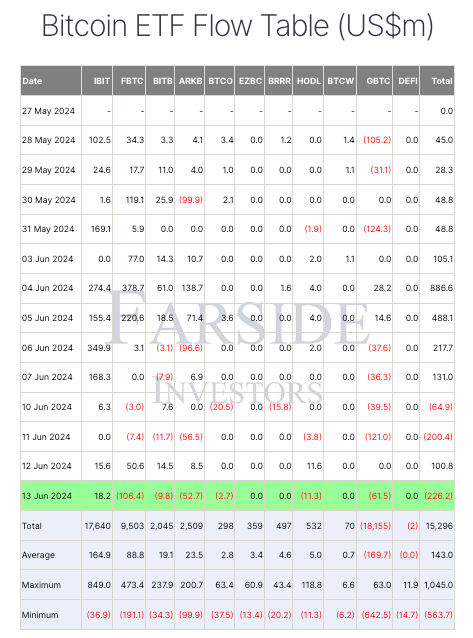

Bitcoin ETFs see sharp $226.2M outflow amid ETH ETF news

Bitcoin ETFs see sharp $226.2M outflow amid ETH ETF news After a successful Wednesday, spot Bitcoin ETFs saw another significant downturn yesterday. According to data from Farside, June 13 saw outflows totaling $226.2 million, contrasting sharply with the $100.8 million recorded on June 12.

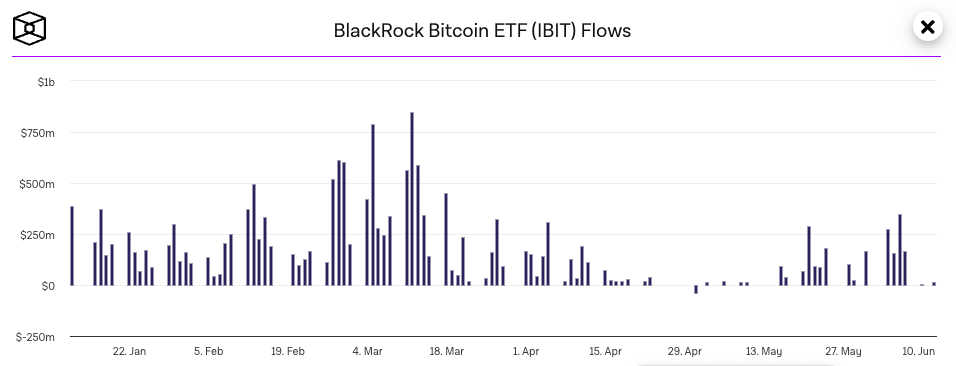

Fidelity’s FBTC led the outflows with $106.4 million. This is the highest outflow FBTC has seen in the past month and a sharp trend reversal from the $50.6 million inflow it saw on June 12. Grayscale’s GBTC ranked second with $61.5 million in outflows, followed by Ark’s ARKB’s $52.7 million outflow. Only BlackRock’s IBIT saw inflows yesterday, totaling $18.2 million.

This continues the 44-day streak of continuous inflows to IBIT. IBIT’s track record of inflows has only broken since its launch. On May 1, IBIT recorded $36.9 million in outflows.

The massive discrepancy between Wednesday’s inflows and yesterday’s outflows could, at least in part, be attributed to the volatility across the broader market. This volatility was a result of the latest news coming from the SEC, which stated that the first spot Ethereum ETFs will be approved this summer.

While market analysts doubt that ETH ETFs would garner the same institutional attention, the new product would undoubtedly draw some volume from Bitcoin ETF. The fact that the Bitcoin ETF market has so far reacted with significant outflows on rumors and news about ETH ETFs further confirms this.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass