Slight Bitcoin difficulty increase expected, but Texas heat could impact hash rate

Slight Bitcoin difficulty increase expected, but Texas heat could impact hash rate Quick Take

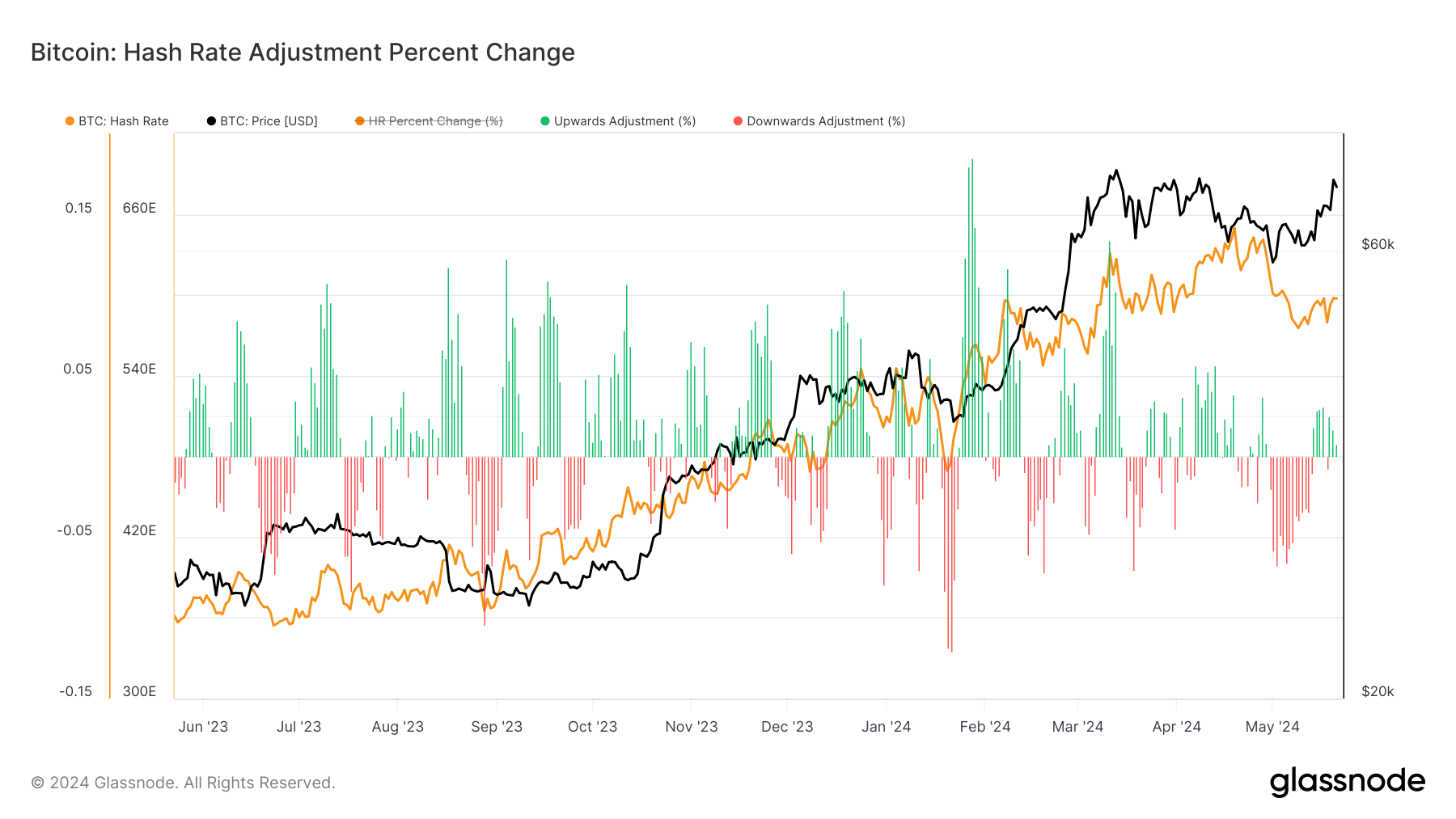

According to Newhedge data, Bitcoin’s difficulty is set to adjust tomorrow at around 9 am GMT on May 23, with a slight increase expected, just under 1%. This adjustment is significant as it follows the recent Bitcoin halving. The previous adjustment saw the largest difficulty drop since 2022 due to a decline in the hash rate, which fell approximately 12% from peak to trough.

However, the hash rate has been on a slight upward trend since early May, now averaging around 600 EH/s on a 7-day moving average, according to Glassnode.

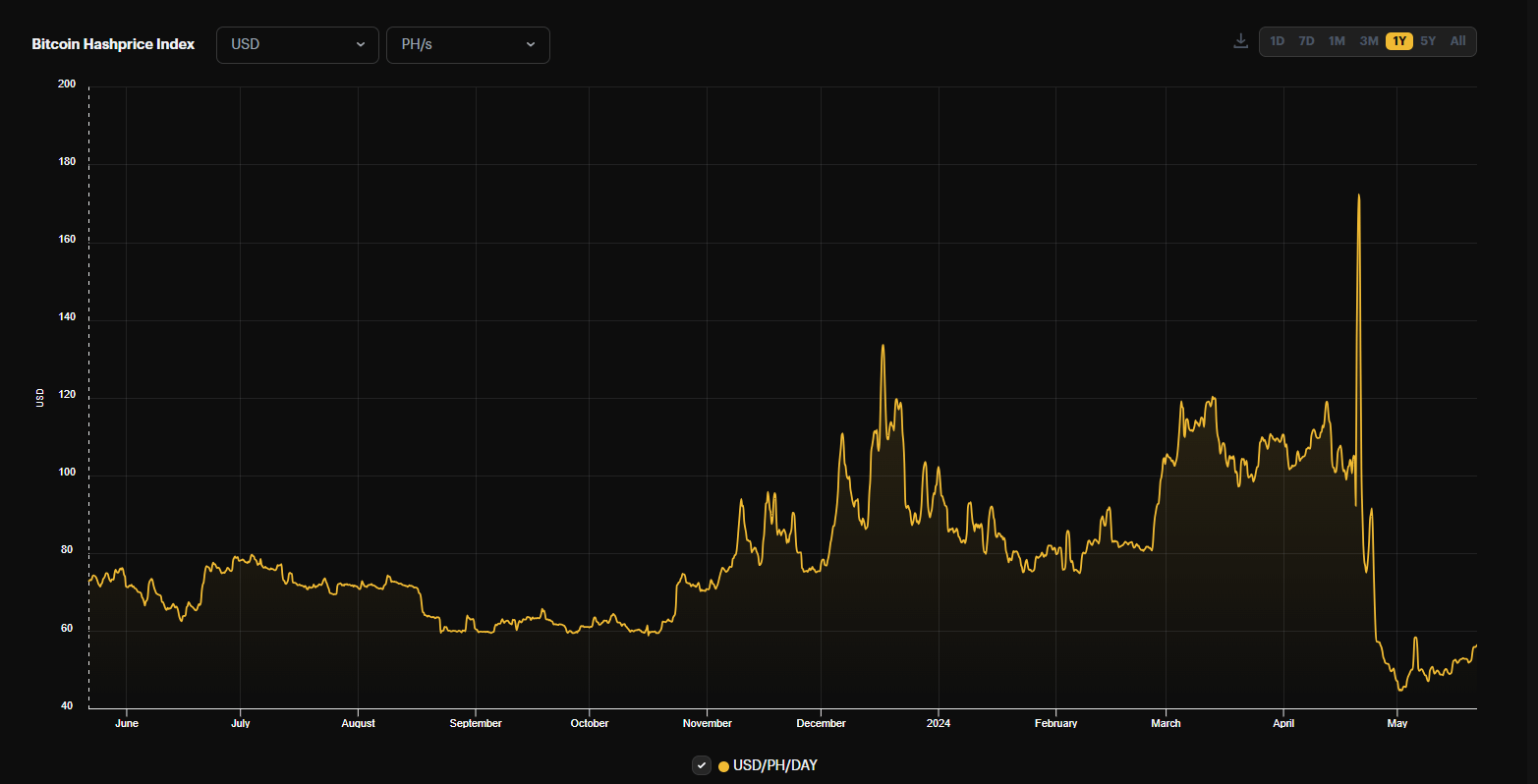

The hash price is also rising, currently at about $56 per PH/s, though it remains considerably lower than the $100 per PH/s level seen before the halving, according to data from Luxor. Luxor’s Q1 report indicates that forward contract prices are trading in contango through October.

Despite this optimistic forecast, the hash rate often stagnates or drops during summer due to heat waves, particularly in Texas, where much of it is based.

This summer, electricity traders anticipate a significant spike in Texas power prices, a concern echoed by Matthew Sigel, head of digital assets research at VanEck, who suggests that the hash rate could face downward pressure.

Sigel says:

“3-month forwards are now over $200/MWh (20¢/kWh). As a result, some think the #bitcoin hash rate may be under pressure this summer & bottom in August/September after the Texas power peak”.

CoinGlass

CoinGlass

Farside Investors

Farside Investors