Crypto trading sinks to 2019 levels as Binance sees market dip and Huobi volumes surge

Crypto trading sinks to 2019 levels as Binance sees market dip and Huobi volumes surge Crypto trading sinks to 2019 levels as Binance sees market dip and Huobi volumes surge

Huobi Exchange spot trading volume surged by 46.5% to $28.9 billion in August.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Spot and derivatives trading activities on centralized cryptocurrency exchanges declined for the second consecutive month by 11.5% to $2.09 trillion, setting a new low for the current year, according to CCData.

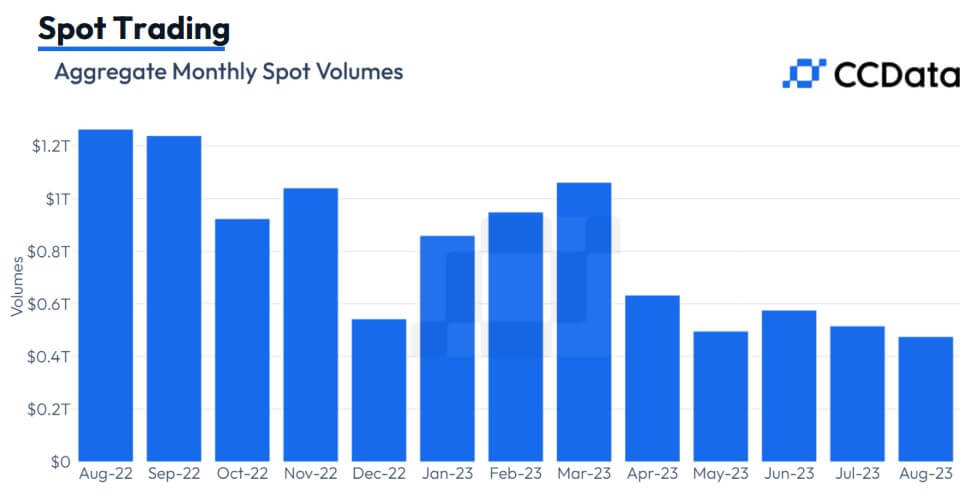

The crypto data aggregator reported that spot trading activities fell 7.78% to $475 billion in August, the lowest volume recorded since March 2019. CCData stated that daily volumes on centralized exchanges also hit a low of $5.90 billion on August 26, the weakest since Feb. 7, 2019.

Per CCData, the decreased crypto trading activity was despite Grayscale’s recent success against the U.S. Securities and Exchange Commission (SEC). According to the firm, the legal victory failed to spur a meaningful accumulation of crypto assets. The firm wrote:

“The trading volumes on centralised exchanges have remained low since April this year and are now comparable to the stagnant trading activity in the bear market of 2019.”

Binance market share falls

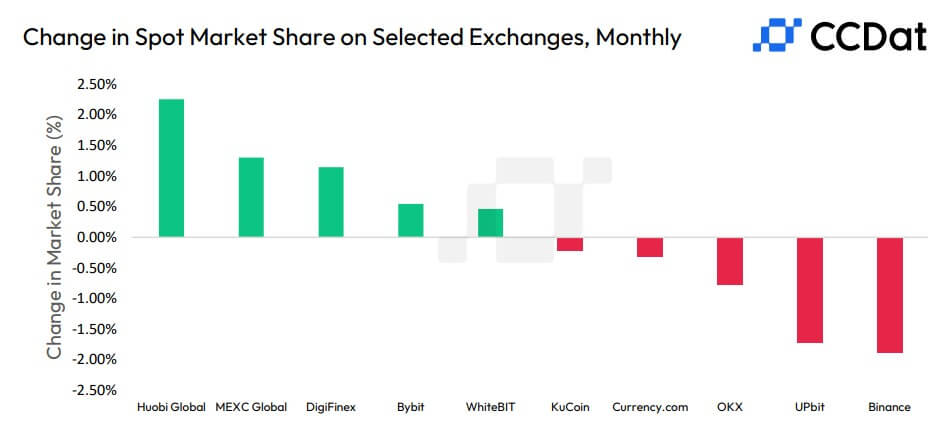

While Binance continues to lead in spot trading volume with $183 billion, it’s noteworthy that the exchange’s market share has declined consistently for six consecutive months, now resting at 38.5%—its lowest point in the past year.

Binance’s recent setbacks can be primarily attributed to regulatory and legal issues, which have prompted significant changes within the company’s top leadership. Several high-ranking executives have departed, ostensibly for personal reasons; however, there is widespread speculation that their departures are linked to mounting regulatory pressures.

An example of how these issues have affected Binance is how its trading volume within Russia plummeted by over 80%, according to Kaiko data. Although Binance has publicly stated its commitment to adhering to imposed sanctions on the country, recent media reports have raised questions about the exchange’s continued use of sanctioned financial institutions to facilitate peer-to-peer transactions.

Huobi volume climbs

In August, the Huobi Exchange experienced a substantial boost in its spot trading volume. Notably, its spot trading volume surged by an impressive 46.5%, reaching $28.9 billion. This surge catapulted Huobi into the position of the second-largest platform in the industry and saw its spot market share jump to 6.3%, its highest point since October 2021.

This surge in Huobi’s trading activity has drawn significant attention, particularly in light of its associations with Justin Sun, the founder of Tron’s network, and ongoing inquiries regarding its stablecoin reserves.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass