ICO Watch: What is Lendingblock?

ICO Watch: What is Lendingblock?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The cryptocurrency market is rapidly maturing, with governments around the world developing regulatory frameworks that pave the way for institutional investors to enter the crypto fray. 2017 saw the emergence of financial mechanisms such as futures trading hit the cryptocurrency ecosystem, along with a surge in blockchain incubators and accelerators that bridge the gap between venture capital and pre-ICO ventures.

Distributed ledger technology has now captured the attention of large-scale institutional capital, and with this attention comes the development of financial mechanisms that mirror those present in traditional securities markets.

While it’s true that the volatile nature of the cryptocurrency market makes it ill-suited to some financial services present in traditional securities markets — the US SEC’s recent prohibition on cryptocurrency ETF creation is a good example — there is a significant amount of demand present within the blockchain market ecosystem for more robust financial vehicles.

The Rise of Lending Platforms

Lending platforms are beginning to emerge in the cryptocurrency market in response to this growing need, and are primarily present in the form of exchange-specific margin lending. A new blockchain platform, however, is aiming to accelerate the maturation of the cryptocurrency market by creating a cross-chain lending platform that functions as a crypto equivalent to securities lending.

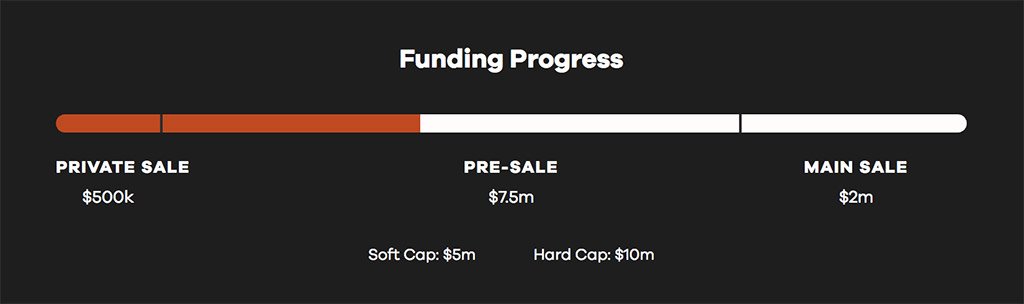

Lendingblock is currently in a pre-sale stage and has recently completed a successful private sale.

The Lendingblock platform is heavily focused on enhancing liquidity across the entire crypto market by allowing investors, funds, and traders to access assets that can be used to support trading, fund working capital, or fulfill investment funding needs.

Why is Lendingblock important, though, and what are the implications of a fully collateralized crypto asset borrowing and lending platform for the blockchain ecosystem? Does the cryptocurrency market currently need a DLT equivalent of traditional securities lending? We’ll proceed to examine the Lendingblock project and analyze its constituent parts to assess the potential impact of the upcoming Lendigblock initial coin offering.

What is Lendingblock?

The Lendingblock project aims to create an open exchange for crypto asset loans that matches borrowers and lenders in a transparent manner.

The Lendingblock project aims to create an open exchange for crypto asset loans that matches borrowers and lenders in a transparent manner.

There are a number of lending platforms present in the blockchain ecosystem at present, so it’s important to highlight the key difference between Lendingblock and these platforms — Lendingblock isn’t concerned with lending in the same sense as Ponzi-esque platforms such as BitConnect.

Instead, Lendingblock is strictly focused on the lending of specific assets in order to perform important market functions.

Built upon the Ethereum blockchain, Lendingblock is designed to provide funds, market makers, investors, and traders with the ability to lend or borrow crypto assets. The Lendingblock ecosystem matches participants in a transparent and fair manner and implements lending terms via a smart contract system. Importantly, the Lendingblock platform is blockchain agnostic, enabling cross chain crypto to crypto collateralized lending.

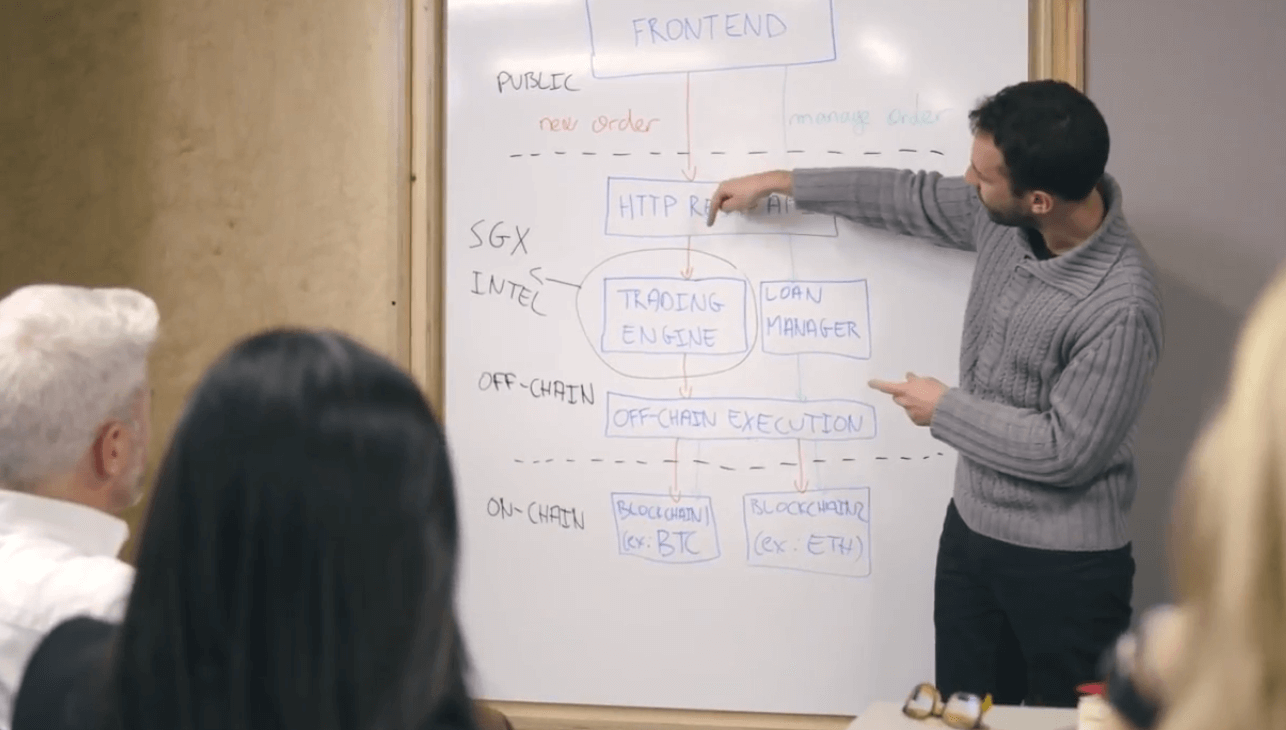

Lendingblock’s approach to the implementation of smart-contract-executed lending terms and the overall technical architecture of the platform itself is unique — a hybrid model incorporates both decentralized and centralized components, allowing for the transparent management of collateral and contract execution on-chain while securing private data in cloud-based infrastructure.

Lendingblock ICO

The Lendingblock project is aiming to capture $10 million across the entire Lendingblock ICO, which will be used to establish an open, real-time exchange that links borrowers and lenders at market clearing interest rates.

The Lendingblock project is aiming to capture $10 million across the entire Lendingblock ICO, which will be used to establish an open, real-time exchange that links borrowers and lenders at market clearing interest rates.

Lendingblock aims to offer both web and mobile tools alongside APIs that deliver advanced functionality for institutions and individuals.

The presentation of the Lendingblock ICO is worth highlighting and is arguably one of the most clearly delineated, well-composed offerings to hit the market of late. Lendingblock provides potential investors with a litepaper, a token paper, and a whitepaper, the last of which is published in an intuitive GitBook format — we’d like to see this practice adopted by the ICO ecosystem at large.

The Lendingblock whitepaper breaks down a number obvious questions that arise from the potential deployment of a crypto asset lending platform succinctly, dedicating a significant portion of the paper to the legal, regulatory, and risk considerations of the project and the legal implications of the smart contract nature of lending arrangements on the drafting process.

Why is Lendingblock launching an ICO, however, and does the core Lendingblock concept require tokenization at all? Why is asset lending important to the cryptocurrency market?

Wait — Why Lend Cryptoassets?

Securities lending is a key element of any complex, liquid trading ecosystem, and performs an important function in traditional securities markets. Both brokers and market makers rely on securities lending in order to ensure the settlement of trades or to make sure that purchases can be made.

Securities lending is a key element of any complex, liquid trading ecosystem, and performs an important function in traditional securities markets. Both brokers and market makers rely on securities lending in order to ensure the settlement of trades or to make sure that purchases can be made.

Brokers, for example, are able to use borrowed assets to ensure traders receive what they ordered. A market maker is often obligated to provide assets for sale at any given time, but doesn’t always hold said assets at all times and thus relies on asset lending to meet requirements.

The purposes of asset lending in the crypto market are varied — a trader may wish to take a short position on the assumption that the value of an asset will fall, and will thus borrow assets to sell at the current market rate, then repurchase them at the anticipated lower rate in future to repay the loan. Asset lending is also critical to hedging and arbitrage, as well as fails-driven borrowing in order to meet settlement obligations.

There are currently no platforms that provide comprehensive chain-agnostic crypto-asset lending services in the blockchain ecosystem, an issue that the Lendingblock project is aiming to redress.

Should the Lendingblock platform succeed in creating such a platform, it will be uniquely positioned to service the incoming wave of venture capital and institutional investors that are poised to enter the crypto market en masse.

Lendingblock co-founder, Steven Swain, commented on the need for a reliable collateralized lending platform in the cryptocurrency market in an interview with CryptoSlate, outlining Lendingblock’s focus on promoting mainstream adoption:

“Our vision is to become the trusted backbone for collateralised lending in the crypto economy. We’ve witnessed that interest in and growth of crypto assets has outstripped the maturity of supporting financial services (exchanges, payment systems, financing) that allow people to access the markets simply and safely. This will become more of an issue as institutional interest in crypto markets grow, and as conventional assets (securities, bonds, commodities, currencies) migrate to the blockchain. These services are the weakest link in the crypto chain and are a barrier to mainstream adoption, and it’s our plan to change that.”

How Lendingblock Works

Lendingblock breaks platform users down into either lender or borrower, regardless of whether users are retail or institutional in nature. Lenders using the Lendingblock platform will be able to capitalize on incremental interest income from their asset portfolio without sacrificing the benefits of long-term ownership and will be supported by full collateralization alongside smart contract-executed lending terms.

Borrowers using the Lendingblock platform will access the previously-outlined benefits of asset lending within the cryptocurrency market, but will be able to do so via a platform that offers a transparent pricing and fee structure based on market supply and demand.

Borrowers using the Lendingblock platform will access the previously-outlined benefits of asset lending within the cryptocurrency market, but will be able to do so via a platform that offers a transparent pricing and fee structure based on market supply and demand.

Both borrowers and lenders using the Lendingblock platform will be subject to KYC and AML verification and screening in order to ensure the platform remains compliant, and will be able to complete profiles that allow them to specify the nature of the lending or borrowing arrangement they are seeking.

An order book will allow users to browse borrowing offers and lending requests, complete with a matching service.

When borrowers are matched with a lender, a smart contract is created to establish a lending agreement. Collateralization is a critical element of this process — lenders are able to specify the forms of collateral they are willing to accept during the initial specification profiling step. Borrowers link collateral to a smart contract and lenders link loan principal, at which point the smart contract enters a servicing/operation stage.

The Lendingblock platform utilizes SGX oracles to coordinate the management of loan collateral and principle, as outlined by Swain:

“The loan principle and collateral are not placed into the smart contract, but rather into native wallets on the respective blockchains. The SGX oracles then Control and coordinate the value transfer when instructed to do so by the smart contract. If you like, the smart contract is the brains, and the oracles are the brawn. We create a smart contract and associated native chain wallets specific to each loan, so there is no pooling of assets across loans or users.”

Over the course of the agreement borrowers make interest payments to lenders in the form of LND, which is the native crypto token of the Lendingblock platform and the justification for tokenization. Lendingblock appear to have opted for a native token for the payment and receipt of interest in order to lower exchange fee costs and facilitate smart contract lending agreement execution.

Swain highlights the need for simplification in the maintenance of interest repayments, presenting a simple argument for the LDN token:

“The token exists to make it simple to manage incoming and outgoing interest payments on a portfolio of loans – this is important as our customer research showed us that most people hold more than one asset.”

The Lendingblock platform makes use of oracling services to ensure that collateral is maintained at a sufficient level. The smart contract lending agreement is finalized when the lender receives full repayment of the principal or, in the case of default, receives the collateral in in lieu of it.

Tech Teardown

The technical architecture of the Lendingblock platform takes a hybridized approach that incorporates both centralized and decentralized elements. Lendingblock outlines the structure of the platform as two different “zones”, the first of which is a “decentralized zone” that consists of an Ethereum ledger that executes the smart contracts critical to Lendingblock functionality.

This zone also includes additional ledgers that hold loan collateral and principal, which are likely monitored via Ledgerblock oracling services.

Ledgerblocks “centralized zone” is a cloud-based infrastructure that stores private internal data, provides access to platform services, and connects with external services such as KYC providers and pricing data. Notably, this zone also includes the SGX-based oracles that monitor distributed ledgers.

Normally, any platform dealing with the movement of crypto capital that incorporates centralized elements raises eyebrows within the cryptocurrency community. RSK’s approach to liquidity within its “2-way peg” sidechain method of Bitcoin smart contract execution is a good example of this, with the so-called “RSK Federation” causing dissent within the community due to the opaque nature of fund management.

Lendingblock, however, presents a technical architecture in which all capital movement is verifiable and traceable on-chain, which will likely go far in assuaging investor fears regarding the management of collateral within the Lendingblock ecosystem.

Lendingblock, however, presents a technical architecture in which all capital movement is verifiable and traceable on-chain, which will likely go far in assuaging investor fears regarding the management of collateral within the Lendingblock ecosystem.

While not strictly technical in nature, the legal considerations of the Lendingblock platform are worth mentioning in this section of our analysis. Lendingblock appears to have gone to great lengths to ensure that their platform creates lending agreements that present a strong argument for legal enforceability, and provide a natural language documentation in tandem with the smart contract lending agreement.

The Lendingblock whitepaper goes into great detail regarding the legal intricacies of their proposed contract execution methodology, but outlines a strong case for regulatory and legal support despite the lack of statute or case law specifically recognizing cryptocurrency as property.

Swain has stressed the importance of regulatory compliance to the Lendingblock project, identifying it as critical to the safe operation of the crypto market and a key element of the process that will bring the crypto economy into the mainstream financial system:

“The regulatory landscape is likely to evolve quickly and global regulators will evaluate the application of existing regulatory frameworks to the crypto landscape. Lendingblock has established a two-pronged approach to regulatory compliance; work with the GFSC to achieve compliance with the DLT Regulatory Framework, as well as anticipate broader global regulatory developments and establish appropriate controls in advance of potential compliance requirements”

The Lendingblock Team & Partners

The success of a blockchain platform is determined by the quality of the team behind it, and as such Lendingblock ICO appears to be positioned as one of the more promising projects to launch in 2018. Lendingblock is the brainchild of Deloitte Partner and Investment Banking MD Steven Swain and Deloitte blockchain consultant Linda Wang, both of whom possess extensive experience in computer science.

Wang and Swain are backed by a core team that includes ex-Credit Suisse and Deutsche Bank product managers, hedge fund managers, and experienced solidity software engineers, leaving little to be desired from a technical perspective.

The Lendingblock advisory team boasts Security Engineering Ph.D.’s, deep AI engineers, and data scientists, providing the platform with a significant amount of technological clout with which to achieve their goals.

Interestingly, Lendingblock provides a full breakdown of the organizations they are partnered with in the Lendingblock whitepaper, and is upfront regarding the digital marketing and PR relationships they have established to promote their platform.

The Lendingblock team is supported by Norton Rose Fullbright, who deliver legality and enforceability advisory, as well as Isolas, a Gibraltar-based law firm that is assisting Lendingblock with the legal structure of their ICO.

Lendingblock Tokenomics

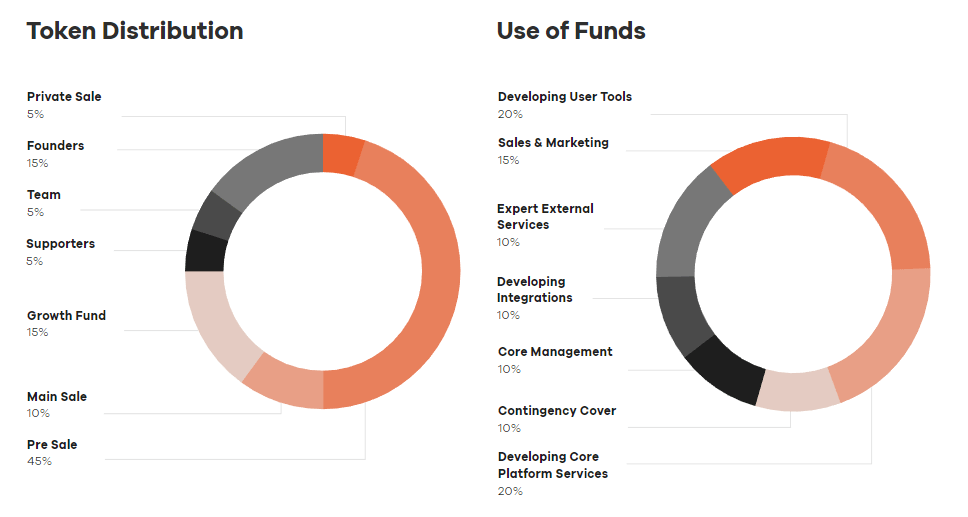

Lendingblock will be issuing 1,000,000,000 LND over the course of their token sale period, with a hard cap of $10 million USD. Each LND will carry an effective value of $0.016667 USD. In a move becoming more prevalent with high-level ICOs, Lendingblock has also set a floor of $5 million USD that, if not achieved, will result in the return of all investor capital. 60% of the total LND supply will be available for purchase during the token sale, split over a private sale, pre-sale, and public sale.

The LND token will be issued as an ERC20 token on the Ethereum blockchain and will function as a utility token that is used to facilitate interest payments between borrowers and lenders. Lendingblock outline the valuation of LND as governed primarily by demand for the token as the development of network effects attract more platform participants, which will be driven by global community engagement, targeted business development, and institutional sales.

Overall, Lendingblock presents a justifiable purpose for the creation of the LDN token and have set realistic funding goals supported by a soft cap level that will serve to assuage investor concerns of failure.

With the private funding round of $500,000 USD already successfully concluded and the pre-sale in full swing, Lendingblock is positioned to achieve hard cap well before the conclusion of the public sale on the 30th of March.

Final Thoughts

With the current influx of institutional investors entering the cryptocurrency market, platforms that provide analogues to financial mechanisms present in the more robust traditional securities market not only capitalize on the needs of entities that rely on them, but also contribute to the overall stability or, in the case of Lendingblock, liquidity, of the crypto market as a whole.

With the Lendingblock ICO likely to succeed in launching a blockchain equivalent of securities lending, a future in which we see crypto-based ETFs or other such financial instruments may not be so far away.

For more information on Lendingblock, visit the Lendingblock official website or watch the short video below.

CoinGlass

CoinGlass

Farside Investors

Farside Investors