Research: US leads weak Bitcoin and Ethereum accumulation into festive period

Research: US leads weak Bitcoin and Ethereum accumulation into festive period Research: US leads weak Bitcoin and Ethereum accumulation into festive period

The appetite for crypto accumulation slows significantly going into the new year.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin accumulation has softened significantly but as 2022 draws to a close, the U.S. is buying more BTC than any other region, according to CrytoSlate’s analysis of Glassnode data.

A similar pattern of accumulation and distribution was noted with Ethereum.

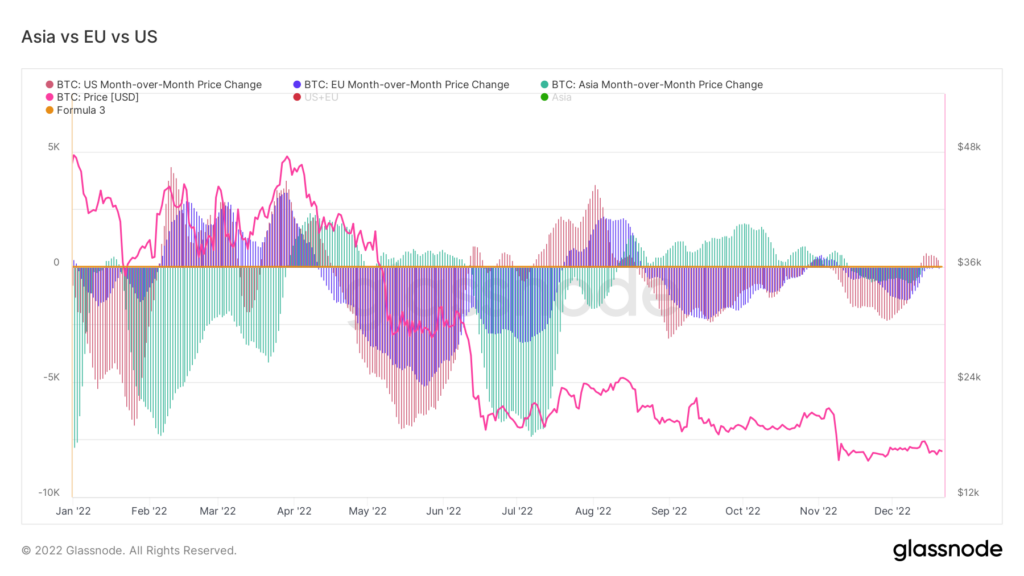

Bitcoin accumulation and distribution by region

The chart below depicts Bitcoin accumulation and distribution by the U.S., EU and Asia regions. It shows strong bullish sentiment from the U.S. and EU in the first half of the year, leading to high accumulation levels for those regions. At this time, Asia was selling.

Maximum pain post-Terra collapse, as Bitcoin was rejected at $25,000 in mid-August, saw Asia flip from distribution to accumulation. Meanwhile, at this point, the U.S. and EU went the other way, flipping from accumulation to distribution.

Asia continued buying into September and November. But since mid-November, no regions were accumulating.

Leading into Christmas, the U.S. is accumulating again, albeit at weak levels.

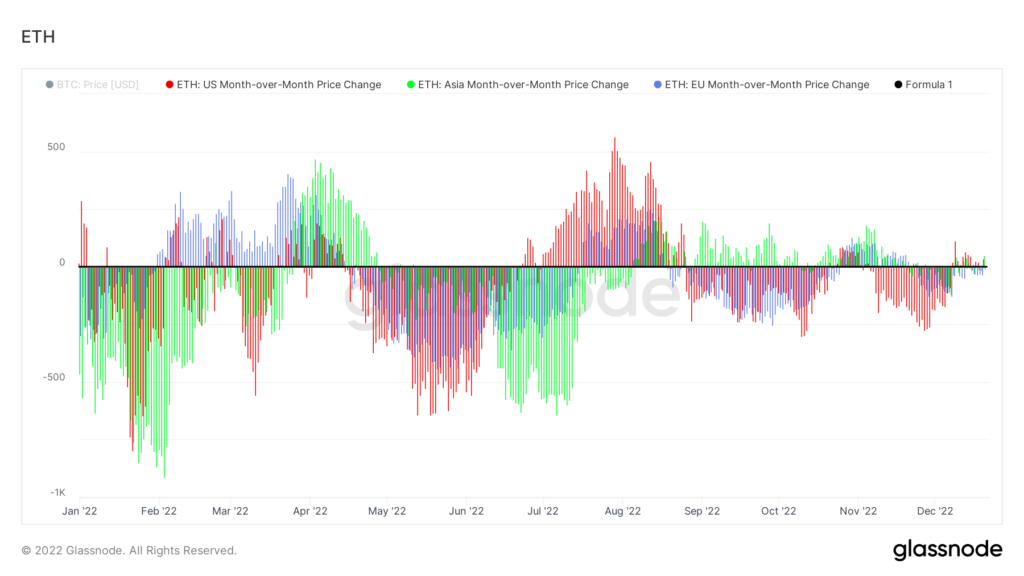

Ethereum accumulation and distribution by region

Analysis of Ethereum accumulation and distribution by regions shows a similar pattern, such as the U.S. and EU flipping to heavy accumulation post-Terra collapse, while Asia went the other way.

Much like the Bitcoin chart above, a noticeable drop off in activity occurs as the year draws in. So much so, ETH accumulation is now at its weakest point for 2022.

With macroeconomic uncertainty continuing to linger, the appetite for crypto has slowed significantly going into the new year.

Farside Investors

Farside Investors

CoinGlass

CoinGlass