Dogecoin leads gains as crypto markets crash further

Dogecoin leads gains as crypto markets crash further Dogecoin leads gains as crypto markets crash further

Such coin, much wow.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Over 1 million trading accounts were liquidated over the weekend. But one crypto shows no signs of stopping: We’re talking about meme cryptocurrency Dogecoin—the world’s fifth-largest crypto as of press time.

Who let the Dogecoin out?

DOGE is up 34.7% in the past day, 459.8% in the past week, and over 615.1% in the past month. This means an investment into Dogecoin has outpaced the rise of any large-cap cryptocurrency in a comparable period, and any traditional savings account in a 10-year period (probably underestimating that).

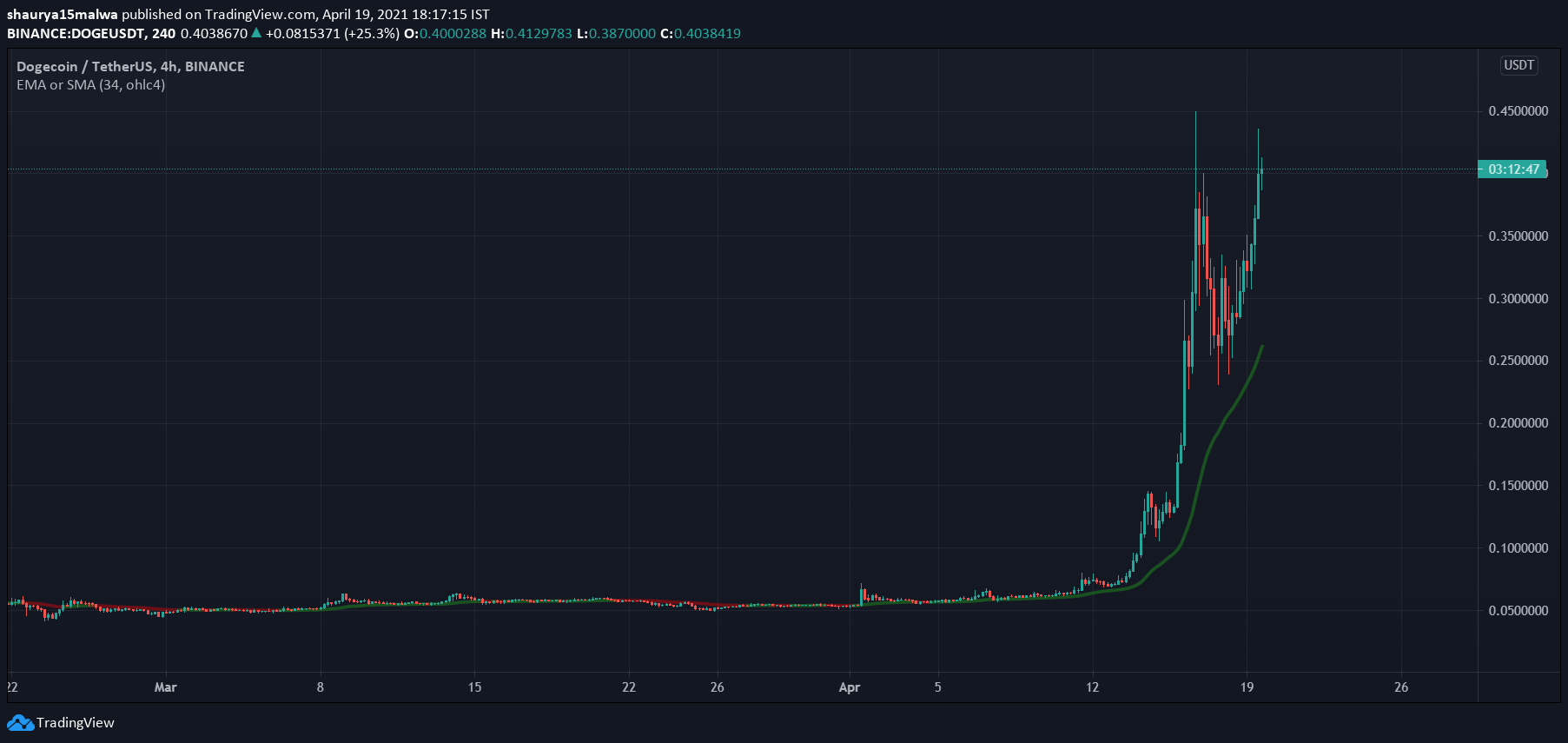

As the below image shows, DOGE pumped like a literal space-bound rocket in the past week, from nearly $0.057 to over $0.40 at press time. A small pump of just a few cents more would take DOGE to its highest-ever value of $0.45.

The coin has no use-case, no active development, no official roadmap ahead, and no ‘official’ face for the project, but this hasn’t stopped DOGE from reaching a market cap of $53 billion—ahead of arguably useful projects like Uniswap, Chainlink, and Polkadot.

One narrative that sticks out for Dogecoin is its clear-cut meme presence. Its mascot is a Shiba Inu and its logo is a cute cartoon of a Shiba Inu. And there’s then the offbeat points:

The fact that $DOGE is #5 and about to flippen $BNB is a testament to:

1) the power of memes & social media influencers

2) the sheer amount of central banking liquidity sloshing around the system and inefficiently allocated

3) how much the truth there’s behind the IQ bell curve— Qiao Wang (@QwQiao) April 19, 2021

It did, however, get some coverage in the Korean market recently. As MakerDAO’s Asia head of business development Doo Wan Nam pointed out on Twitter, Dogecoin saw a mention on Chosun, the country’s oldest newspaper, today—which may have contributed to the price rise.

God, @dogecoin all over the Korean news today. No wonder Korea has a higher volume on it. They say "The cuter the pumpier" ?

— Doo (@DooWanNam) April 19, 2021

Meanwhile, the DOGE pump took place as other cryptocurrencies gradually recovered from the aftermath of the past weekend. However, the market bleed continued as of press time.

As CryptoSlate previously reported, the weekend saw 1 million individual trading accounts see over $10 billion in liquidations—the largest ever for this year. Bitcoin alone saw $5 billion in liquidations while altcoins turned red across the board and saw double-digit percentage losses.