CME leads unprecedented growth in Bitcoin ‘cash’ open interest

CME leads unprecedented growth in Bitcoin ‘cash’ open interest Quick Take

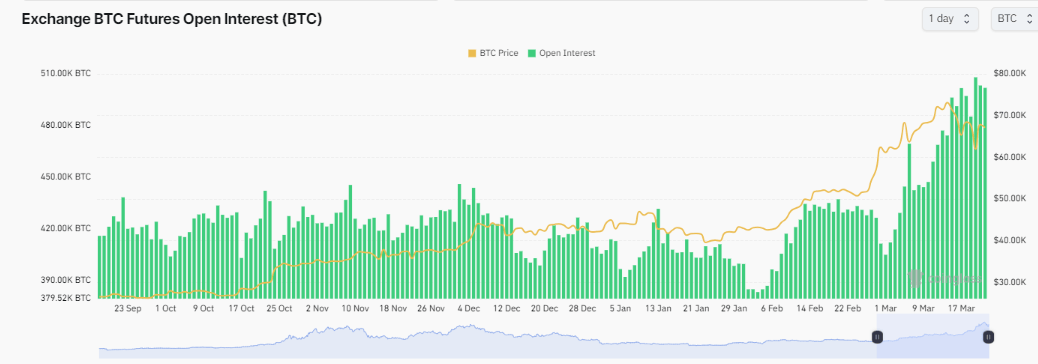

Recent data highlights a notable increase in Bitcoin open interest, reaching 500,000 BTC, despite a minor reduction of about 10,000 BTC during the latest dip from peak levels, according to Coinglass.

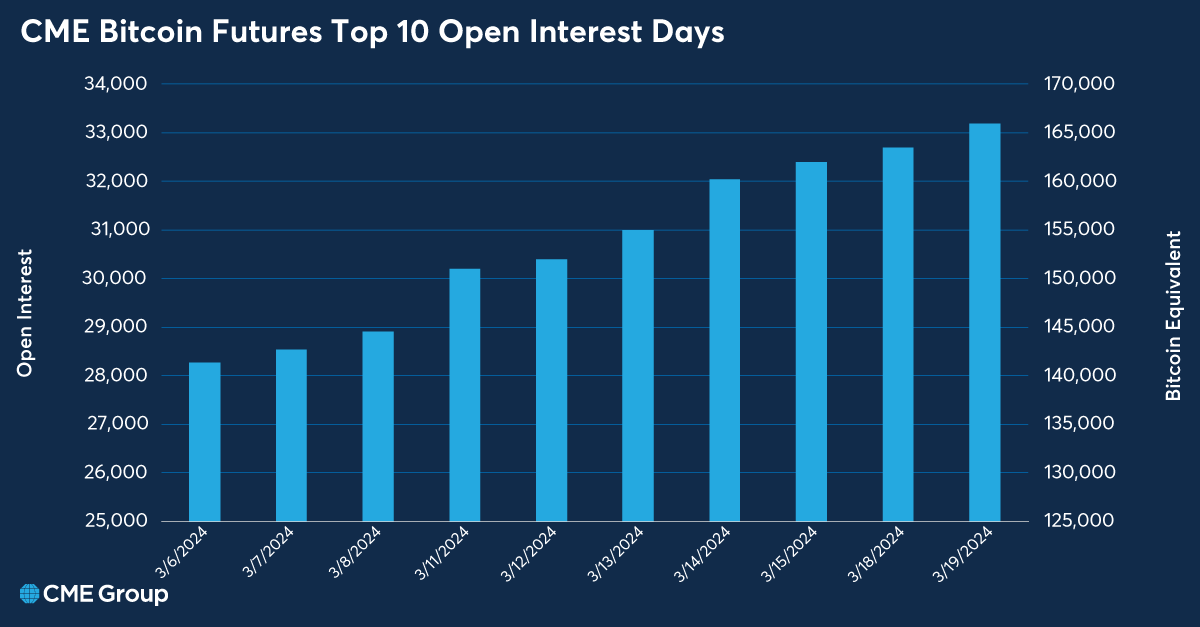

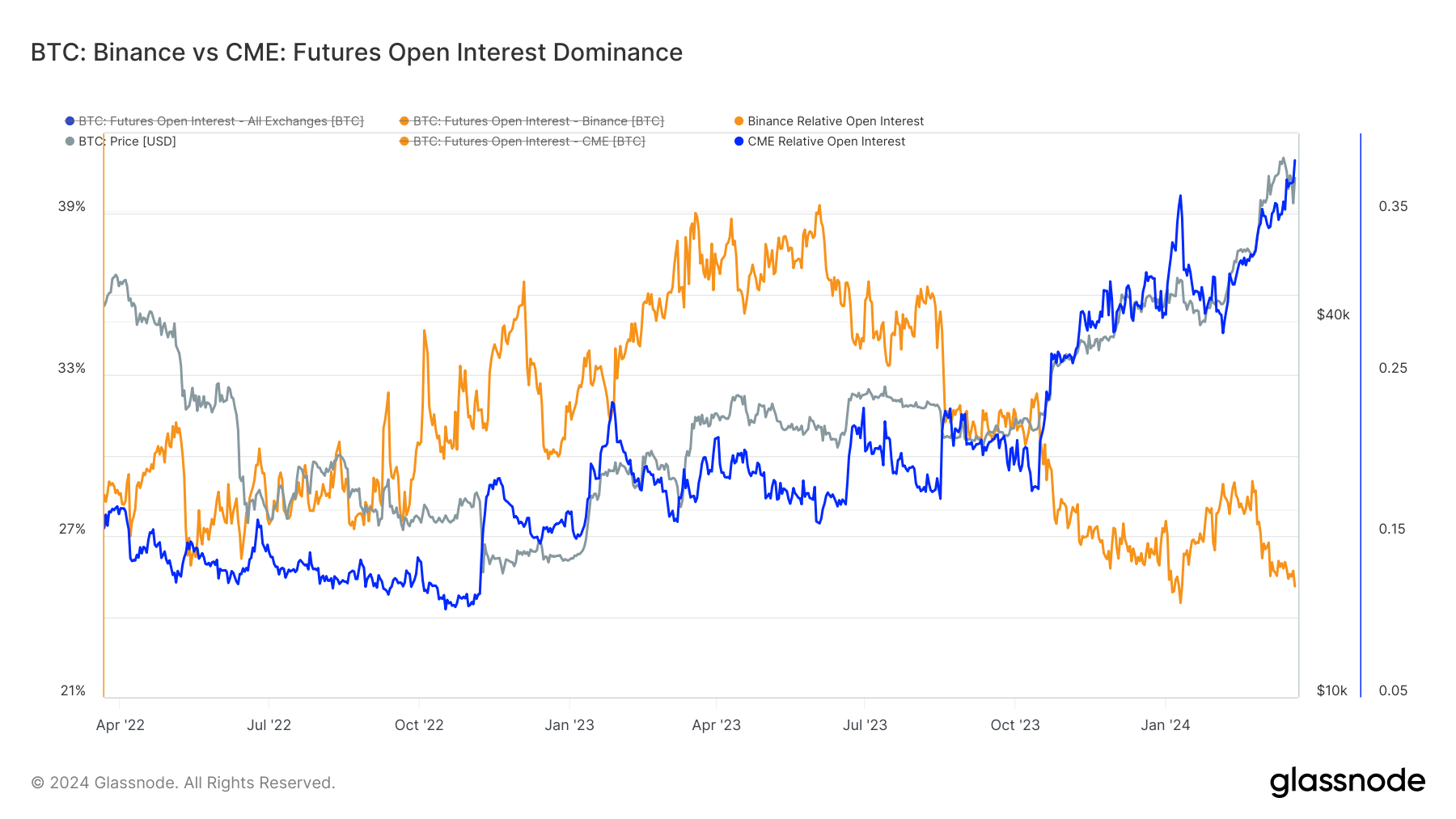

The total open interest has seen a 25% increase since early March, with a notable contribution from trading activities on the CME, an institutional platform. Specifically, the CME Group has experienced a significant upturn in institutional engagement, marking a 20% increase in its open interest since March 5, during a period of ten days of record-breaking growth, according to CME Group.

This trend highlights a growing gap between CME, which requires cash margins, and Binance, which uses crypto margins.

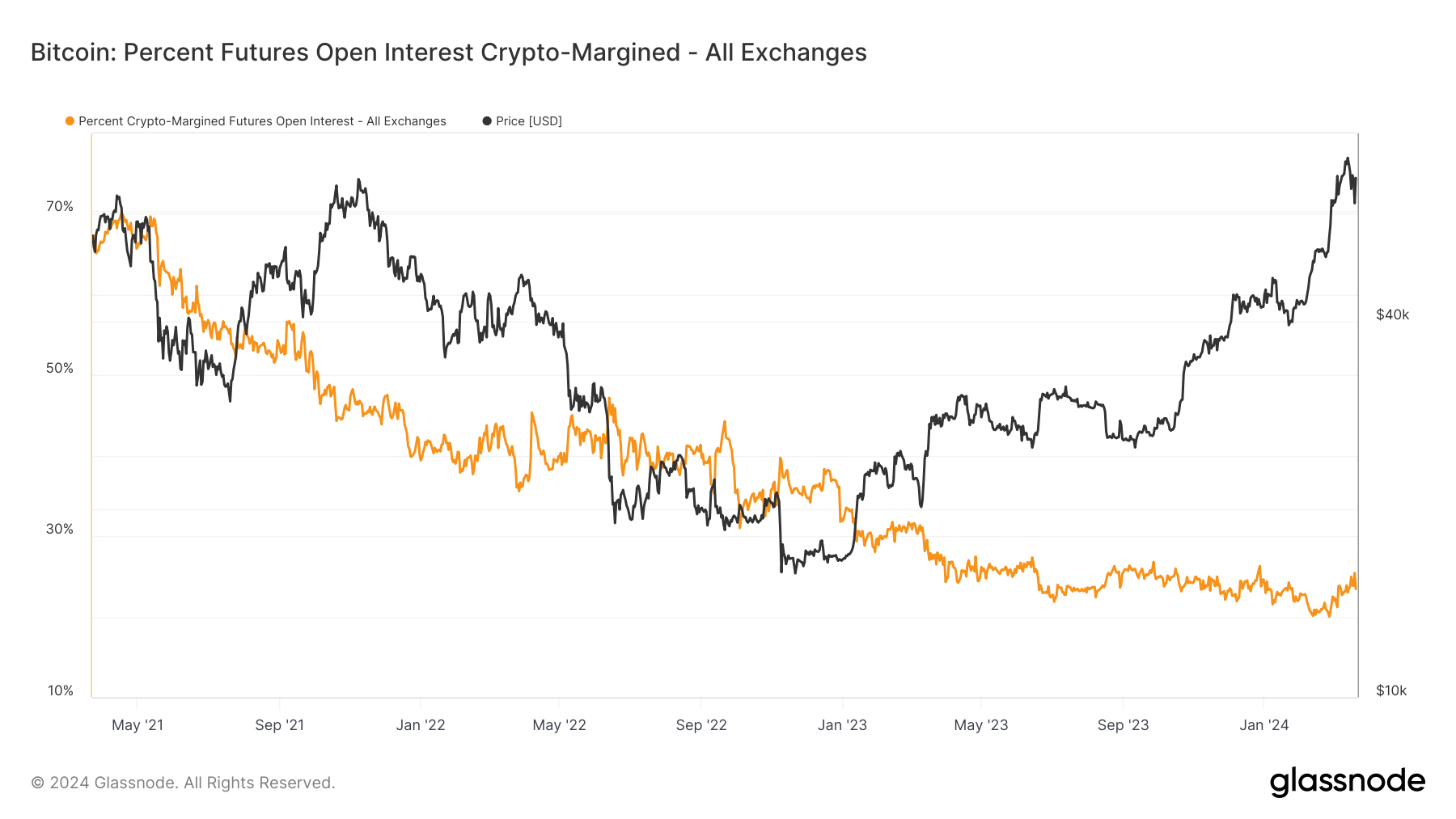

As cash-margined futures on platforms like the CME use stable assets for margins, such as USD, and grow in popularity, they could lead to a calmer Bitcoin market. Cash, a less volatile asset than BTC, continues to be the predominant margin asset.

Currently, crypto margin has fallen to around 20% of all margin accounts, with the remaining 80% being cash margins, according to Glassnode.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass