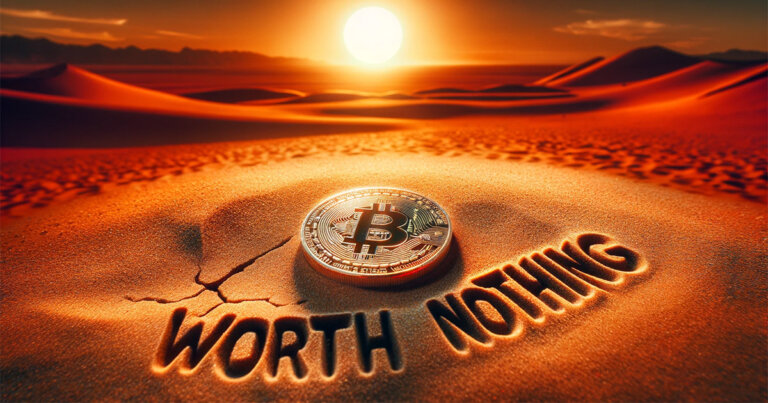

German asset manager DWS internally split on crypto as one camp still believes crypto is ‘worth zero’

German asset manager DWS internally split on crypto as one camp still believes crypto is ‘worth zero’ German asset manager DWS internally split on crypto as one camp still believes crypto is ‘worth zero’

Investment giant DWS Group struggles with internal debate over the inherent value of digital currencies

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The inherent value of digital currencies remains a hot topic of dispute for legacy fund managers, ignited by the $900 billion German asset manager DWS Group holding two contrasting viewpoints on crypto within the firm.

While DWS is poised to introduce crypto ETFs to the European market, not everyone at the company believes crypto has a future.

Speaking to Bloomberg, Bjoern Jesch, DWS’s global chief investment officer, highlighted the divergent opinions within his team. Jesch stated,

“One camp of people in my group is saying forget it, the value of crypto is zero, there’s nothing behind it.”

Thus, inside DWS, one faction maintains that cryptocurrencies, including Bitcoin, hold no intrinsic value, while the other argues their worth is evident in their prevailing market prices.

As Bitcoin rallies, optimism surrounding the potential approval of crypto ETFs by US regulators is mounting. This, combined with applications from major firms like BlackRock Inc. and Fidelity Investments to launch crypto ETFs, underpins the growing acceptance of cryptocurrencies.

According to Bloomberg, DWS, majority-owned by Deutsche Bank, inked a deal with Galaxy Digital in April to develop a suite of ETFs for the European market. This move, coupled with an expanded mandate for the DWS Fintech Fund to buy crypto, signifies a broader acceptance of digital currencies within the firm.

However, Jesch admitted to Bloomberg that forecasting digital currencies remains complex due to their limited history and the absence of collateral, an economy, or a central bank. Specifically, Jesch told Bloomberg,

“The most complex thing is to make a forecast on digital currencies. You do not have that much history. You don’t have collateral, you don’t have an economy, you don’t have a central bank. You could of course, argue that tomorrow is zero maybe, or maybe it’s not, maybe it’s $40,000.”

As such, even with the advent of ETFs, it seems that, for many institutional skeptics, crypto will continue to inhabit the speculative fringe.

As the global financial giants navigate this delicate balance, the future of cryptocurrencies remains uncertain yet intriguing.

CoinGlass

CoinGlass

Farside Investors

Farside Investors