Coinbase stock surges to highest since April 2022

Coinbase stock surges to highest since April 2022 Coinbase stock surges to highest since April 2022

Regulatory compliance and global licensing achievements fuel Coinbase's stock surge to a 10-month peak.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

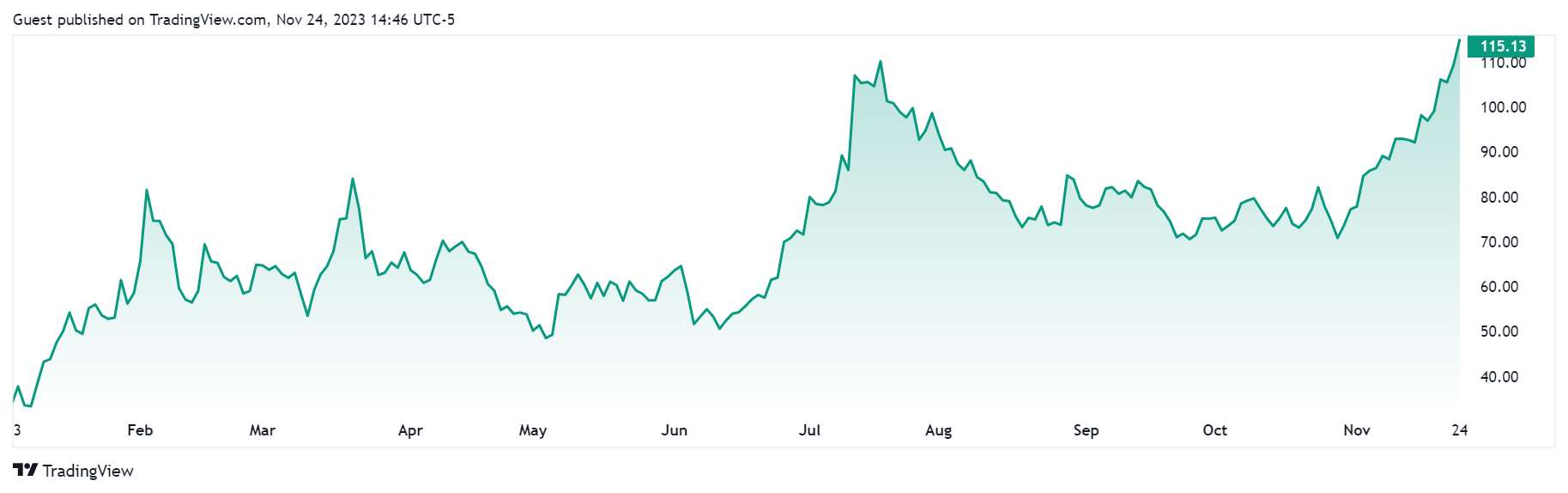

Coinbase’s COIN stock has rallied to its highest point since late April 2022 at $115, representing a 216% growth on the year-to-date metric, according to Tradingview data.

Observers have linked COIN’s price performance to the generally positive trend observed in the crypto space, where flagship digital assets like Bitcoin, Ethereum, and Solana have recorded more than 100% gains during the past year.

Why Coinbase stock is rising

Over the past year, Coinbase has emerged as one of the biggest industry players following the collapse of several crypto firms.

The exchange’s strong reputation has played a huge role in its business as it has recently touted its strong compliance-first approach following the issues of rivals like Binance.

Coinbase CEO Brian Armstrong stated this approach has been proven right, highlighting how the firm embraced “compliance to become a generational company” that can stand the test of time.

Besides that, the company also plays an active role in several spot Bitcoin exchange-traded fund (ETF) applications with the U.S. Securities and Exchange Commission (SEC).

Several applicants, including Fidelity, Invesco, WisdomTree, VanEck, and Ark 21 Shares, have surveillance-sharing agreements (SSAs) with the exchange. Additionally, the firm would be helping asset managers like Franklin Templeton custody of their fund’s BTC.

Meanwhile, the exchange has grown substantially, securing Bermuda’s licensing to launch an international exchange and offering perpetual futures trading to non-U.S. retail customers.

Additionally, it has secured licenses in several European countries, including the Netherlands, Spain, Ireland, Singapore, and Italy, as part of its expansion outside the U.S.

It has also launched several products, including creating an institutional lending service, adding new assets, and unifying its USD and USDC order books.