Austrian Bitcoin Brokers Propose “Gold Standard” in Response to Regulatory Pressure

Austrian Bitcoin Brokers Propose “Gold Standard” in Response to Regulatory Pressure Austrian Bitcoin Brokers Propose “Gold Standard” in Response to Regulatory Pressure

Photo by takaharu SAWA on Unsplash

Bitcoin has is often referred to as “digital gold”, with both assets sharing a number of similar characteristics. The CEO of Austria’s biggest Bitcoin broker, however, has recently recommended the implementation of a regulatory framework for Bitcoin that mirrors that of precious metals.

Eric Demuth, the CEO of Bitpanda — one of the largest cryptocurrency exchanges in Europe —compared the regulatory status of Bitcoin and other cryptos under EU law to gold in an interview with Bloomberg earlier this week. Cryptocurrency transactions within the EU that exceed 10,000 euros are set to be subject to anti-money laundering rules which, according to Demuth, which could potentially stifle the emerging market for digital currency:

“Regulation provides us with more legitimacy, we’ve wanted to be regulated, but so far have been told that we cannot be.”

Austria Pivots on Cryptocurrency Regulation

Demuth proposes a solution to the ongoing cryptocurrency debate that would place Bitcoin and other digital currencies in the same position as gold, which would potentially make cryptocurrency more attractive to retail investors. Under EU law, gold is not subject to any specific capital requirements — banks are able to account for gold in a similar manner to government bonds or cash. Retail sales of gold in the EU are also exempt from value-added tax.

Cryptocurrency regulation in the EU is a complex issue, as member states vary wildly in their stance on how digital currencies should be handled from a legal perspective.

In February this year the Austrian finance ministry pledged to tighten up regulation on cryptocurrencies, stating that the current trading rules for gold and derivatives would be used as inspiration for the development of a new regulatory framework for cryptocurrencies both within Austria and the EU at large.

Austrian financial policy exerts a strong influence on the incumbent financial industry, with the Austrian school of economics widely regarded as the true heir of classical economics. As such, the Austrian perspective on cryptocurrency regulation is critical in the development of the EU’s approach to regulation across all member states.

Austrian Finance Minister Hartwig Loeger has recently announced that the Austrian government is proactively working toward extending oversight measures drawn from traditional financial products to cryptocurrencies:

“Cryptocurrencies are significantly gaining importance in the fight against money laundering and terrorism financing. That’s an important aspect for the changes we support. We need more trust and more security.”

While progressive voices within the country such as BitPanda’s Eric Demuth are calling for a more nuanced approach to the regulation of cryptocurrencies, Austrian central bankers are calling for a more stringent stance. Ewald Nowotny, the chief of the Austrian central bank, has called for an end to the country’s laissez-faire stance on Bitcoin and other cryptocurrencies:

“Bitcoins weren’t created transparently and publicly, and they are suitable for money laundering. For a long time, I had the view that investment in Bitcoin should be a private matter. But I got the feeling that a legal provision is needed.”

Austria’s potential regulatory model also includes provisions for initial coin offerings, which would be required to be based on “digital prospectuses” that are approved by the finance ministry. This move would see ICOs governed by the same laws that prevent market manipulation, front-running, and insider trading in the traditional securities market.

Regulatory Bodies Scramble to Keep Pace With Blockchain Innovation

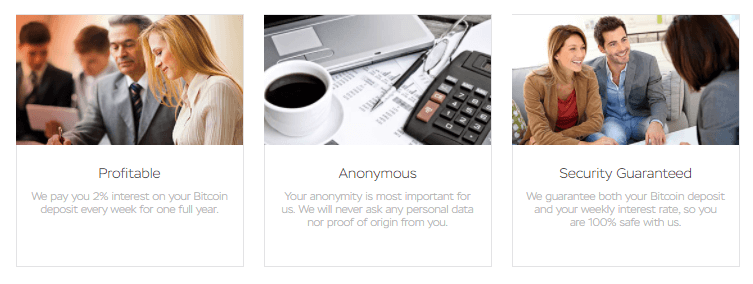

Austria’s reactionary pivot on cryptocurrencies is at least in part due to a recent scam that resulted in the loss of 12,000 BTC in the country. The scam, operating under the name “Optioment”, offered guaranteed returns via arbitrage trading — a common vehicle for exit scams in the cryptocurrency ecosystem. While the website for the scam is down, an archive page is still available.

The Austrian Financial Market Authority released an official statement regarding the scam, which is now the subject of an Interpol investigation. The FMA has since highlighted the risks of money laundering and terrorism financing associated with cryptocurrency transactions, calling for banks to “pay special attention and take additional measures if needed to recognize such transactions, validate them and review the origin of the funds.”

Despite growing regulatory concern form Austrian regulatory bodies, blockchain industry growth in the country is developing rapidly.

Austrian Green-energy Bitcoin mining operation HydroMiner is set to raise $2.8 million in an initial coin offering and plans to capitalize on Austria’s significant hydroelectric power generation infrastructure to mine digital currencies at a lower cost with less environmental impact.

According to BitPanda co-CEOs Eric Demuth and Paul Klanschek, the tightening of the Austrian regulatory noose has had little effect on the day-to-day operation of the BitPanda platform, stating that the brokerage will “easily” surpass 1 billion euros in turnover this year.

CoinGlass

CoinGlass

Farside Investors

Farside Investors