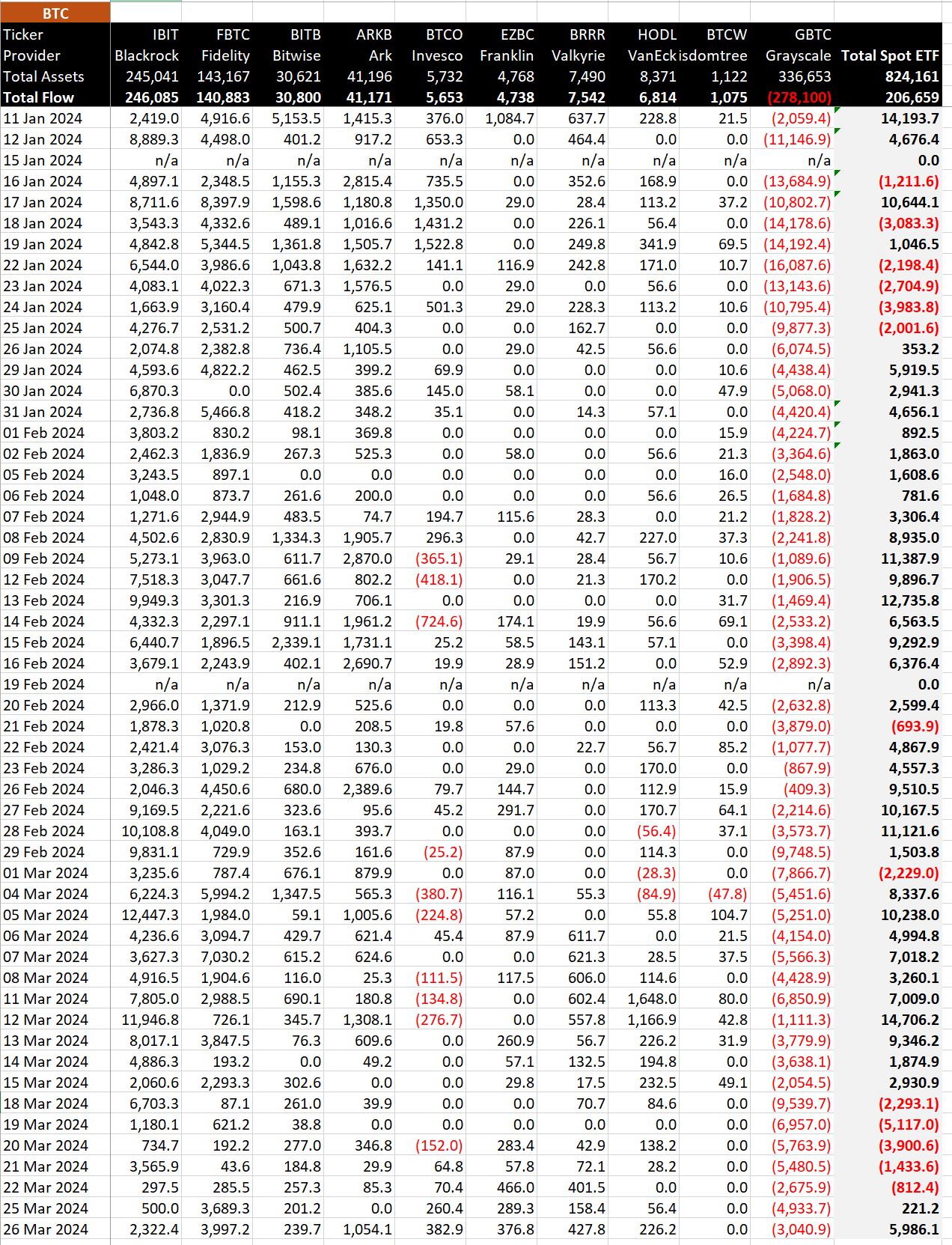

BitMEX’s recent data highlights a substantial inflow in Bitcoin (BTC) Exchange-Traded Funds (ETFs), showcasing their most significant day of inflows since March 13, with a total of $418.0 million, equivalent to 5,986.1 BTC. Notably, Fidelity’s FBTC ETF led the surge with an exceptional $279.1 million in net inflows, equivalent to 3,997.2 BTC, maintaining its strong sequence of consecutive inflow days. This increase has elevated their total net inflows to an impressive $7.4 billion, translating to 140,883 BTC.

BitMEX’s data reveals that BlackRock’s IBIT also experienced a solid inflow of $162.2 million, equal to 2,322.4 BTC, marking its best performance since March 21. This contribution boosted their total net inflows to $13.5 billion, corresponding to 246,085 BTC. Conversely, GBTC faced substantial outflows amounting to $212.3 million, or 3,040.9 BTC, leading to a cumulative net outflow of $14.3 billion and a net loss of 278,100 BTC.

Following five outflow data, the Bitcoin ETF sector continues a robust influx, with total net inflows reaching $11.7 billion, equivalent to a significant 206,659 BTC this year.