Bitcoin abruptly drops as it hits $10,500 causing panic in the market

Bitcoin abruptly drops as it hits $10,500 causing panic in the market Bitcoin abruptly drops as it hits $10,500 causing panic in the market

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin has been on a near-relentless rally higher over the past 60 days, entering a clear uptrend after bottoming at $6,400 in December of 2019. It has gained 63 percent since the local bottom.

Although this is already an impressive feat in and of itself, analysts expected the cryptocurrency’s prospects to turn even more optimistic with the passing of a key price point — $10,500.

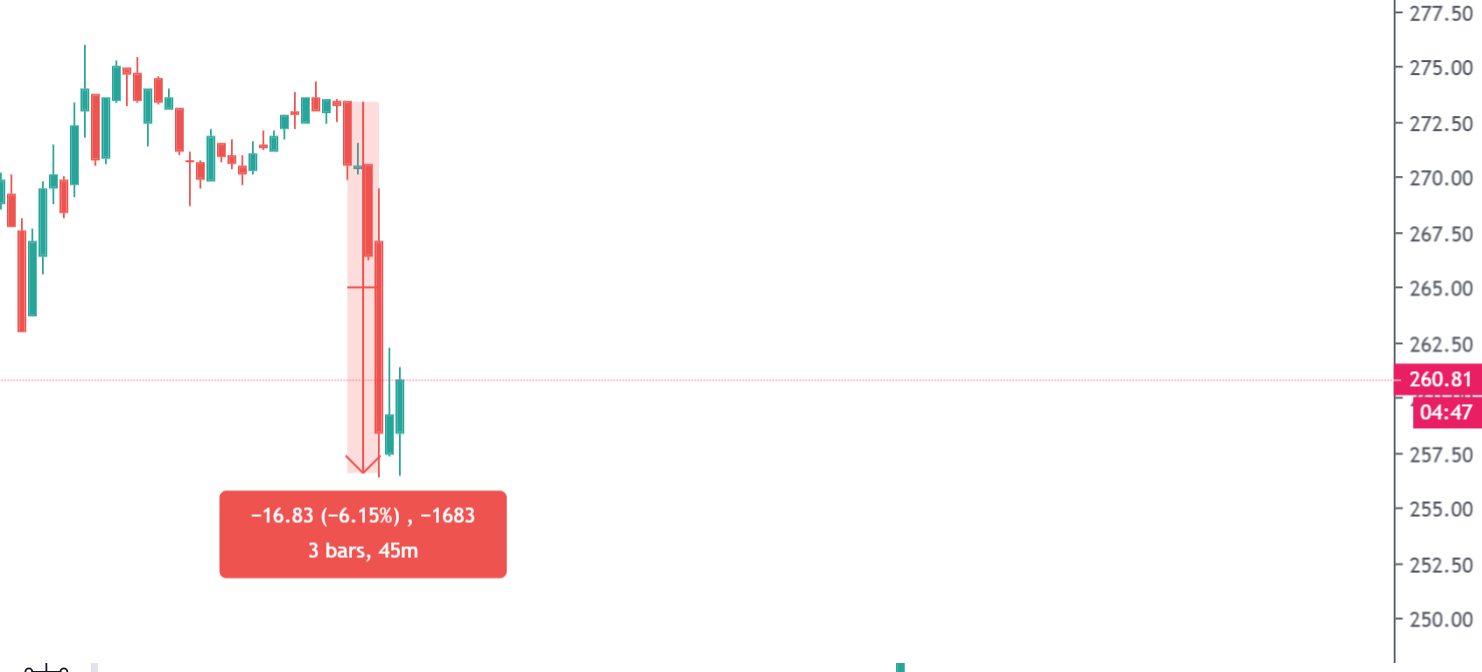

However, as soon as the bitcoin price hit the highly anticipated $10,500 level, it immediately slipped by four percent against the USD. The move led even the best performing cryptocurrencies in this rally including Ethereum to plunge by around six percent.

Bitcoin flipping $10,500 into support will be massive for the bull case

Prominent technical analyst Cred — who sports over 140,000 followers — remarked that since $9,500 has been breached, Bitcoin’s nearest resistance is $10,500, the midpoint of the tried-and-true range between $9,500 and $11,500.

So far, the cryptocurrency has rejected that level.

Though, Cred remarked that if Bitcoin can confirm a close above $10,600 — just a smidgen above the resistance he identified — prices will continue higher, likely unfettered until the other long-term resistance he identified at $11,500.

Close above $9500 took price back within old weekly range.

Now at resistance around range midpoint (~$10500).

Not chasing this daily engulfing, will be waiting for deeper pullback ($9500) or daily continuation >$10600.

Your spot $BTC is up, why risk it to chase? Enjoy. pic.twitter.com/lhu1QL81Dl

— Cred (@CryptoCred) February 11, 2020

The importance of $10,500 was echoed by analyst Pierre, who wrote in his own analysis that “breaking above this level would lead to my $11,500 weekly target,” though a rejection of this level could lead to a retrace of at least 5 percent.

$10,500 is also important because this price point was the top of Bitcoin’s rally in September 2019, which was caused by China’s embracing of blockchain technologies in an unexpected fashion.

A failure to break past the previous swing high, analysts say, would mark a swing failure pattern (SFP) candle, which would likely mark the top for the ongoing Bitcoin rally should it form.

Ongoing battle at $10,500

After falling short of $10,500 earlier today and falling as low as $10,300 from there, bulls tried to pass this level yet again just minutes ago, pushing Bitcoin as high as $10,550 before prices dropped by $120 in minutes to $10,420.

This inability to pass this key resistance only accentuates its importance for buyers to surmount.

Can bulls bring prices above $10,500

Fortunately, a number of analysts are convinced that investors are likely to push and keep the price of Bitcoin above $10,500 in the coming days, despite the recent failures to do so.

Financial Survivalism, the cryptocurrency trader who at the start of 2020 called for an immediate rally to the $9,000s, recently remarked that the three-day Ichimoku Cloud for Bitcoin is now “fully bullish,” signaling a buy at $10,268, suggesting more upside is imminent.

The 3D Ichimoku Cloud (traditional settings) is now fully bullish and it recently signaled a buy at $10,268. $BTC pic.twitter.com/YrZgDY7wVI

— Financial Survivalism (@Sawcruhteez) February 12, 2020

And Dave the Wave, the trader who in the middle of 2019 said the price of BTC would retrace to the mid-$6,000s, just doubled down on his prediction the asset will hit $11,000 to $11,500 before any significant pullback, if at all.

Bitcoin Market Data

At the time of press 9:03 am UTC on Feb. 13, 2020, Bitcoin is ranked #1 by market cap and the price is down 0.82% over the past 24 hours. Bitcoin has a market capitalization of $185.99 billion with a 24-hour trading volume of $42.17 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:03 am UTC on Feb. 13, 2020, the total crypto market is valued at at $298.92 billion with a 24-hour volume of $168.04 billion. Bitcoin dominance is currently at 62.24%. Learn more about the crypto market ›