Altcoin Cycle Signal indicates altcoins could take the limelight in new market phase

Altcoin Cycle Signal indicates altcoins could take the limelight in new market phase Quick Take

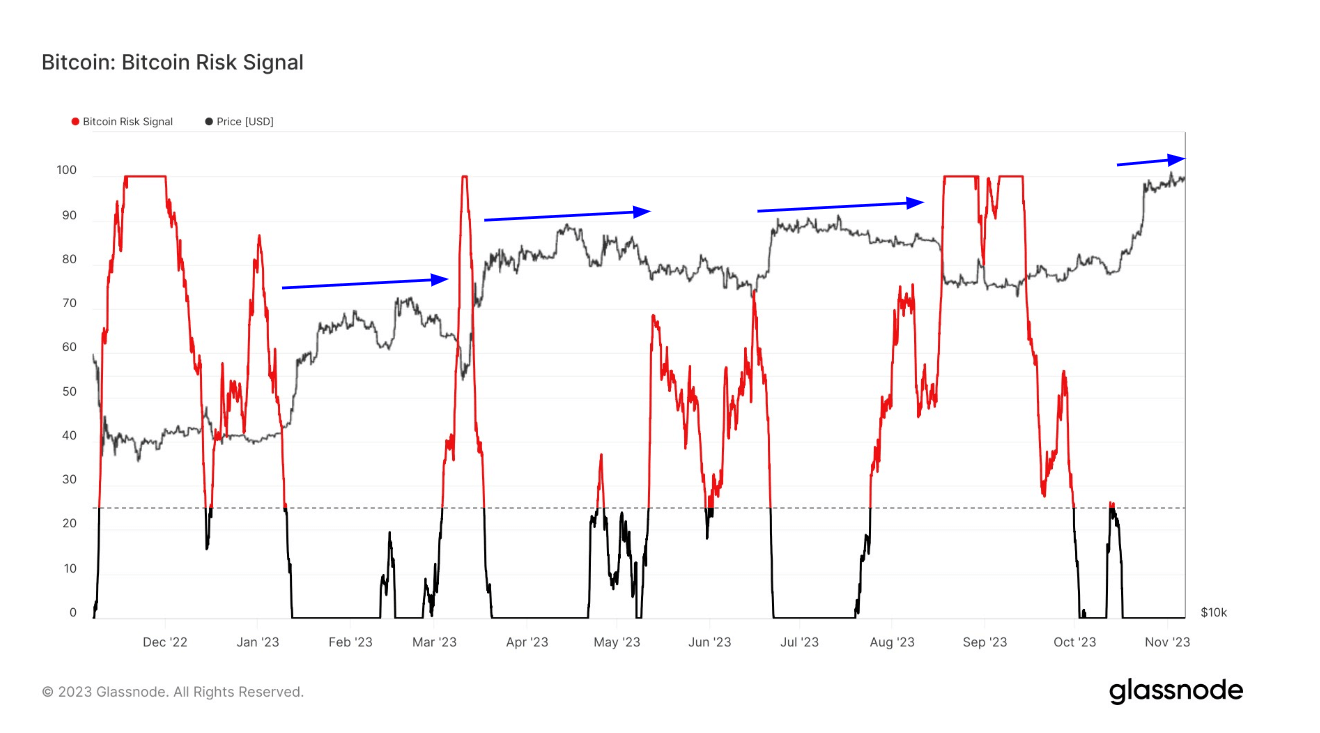

Historical analysis reveals a fascinating pattern between Bitcoin’s (BTC) risk profile and the market performance of altcoins. The Bitcoin Risk Signal, a measure of the potential for a significant drawdown in Bitcoin’s price, is currently at ‘0,’ indicative of the least risk. Over the past year, there have been four instances of such ‘zero-risk’ accumulation periods for Bitcoin, observed in February, April, July, and November. Each of these periods followed a surge in Bitcoin’s price, hinting at the potential correlation between price appreciation and accumulation.

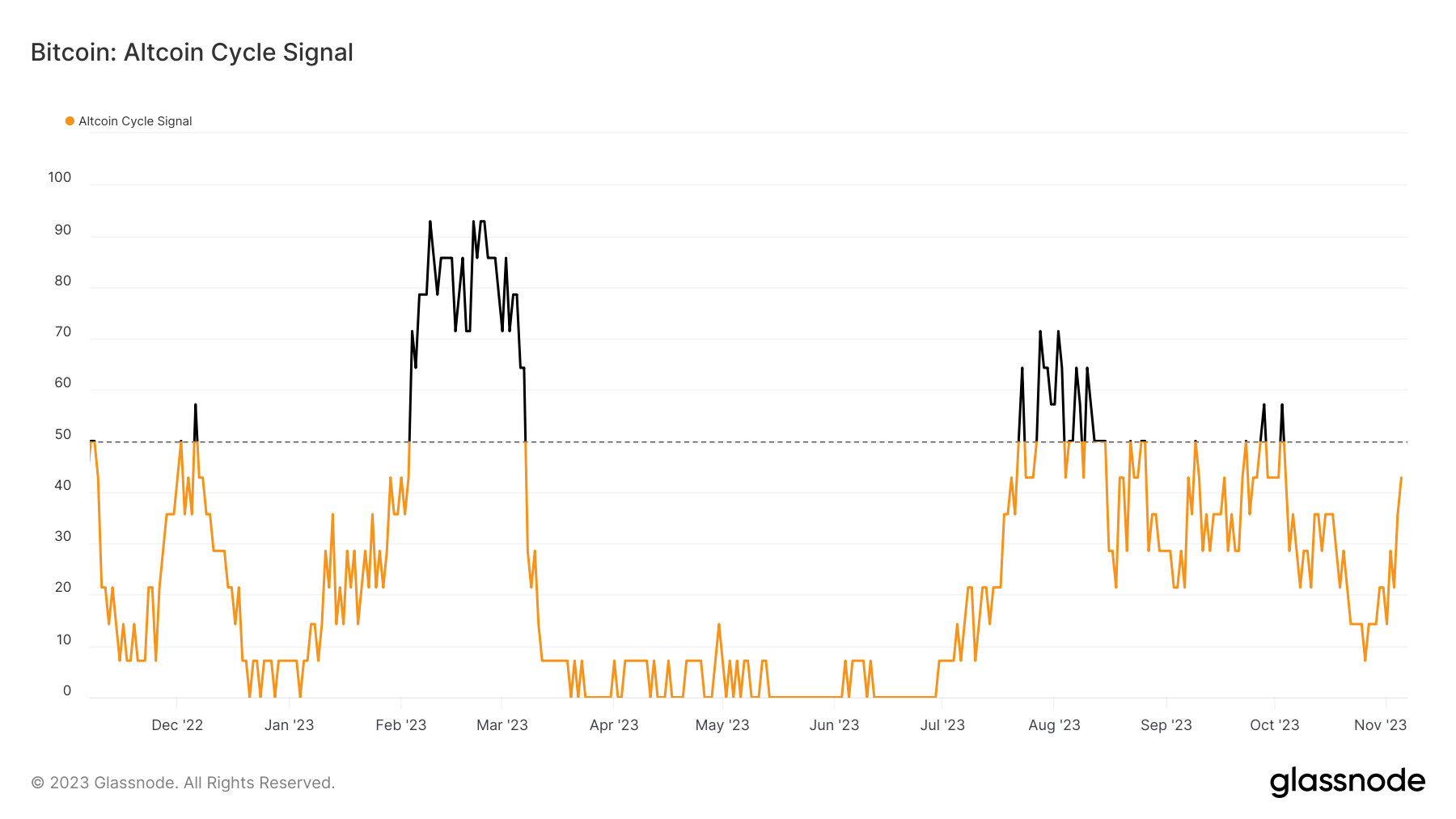

Parallel to the Bitcoin narrative, the Altcoin Cycle Signal provides insights into the performance of altcoins relative to Bitcoin. This indicator, calculated using the price data of the top 250 altcoins by market capitalization (stablecoins excluded), depicts the market’s inclination towards Bitcoin or altcoins. During periods identified as ‘Bitcoin Season,’ Bitcoin tends to outperform the altcoin basket, while the reverse holds true during ‘Altcoin Season.’

Interestingly, the Altcoin Cycle Signal has been observed to follow Bitcoin’s accumulation consolidations, as seen in February and August. Currently nearing 50, the altcoin signal could imply an upcoming phase where altcoins start to outperform Bitcoin, provided the latter continues its accumulation trend.