Ad

CBOE Volatility Index

Source: FRED

What is CBOE Volatility Index?

The CBOE Volatility Index (VIX), often referred to as the “fear gauge,” is a real-time measure of market volatility and investor sentiment. It was introduced by the Chicago Board Options Exchange (CBOE) in 1993 and has since become one of the most widely followed barometers of market risk and uncertainty.

The VIX is calculated based on the prices of options on the S&P 500 Index (SPX), and it represents the market’s expectations for volatility over the next 30 days. Typically, the VIX rises when market uncertainty and fear increase, and it declines when confidence and stability return.

History of the VIX

The VIX was created by economist Robert E. Whaley in 1993 as a way to measure expected volatility. Initially, the index was derived from options on the S&P 100 Index, but in 2003, the CBOE shifted its focus to the broader S&P 500 Index, which more accurately reflects the overall market.

The VIX gained widespread recognition during times of financial stress, most notably during the dot-com bubble of the late 1990s, the 2008 global financial crisis, and, more recently, the COVID-19 pandemic. In each of these crises, the VIX spiked sharply as fear gripped the markets, providing a real-time glimpse into the level of investor anxiety.

During the 2008 financial crisis, for instance, the VIX surged above 80, far higher than its historical average of around 20, reflecting the extreme uncertainty and risk that dominated the market.

Over the years, the VIX has evolved from a simple volatility measure into a tradable asset, with futures and options on the VIX now available, allowing investors to speculate on or hedge against market volatility.

How the VIX is Calculated

The VIX is calculated using a complex formula that averages the weighted prices of S&P 500 index options with near-term expiration dates. These options are sensitive to changes in market conditions and provide insights into where investors believe the market will move in the short term.

Specifically, the VIX is based on the implied volatility of options, which is the market’s expectation of how much the price of the S&P 500 might fluctuate. Higher implied volatility means higher expected movement (up or down), and thus a higher VIX reading.

Understanding the VIX in the Context of Investor Sentiment

The VIX reflects a unique form of market sentiment that’s often labeled as “fear” because it tends to rise during periods of financial turmoil. When market participants expect higher volatility, either due to economic data releases, geopolitical events, or financial instability, they often seek protection by buying options. This activity pushes up option prices, which in turn increases the VIX.

Conversely, during times of market calm and optimism, demand for protective options decreases, leading to lower implied volatility and a drop in the VIX. For this reason, the VIX is often used by investors as a contrarian indicator—when the VIX reaches extreme levels, it may signal a market bottom or top.

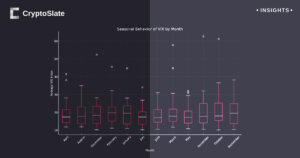

Correlation Between VIX and Bitcoin

While the VIX is fundamentally tied to traditional stock markets, especially the S&P 500, its relationship with Bitcoin has drawn increasing attention over the years. As Bitcoin has matured from a niche asset into a mainstream investment class, investors have sought to understand how it interacts with other market indicators, including the VIX.

One interesting correlation that has emerged is the tendency for Bitcoin prices to move inversely with the VIX during times of heightened market volatility. When the VIX spikes, signaling rising fear and uncertainty in traditional markets, Bitcoin often sees an increase in trading volume and price volatility. This can be attributed to Bitcoin’s perception as a store of value or a hedge against traditional market risk.

For instance, during the COVID-19 pandemic market turmoil in March 2020, both the VIX and Bitcoin experienced sharp price movements, with the VIX reaching its highest level since the 2008 financial crisis, and Bitcoin undergoing a significant crash followed by a rapid recovery.

At the same time, Bitcoin is not entirely decoupled from the traditional financial system. While some see Bitcoin as a hedge against stock market volatility, others view it as a risk asset that can sell off during times of extreme market stress. In the long run, Bitcoin’s price behavior tends to be more independent from the VIX, but during short-term market shocks, the two can become more correlated as investors liquidate assets across the board, including Bitcoin, to raise cash.

VIX and Bitcoin as Volatility Measures

Both the VIX and Bitcoin share a commonality in their high volatility. The VIX measures expected volatility in traditional stock markets, while Bitcoin, by nature of its decentralized and relatively nascent structure, experiences significant price swings.

However, the causes of volatility differ—whereas VIX volatility often stems from macroeconomic factors like interest rates or political developments, Bitcoin volatility is frequently driven by factors unique to the crypto market, such as regulatory news, technological advancements, or shifts in institutional adoption.

The Future of the VIX and Crypto Markets

As the crypto market matures, it is possible that correlations between traditional financial indicators like the VIX and Bitcoin will evolve. Increased institutional participation and the development of crypto derivatives markets, including Bitcoin futures and options, may lead to more direct relationships between crypto assets and traditional market volatility indices.

Furthermore, as Bitcoin increasingly becomes part of diversified portfolios, its behavior relative to traditional market volatility, including the VIX, will continue to be an area of interest for traders and investors alike.

The introduction of crypto-specific volatility indices, such as the Bitcoin Volatility Index (BVIX), also provides further insight into the unique volatility characteristics of crypto assets, adding to the broader understanding of market sentiment across both traditional and digital asset classes.

Conclusion

The CBOE Volatility Index remains a vital tool for gauging market sentiment and understanding the broader financial landscape. While it originates from traditional markets, its interplay with Bitcoin highlights the evolving nature of modern finance, where digital assets are increasingly considered in relation to legacy systems. By keeping an eye on the VIX, investors can better navigate periods of market uncertainty, whether they’re trading in stocks, crypto, or both.