Bitcoin, Solana products lead first crypto investment inflow since mid-August

Bitcoin, Solana products lead first crypto investment inflow since mid-August Bitcoin, Solana products lead first crypto investment inflow since mid-August

U.S. investors, however, remain cautious, withdrawing over $19 million from crypto instruments this week.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Crypto investment products have recorded their first inflows since mid-August, as $21 million flowed into these products in the past week.

CoinShares analyst James Butterfill said the inflows were a “reaction to a combination of positive price momentum, fears over US government debt prices and the recent quagmire over government funding.”

However, he noted that trading “volumes remain seasonally low in both the investment product and broader crypto markets.”

Bitcoin, Solana dominate

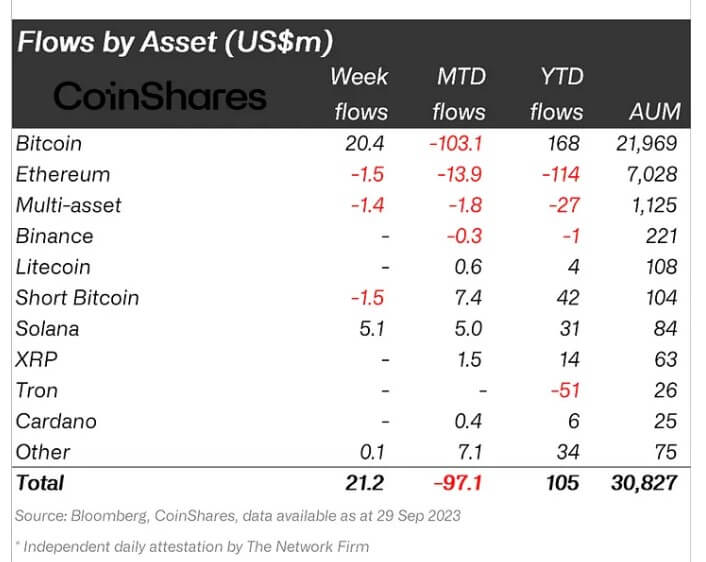

According to the latest CoinShares weekly report, Bitcoin (BTC) and Solana’s (SOL) investment products contributed significantly to the recorded inflow. Per Coinshares, BTC products saw the most inflows with $20 million, while SOL “continues to shine” with inflows amounting to $5 million.

Solana products have enjoyed a largely positive year, recording 27 weeks of inflows and just four weeks of outflows. The asset has a positive year-to-date flow of $31 million, higher than that of XRP, Cardano, and others.

Meanwhile, Ethereum (ETH) maintained its “least loved altcoin” coin tag by recording outflows totaling $1.5 million the previous week. This brings Ether product outflows to a seventh consecutive week and a negative year-to-date flow of $114 million.

U.S. sentiment remains bearish

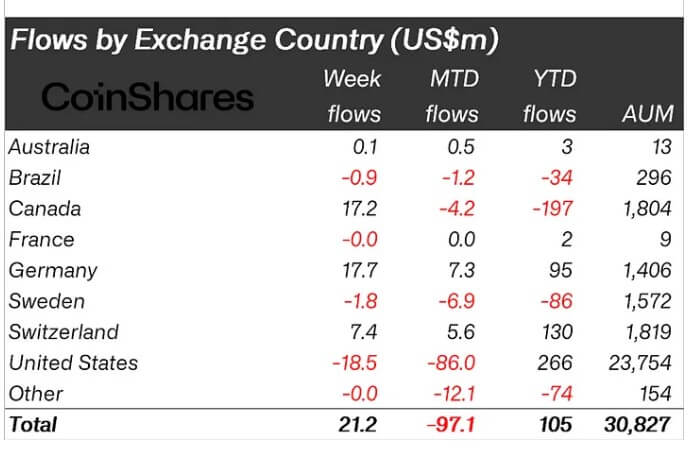

U.S. investors have shown caution, withdrawing around $19 million from their investment products in the last week. These exits can be attributed to the continued regulatory uncertainty surrounding crypto-related businesses within the region.

While the U.S. Securities and Exchange Commission (SEC) has allowed Ethereum futures exchange-traded funds (ETFs) to go live today, the financial regulator has continued to delay decisions on spot Bitcoin ETFs.

These unclear regulatory measures have resulted in a negative monthly flow of $86 million, while its year-to-date flow is a positive $266 million.

Meanwhile, investors in Europe and Canada continue to pump funds into crypto investment products as these regions saw inflows of $23 million and $17 million, respectively, during the previous week.

CoinGlass

CoinGlass

Farside Investors

Farside Investors