Op-ed: Why the SEC should stay away from crypto (Part I)

Op-ed: Why the SEC should stay away from crypto (Part I) Op-ed: Why the SEC should stay away from crypto (Part I)

The U.S. needs a dedicated Digital Assets Commission to navigate the complex crypto landscape and foster innovation amidst regulatory challenges.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

It is time for the U.S. to implement intelligent, progressive, and specific digital asset regulation.

The Securities and Exchange Commission’s recent charges against Coinbase and Binance have brought the debate on digital asset classification to a boiling point, and I believe it demonstrates that the organization is not equipped to regulate digital assets competently.

Included in the suits are lists of over 15 digital assets the SEC claims pass the Howey Test and are thus securities. In order to succeed in the suit, SEC Chair Gary Gensler told CNBC,

“All we have to show is that one of [the tokens listed by the exchanges] is a security and they should be properly registering.”

However, when reviewing the alleged securities listed by the exchanges, there is no mention of the black swan that was the Terra-Luna collapse (save for a passing reference in the Binance suit.) Binance currently still lists LUNA as well as the classic token LUNC, while Coinbase listed wrapped LUNA (wLUNA) and still has it available via the Coinbase Wallet. Terra Luna’s failure wiped out tens of billions of dollars from the crypto market cap and led to individual investors losing huge amounts of money.

The SEC also invokes tokens trading on FTX as part of their argument that Coinbase is in the wrong. In the lawsuit, the listing of SOL on FTX.US is presented as part of the evidence claiming that Solana is a security. An almost identical section is also included in the Binance suit.

At this point, it is well known that FTX and its executives had a very well-known presence on Capital Hill and that SBF and his cohorts established personal or working relationships with several members of the U.S. government, Gensler included. U.S. customers lost huge sums when that exchange failed, leaving more than a few members of the government with an embarrassing track record of having snuggled up to alleged fraudsters and the uncomfortable reality of having to disgorge themselves of their substantial campaign donations.

The U.S. has failed on crypto regulation

Coinbase has been publicly requesting guidance on digital asset regulation for years. “The SEC is one where we’ve really struggled over the past few years,” stated Coinbase CEO Brian Armstrong in a Twitter Space earlier this year, implying an intransigence at that agency not encountered elsewhere.

Armstrong explained that Coinbase had attempted to contact the SEC to discuss the regulatory landscape to no avail until the SEC specifically requested to visit Coinbase last year. Coinbase had “30 meetings over the last nine months” with the SEC, which was supposed to culminate in a meeting where feedback would be given.

However, Armstrong alleged that the SEC canceled the meeting the day before it was supposed to happen and sent a Wells Notice to Coinbase the following week. Nine weeks later, it sued the exchange for multiple securities laws violations.

Digital Assets mentions in Congressional Record

While there has been a considerable increase in congressional activity on digital assets over the past few years, with over 1,065 mentions of the term in the record. Nevertheless, real progress on digital asset regulation has been excruciatingly slow.

Digital assets were first mentioned in a Senate hearing from 2000 titled “Utah’s Digital Economy and the Future: Peer-to-Peer and Other Emerging Technologies,” in which they were likened to “databases.”

Digital assets were also mentioned in a 2001 Congressional hearing by the Energy and Commerce Subcommittee on Commerce, Trade, and Consumer Protection. John Schwarz, the President and CEO of Reciprocal, Inc., argued that “securing digital assets and preventing unwanted digital intrusion is equivalent to defending personal and potentially national integrity.”

While Schwarz was talking about digital files such as mp3 audio and mp4 videos, it is the first official mention of the term now making headlines.

The term was cited infrequently each year until 2019, when digital asset mentions surged to 21, including the proposed bills, Managed Stablecoins are Securities Act and the Keep Big Tech Out Of Finance Act.

By 2022 there were 598 mentions of the term “Digital Assets,” including 22 bills, 14 Congressional Hearings, and over 500 mentions in Congressional calendars. This year, in 2023, there have only been 68 mentions to date, the congressional calendar collection being the biggest cause of the drop, falling from 501 to just eight mentions.

Trends in Digital Asset usage

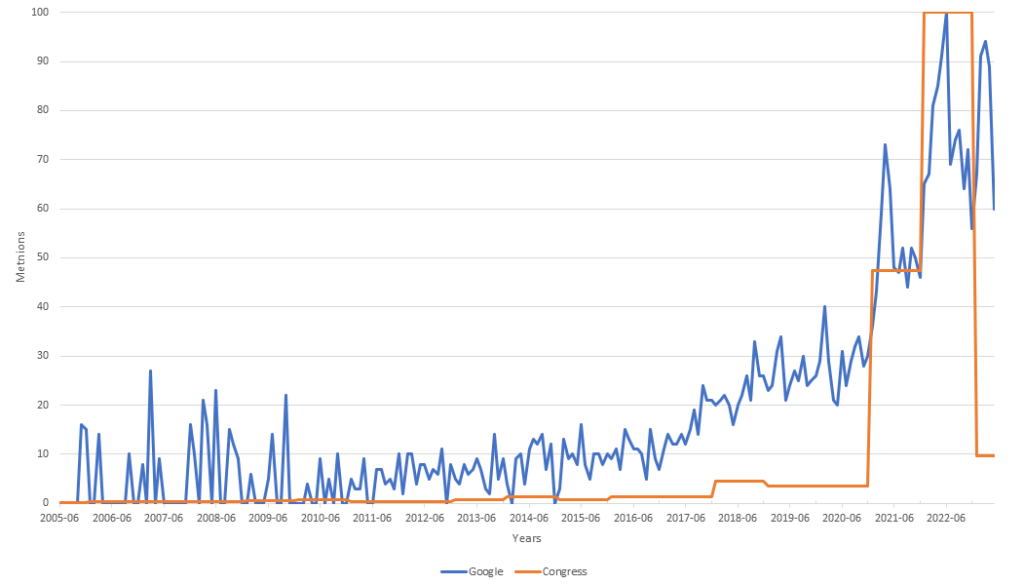

I compared the “Digital Assets” mentions on Govinfo.gov’s Congressional and Federal databases to the search volume of the same term on Google from 2005 to the present.

The normalized chart below shows interest through Google Search picking up from around 2017, while it took until 2020 for the U.S. Government to increase the use of the term on the record.

In the chart, the data is scaled to a common reference point, allowing for easy comparison and analysis of the different data sets. Notably, there has been an extreme decline in mentions on the official public record for “Digital Assets” to just 9.7 at a time when Google Search traffic is above 60.

Interest from Google Search seems to have formed a double top, with a peak in 2021 and a lower high at the start of 2023. The technical analysts of the world would suggest such a movement is a bearish indicator if this was a stock or token chart.

Moreover, interest from Congress has simply fallen off a cliff, with mentions falling from 598 in 2022 to just 58 six months into 2023.

Why?

Has conversation on digital assets been moved off the official public record into back channels and social media? Was the surge in 2022 related to an urgent need to define Digital Assets?

If that were the case, then why are companies who are (publicly) begging for guidance on digital asset regulation being sued by the SEC?

In part two of this feature, we will explore the implications of the SEC’s actions and explore alternative approaches to crypto regulation that could benefit the industry and its investors.

Continue reading Part II.

CoinGlass

CoinGlass

Farside Investors

Farside Investors