CME Bitcoin futures hit new highs as investor interest surges

CME Bitcoin futures hit new highs as investor interest surges Quick Take

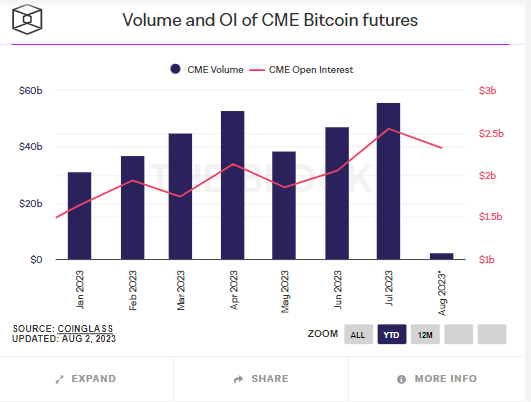

Data from The Block reveals that the Bitcoin futures trading volume and open interest on the Chicago Mercantile Exchange (CME) have reached their highest levels for the year. The trading volume for July 2023 reached a remarkable $56 billion, and open interest hit a peak of $2.55 billion. This suggests a significant rise in market participation and investors’ strong interest in Bitcoin futures.

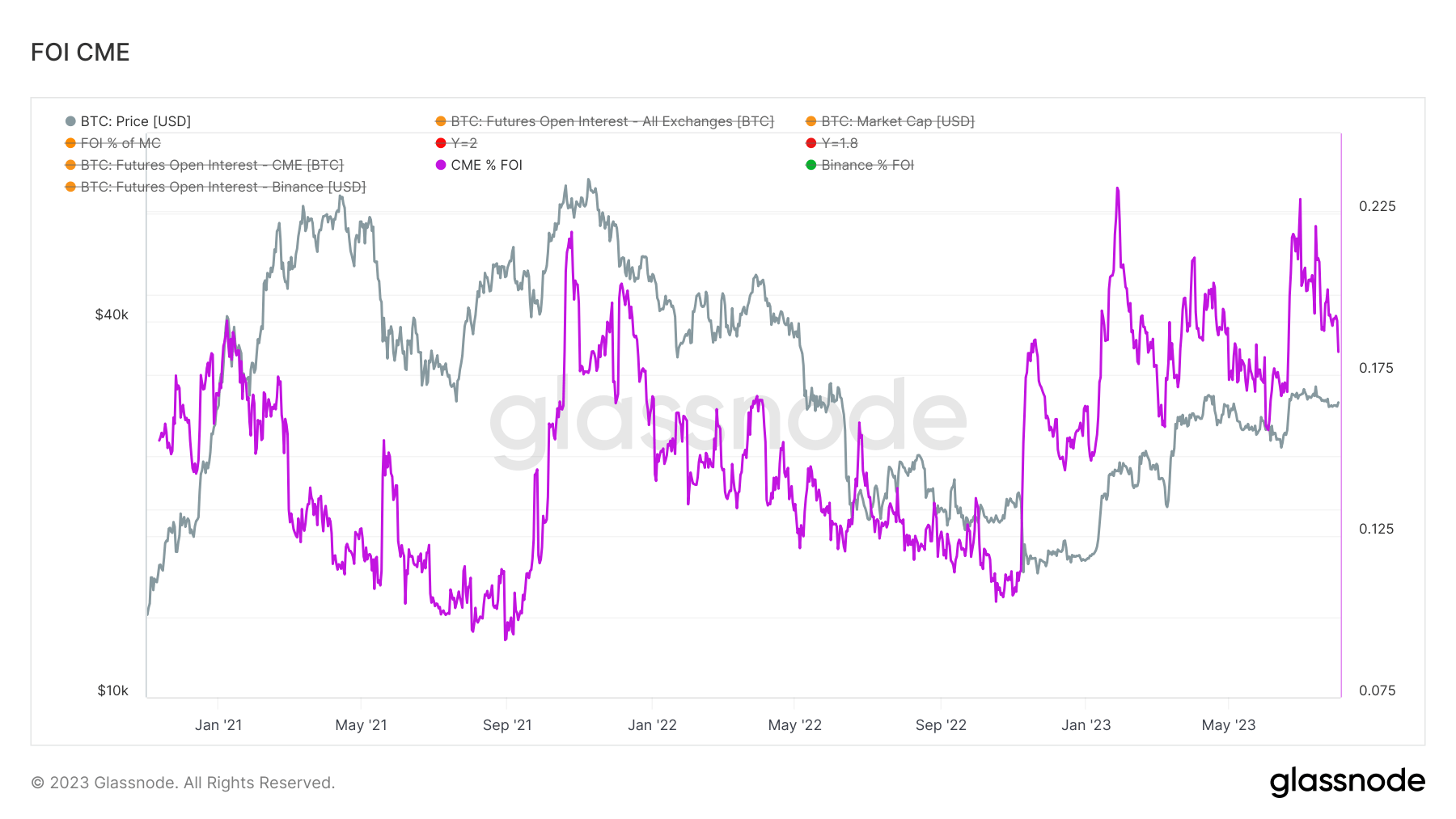

Additional data from Glassnode shows that the CME’s share of the total futures open interest is currently 18%, just below its highest-recorded share of 23%. This indicates that the CME continues to hold a substantial portion of the overall market share, despite fierce competition in the futures market.

These results highlight the growing acceptance and use of Bitcoin futures as an investment tool. This could potentially indicate a wider trend toward the adoption of cryptocurrencies and their derivatives in the financial market.

.