Bitcoin’s halving sent on-chain metrics through the roof while whales accumulate

Bitcoin’s halving sent on-chain metrics through the roof while whales accumulate Bitcoin’s halving sent on-chain metrics through the roof while whales accumulate

Photo by Paola Ocaranza on Unsplash

The Bitcoin network successfully went thought its third halving on Monday. Consequently, reducing the rate of issuance from 12.5 BTC per block to 6.25 BTC.

Some of the most prominent figures within the industry anticipated that this event could trigger a catastrophic correction. However, the flagship cryptocurrency only took a 19 percent nosedive over the weekend. And, it has recovered more than half of the losses incurred since then.

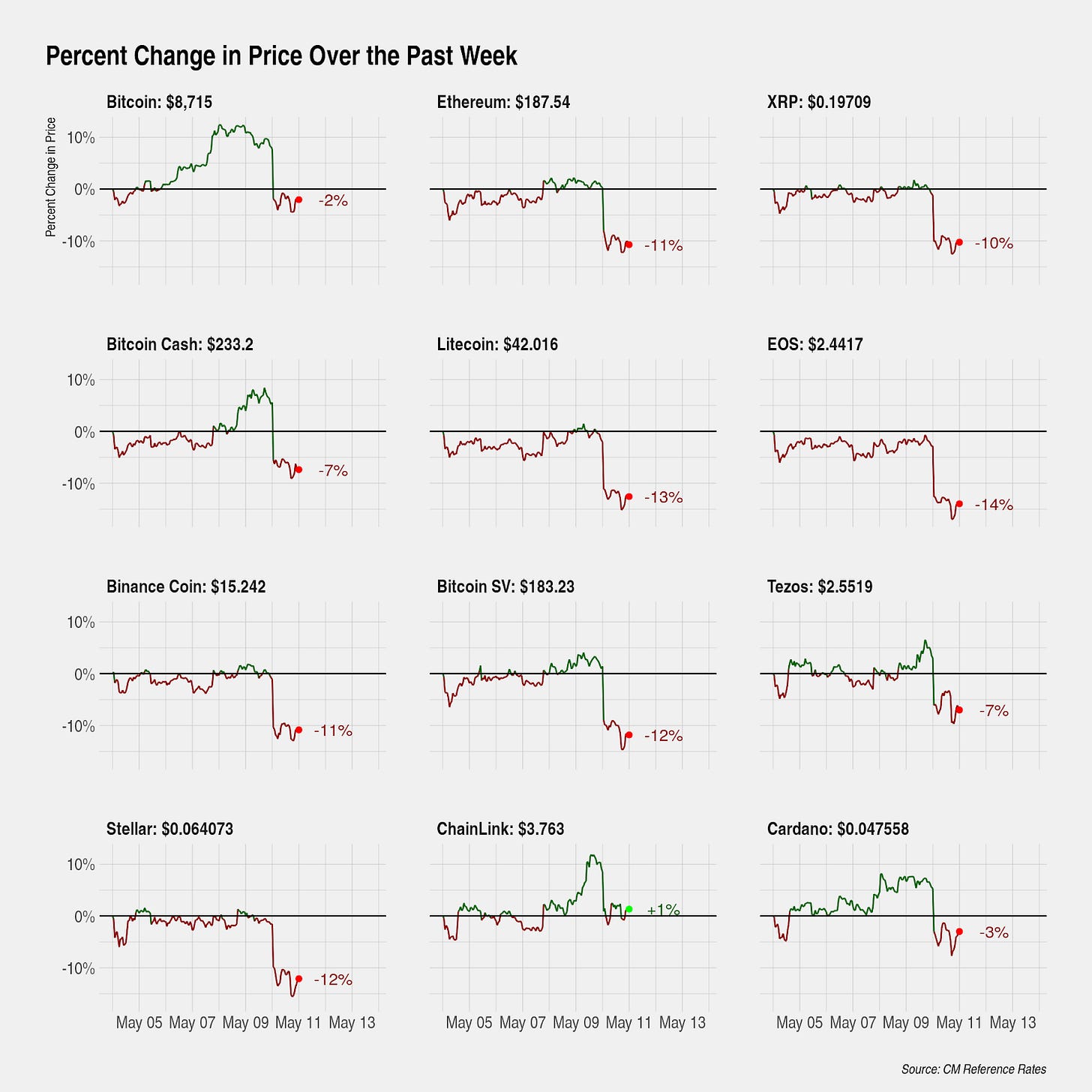

Coin Metrics maintains that the recent block rewards reduction event has actually benefited Bitcoin as it continues to outperform most other major crypto assets. With such a considerable price action, the all-in-one crypto financial data provider believes that BTC is poised to shine.

On-Chain Metrics Explode

The run-up to Bitcoin’s halving was impressive. Not only high levels of volatility struck back in the cryptocurrency market, but on-chain metrics exploded.

Data from Coin Metrics reveals that Bitcoin transaction fees skyrocketed over 170 percent last week in anticipation of the block rewards reduction event. And this week, transaction fees were up more than 30 percent.

Although high transaction fees are commonly seen as negative since they make Bitcoin barely usable for microtransactions, Coin Metrics maintains that fee growth is a positive sign. The Boston-based company argues that when transaction fees are rising it indicates that the network usage is also increasing rapidly.

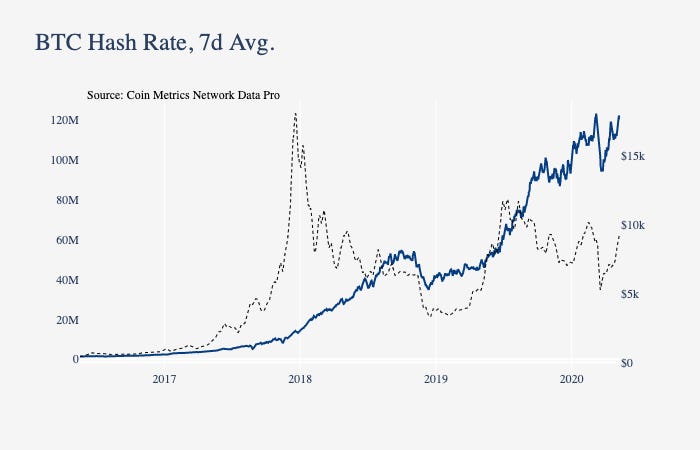

Moreover, Bitcoin’s hash rate, which is the computing power of the network, surged to a new all-time high. As miners with obsolete units worried about the effects of the halving, they rushed to get a piece of the last 12.5 BTC blocks. Subsequently, pushing the hash rate further up.

Charles Edwards, digital asset manager at Capriole Investments, believes that despite the recent spike in hash rate, the network’s processing power could be set to drop. The analyst maintains that miners’ production cost doubled to $14,000 after the recent halving, which may incentivize unprofitable miners to shut off their units to avoid more losses.

Meanwhile, Jake Yocom-Piatt, project lead at Decred, affirmed that miners will do anything to keep the same revenues they had so they may be forced to push Bitcoin’s price up to stay afloat.

Yocom-Piatt stated:

“Miners’ costs are effectively fixed, so to maintain the same profit margins, they are incentivized to double the price at which they sell their Bitcoin. I expect this supply shock will drive the Bitcoin price up by moving offers from miners up substantially.”

Even though it is too early to tell whether or not these key industry players are preparing to drive Bitcoin’s price up, certain metrics suggest so.

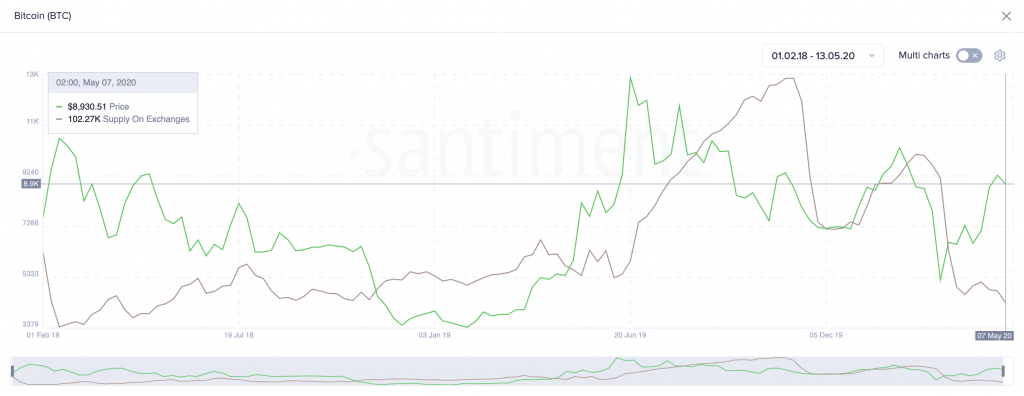

Bitcoin Is Leaving Exchanges

The supply of Bitcoin being held across multiple cryptocurrency exchanges has not been as low as today since May 2018. Over the last three months alone, the number of BTC in Bitfinex and BitMEX’s wallets dropped by more than 50 and 30 percent, respectively.

Coin Metrics said:

“The amount of BTC held by BitMEX and Bitfinex has reached new lows following the March 12th crash. Bitfinex now holds 93.8K BTC, down from 193.9k on March 13th. BitMEX’s BTC supply is now down to 216.0K BTC, down from a peak of 315.7K on March 13th.”

The significant reduction in supply on exchanges implies that the number of BTC “hodlers” is rising at an exponential rate.

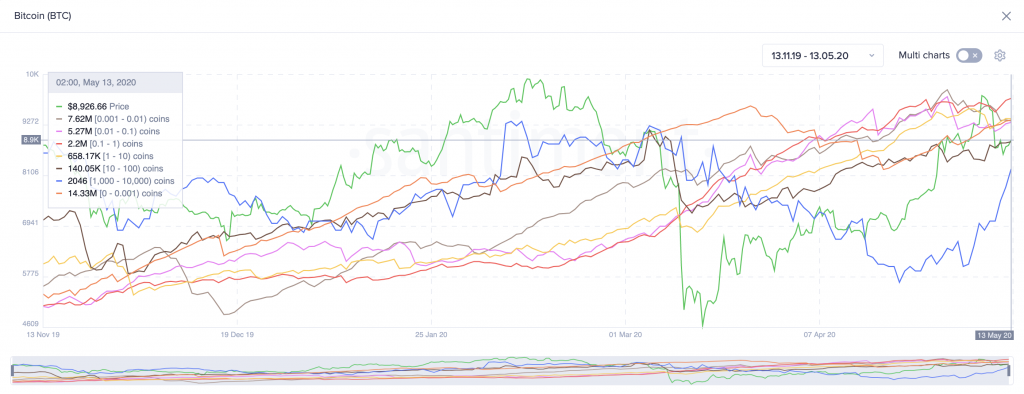

A look at Santiment’s holders’ distribution chart shows that retail investors with 0.001 to 100 BTC have been heavily accumulating over the past six months. And most recently, the number big players with 1,000 to 10,000 BTC also started increasing.

While holders distribution is not necessarily a price forshadower, it certainly provides a view of the vote of confidence that investors are giving to the pioneer cryptocurrency. Even billionaire Paul Tudor Jones believes that Bitcoin has attractive store of value characteristics in the face of a global financial crisis.

As the flagship cryptocurrency becomes more scarce over time, some believe that it has only one way to go — up. Only time will tell whether the recent halving is indeed the catalyst to the next bull run.

Bitcoin Market Data

At the time of press 9:05 pm UTC on May. 14, 2020, Bitcoin is ranked #1 by market cap and the price is up 5.49% over the past 24 hours. Bitcoin has a market capitalization of $177.26 billion with a 24-hour trading volume of $55.99 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:05 pm UTC on May. 14, 2020, the total crypto market is valued at at $262.69 billion with a 24-hour volume of $176.91 billion. Bitcoin dominance is currently at 67.54%. Learn more about the crypto market ›