Fidelity spearheads $186 million surge in Bitcoin ETF inflows, Ethereum ETFs face $15 million outflow

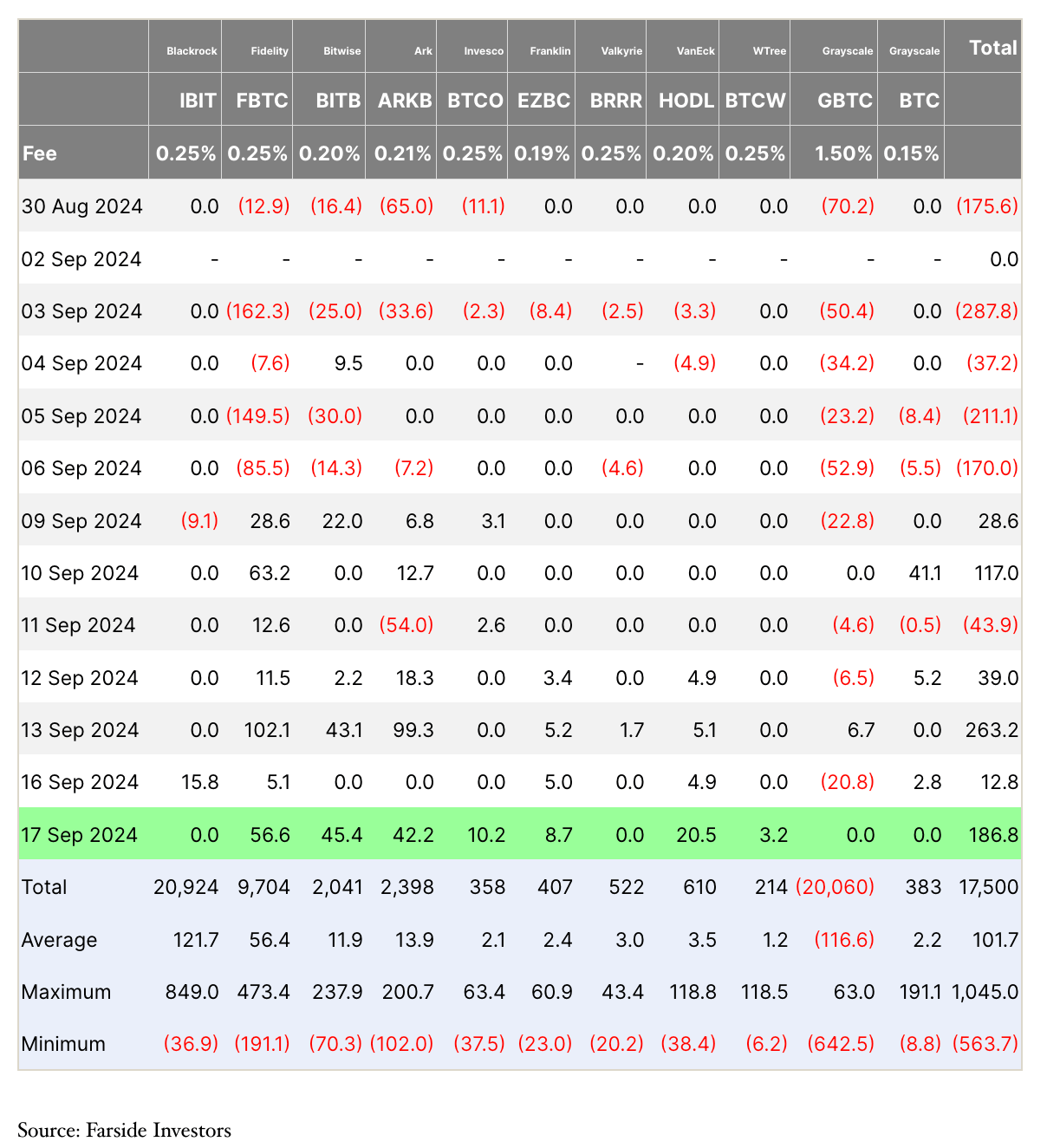

Fidelity spearheads $186 million surge in Bitcoin ETF inflows, Ethereum ETFs face $15 million outflow Bitcoin ETFs recorded net inflows of $186.8 million on Sept. 17, up from $12.8 million the previous day. Fidelity led with $56.6 million, followed by Bitwise and Ark at $45.4 million and $42.2 million, respectively. VanEck and Invesco also saw positive flows, bringing in $20.5 million and $10.2 million.

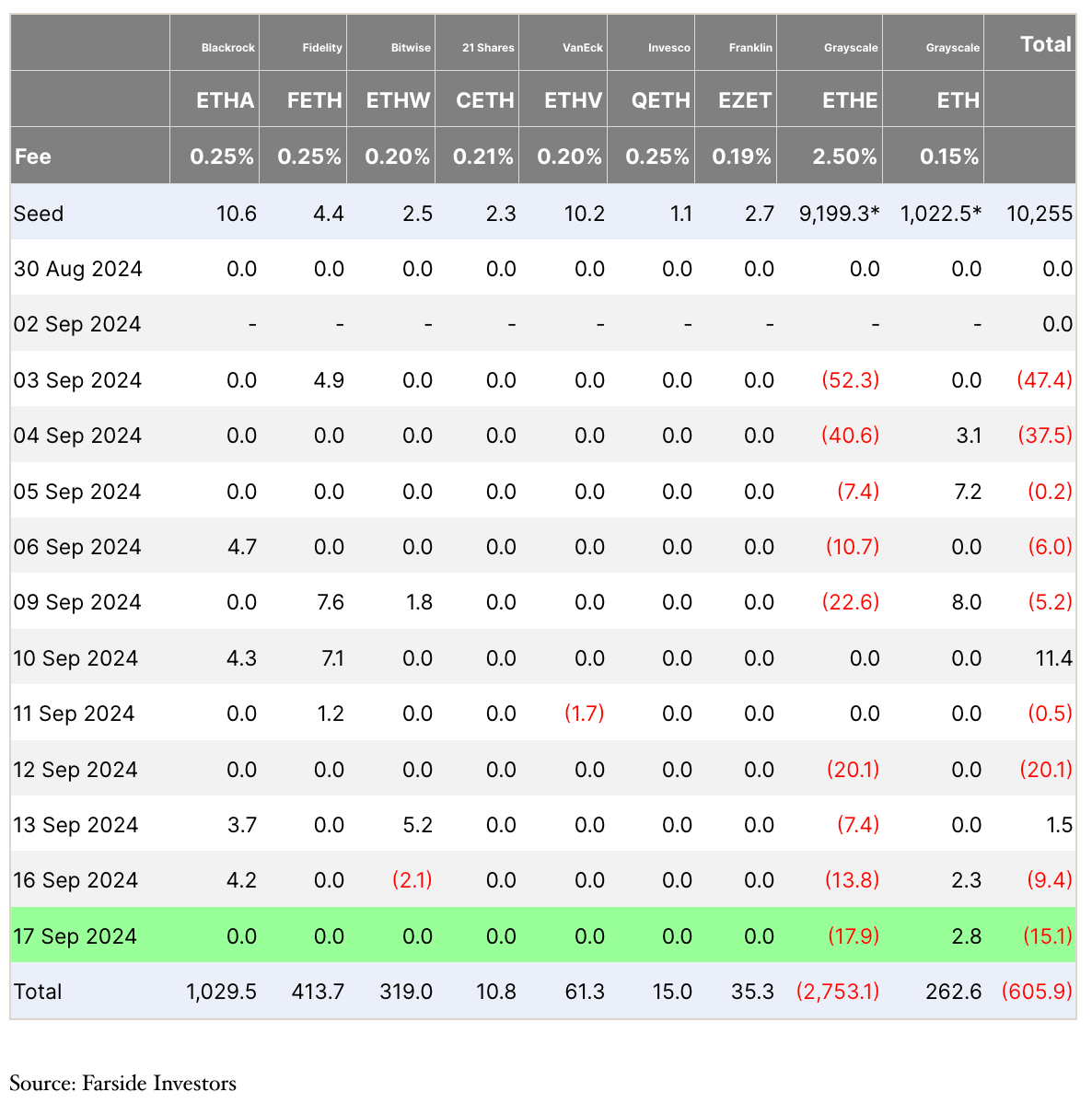

In contrast, Ethereum ETFs experienced net outflows totaling $15.1 million on the same day. Grayscale’s ETHE reported an outflow of $17.9 million, partially offset by a $2.8 million inflow into its mini ETF, ETH. This continues the trend of outflows for Ethereum ETFs, which have seen only two days of positive flows throughout September.

In contrast, Ethereum ETFs experienced net outflows totaling $15.1 million on the same day. Grayscale’s ETHE reported an outflow of $17.9 million, partially offset by a $2.8 million inflow into its mini ETF, ETH. This continues the trend of outflows for Ethereum ETFs, which have seen only two days of positive flows throughout September.

The resurgence in Bitcoin ETF inflows follows a decrease on Sept. 16, when net inflows dropped to $12.8 million from $263.2 million on Sept. 13. The latest figures indicate renewed investor interest in Bitcoin ETFs, particularly from major firms like Fidelity and Bitwise.

CoinGlass

CoinGlass

Farside Investors

Farside Investors