Bitcoin’s Puell Multiple struggles to recover post-April halving decline

Bitcoin’s Puell Multiple struggles to recover post-April halving decline Onchain Highlights

DEFINITION:The Puell Multiple is calculated by dividing the daily issuance value of bitcoins (in USD) by the 365-day moving average of daily issuance value.

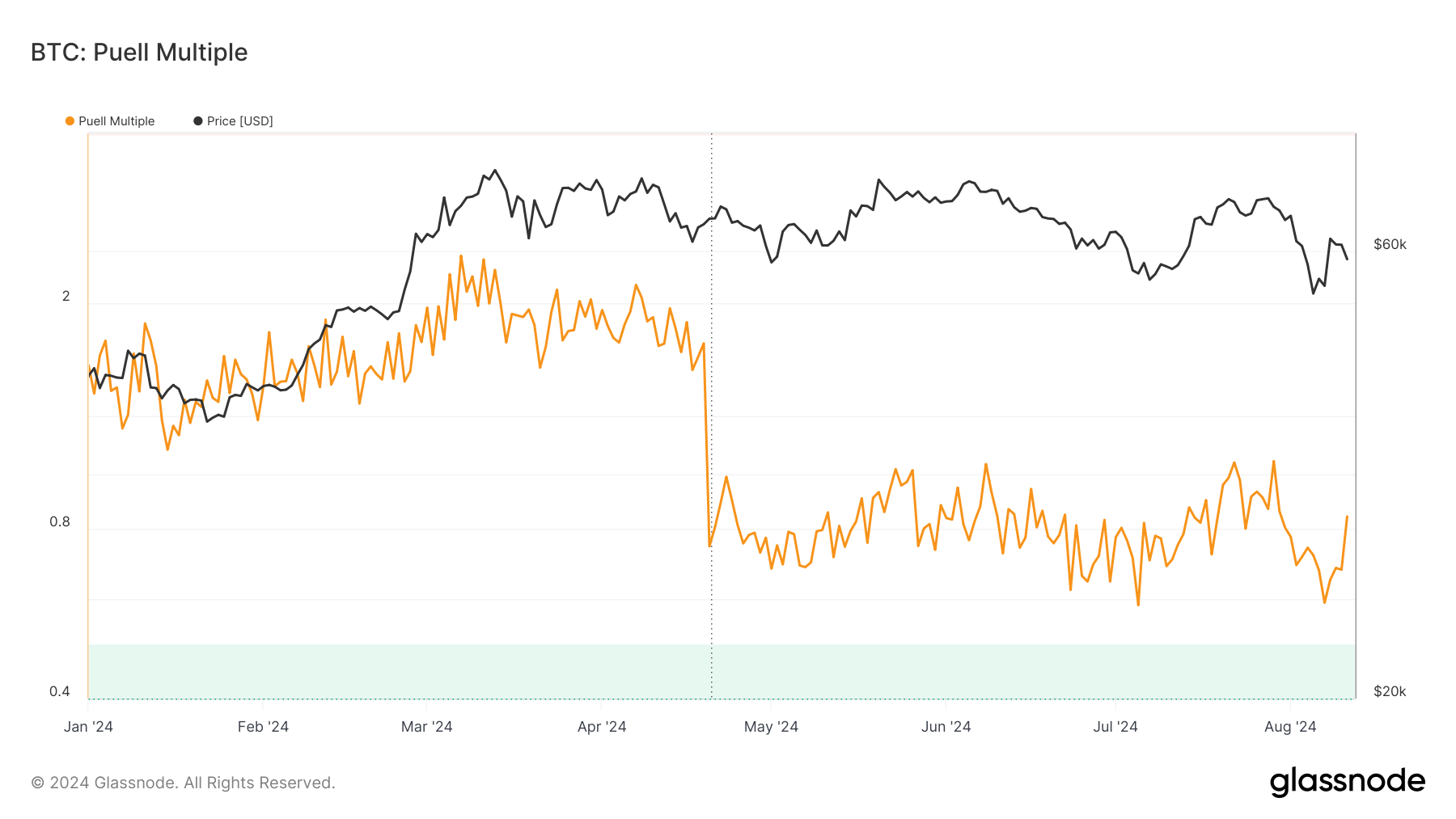

The Puell Multiple metric, which measures the ratio of the daily issuance value of Bitcoin to its 365-day moving average, dropped to 0.8 in April following the halving, signaling miner revenue stress.

Historically, such drops have aligned with market bottoms, but this year, the recovery appears more prolonged. Despite Bitcoin’s relative price stability, the Puell Multiple has struggled to regain ground after reaching a low in April, reflecting ongoing market uncertainty.

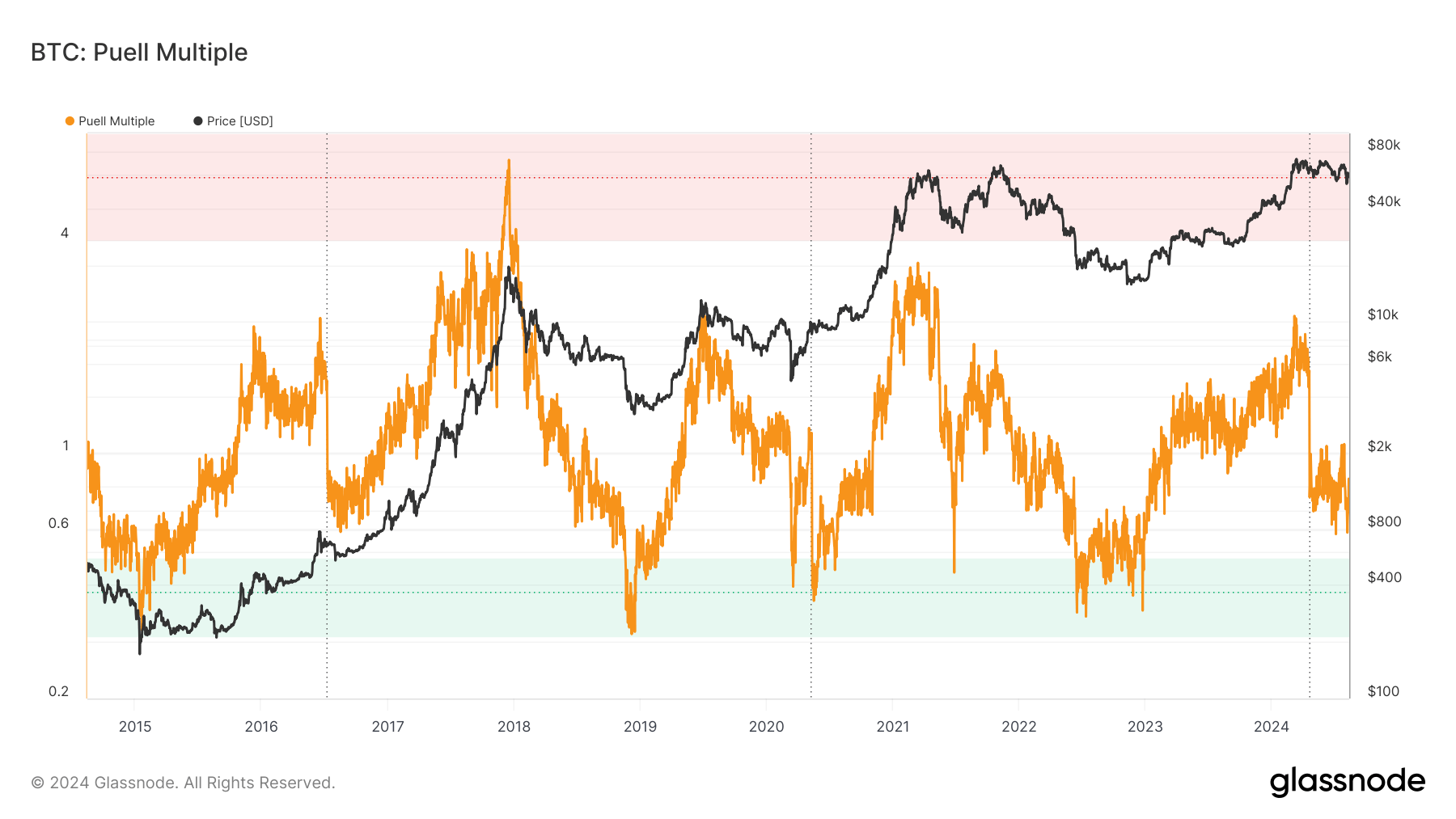

The long-term chart of the Puell Multiple highlights distinct cyclical patterns corresponding to major market shifts. Peaks in the metric have historically coincided with intense bull markets, such as those in late 2017 and early 2021, often preceding significant corrections.

In contrast, the metric typically bottoms out during bear markets, signaling periods of low miner profitability and potential market bottoms. The current levels remain well below these historical peaks, suggesting that while Bitcoin has shown resilience, it has not yet entered a phase of overvaluation, possibly indicating that further upward momentum is needed to reach previous bullish conditions.

CoinGlass

CoinGlass

Farside Investors

Farside Investors