China combats struggling financial markets with tax cuts

China combats struggling financial markets with tax cuts Quick Take

In a determined bid to reanimate its ailing financial markets, China has slashed stock trading taxes by half, as reported by market analyst Ayesha Tariq. Alongside this, the government has directed state-owned banks and funds to invest in stocks, adding a new layer of complexity to the nation’s economic landscape. Highly noticeable is the staggering 80% drop encountered by Evergrande, a key real estate player, in its first trading session for 17 months, marking an intensifying property market crisis, according to the BBC.

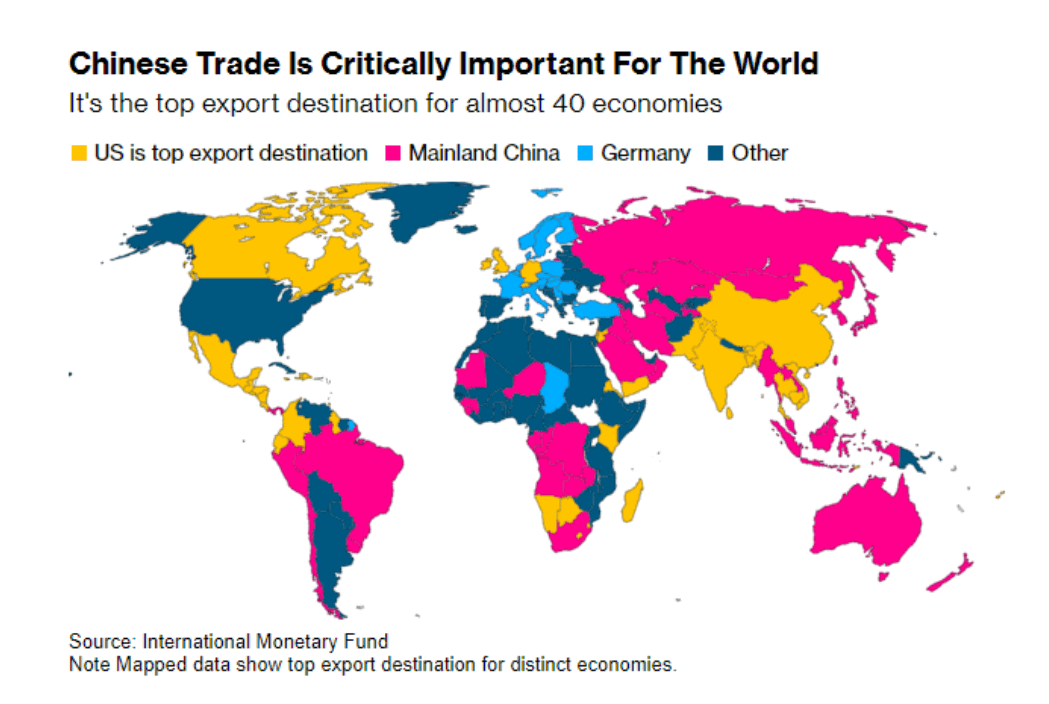

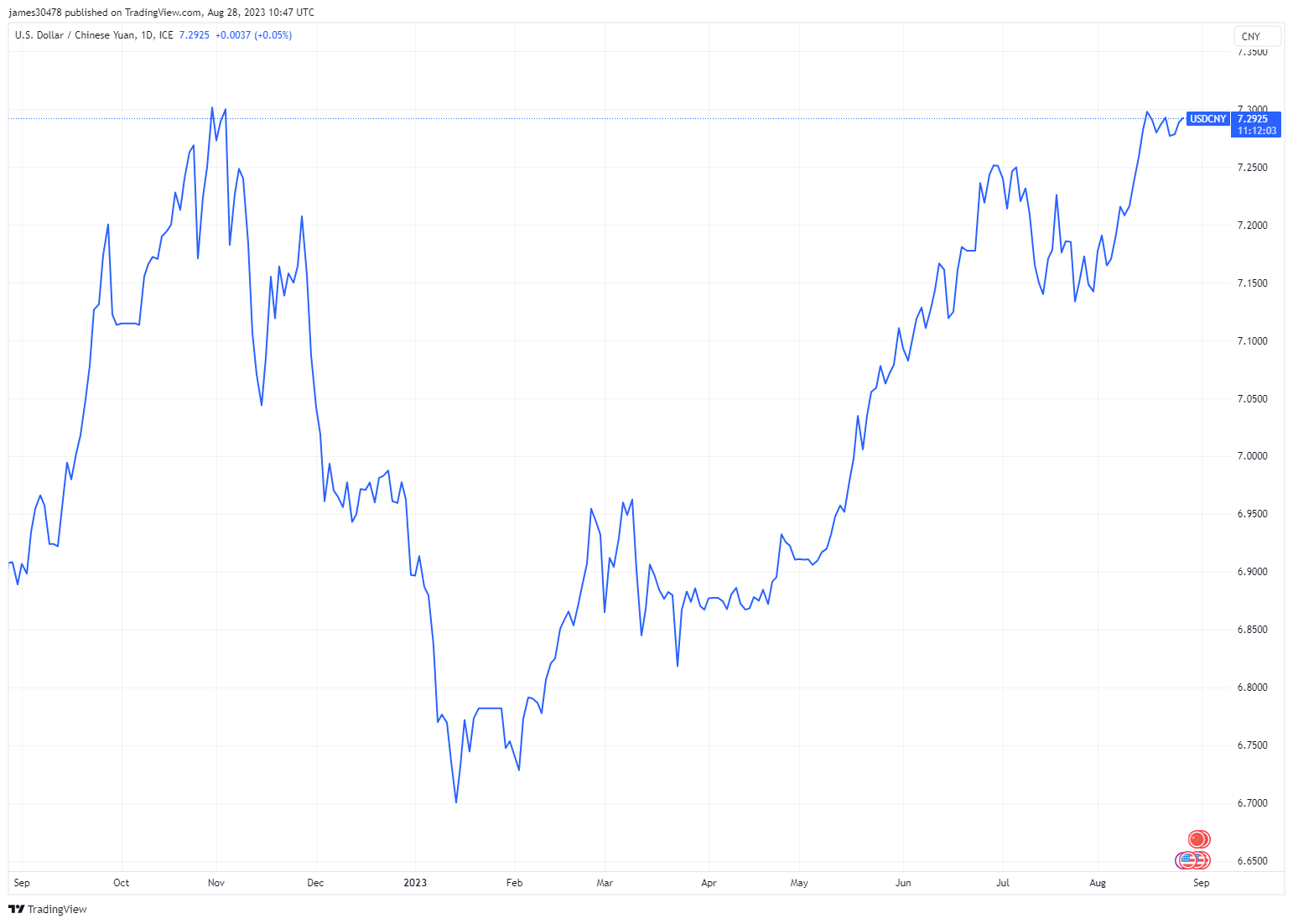

Furthermore, the Chinese Yuan has plunged to its lowest level against the US dollar this year, settling at 7.29, further underscoring the mounting debt challenge. A pivotal concern emerging from this situation is China’s export deflation, a development that can potentially have severe repercussions for the Western economies. As the top exporter for nearly 40 economies, according to the International Monetary Fund, the impact of these Chinese economic measures cannot be overstated.

Farside Investors

Farside Investors

CoinGlass

CoinGlass