1. Solana Wallet

Connect a Solana self-custody wallet (Phantom, Solflare or Torus).

A weekly recap of key Bitcoin metrics and the macro factors affecting its price performance in the market, published every Saturday.

Cover art/illustration via CryptoSlate

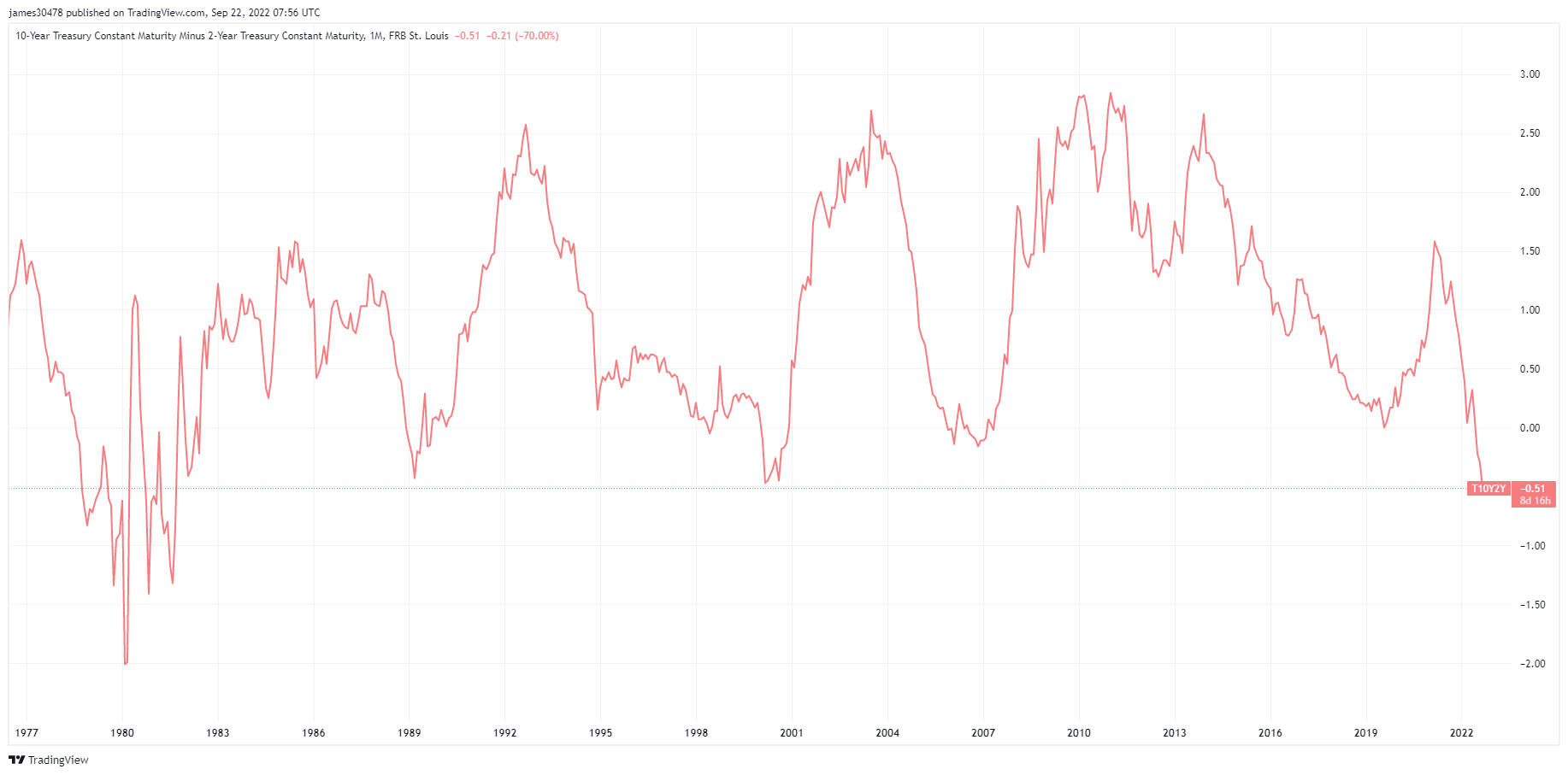

The fed delivered its third consecutive 75 basis point hike accompanied by higher forecasts of future rates, pushing the dollar index and fixed income yields to new highs. Volatility across all asset classes had picked up, which had seen the ten-year minus two-year yields eventually close the widest since the year 1988.

The FOMC’s 75bps hike took the target range from 3% to 3.25%, with forecasts for the benchmark projected to reach the end of 2022 at 4.4%. Unemployment for 2023 increased to 4.4% from 3.9%, with rate hikes expected to cool the labor market.

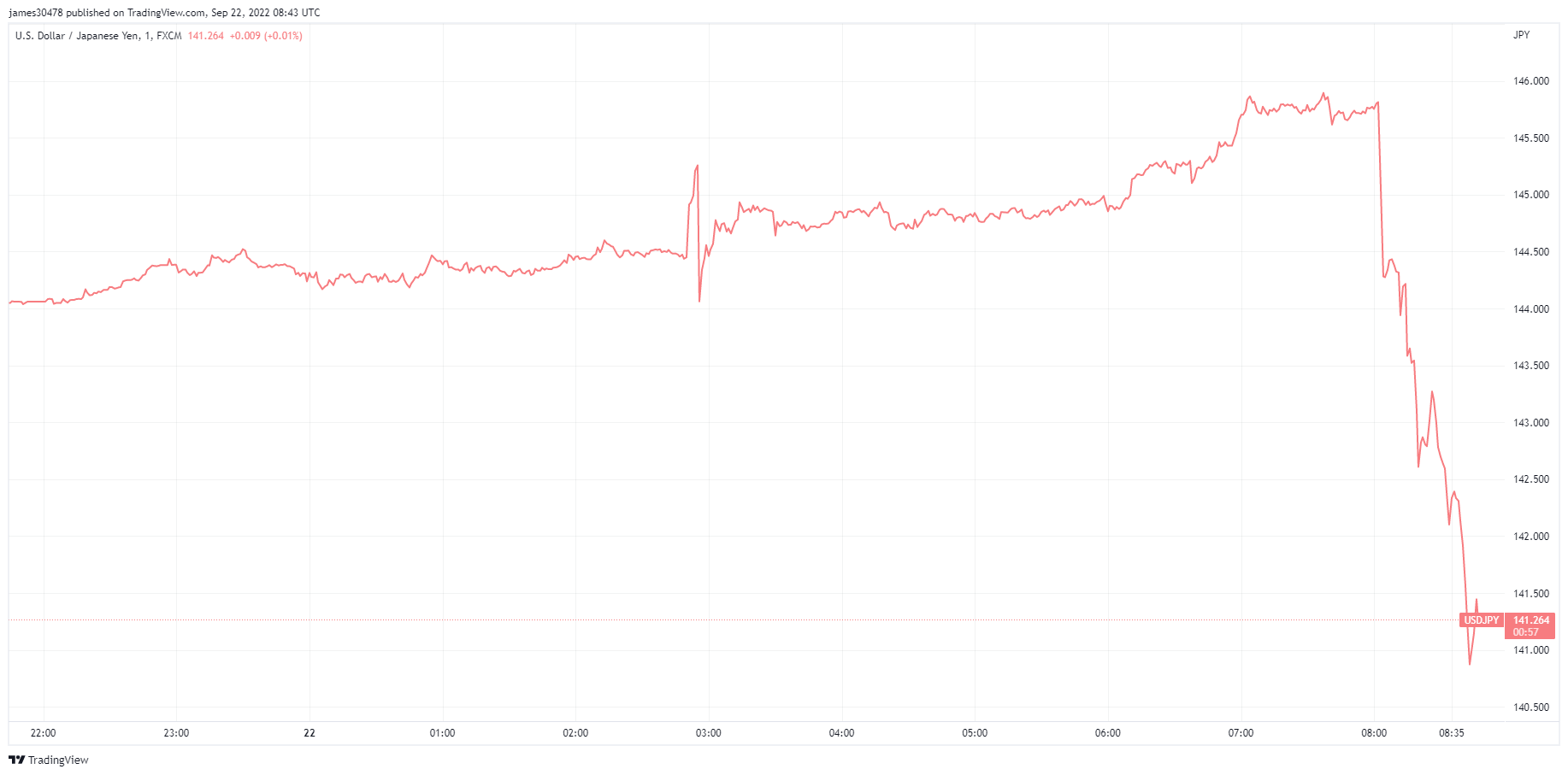

As a result, the Euro hit its lowest point since 2002 vs. USD (0.96). The pound dropped to 1.08, and USDJPY had smashed through 145, with 10- year Japanese government bonds still hitting 0.25%.

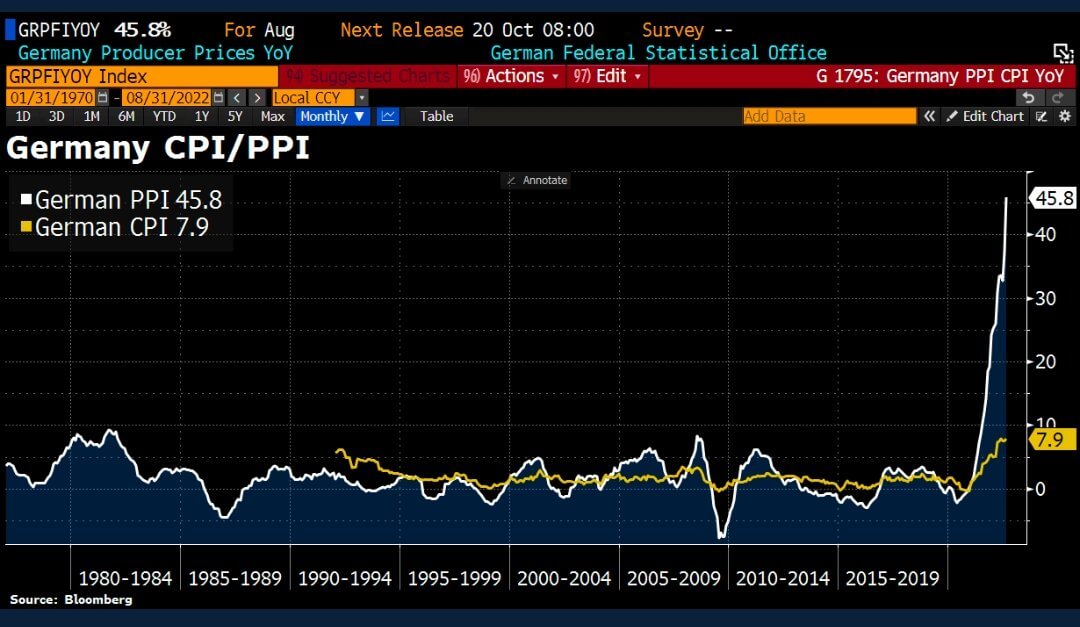

German August Producer Prices Index (PPI) surged 45.8% (vs. 37.1% expected) from a year ago. This was driven mainly by soaring energy prices, raising chances of higher CPI inflation in the next reading.

Concerning energy, PPI rose almost 15% compared to August 2021; however, energy prices were twice as high as in the same period last year, an increase of 139%. This would be why energy prices are not considered in the CPI print, as central banks would have to increase interest rates aggressively.

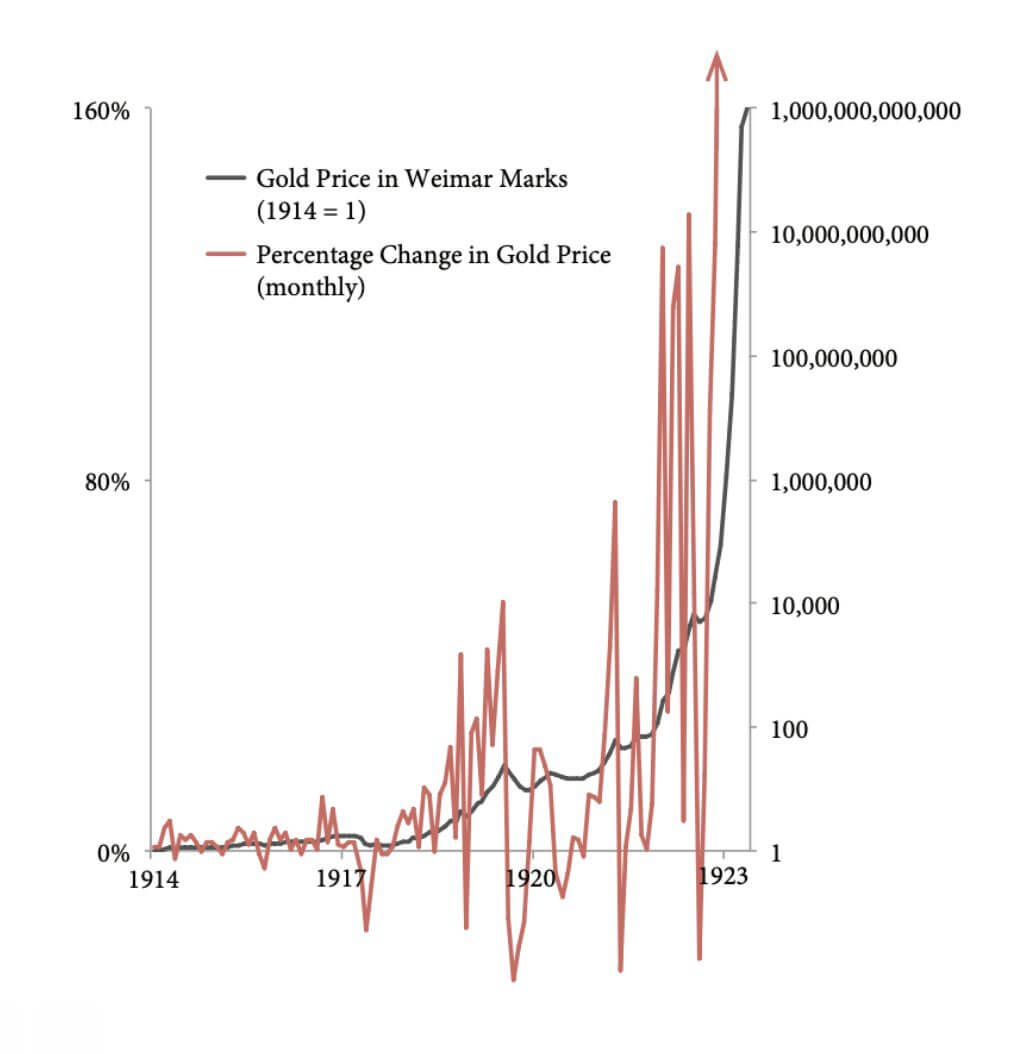

Germans have bad memories of hyperinflation as it affected the German Papiermark, the currency of the Weimar Republic, in the early 1920s. To pay for the reparations of WW1, Germany suspended the gold standard (convertibility of its currency to gold). The Germans used to pay war reparations by mass printing bank notes to buy foreign currency to pay for the reparations, which led to greater and greater inflation.

“A loaf of bread in Berlin that cost around 160 Marks at the end of 1922 cost 200,000,000,000 Marks by late 1923”- History Daily

The gold price in Weimar Marks in 1914 equaled 1, as golds supply increased only around 2% a year, a relatively stable asset. However, within the next decade, the percentage change in gold price fluctuated because the denominator (Weimar Marks) increased drastically in the money supply.

A similar situation occurred in the 2020s, as Bitcoin has similar characteristics to gold. Bitcoin is volatile in nature but also exasperated due to the increase in M2 money supply (consisting of M1 plus savings deposits).

The Bank of Japan left its policy rate unchanged at negative 0.1% and committed to keeping the ten-year treasury to 0.25%, sending the yen to a 24-year low against the dollar.

However, on Sept 22, Japan’s top currency diplomat Kanda confirmed they intervened in the FX market. The Japanese government stepped into the market to buy yen for dollars and conducted the first FX intervention since June 1998. The yen soared against the DXY, dropping from 145 to 142.

“If you manipulate the key aspect of money, you manipulate all of our time. And when you have manipulation in money, you have, you MUST have misinformation everywhere in society… Bitcoin is the opposite system. Hope, truth, better future. Spend time there.” – Jeff Booth.

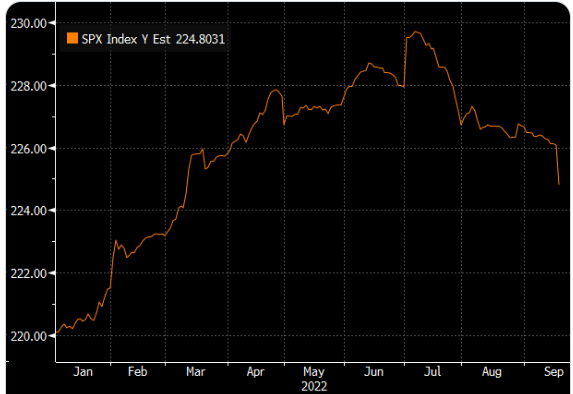

Equities tried to put on a brave face but continued to get battered by rising interest rates. So far, in 2022, equity markets have been downgraded massively in valuations. With the end of the quarter and quarterly earnings season approaching, expect downgrades in earnings to continue this onslaught.

As supply chains continue to break down, the cost of capital increases, and a surging DXY are all liabilities for public companies. Expect to see the unemployment rate start to spike from Q4 onwards.

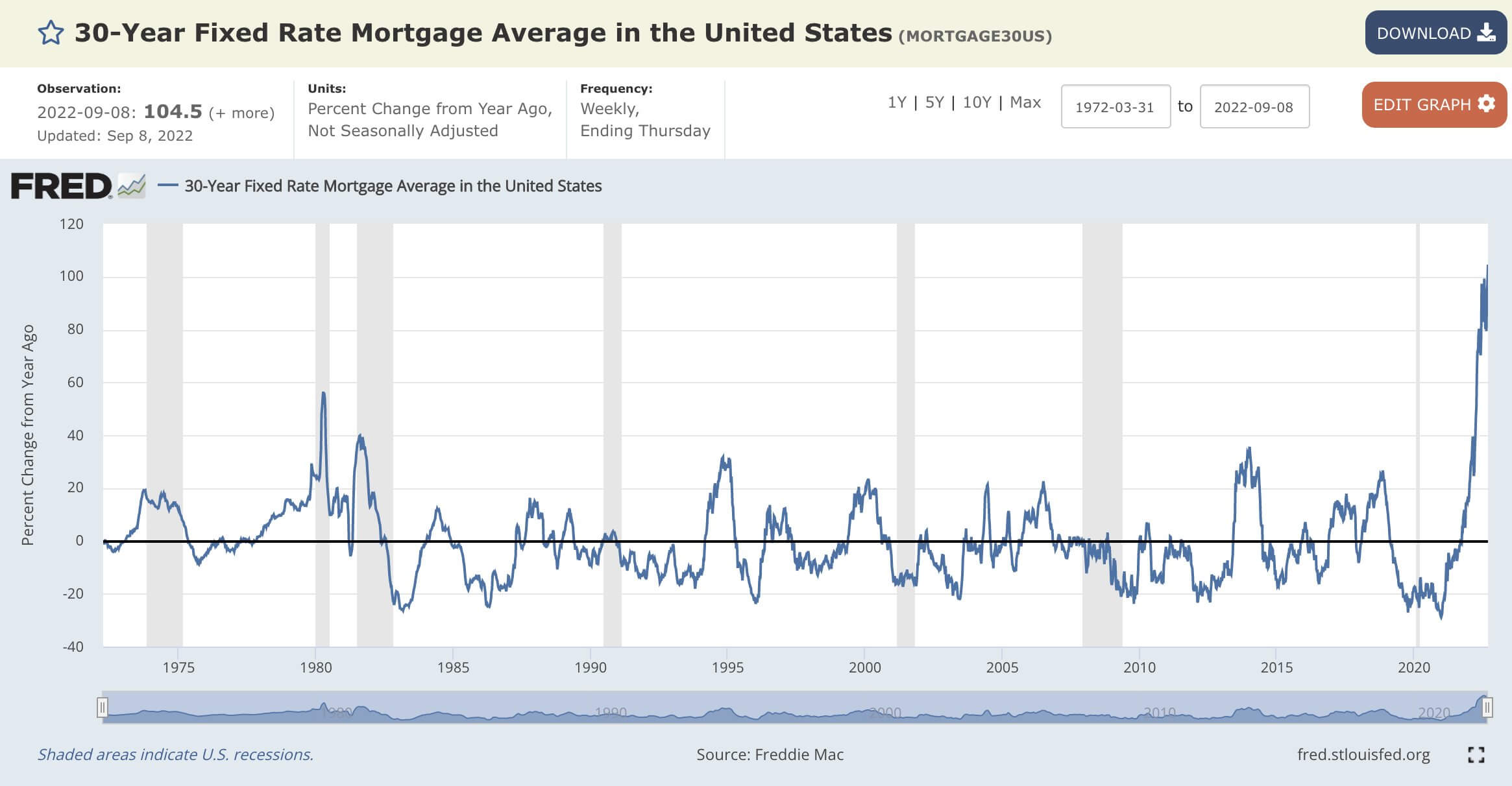

The average fixed 30-year mortgage rate has accelerated by +104.5% on a year-over-year basis. This appears to be the fastest change rate since the data was collected in 1972.

The current 30-year fixed mortgage on Sept. 21 was 6.47% highest since 2008; it was just 2.86% in September 2020.

September 2020: a median home price of $337k with a 30-year mortgage rate of 2.86% would see a total paid over 30 years of $502k.

However, compared to September 2022: a median home price of $440k with a 30-year mortgage rate of 6.47% would see a total paid over 30 years of $998k.

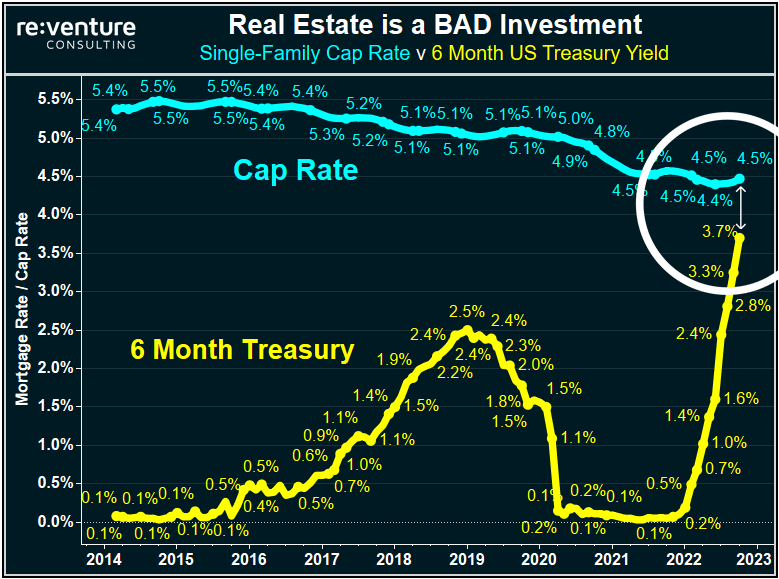

Problems continue to pile up for real estate investors. The single-family cap rate vs. six-month US treasury yield identifies why real estate is a liability with rising interest rates. The 6-Month US Treasury now yields almost the same, if not more, in certain states as buying & renting out a house in America (aka Cap Rate).

Real estate has less incentive for investors to be in these markets due to prices going down. The next apparent sign is reduced investor demand and margin calls to sell properties and get the asset off the books. Each time the federal reserve increases interest rates, the capital cost increases on existing portfolios. A trend to follow is to see wall street and big banks looking to exit as quickly as possible, as they have already earned their fees.

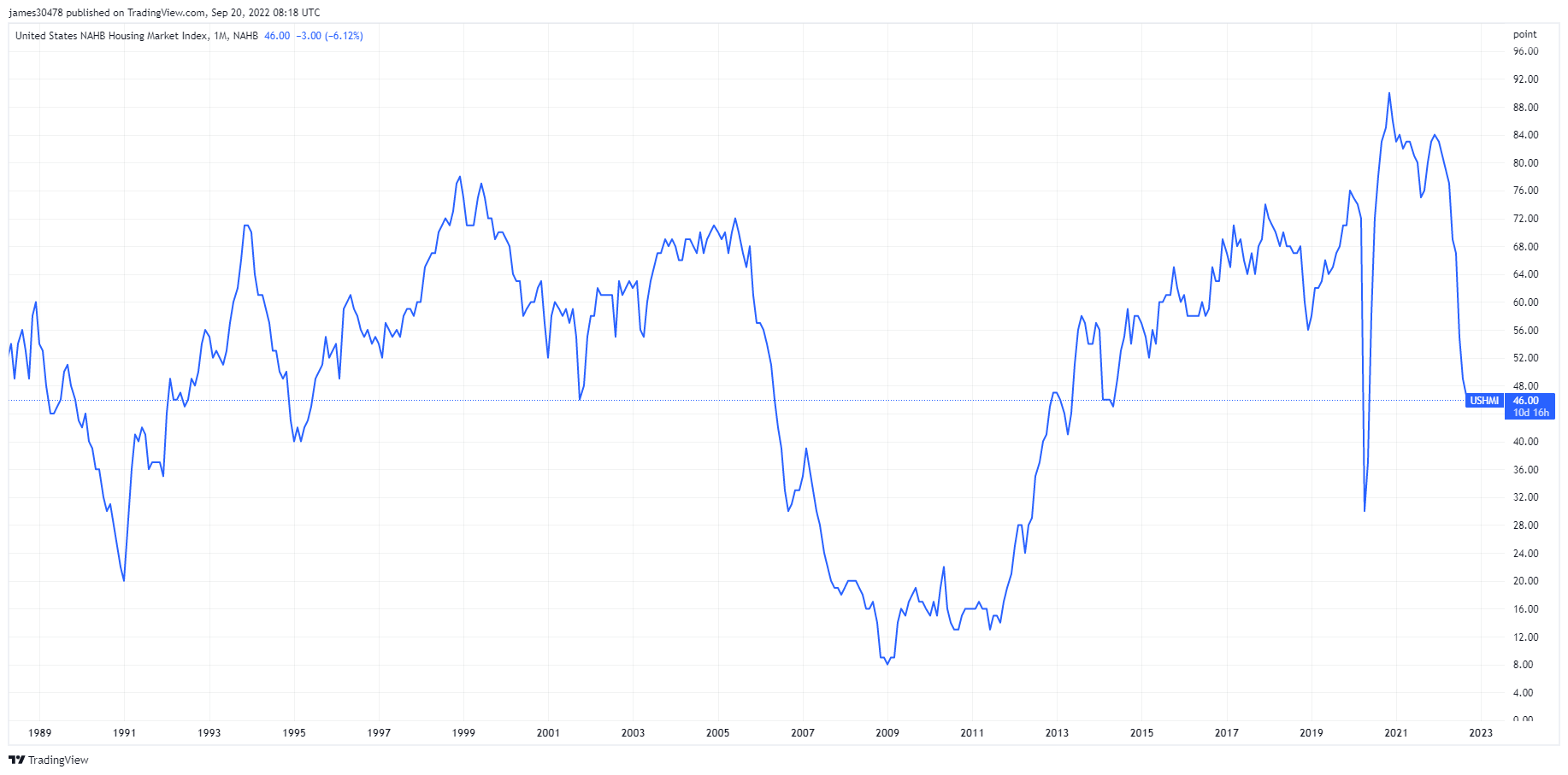

Another indicator that signifies a darkening outlook for US homebuilders is the NAHB housing market index which came out on Sept. 19. The index fell for a ninth consecutive month and by more than expected in September. The index is threatening to sink to levels last seen during the housing crisis between 2006 and 2013, with activity in sales in the new homes market almost grinding to a halt.

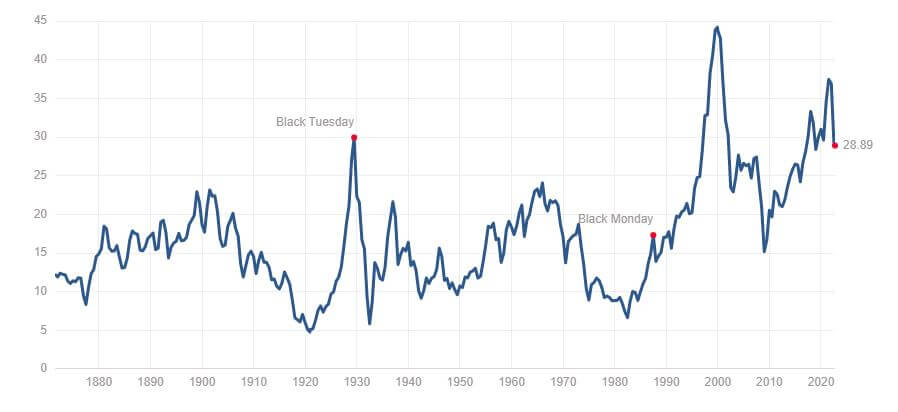

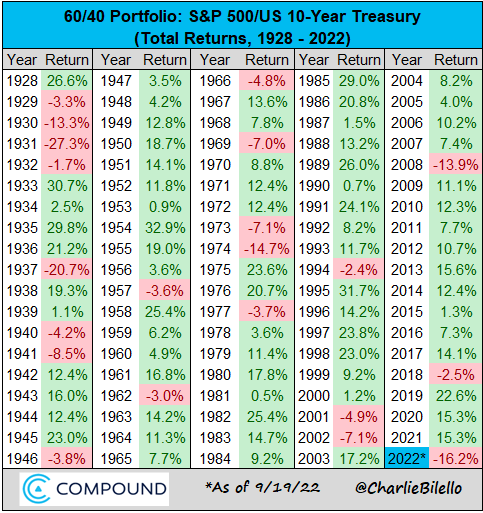

The 60/40 portfolio has served investors well for the past 40 years, with low inflation, volatility, and falling interest rates. The balanced portfolio would see 60% in equities and 40% in bonds.

Why was this strategy the ultimate insurance

Why it isn’t anymore

A 60/40 portfolio of US stocks/bonds is down 16.2% in 2022, which is on pace for its worst calendar year since 1937.

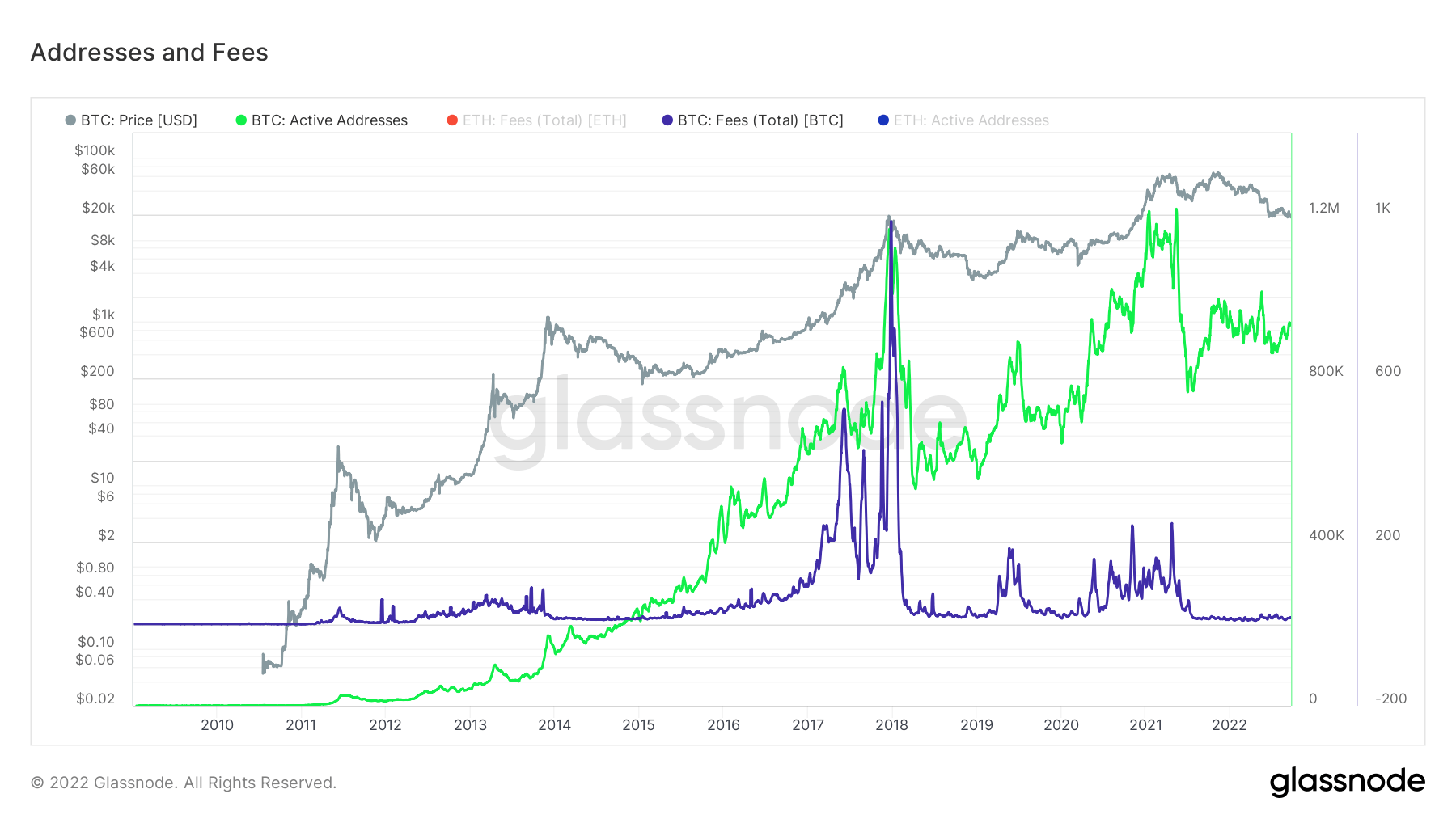

Active addresses are the number of unique addresses active in the network, either as a sender or receiver. Only addresses that were active in successful transactions are counted. Addresses are a great way to understand what activity is occurring on the network. Active addresses have been flat/muted for almost two years now, showing little activity on the network as speculators have left the ecosystem.

In addition, gas fees are meager and muted at levels seen almost since 2018. Fees will go up based on transactional activity, which also supports the case that it is a ghost town on the Bitcoin network.

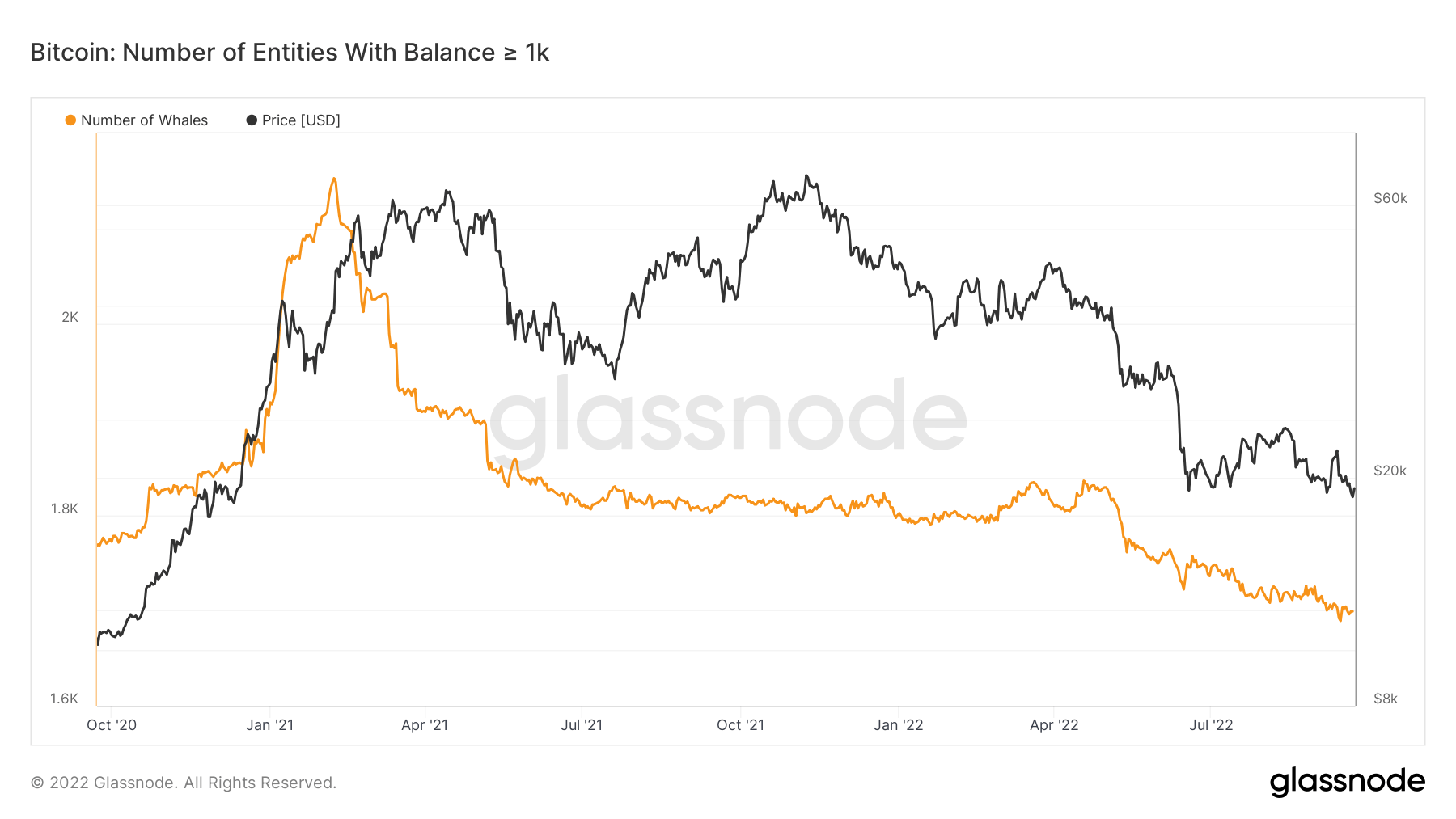

The number of entities with a balance of 1,000 or more Bitcoin is considered a whale. During the peak of the early 2021 bull run, there were almost 2,500 whales as Bitcoin approached $60,000. However, as whales are considered the smart money of the Bitcoin ecosystem, they sold when the price was high; expect to see this cohort’s accumulation if Bitcoin trends lower in price.

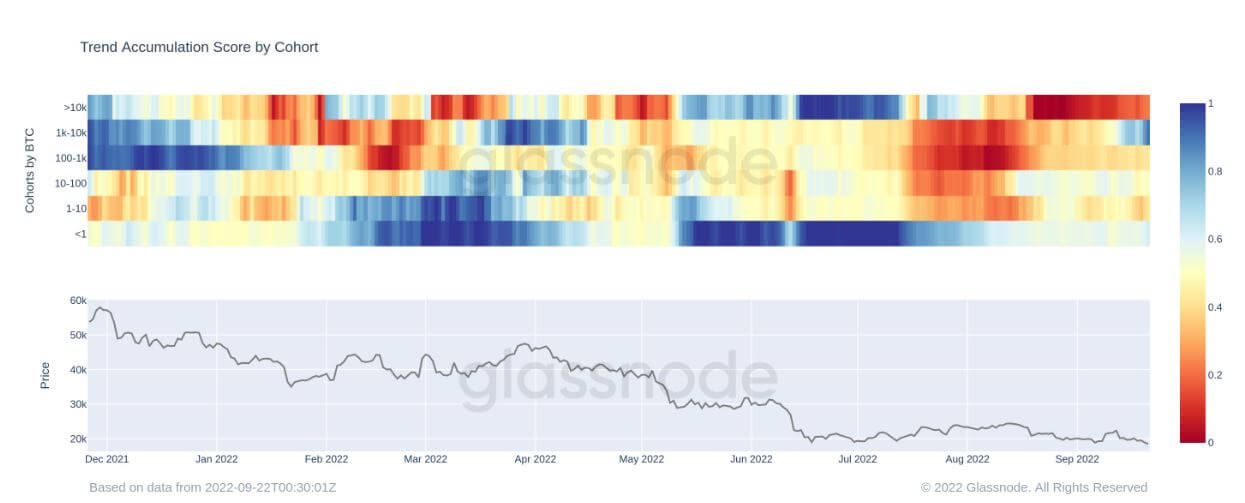

The accumulation trend score by the cohort confirms the thesis above; the metric monitor’s distribution and accumulation by each entity’s wallet. The 1k-10k entity has started to increase its holdings since Sept. 19, signified by the dark blue, which is encouraging to see as they see Bitcoin as value for money at these price ranges.

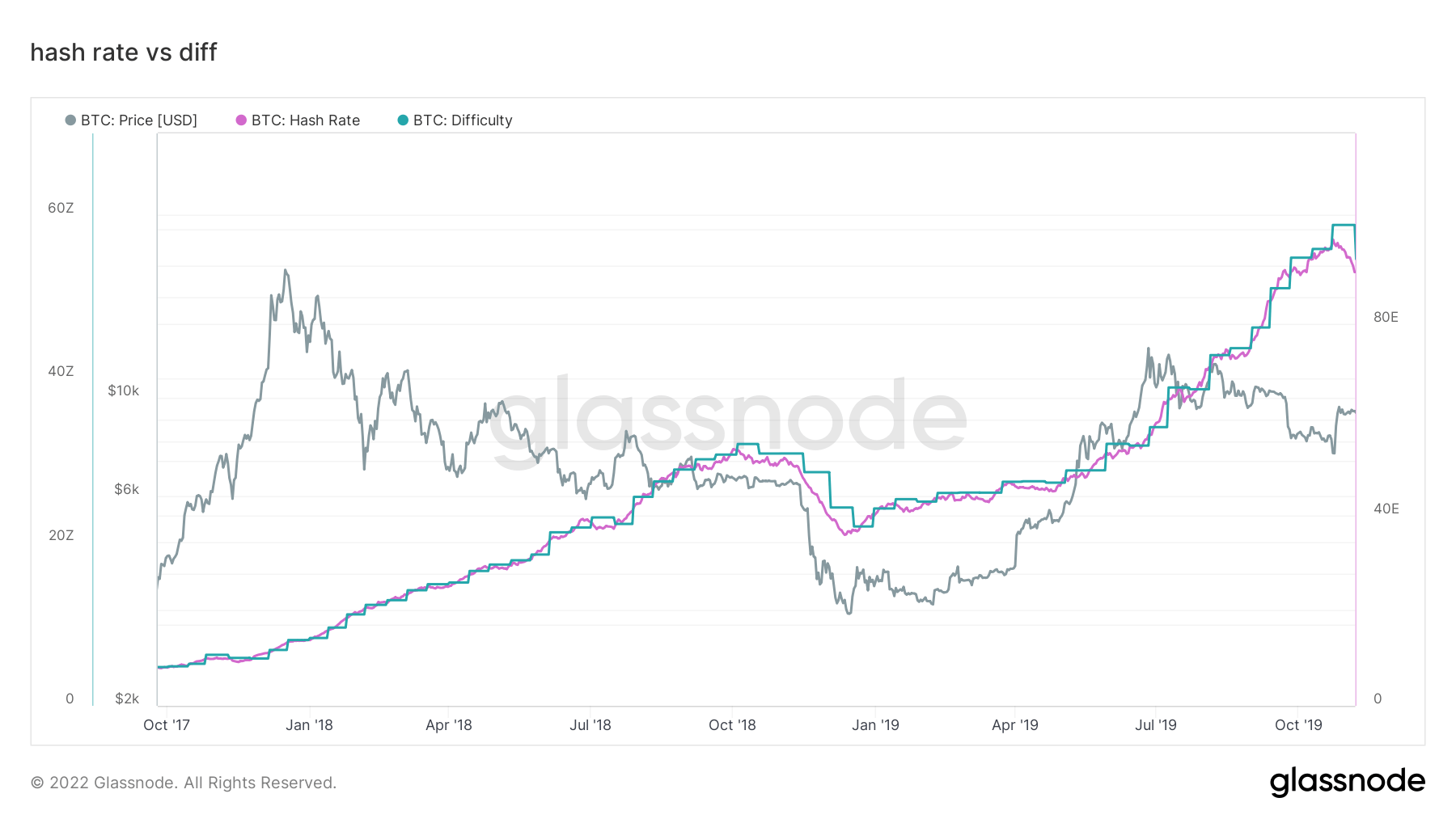

Looking back at the 2017-18 cycle, the final capitulation wasn’t until the miners capitulated. The Bitcoin hash rate fell over 30% from the peak as miners shut down due to being unprofitable. With rising energy bills and rates, something similar most likely occurs during the winter as the strain will intensify on unprofitable miners.

In addition, miner revenue per TeraHash (hash rate/ miner revenue) hasn’t broken down below its all-time lows, which has the potential to happen due to rising hash rate and BTC falling prices.

The mining industry is a game of survival of the fittest; any decent minor uses stranded energy and has a fixed PPA. As borrowing rates increase with energy prices, unprofitable miners will start to capitulate and fall off the network.

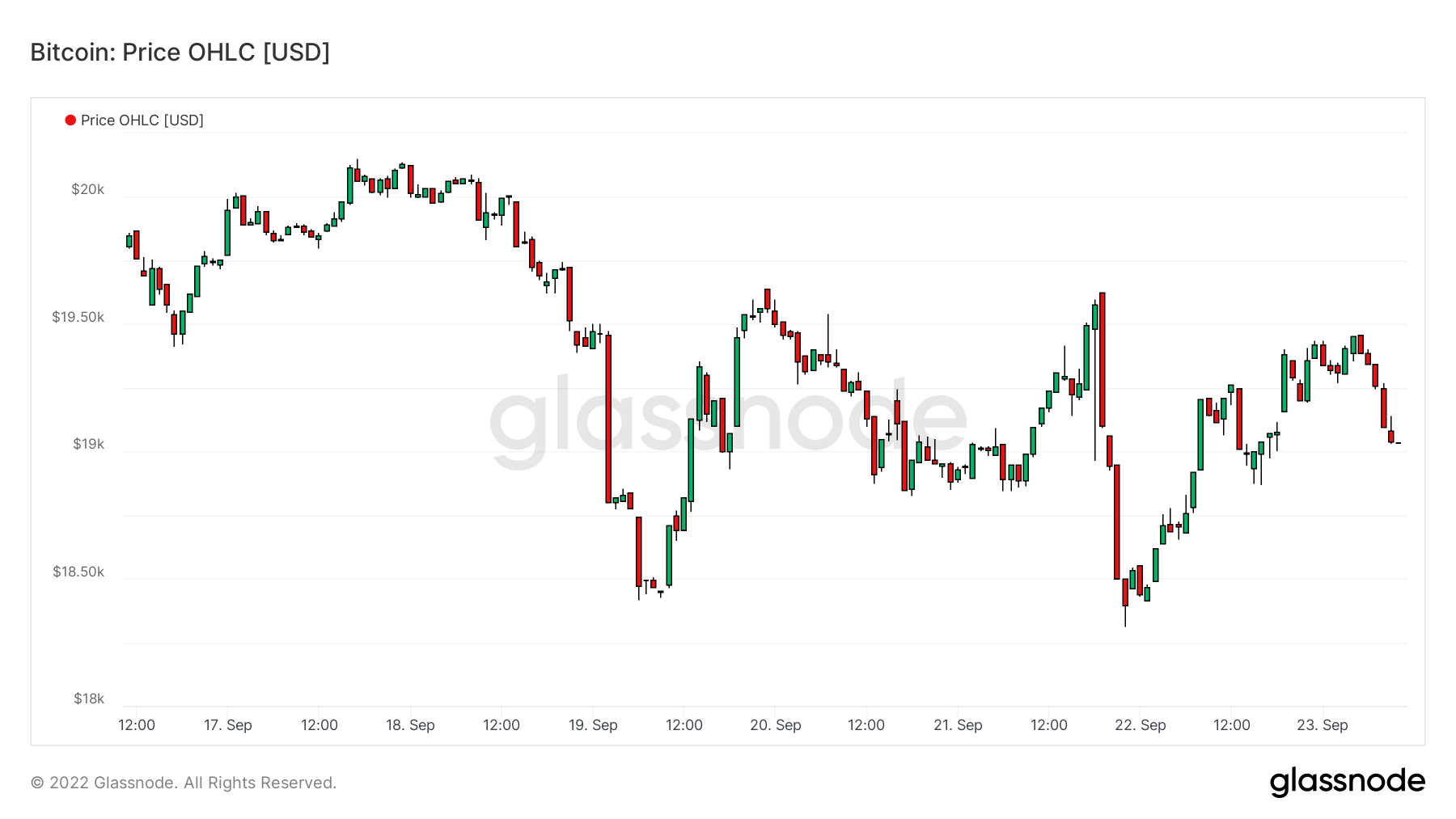

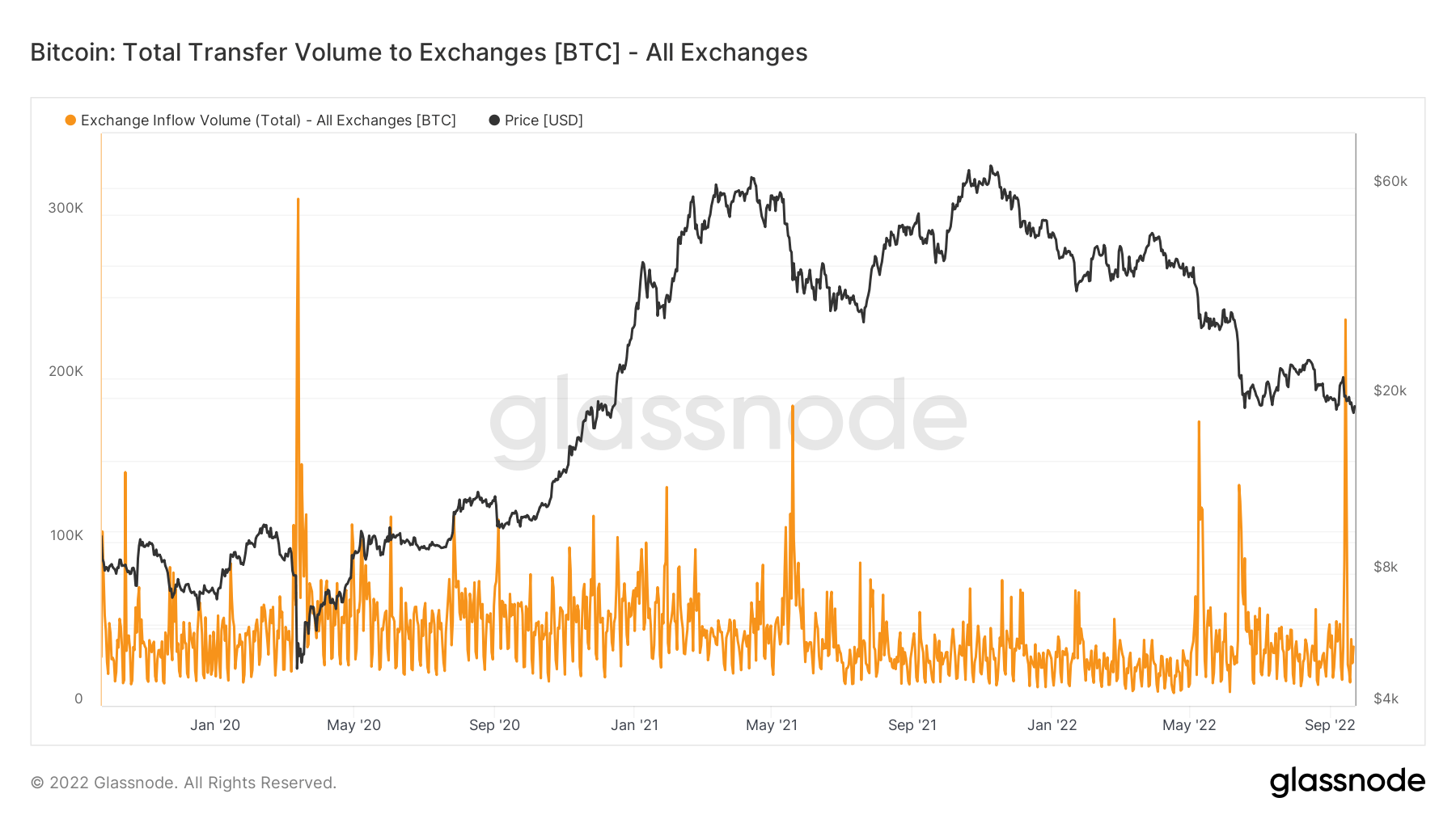

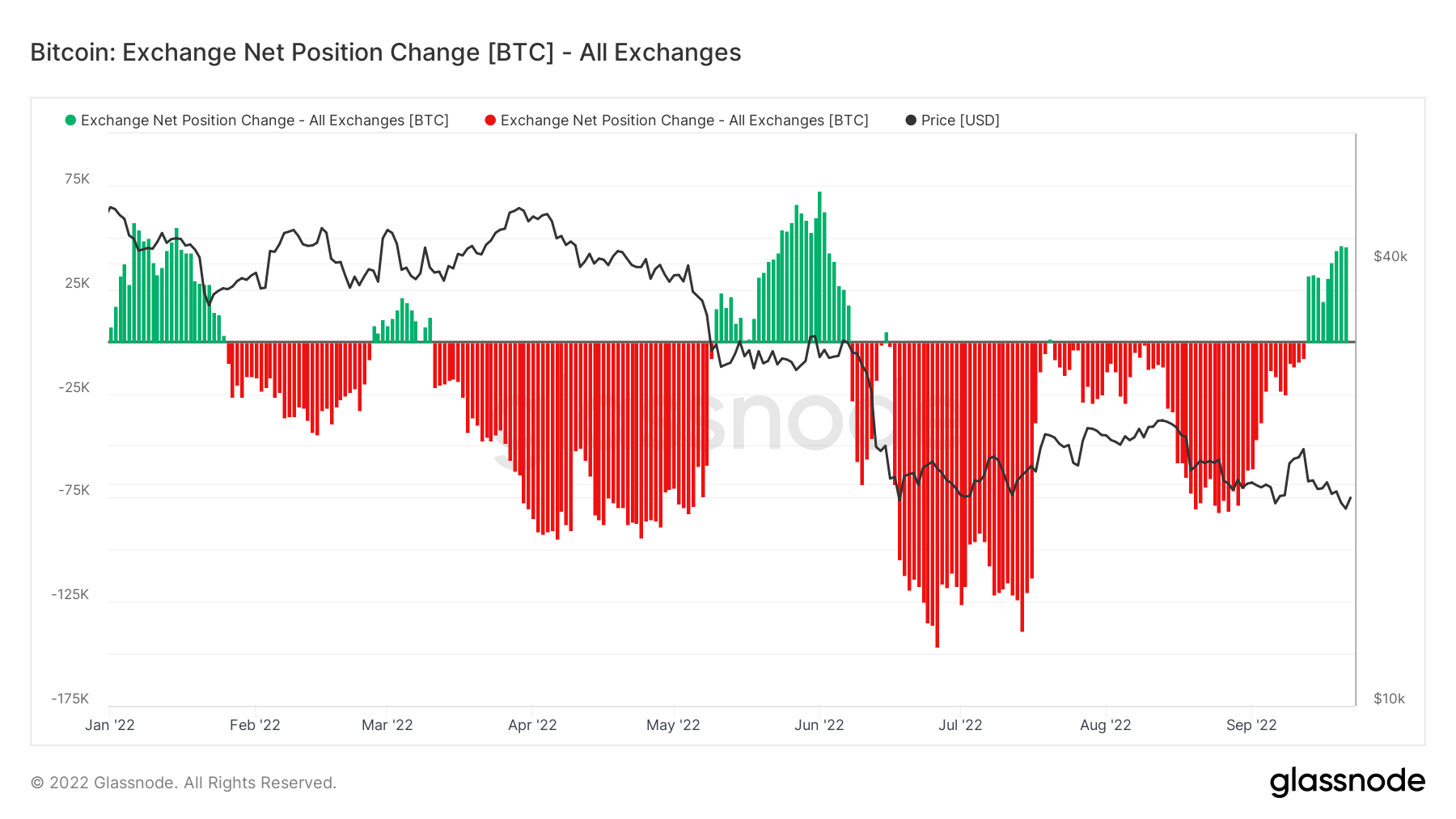

On-chain activity can determine how many coins are being spent to and from exchanges. The first metric contextualizes this, total transfer volume to exchanges. On Sept 19, 250k BTC was sent back onto exchanges which would be the highest amount since March 2020.

This is further supported by the metric exchange net position change, which shows inflows are the dominant regime. This has occurred only four times this year, both around the Russian invasion and the Luna collapse. A lot of bearish sentiment is being trickled through onto exchanges.

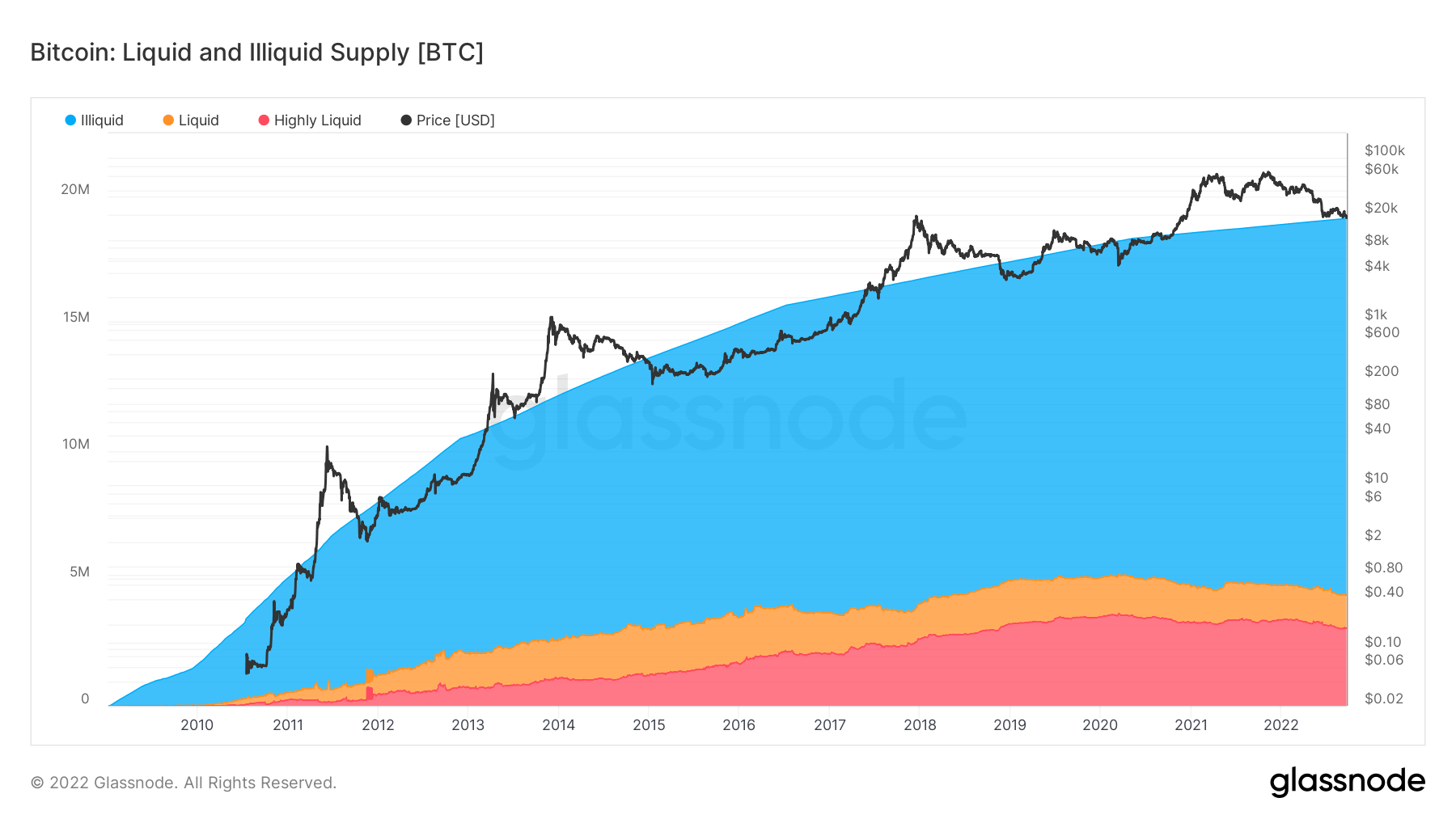

The total supply held by illiquid, liquid, and highly liquid entities. The liquidity of an entity is defined as the ratio of cumulative outflows and inflows over the entity’s lifespan. An entity is considered to be illiquid / liquid / highly liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively.

Bitcoin is closing in on 15 millionth bitcoin becoming illiquid; these are coins kept offline in hot or cold storage wallets. The circulating supply is around 19 million, with a staggering amount of the illiquid supply currently sitting at 79%.

This metric also breaks down the liquid and highly liquid supply. Since the beginning of the year, liquid and highly liquid BTC has decreased by around 400k BTC and become illiquid, which is bullish over the long term as fewer investors are speculating over the asset and holding it as a store of value.

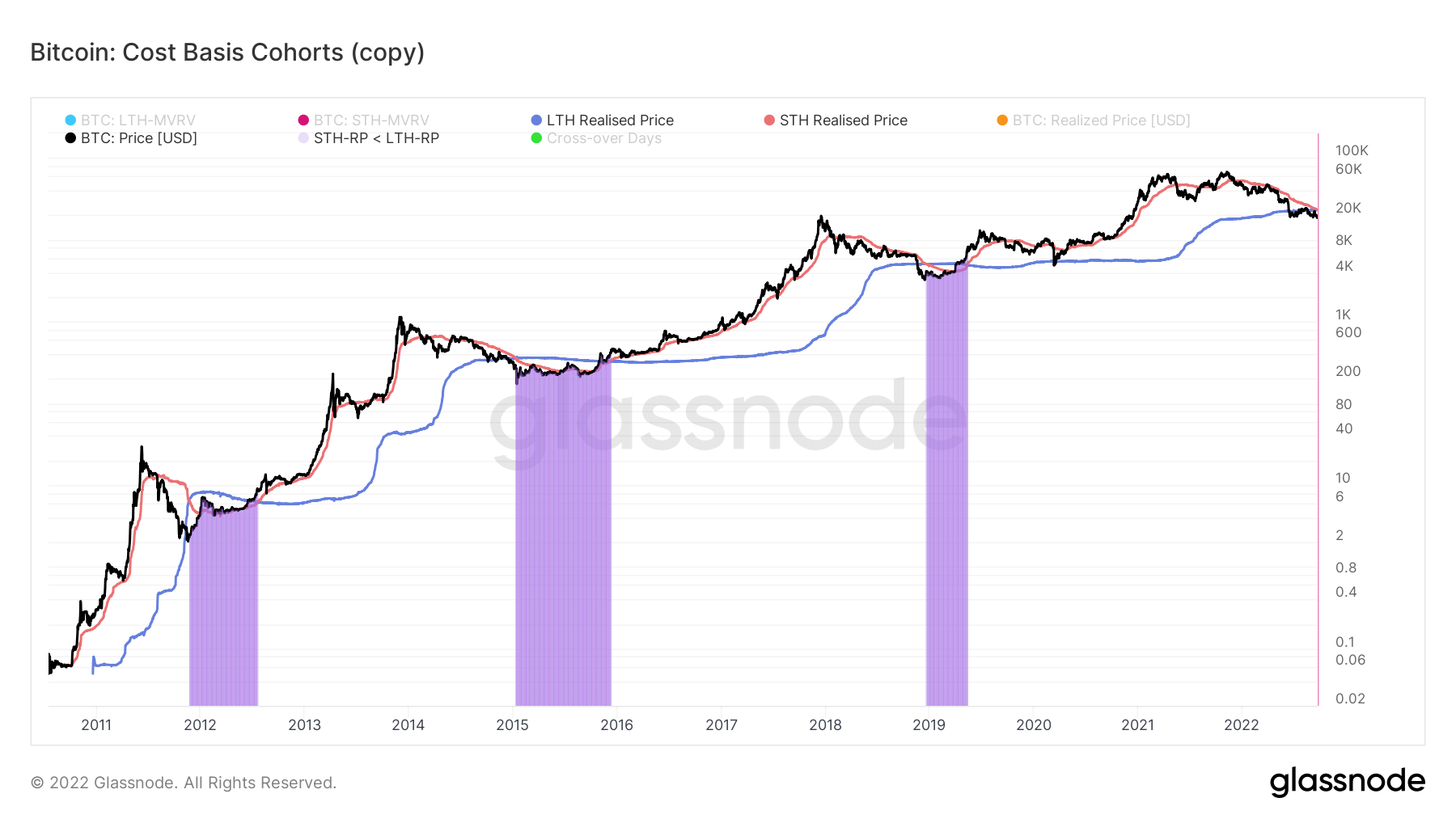

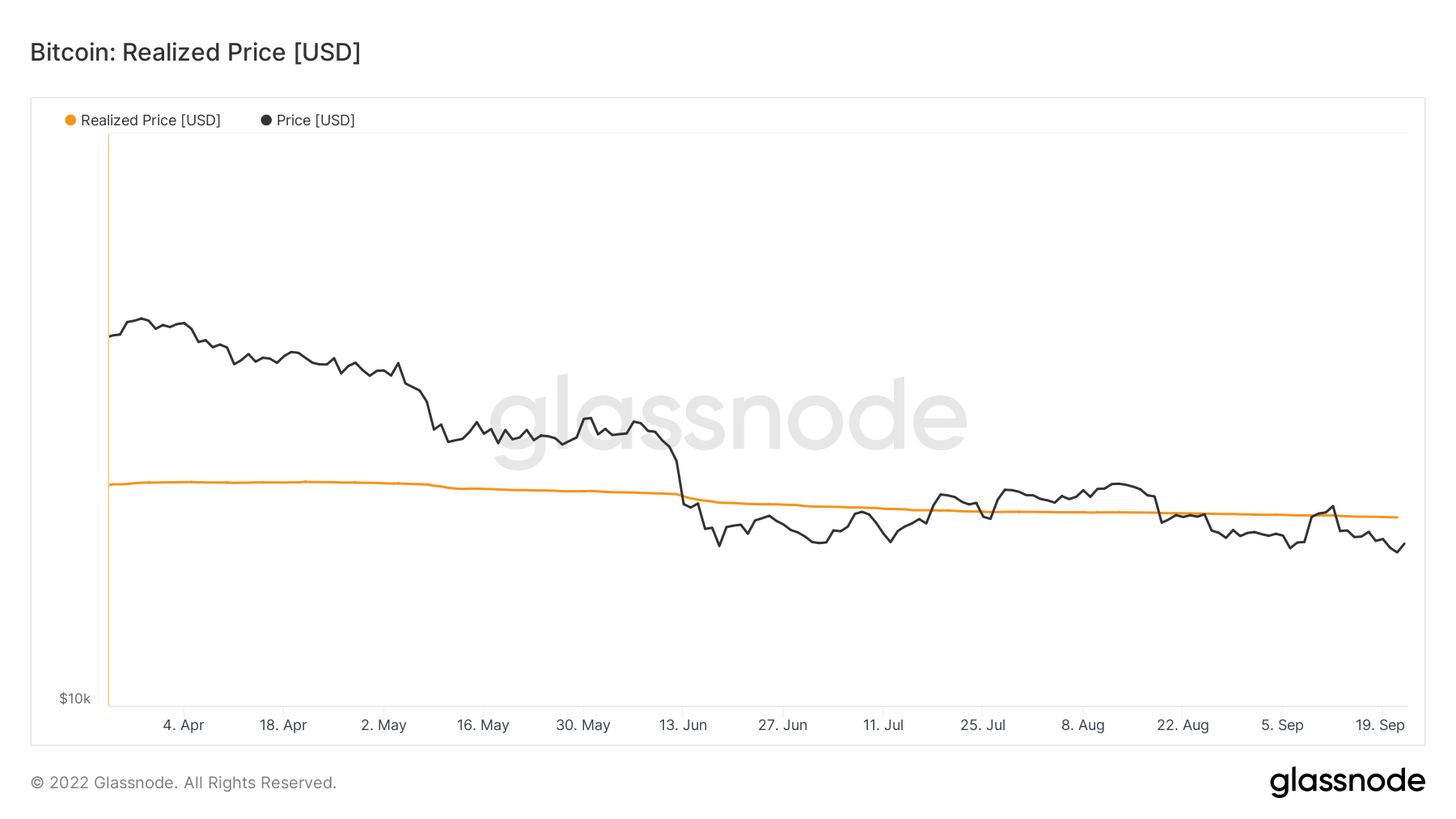

Realized price was the aggregate price when each coin was last spent on-chain. Further analyzing short and long-term holder cohorts, we can calculate the realized price to reflect the aggregate cost basis of each group.

This metric calculates the ratio between LTH and STH realized price:

During bear markets, as the price continues to fall, STH realized price will fall below LTH realized price. When capitulation occurs, highlighted by the purple zone, these events usually happen during late-stage bear markets.

The price has been in a downward spiral for almost a year, since November 2021, and we are yet to cross over; the expectation of this crossover could occur before the end of September. In previous bear market cycles, it usually takes on average 220 days to recover after the crossover.