Examining Tether’s impact on Bitcoin’s price performance

Examining Tether’s impact on Bitcoin’s price performance Examining Tether’s impact on Bitcoin’s price performance

The synchronous surge in Tether's supply and Bitcoin's price suggests a complex market relationship between the two assets.

Quick Take

CryptoSlate’s data analysis found an interesting correlation between Tether’s (USDT) circulating supply and Bitcoin’s price.

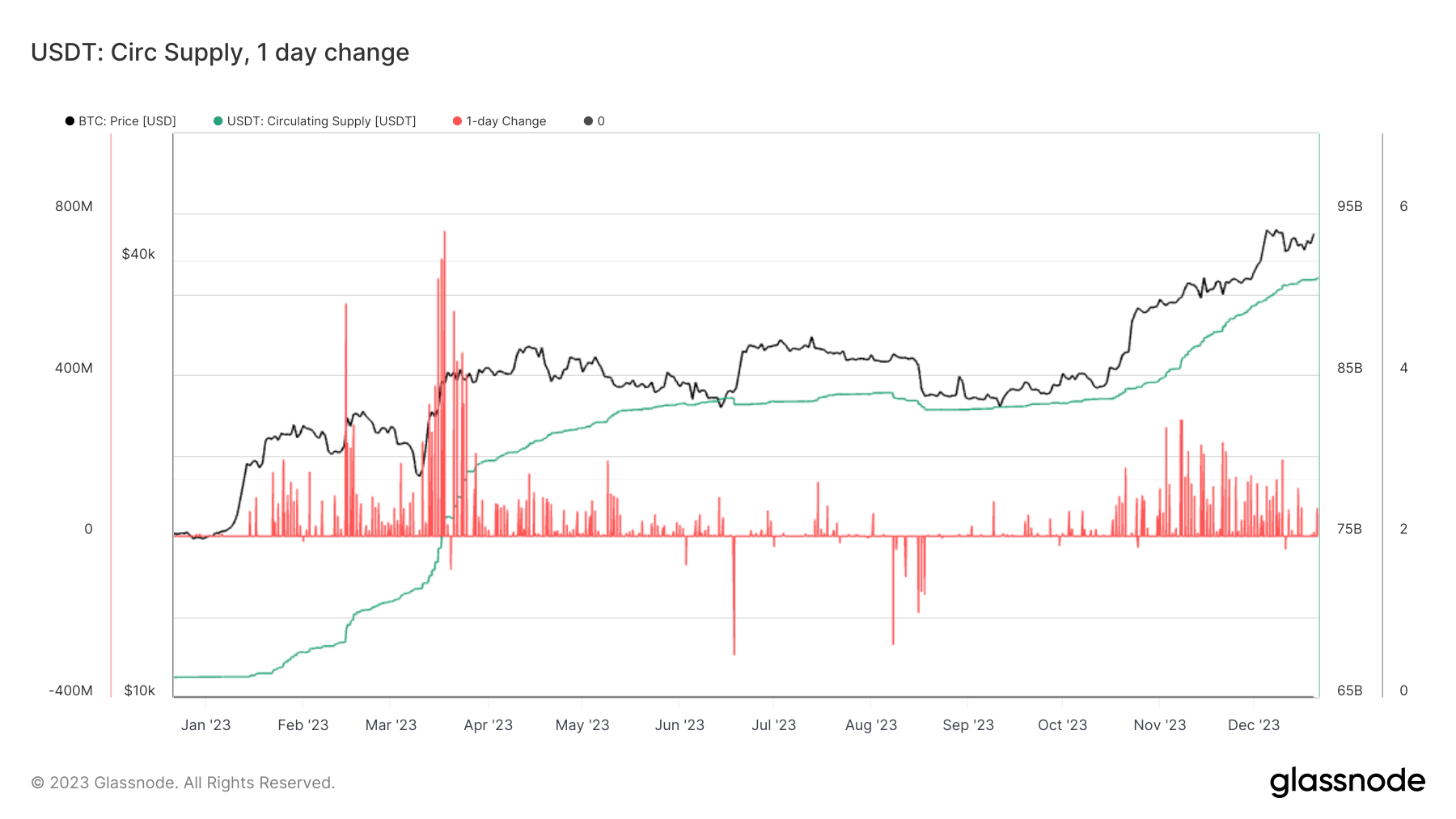

The beginning of 2023 saw the USDT supply standing at an estimated 66 billion, dramatically increasing to 91 billion by year’s end. This growth in USDT supply is not isolated but appears to parallel an exciting development in Bitcoin prices.

In the past 60 days, Bitcoin saw a remarkable 61% price surge. Coinciding with this upward trend, an almost daily increase in USDT’s circulating supply has been observed, signifying a potential relationship between these two phenomena.

Earlier in the year, the collapse of Silicon Valley Bank (SVB) caused a significant market correction. In the aftermath of the collapse, Tether exhibited an interesting pattern: there were three successive days of growth, each seeing an additional 75 million added to the supply. While this wasn’t directly correlated with Bitcoin’s price action at the time, it underscores the pivotal role USDT’s supply has in the complex digital assets market.

The data implies a possible connection between the rise in USDT supply and the stability and recovery of Bitcoin’s price. Nonetheless, this correlation doesn’t necessarily indicate causality, and a deeper exploration is required to fully understand the underpinnings of these market movements and their potential implications for future trends.