Bitcoin breakout against US bonds sees it hit new all-time high

Bitcoin breakout against US bonds sees it hit new all-time high Quick Take

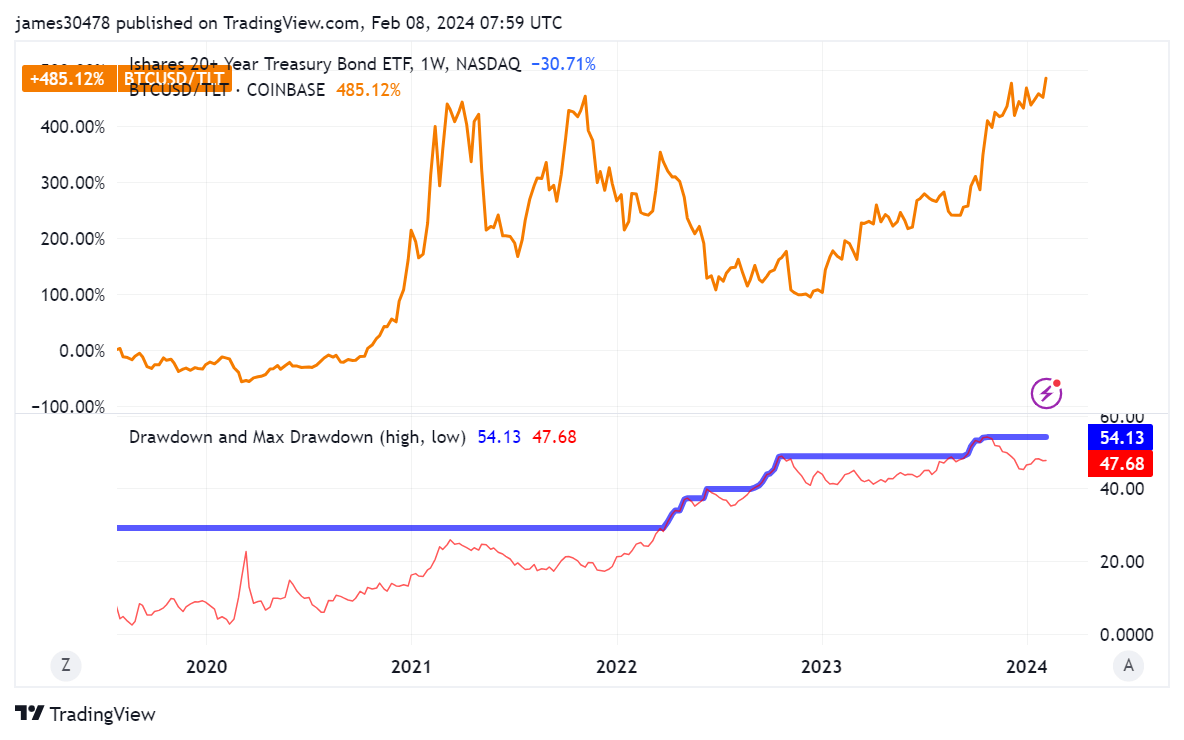

A trend emerged between Bitcoin and TLT, the U.S. long bond ETF, in early December as BTC denominated in TLT hit a triple top level previously seen in 2021.

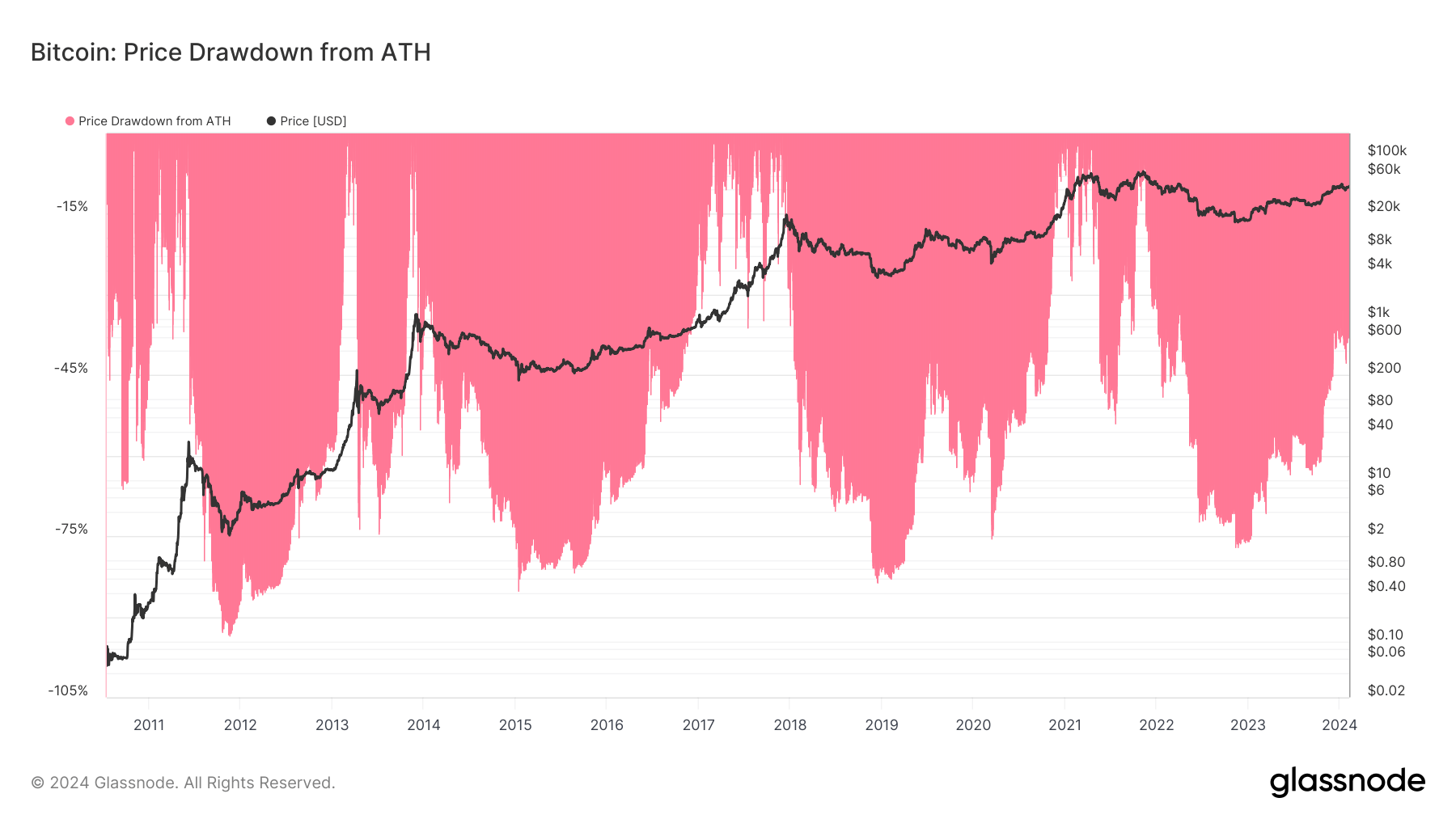

Bitcoin just rallied above $44,200 and is 36% off its all-time high of $69,000; it has showcased a significant dominance in relation to TLT, which is currently trading around $94 and stands 48% off its peak. This divergence is further highlighted as it currently requires 471 TLT to purchase one Bitcoin, surpassing previous highs of approximately 420 and 440 in March and November 2021, respectively, when Bitcoin was trading well above $50,000.

This trend suggests an interesting aspect of the financial markets, as Bitcoin, traditionally viewed as a risky asset, displays resilience compared to TLT, a global benchmark for relatively safe assets. Notably, BTC ETFs are experiencing substantial inflows, potentially offering tailwinds to Bitcoin’s price.

Contrarily, market forecasts may dampen TLT’s prospects; the CME fed watch tool is currently projecting an 82% chance of a pause by March 2024, contrary to the optimism that prompted TLT to rally in recent weeks.

Compounded by challenges in the banking sector, for example, New York Community Bank stock is nearly down 70% year-to-date, according to The Kobeissi Letter; these developments present a compelling narrative of potential shifts in asset dynamics, worthy of close attention.

Farside Investors

Farside Investors