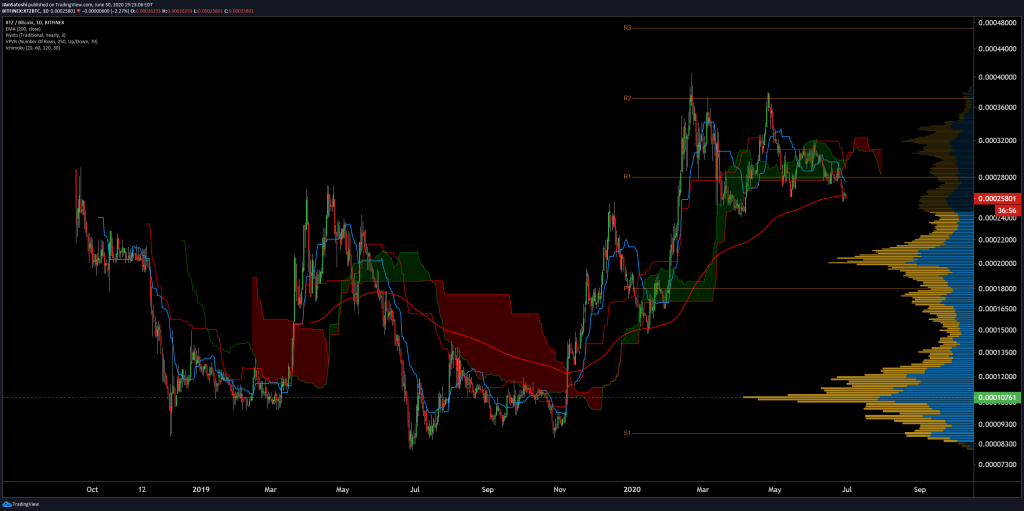

For the first time since 2019, Tezos is at risk of breaking below its 200-day EMA

For the first time since 2019, Tezos is at risk of breaking below its 200-day EMA For the first time since 2019, Tezos is at risk of breaking below its 200-day EMA

Photo by Alto Crew on Unsplash

Tezos, like most other cryptocurrencies, has been caught within the throes of an extended bout of sideways trading as it hovers within the mid-$2.00 region.

The token’s intense upwards momentum seen throughout the past few months has stalled in recent times, and it is now hovering just above what appears to be a crucial horizontal support level at $2.30.

This coincides closely with its 200-day moving average, which is now at risk of being broken below for the first time since late-2019.

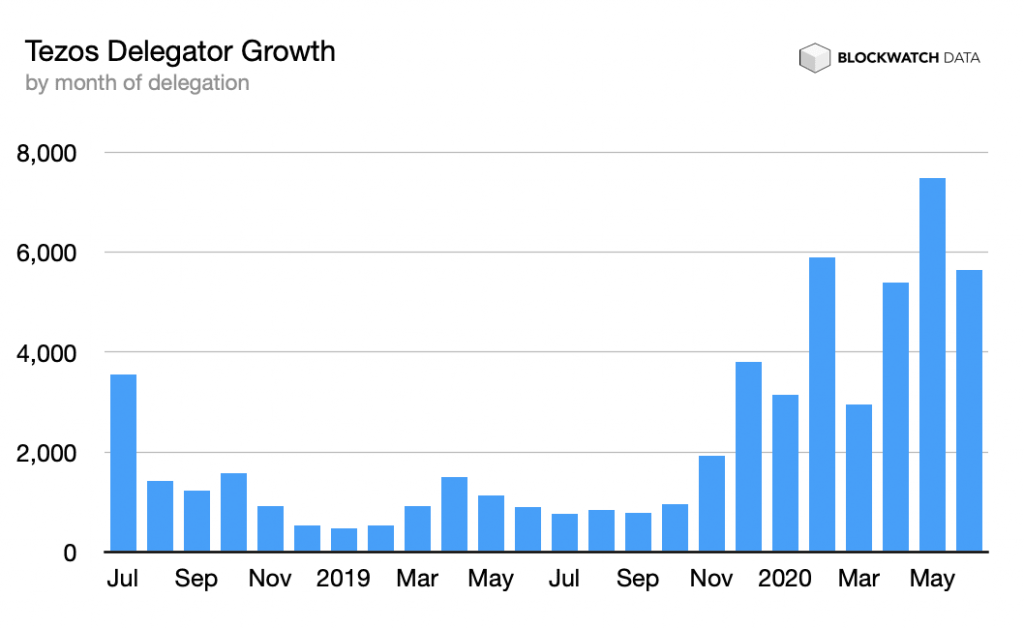

It is important to note that Tezos remains fundamentally strong despite it flashing some signs of subtle weakness. This strength can be seen while looking towards the total number of Tezos delegators helping to run the network.

Tezos at risk of breaking 200-day EMA as momentum stalls

At the time of writing, Tezos is trading up just under 2% at its current price of $2.43. This is around the level at which the cryptocurrency has been trading for the past several days.

The token has seen some immensely bullish price action throughout late-2019 and 2020, with its lucrative staking rewards being partially behind the influx of new investors.

This momentum, however, has stalled in recent weeks as Bitcoin and the aggregated cryptocurrency market remain caught within a multi-week bout of sideways trading.

XTZ is currently trading just a hair above its crucial support at $2.30 that has been ardently defended by bulls over the past week.

This level also coincides with its 200-day EMA – which is a crucial support level that it has been trading above throughout all of 2020.

Tezos now appears to be at risk of declining beneath this level. Josh Olszewicz – a respected analyst – noted that this would mark the first break below this level seen since November of 2019.

“1D XTZ – looks [ready] to break below the 200-day EMA for the first time since Nov 2019.”

XTZ remains fundamentally strong despite technical weakness

Although it could be on the cusp of seeing a massive decline, it is important to note that Tezos remains fundamentally robust.

As reported in a recent issue of Our Network from Spencer Noon, the number of XTZ delegators has continued climbing higher in recent times – a positive sign from a fundamental perspective.

“The total number of new Tezos delegators continued to grow and reached its highest growth ever (+7.5k) in May and is set to keep this pace in June. Over its short 2 years of existence, Tezos went through two growth epochs already and is in the middle of its third.”

A rising delegator count will likely help incubate growth in both Tezos’ development activity and its investor base, which could help sustain its uptrend in the months ahead.

Tezos Market Data

At the time of press 9:15 pm UTC on Jul. 1, 2020, Tezos is ranked #12 by market cap and the price is up 0.59% over the past 24 hours. Tezos has a market capitalization of $1.76 billion with a 24-hour trading volume of $66.21 million. Learn more about Tezos ›

Crypto Market Summary

At the time of press 9:15 pm UTC on Jul. 1, 2020, the total crypto market is valued at at $263.44 billion with a 24-hour volume of $57.35 billion. Bitcoin dominance is currently at 64.67%. Learn more about the crypto market ›