Cardano (ADA) broke $3 today. Here are the top reasons why

Cardano (ADA) broke $3 today. Here are the top reasons why Cardano (ADA) broke $3 today. Here are the top reasons why

The much-awaited smart contract integration has gone live on the testnet, bringing ADA to a price level not seen in its history.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Cardano (ADA) crossed the $3 mark for the first time in its history this morning, reaching a marketcap of as much as $99.6 billion at press time and frenzied activity on social mediums.

The move came as smart contracts—a self-executing contract with the terms of the agreement between buyer and seller being directly written into lines of code—went live on the testnet, years after being awaited by the broader Cardano community.

So there we have it. Since c. 20:20 UTC today, the #Cardano Testnet now officially supports #Plutus #smartcontracts. Final testing & integrations ahead. SPOs will now upgrade their mainnet nodes. Then next stop… mainnet upgrade. Still on track for 12 September. Onward! $ADA pic.twitter.com/Wl5CUpRB4L

— Input Output (@InputOutputHK) September 1, 2021

ADA breaks $3

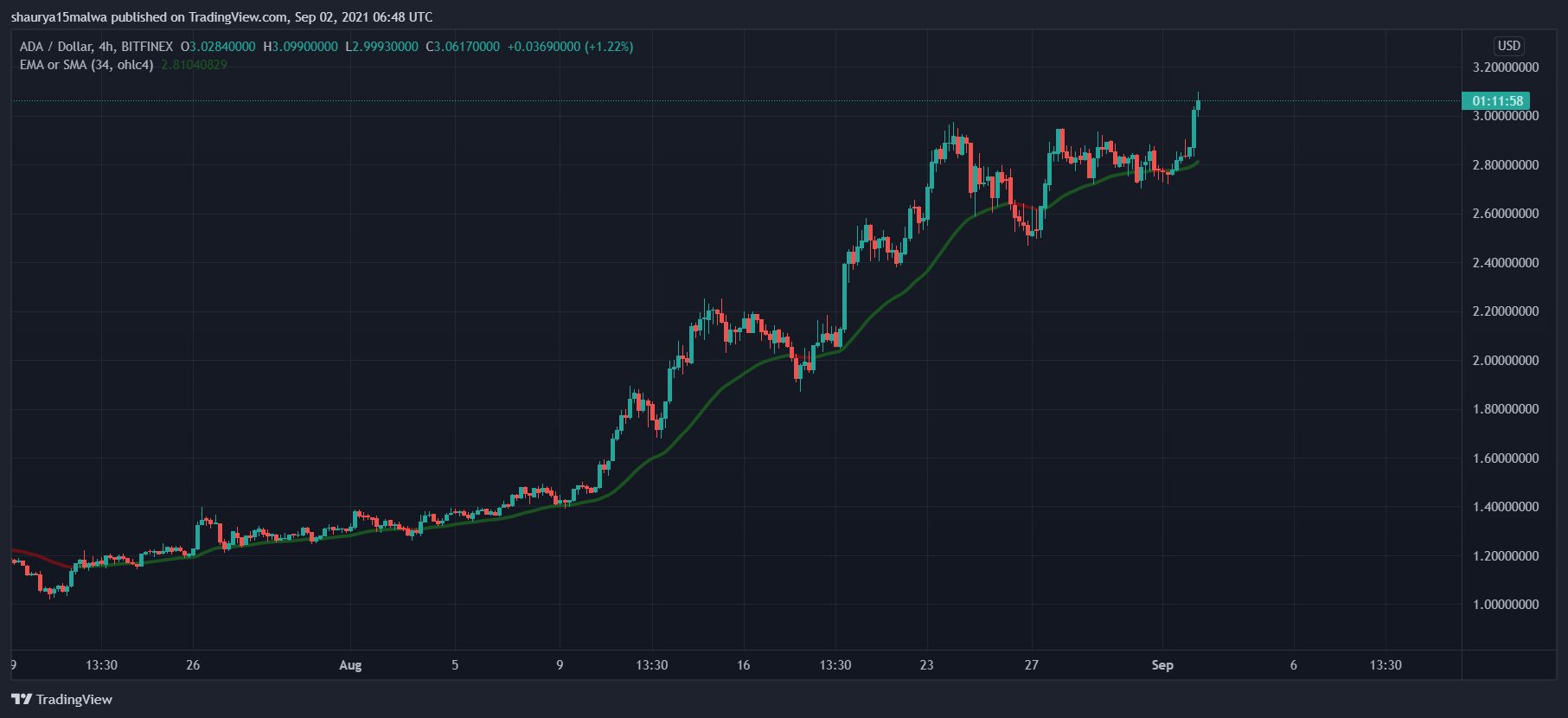

As the below image shows, ADA remains in a strong uptrend and trades above its 34-period exponential moving average (a popular tool used by traders to determine market strength and trend). It currently has no resistance levels and has been on an uptrend since the $1.20 mark from last week.

Data from Bybt shows those betting against Cardano lost it big yesterday: Over $5 million worth of ADA ‘shorts’ were eviscerated as token prices jumped over 10% in a few hours. $1.25 million worth of those came from Binance alone, while Bybit was next in line with $800,000 in ADA short liquidations.

The Cardano network is worth nearly $100 billion at current prices. It has a circulating supply of 32 billion and a max supply of 42 billion, implying a $138 billion ‘fully diluted marketcap’ if all tokens were to trade on the open market.

Fundamentals driving Cardano

Several fundamental factors preceded ADA’s road to $3, starting with technical improvements and roadmap completions, and higher adoption of ADA in local markets.

Cardano, alongside Ethereum, was one of the most popular crypto investments in the island-nation of Singapore, with a chunk of first-time crypto buyers choosing the token alongside Bitcoin and Ethereum for their initial purchases. A separate report, on the other hand, showed institutions were increasingly betting on ADA as well, alongside new crowd favorite Solana.

ADA also saw its first-ever entry in the crypto-frenzied Japanese market last month. It was ‘approved’ for trading after passing strict regulatory listing checks in Japan, arguably drawing investor attention from that market.

On the technical side: The Alonzo Purple rollout phase began months ago and is the culmination of months of work on the most crucial upgrade that will usher the smart contract functionality to the network, marking the beginning of the new Goguen era, as road mapped by the developers.