DeFi activity on Binance Smart Chain increased 487% since 2020

DeFi activity on Binance Smart Chain increased 487% since 2020 DeFi activity on Binance Smart Chain increased 487% since 2020

The activity on BSC keeps increasing, judging by the latest data, which revealed a 20% boost compared to the previous quarter.

Image by rawpixel.com

The activity on Binance Smart Chain (BSC) continues increasing as the number of unique active wallets (UAW) connected to the network surpassed 608,500 per day on average during Q3, according to DappRadar’s recent report.

The popular data acquisition and analysis company noted that this reflects a 20% increase quarter-over-quarter, while, over a year period, the metric rose an impressive 487%.

Boosted activity

The entire blockchain industry recorded a 25% usage increase from the previous quarter, reaching more than 1.54 million UAW connected on a daily average, the report noted.

Based on DappRadar’s data, the boosted activity recorded on the Binance-branded standalone proof-of-stake (PoS) platform, which runs parallel with Binance Chain (BC), falls in line with the industry’s positive trend.

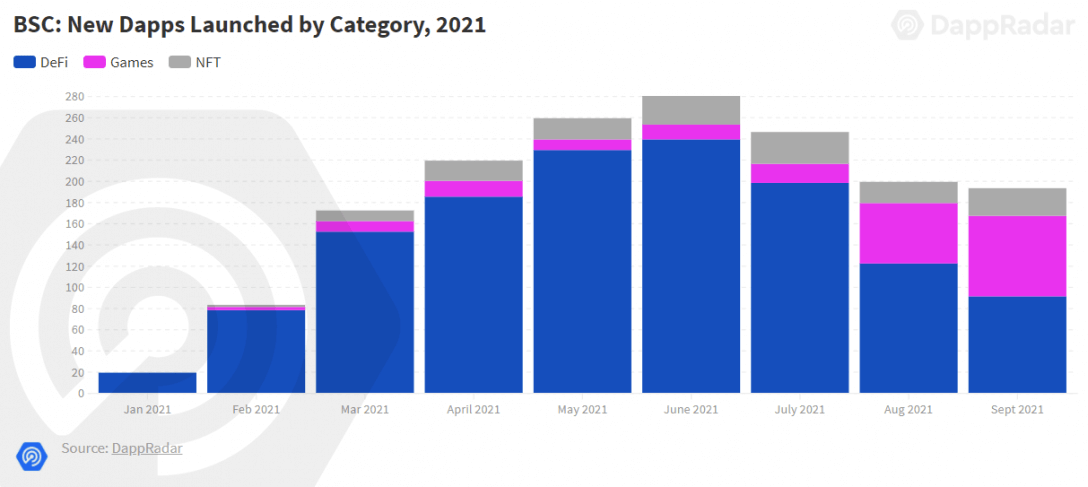

The play-to-earn (P2E) movement evolved into one of the key drivers behind the industry’s incremental growth.

“The game sector attracted 168,700 daily UAW on average during the quarter, improving the metric by an impressive 1,700% from the previous quarter,” read the report, pointing out that on BSC as well, games played a crucial part in driving the usage up, luring the attention of hundreds of thousands of players.

Meanwhile, the daily UAW interacting with DeFi dapps went down 14% from the previous quarter, recording an average of 412,000 UAW.

BSC games

“Mobox: NFT Farmer is established as one of the most played dapps in the industry, the game attracted over 30,000 daily UAW on average in September, 335% higher than the previous quarter,” continued the report, looking deeper into the games behind the usage surge in Q3.

Mobox enables users to stake liquidity provider (LP) tokens or stablecoins, in order to obtain rewards in KEYs. KEYs are yield farming tokens that can unlock NFTs, which can be utilized as playing characters or staking assets in the MOBOX platform.

CryptoBlades is another BSC game that drew impressive attention during Q3. The game enables players to engage in player-versus-environment (PVE) battles and earn the in-game currency SKILL. By staking SKILL within the same platform, players can increase their token holdings and acquire upgrades.

“At one point during Q3, it became one of the three most played games in the entire industry. On August 6, it reached its peak with 406,000 UAW connected to the game dapp. However, in recent weeks, the interest in the battle game has cooled down. Mostly due to the fall in the price of SKILL, the potential earnings diminished, losing engagement and popularity among the crowd,” revealed the report.

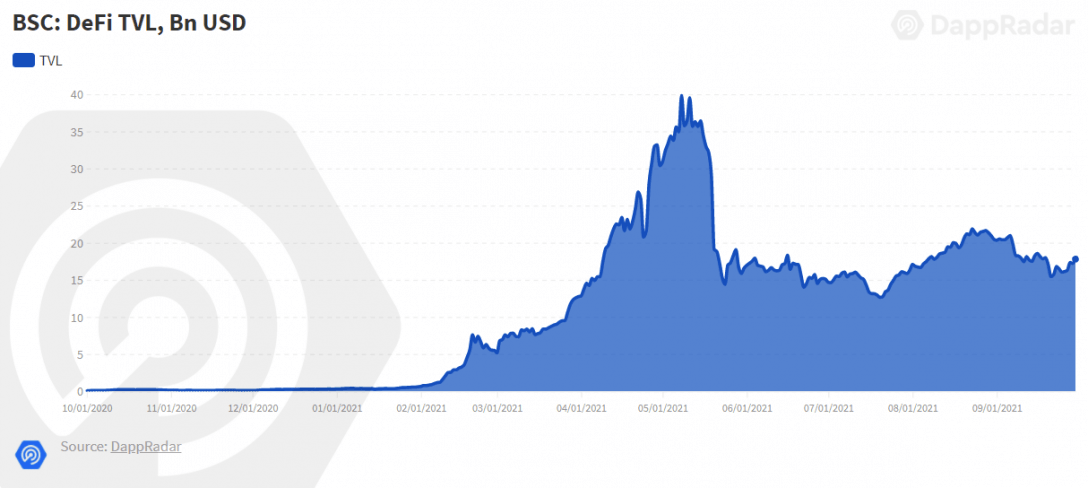

The network’s TVL

“Despite BSC users turning their attention to GameFi dapps, the network’s total value locked (TVL) is still on the rise,” noted the report.

Based on the cardinal metric, BSC established itself as the second blockchain in the “DeFi race,” DappRadar pointed out, adding that the network’s TVL recorded $17.78 billion at the end of Q3, reflecting an 18% growth from the previous quarter.

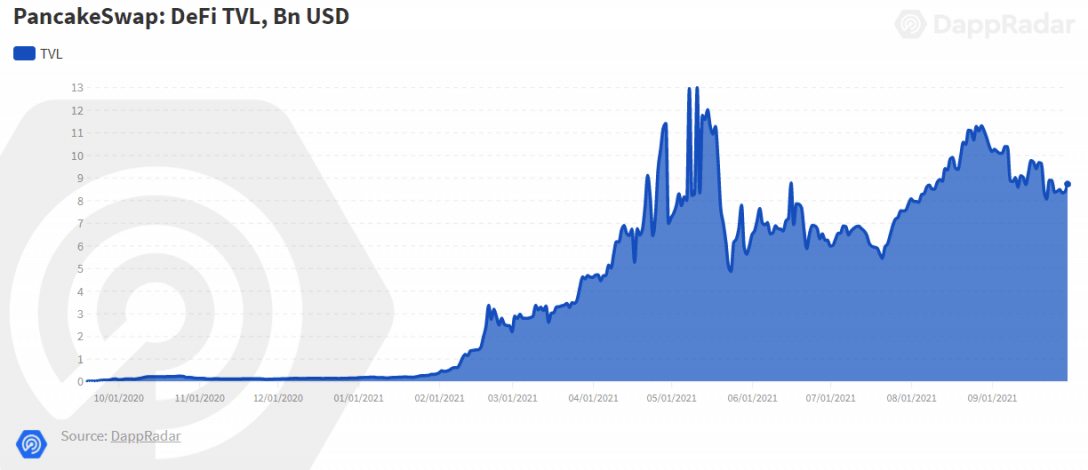

One of the most important dapps of BSC is PancakeSwap, which saw $8.71 billion in TVL at the end of Q3, the report added.

According to DappRadar, this reflects a 39.83% increase, compared to the previous quarter.

The number one automated market maker (AMM) and yield farm on BSC registered 3.06 million UAW during the last 30 days, recording a 21% increase in usage month-over-month and 10.4% quarter-over-quarter, DappRadar noted, calling it a “DeFi gem.”

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass