GMX daily fees soar over 1100% to $2.11M

GMX daily fees soar over 1100% to $2.11M GMX daily fees soar over 1100% to $2.11M

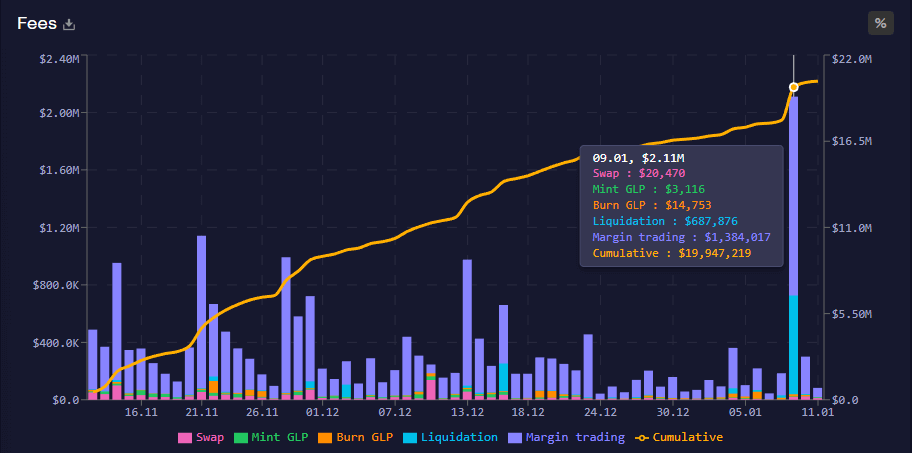

GMX daily fees surged over 1100% reaching $2.11 million. Fees generated primarily from margin trading on Arbitrum and Avalanche blockchains.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

GMX — the native token of the decentralized exchange (DEX) GMX — daily fees hit $2.11 million on Jan. 9 on the back of margin trading volume on Avalanche and Arbitrum.

The huge surge in fee volume — second only to Ethereum for the day — occurred just five days after a GMX whale wallet was hacked on Jan. 4 for $3.4 million.

Roughly 30% of fees generated are swapped to ETH or AVAX and then distributed to GMX token stakers, according to the GMX whitepaper.

Within the 30%, roughly 1% is used to cover the network cost of GMX “Keepers” — leaving approximately 29% of $2.11 million — or roughly $611,900 — for distribution to those staking GMX tokens.

GMX token price was $44.54 as of press time — up 1.5% over the last 24 hours — and had a market cap of $372.8 million.

CryptoSlate research showed that GMX has been one of the best performers through the 2022 bear market so far.

Farside Investors

Farside Investors