As Ethereum skyrockets, 71% of ETH addresses are now in profit, setting a two-year high

As Ethereum skyrockets, 71% of ETH addresses are now in profit, setting a two-year high As Ethereum skyrockets, 71% of ETH addresses are now in profit, setting a two-year high

Image by NASA-Imagery from Pixabay

Ethereum’s surge to over $300 on Saturday created the most profits for holders in over two years; if on-chain data is considered.

Profits hit a local high

Analytics firm Glassnode said today that 71.72 percent of tracked ETH wallets are now “in profit.” This breaks the previous high of 68.17 percent seen a day ago on July 26.

? #Ethereum $ETH Percent Addresses in Profit (1d MA) just reached a 2-year high of 71.727%

Previous 2-year high of 71.616% was observed earlier today

View metric:https://t.co/caVzUVoOt2 pic.twitter.com/4HqpR1HXk5

— glassnode alerts (@glassnodealerts) July 27, 2020

Positive factors supporting the surge include an overall favorable view of Ethereum as technology, Visa’s announcement of building applications on Ethereum, and a recent ruling which declared Bitcoin as “money” in the U.S.

Institutions are accumulating. As CryptoSlate reported earlier, a Fidelity Investments survey this year concluded 11 percent of all surveyed American and British money managers held ETH.

Industry observers say DeFi contributes to the bullishness in Ethereum. For some, it just a matter of time before the network — over which nearly all DeFi projects are built on — fundamentally catches up with its true value.

It’s even caused some prominent Bitcoin holders to accumulate ETH. Raoul Pal, ex-Goldman Sachs alumni and the current co-founder of Real Vision, has spoken positively on Ethereum in recent times.

“I am getting increasingly bullish on Ethereum. ETH is the silver to Bitcoin’s gold. It has more industry uses and less store of value uses (…) ETH is all about adoption rates and usage. Basically, it’s all down to something called DeFi,” said Pal.

The rise of DeFi and yield

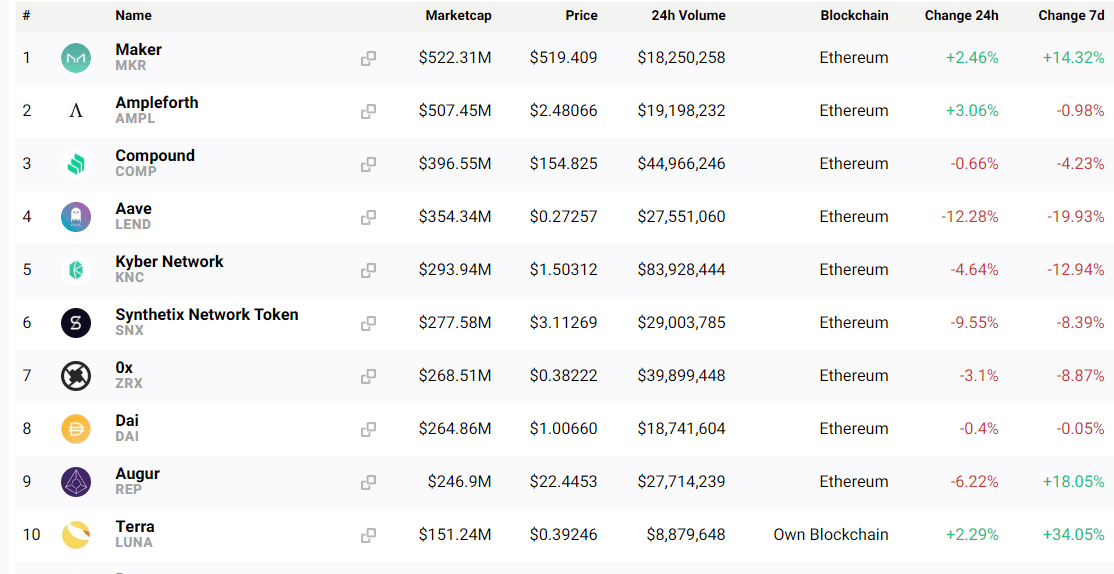

CryptoSlate’s proprietary DeFi tracker shows nine out of ten projects — except for Terra — operate on Ethereum. This creates strong fundamentals for the network, considering billions of dollars are now locked on its blockchain.

Despite the rise of projects like Band, Aave, and YFI, the overall DeFi sector has slightly dipped in the past week. Investors lost 1.11 percent if they invested in a portfolio containing all tokens. Some like FinNexus and Datamine gave returns of 50 percent and 34 percent respectively (from the period July 25-26), but AirSwap and Aave lost 21 percent and 16 percent.

Mainstream media is starting to take attention. Bloomberg reported Saturday on “What is Yield Farming,” reporting on DeFi and its effects to millions of readers that throng the publication. The media giant explored various DeFi projects, the sky-high APYs on some of them, and a section on the risks involved in the space.

Ethereum trades at $309 as of July 26. The world’s second-largest cryptocurrency, by network value, last broke this level a year ago in June 2019. It reached over $360 at the time, before giving back gains and falling to $122. In 2019, ETH’s yearly low was just $104 in February.

Ethereum Market Data

At the time of press 5:58 am UTC on Jul. 27, 2020, Ethereum is ranked #2 by market cap and the price is up 7.09% over the past 24 hours. Ethereum has a market capitalization of $36.21 billion with a 24-hour trading volume of $14.04 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 5:58 am UTC on Jul. 27, 2020, the total crypto market is valued at at $306.66 billion with a 24-hour volume of $92.58 billion. Bitcoin dominance is currently at 61.44%. Learn more about the crypto market ›

Elon Musk

Elon Musk

ETH

ETH