Friend.tech faces continued sniper bot issue, pushing price of popular creators before shares hit market

Friend.tech faces continued sniper bot issue, pushing price of popular creators before shares hit market Friend.tech faces continued sniper bot issue, pushing price of popular creators before shares hit market

Sniper bots' manipulating share prices stirs fairness debate amid resurgence in friend.tech user activity

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Friend.tech (FT), the web3 social token platform that saw a resurgence in user activity recently, has seen an increase in “sniper bots,” causing significant shifts in share prices.

According to a detailed analysis performed by X user @unexployed_ of Castle Capital, these bots, beyond their normally expected functionality, are deploying a technique of ‘sniping’ to gain control over high-value profile shares.

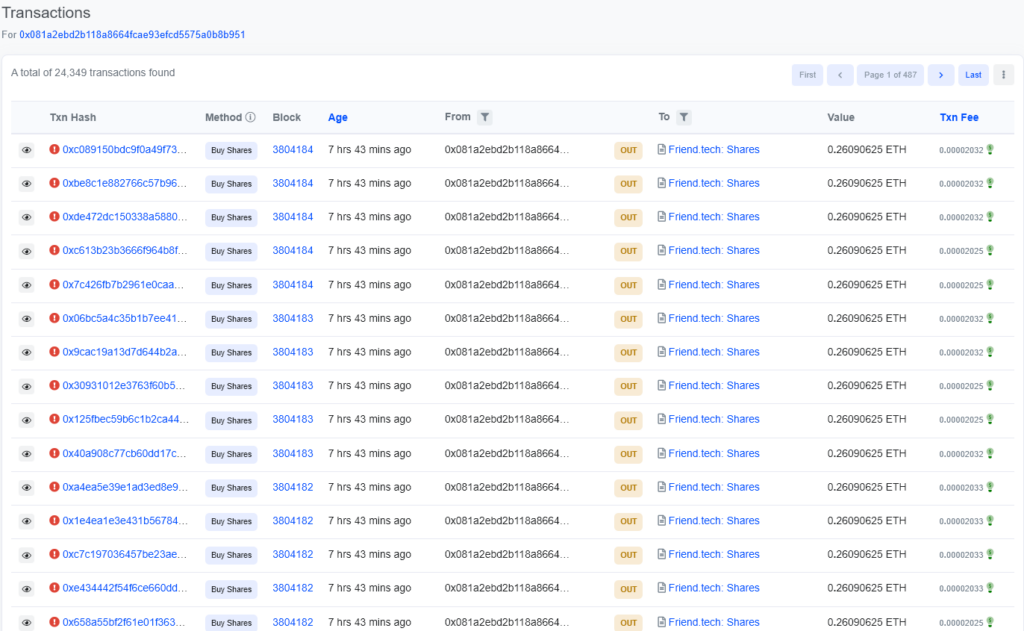

In the case of DappRadar’s recent registration on FT, Unexployed revealed that the share prices started at an unusually high point of 0.26 ETH. This was not triggered by a registered account but seemingly by a sniping address interacting directly with the smart contracts, demonstrating the influence of these bots on the market.

Digging deeper into basescan.org, Unexployed was able to trace the chronological order of buyers and sellers. Within the first four blocks, there were already 65 shares on the market. And DappRadar was not alone. Other entities, such as Moonshilla and Rektdiomedes, also faced a similar situation where snipers gained immediate control over their FT supply.

The primary sniper, identified as 0x081…951, executed over 20,000 transactions to acquire the shares. The first 46 transactions failed with the error “Fail with error ‘Insufficient payment” and were reverted, according to Basescan.

A CryptoSlate analysis of the transactions revealed that the account attempted to purchase the shares before the owner of the account had purchased the first share (a requirement of FT.) The transaction log states Fail with the error, “Only the shares’; subject can buy the first share”

Such spamming behavior was already evident during the first week of FT. According to Bert Miller from Flashbots, spamming the chain and mempool leaks are key factors leading to this phenomenon.

The sniper’s massive control over the supply allowed them to earn a profit of 1.84 ETH by selling their shares. However, the bot’s actions led to a significant reduction in supply, and another sniper incurred a loss of 0.5 ETH, illustrating the competitive nature of these bots.

In the wake of these revelations, concerns are being raised about the fairness of the platform for individual users and high-value profiles. Unexployed suggests FT should consider solutions such as allowing creators to purchase more of their shares upon registering to mitigate the effects of these bots.

FT resurgence in user activity.

It’s clear that despite the drastic drop in initial hype and challenges with ‘sniper bots,’ the platform is making considerable strides. The revenue surged to $5.6 million on Sept. 9, showcasing a 30-day high for the blockchain-based social network.

The revenue spike was propelled by consistent growth in use over the previous two weeks, which is an encouraging sign in light of the substantial decrease in initial excitement that followed after its launch.

The platform’s daily active users tally reached 9,000, with 2,000 new sign-ups recorded on Sept. 9. The same day witnessed a trading volume of $12.3 million, positioning it as the third-highest trading day since its inception. Furthermore, FT collected fees amounting to $1.23 million, making it one of the highest fee-generating days for any dApp in the crypto market.

However, the rise in ‘sniper bots’ has been causing significant shifts in share prices, with the impact unidentified at this time.

It’s worth noting that FT’s beta version made quite a splash when it debuted on Coinbase’s layer-2 Base on Aug. 11. Within ten days, the platform’s fees skyrocketed — surpassing Uniswap and the Bitcoin network. Despite this short-lived success, FT is demonstrating resilience and adaptability in the face of challenges.

As the phenomenon of increasing bots on FT unfolds, how it will respond to the bot activity remains to be seen.

Farside Investors

Farside Investors

CoinGlass

CoinGlass