Binance is still operating normally despite months of FUD

Binance is still operating normally despite months of FUD Binance is still operating normally despite months of FUD

Despite the market fluctuations in late 2022, Binance has maintained its steady operation, ensuring smooth trading experiences for its users.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Toward the end of 2022, the market saw some FUD (fear, uncertainty, and doubt) surrounding the safety and security of Binance, one of the world’s largest and most popular cryptocurrency exchanges.

The concerns stemmed from various sources, including social media posts and online articles, that have raised concerns about the exchange’s security and the possibility of user funds being at risk.

Let’s take a closer look at these recent concerns, examine the audit reports that have been released, and explain why the FUD should not be a cause for concern and why Binance is safe.

Summary of the Concerns

One of the concerns surrounding Binance has been a series of social media posts and online articles that have claimed that the exchange is not secure and that user funds are at risk.

These claims have been fueled by various factors, including the Celcius bankruptcy, the high-profile collapse of FTX, temporary withdrawal pauses, and the recent proliferation of phishing attacks targeting cryptocurrency exchanges.

Despite these concerns, it’s important to note that Binance has a long track record of security and has taken numerous steps to ensure the safety of its users’ funds. For example, the exchange stores most of its users’ funds in offline cold storage wallets that are not connected to the internet and much less vulnerable to hacking attacks.

In addition, Binance has implemented several other security measures, including multi-factor authentication, to protect users’ funds. We’ll look at some of the concerns in greater detail below.

Proof-of-Reserves

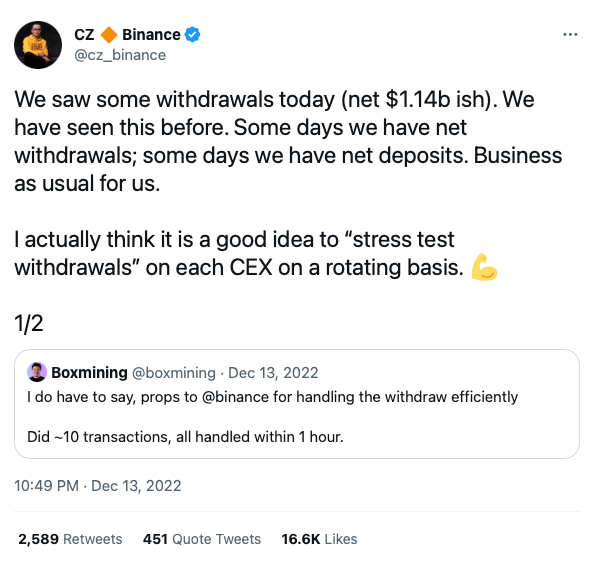

Following the downfall of multiple platforms in 2022, the public became more interested in seeing exchanges’ proof-of-reserves to determine if they have the 1:1 backing of the assets listed. In December 2022, Binance was audited by the financial auditor Mazars, and the report showed that Binance’s Bitcoin (BTC) reserves exceeded over 100%.

However, there were still some concerns since the platform’s liabilities were not included. Former Kraken CEO Jesse Powell criticized the audit in November, claiming that the audit wasn’t enough without covering the negative balances. Binance CEO Chenpang Zhao (CZ) later confirmed that the exchange had no outstanding loans in December 2022.

Pausing USDC withdrawals

On December 13th, 2022, Binance temporarily stopped withdrawing USD Coin (USDC) tokens on the platform. This move caused investors to grow concerned since Celcius halted withdrawals shortly before its bankruptcy in July 2022. In addition, BlockFi also halted withdrawals before its collapse, with bankruptcy hearings proceeding in early January 2023.

However, withdrawals were halted on Binance due to a token swap involving USDC, according to an announcement on Twitter.

In this case, it seems a matter of bad timing, primarily due to the fall of the popular FTX platform a month earlier. Additionally, withdrawals for the Tether (USDT) and Binance Coin (BNB) stablecoins were not limited during this time. Binance was also able to survive a massive surge in withdrawals by users.

On the same day that USDC withdrawals were paused, up to $2 billion in Ethereum tokens were withdrawn from the platform within 24 hours. Chenpang Zhao (CZ) even welcomed the large withdrawals, saying he thought it was

“a good idea to stress test withdrawals on each CEX on a rotating basis.”

The crypto exchange continued to weather a large number of withdrawals, and recently, Binance has seen up to $12 billion in withdrawals within the past two months. Despite the heavy withdrawals, Binance has continued to operate as usual.

Phishing

Another source of FUD surrounding Binance has been the proliferation of phishing attacks targeting all top exchanges. Phishing attacks are a standard tactic hackers use to trick people into giving away their login credentials or other sensitive information by pretending to be a legitimate company or individual.

In the case of Binance, there have been some instances where hackers have set up fake apps, websites, or social media accounts purporting to be affiliated with the exchange and have used these to trick users into giving away their login credentials.

While it’s true that phishing attacks can be a severe risk for any online service, it’s important to note that Binance has taken several steps to protect its users from such attacks.

For example, the exchange has implemented email and SMS verification for login attempts, set up a dedicated security team to monitor phishing attacks, and published several warnings and guidelines to help users protect themselves.

In closing

While there have been some recent concerns surrounding the safety and security of Binance, it’s important to note that the exchange has continued to operate as normal without any issues.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass