Bitcoin mining difficulty drops by over 4%

Bitcoin mining difficulty drops by over 4% Quick Take

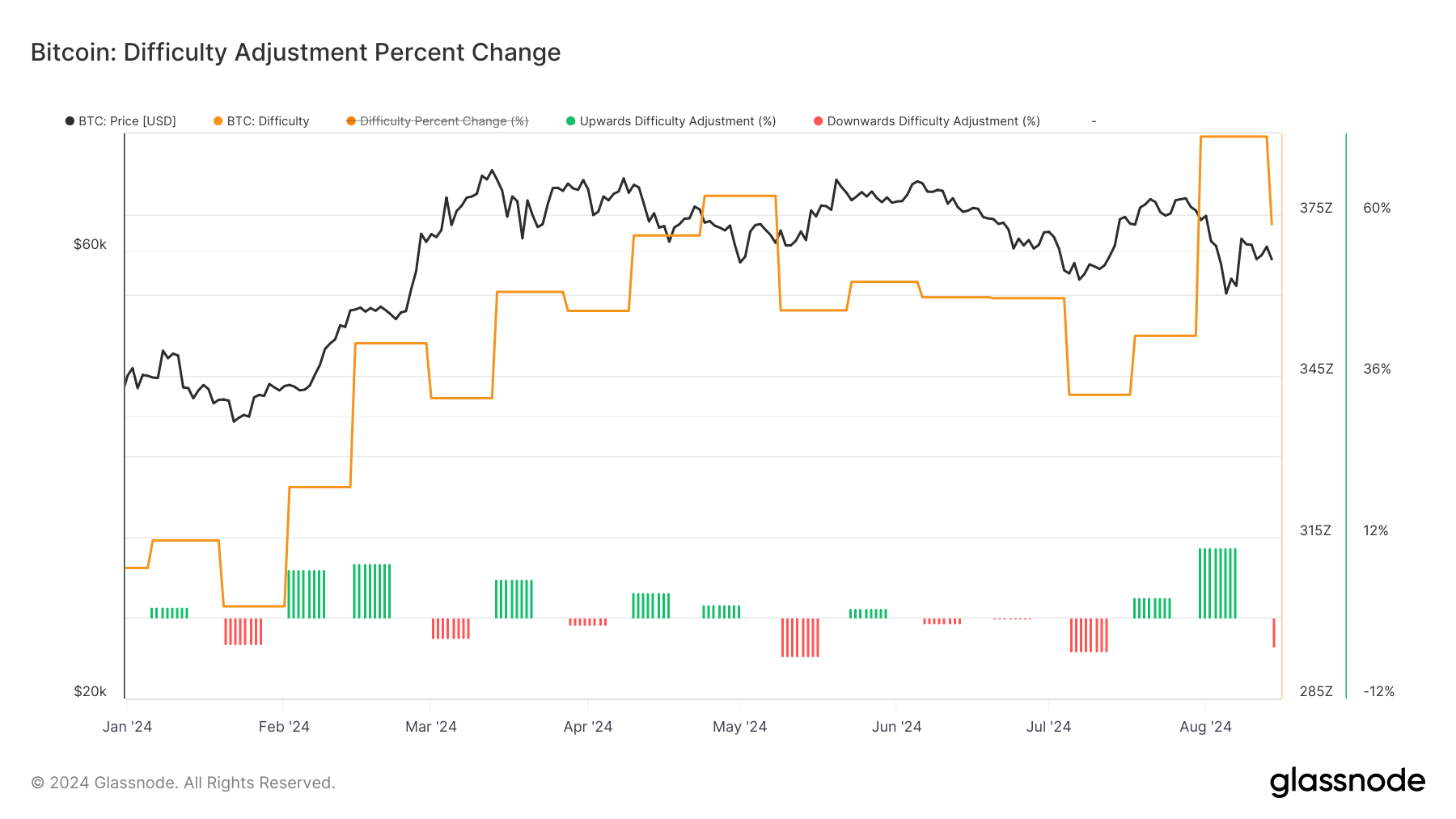

On Aug. 14, Bitcoin mining difficulty decreased significantly by over 4%, according to Glassnode, marking the seventh negative adjustment in 2024. The current difficulty stands at 86.87 trillion (T), reflecting a decline in the network’s hash rate since late July.

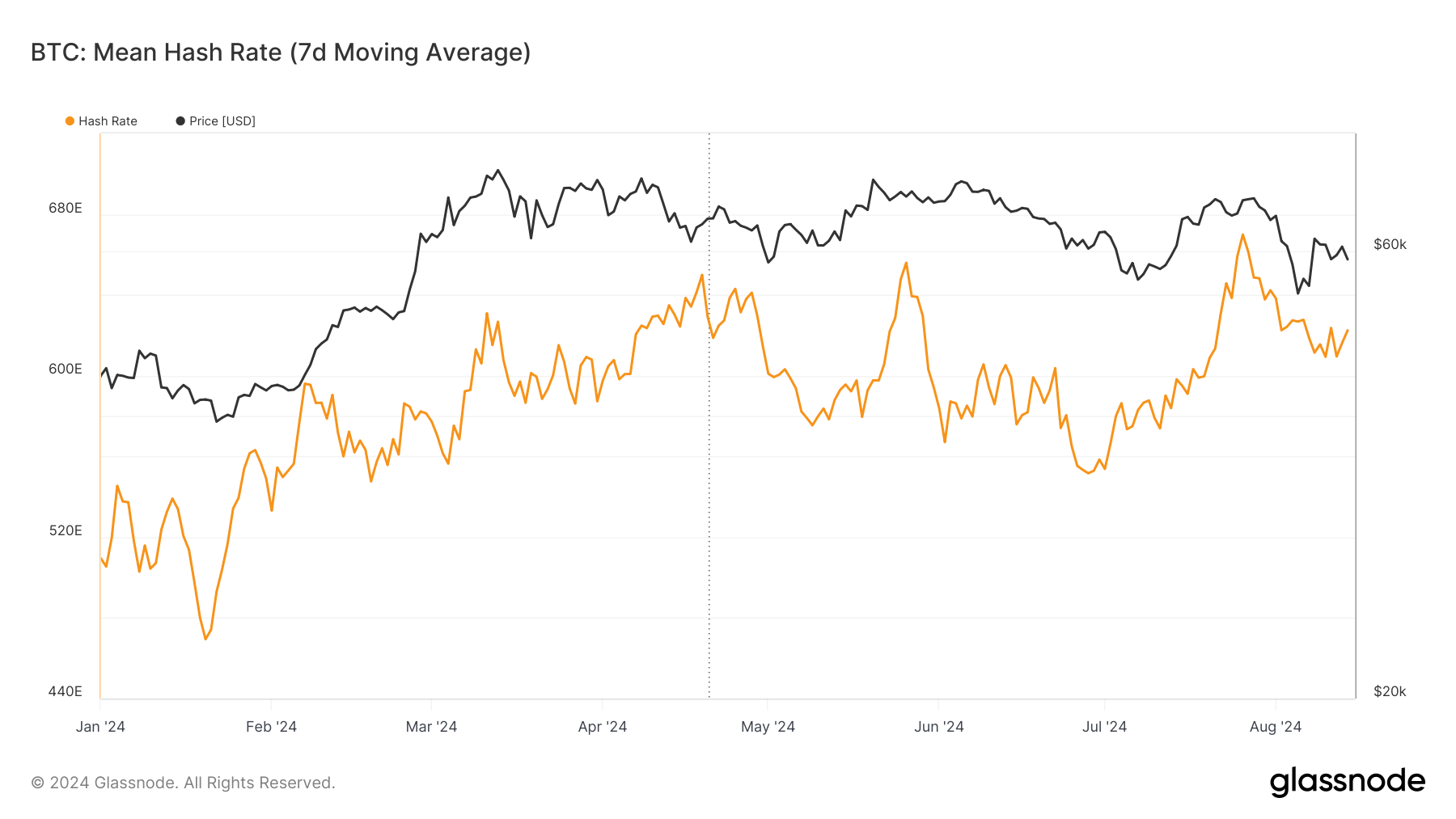

The hash rate, measured on a seven-day moving average, has dropped to approximately 622 exahashes per second (EH/s), down from its all-time high (ATH) of 670 EH/s.

This decrease in mining difficulty is coupled with cycle-low transaction fees, with miners earning less than $500,000 per day. This combination of a relatively high hash rate, a near-record mining difficulty, and minimal transaction fees is exerting significant financial pressure on miners, which Bob Burnett alludes to, who is CEO of Barefoot Mining.

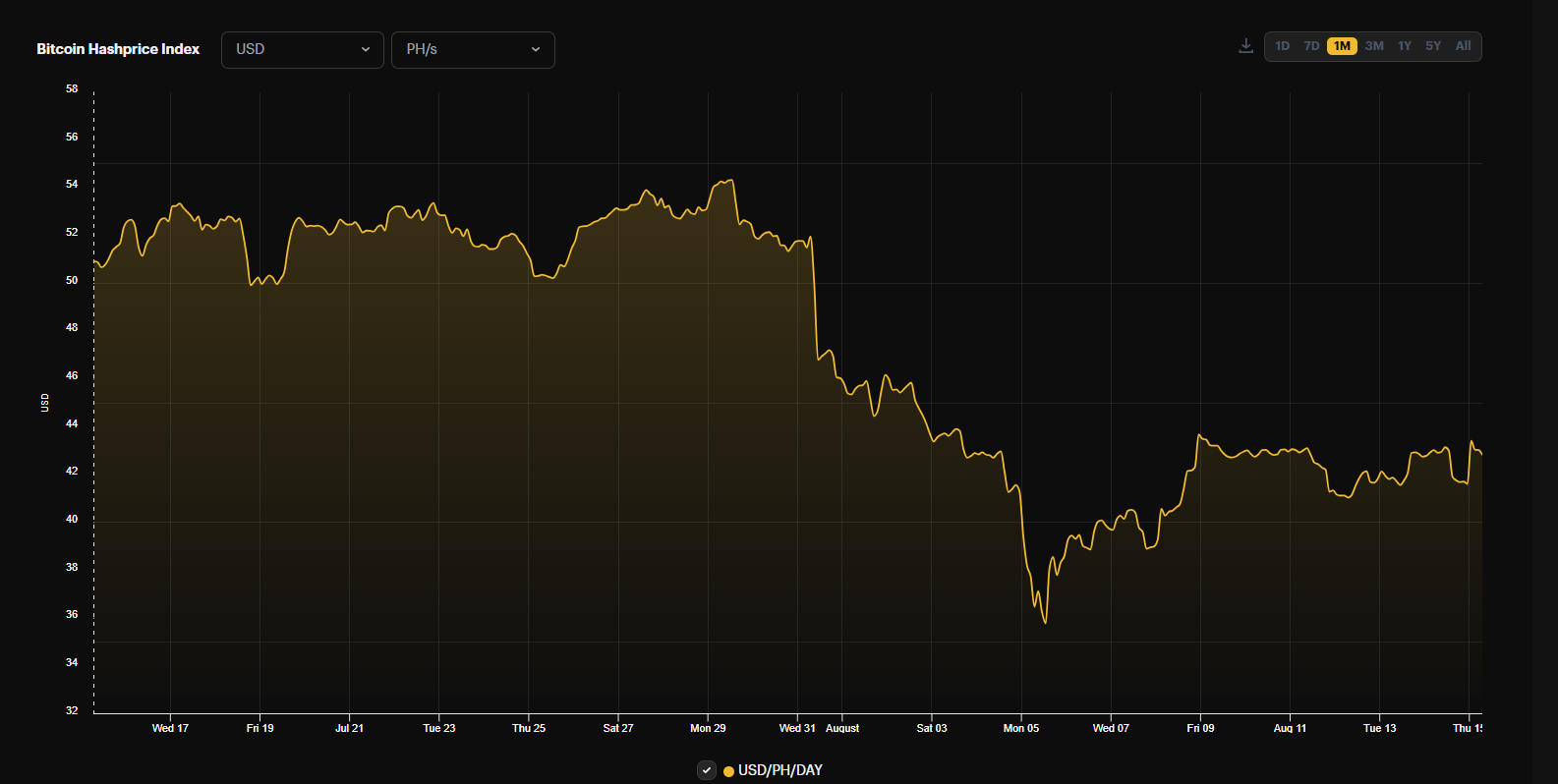

The hash price, which indicates the expected value of 1 terahash per second (TH/s) of hashing power per day, is hovering near its all-time lows at $43 per Peta hash per second (PH/s). This metric confirms the current stress on Bitcoin miners, who face dwindling profitability in an increasingly challenging mining environment.

CoinGlass

CoinGlass

Farside Investors

Farside Investors