Binance Proof-of-Reserves show Bitcoin balance dropped 23k BTC in November amid regulatory woes

Binance Proof-of-Reserves show Bitcoin balance dropped 23k BTC in November amid regulatory woes Binance Proof-of-Reserves show Bitcoin balance dropped 23k BTC in November amid regulatory woes

Binance balance for major cryptocurrencies recorded declines amid its struggles with the regulatory authorities in the United States.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

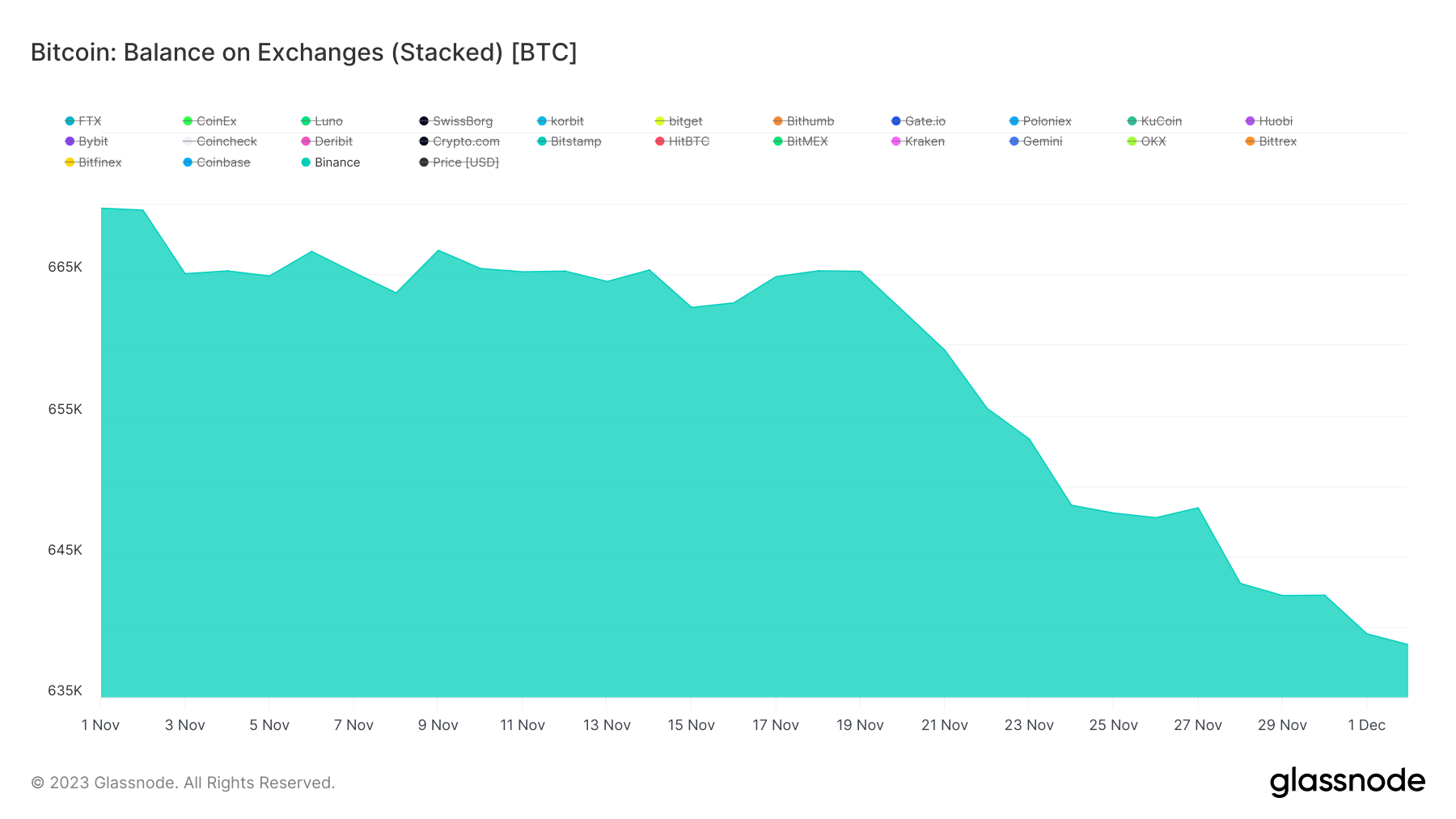

According to its latest proof of reserves report, Binance experienced a significant decline in its Bitcoin balance in November, dropping by over 23,000 BTC, or roughly 4%, coinciding with the exchange’s regulatory issues with U.S. authorities.

According to data from Binance’s website, the total BTC balance of its customers was 584,659 BTC at the beginning of November. However, the balance had decreased to 561,003 BTC by the start of December. This suggests a substantial withdrawal of assets from the platform during the regulatory challenges it faced.

A CryptoSlate Insight analysis highlighted a distinct trend among Binance users during this period. The platform witnessed significant BTC outflows from larger holders, while incoming funds primarily originated from retail users.

Supporting this observation, DeFillama’s data dashboard revealed that Binance encountered outflows surpassing $2 billion between Nov. 1 and Dec. 1.

This decline in Binance’s Bitcoin holdings occurred as the platform resolved to a settlement exceeding $4 billion with the U.S. authorities on issues relating to multiple violations of several financial laws. Additionally, the exchange’s founder, Changpeng ‘CZ’ Zhao, stepped down as CEO after pleading guilty to charges related to money laundering.

Other asset balances

Binance’s website further shows that the platform balances on other major cryptocurrencies also recorded declines during the period.

For context, Ethereum holdings for Binance users dropped by approximately 0.67%, moving from 3.91 million to 3.88 million as users withdrew their assets.

Similar trends were observed in balances for other assets such as XRP, Litecoin, USDC, and Binance’s native BNB token.

In contrast, Binance saw a more than 5% surge in the balance of Tether’s USDT, reaching $15.2 billion. This increase coincided with over 860 million units of the stablecoin being sent to the platform by users during the same period.

Some analysts believe that the upsurge in USDT’s balance on Binance is linked to the stablecoin’s growing market supply. As Binance maintains its position as the leading cryptocurrency exchange by trading volume, crypto traders increasingly deposit their USDT on the platform for trading purposes.

Despite regulatory concerns, data on Binance’s website indicates that the exchange’s assets remain fully backed.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass