Bitcoin shrimps outpace monthly issuance, accumulating 25,000 BTC in 30 days

Bitcoin shrimps outpace monthly issuance, accumulating 25,000 BTC in 30 days Quick Take

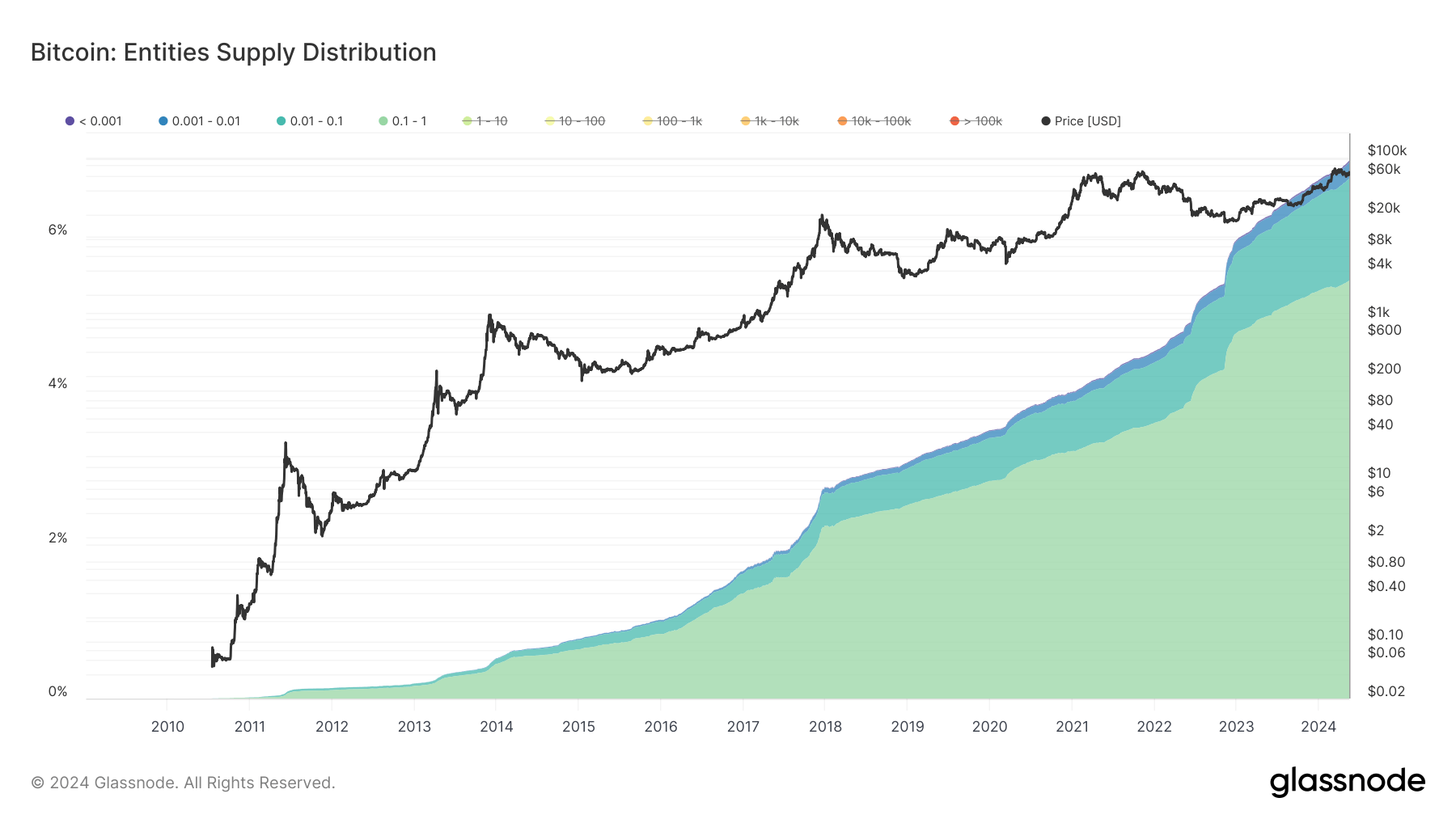

According to Glassnode, in Bitcoin (BTC) ownership, the smallest cohort, known as “shrimps” holding less than 1 BTC, remarkably commands approximately 7% of the BTC circulating supply, demonstrating a significant role in the ongoing accumulation trend.

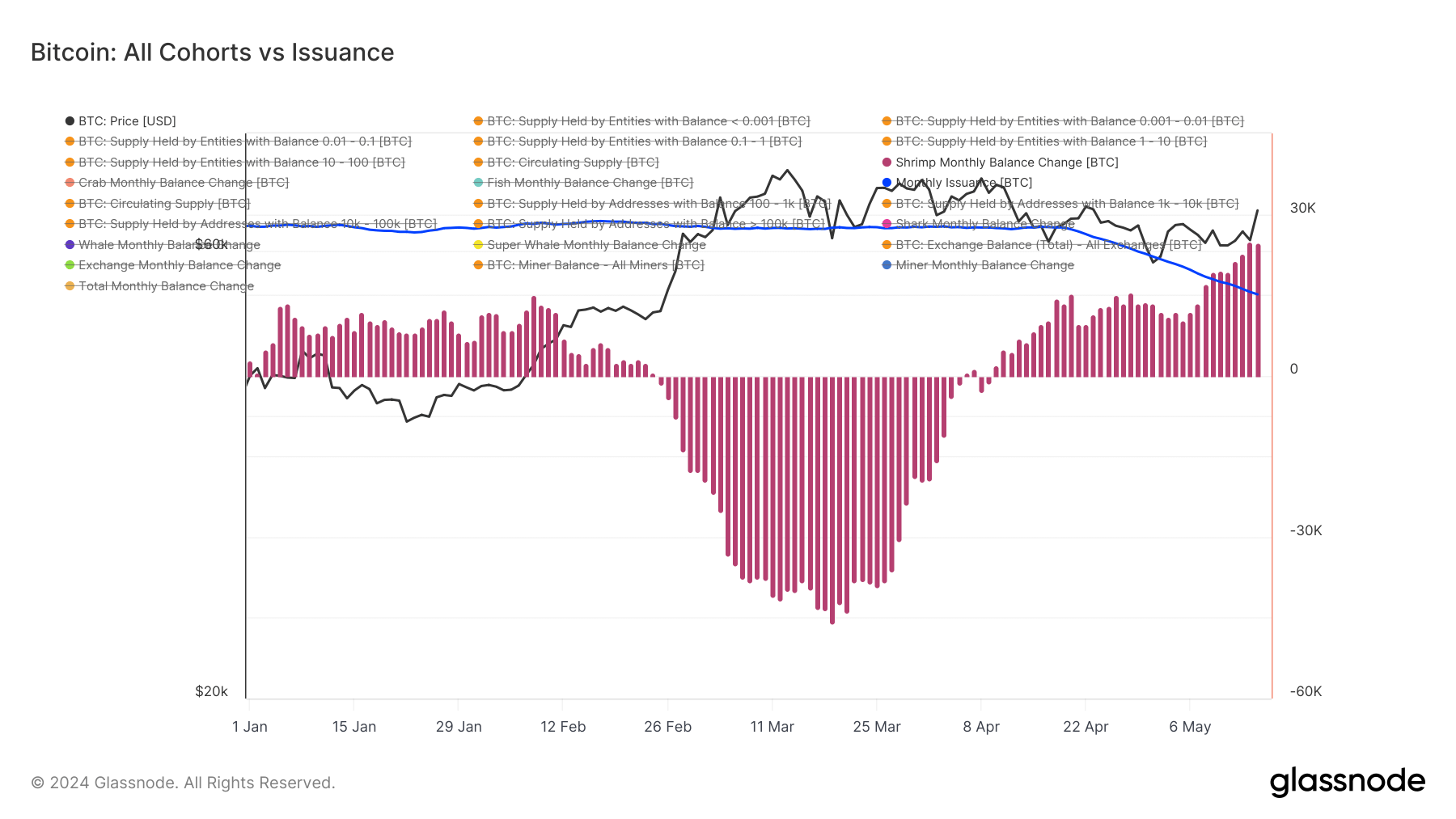

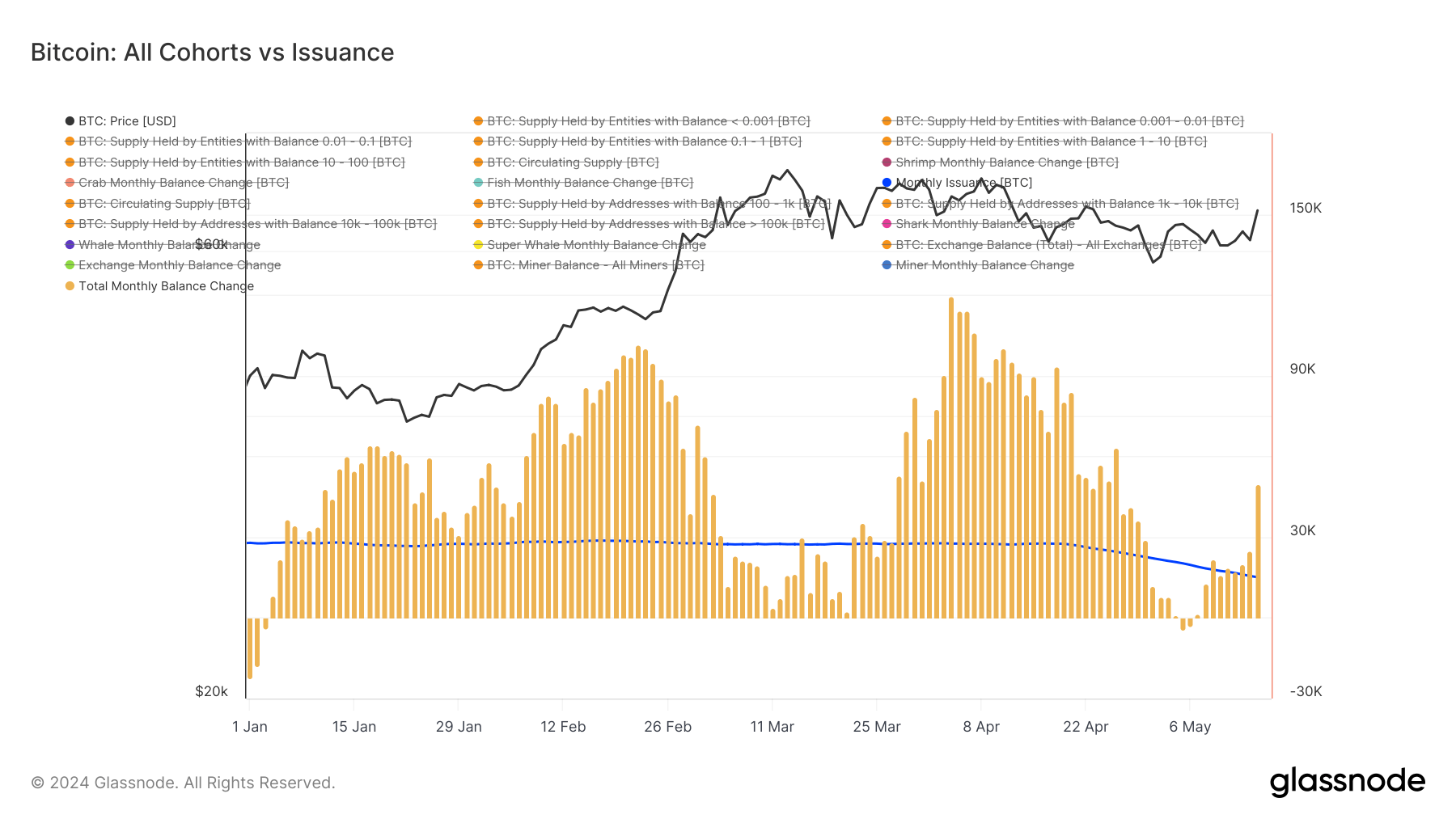

Over the past 30 days, these shrimps have collectively accumulated roughly 25,000 BTC, surpassing the monthly issuance of new BTC, which currently stands at 15,100 BTC.

Analyzing the total monthly balance of all cohorts, the data reveals that collectively, they have accumulated around 50,000 BTC over the past 30 days. This significant accumulation is crucial, as CryptoSlate noticed that on May 8, Bitcoin’s accumulation failed to keep up with issuance, contributing to the price decline below $57,000.

With Bitcoin now trading around $66,000, sustained accumulation over issuance is vital to maintain constructive price action. The shrimps’ aggressive accumulation is a positive sign, indicating strong demand from smaller investors.

Disclaimer: In the past 30 days, the issuance stands at approximately 15,100 BTC due to the recent halving event, which considers the mining rewards pre- and post-halving. However, after May 20, roughly 30 days since the halving, this figure is expected to stabilize around 13,500 BTC per month.

CoinGlass

CoinGlass

Farside Investors

Farside Investors