Money laundering 0.05% of all crypto transactions in 2021: Chainalysis report

Money laundering 0.05% of all crypto transactions in 2021: Chainalysis report Money laundering 0.05% of all crypto transactions in 2021: Chainalysis report

Of all cryptocurrency transactions in 2021, a mere 0.05% can be associated with money laundering. Almost half of all illicit funds are funneled through just a few centralized services, but DeFi is on the rise.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

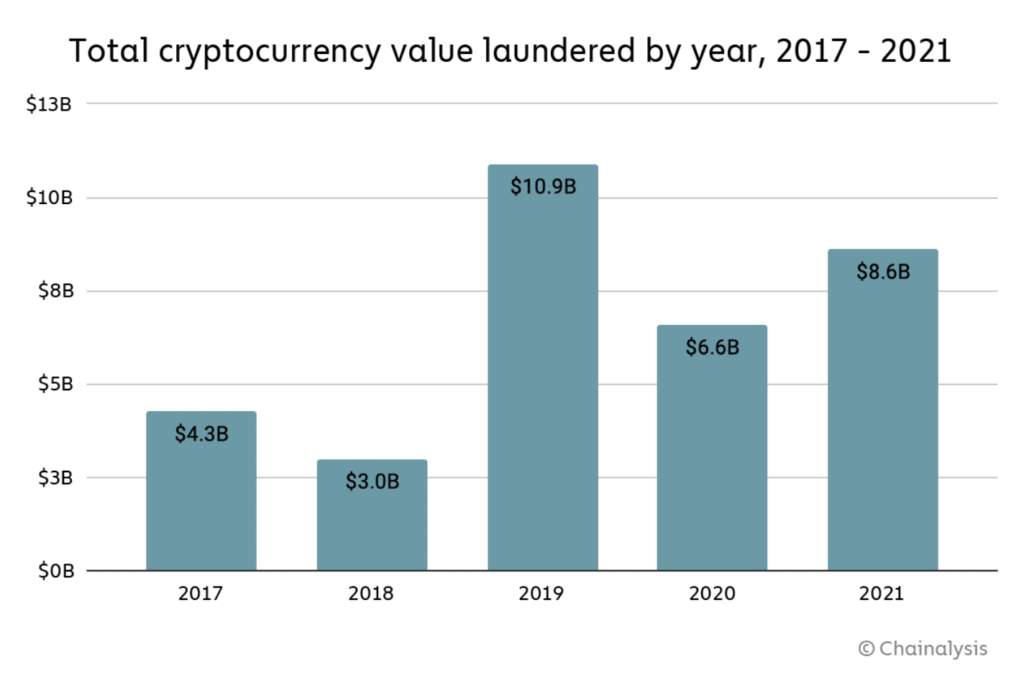

Every year since 2017, blockchain analysis company Chainalysis publishes a report focusing on money laundering and illicit transactions going through the cryptocurrency ecosystem. This year’s report summary shows that while the total amount of laundered money increased by 30%, only a small fraction of all transactions come from illicit activities.

As per the report, cybercriminals dealing in cryptocurrency share one common goal: Move their ill-gotten funds to a service where they can be kept safe from the authorities and eventually converted to cash. That’s why money laundering underpins all other forms of cryptocurrency-based crime.

Nominal 30% increase from 2020

Cybercriminals laundered $8.6 billion worth of cryptocurrency in 2021, a 30% increase from 2020, going by the amount of cryptocurrency sent from illicit addresses to addresses hosted by services.

Despite this, money laundering accounted for just 0.05% of all cryptocurrency transaction volume in 2021, compared to the amount of laundered fiat currency – 5%– that makes up global GDP. This highlights that money laundering is a plague on virtually all forms of economic value transfer.

Money laundering activity in cryptocurrency is also heavily concentrated. While billions of dollars’ worth of cryptocurrency moves from illicit addresses every year, most of it ends up at a surprisingly small group of services, many of which appear purpose-built for money laundering based on their transaction histories.

Law enforcement can strike a huge blow against cryptocurrency-based crime and significantly hamper criminals’ ability to access their digital assets by disrupting these services.

DeFi is playing a bigger role

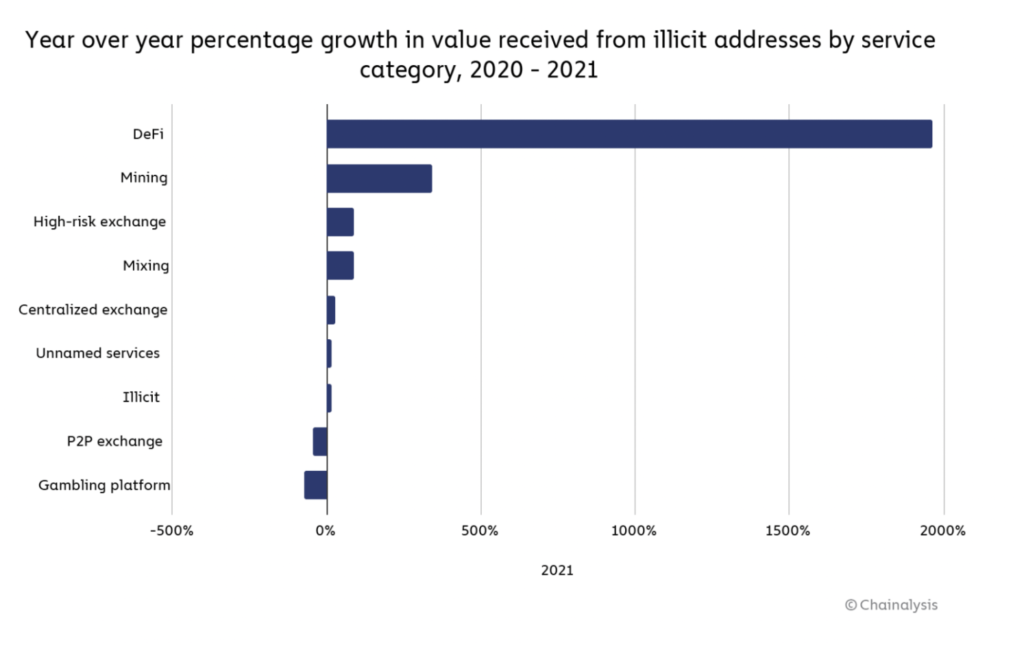

Though the overall percentage of illicit transactions are low, DeFi is increasingly playing a bigger role in money laundering, with decentralized protocols receiving 17% of all funds sent from illicit wallets in 2021, up from 2% the previous year. This translates to a 1,964% year-over-year increase in total value received by DeFi protocols from illicit addresses. Centralized protocols remain more popular, taking in 47% of funds from illicit addresses.

Overall, going by the amount of cryptocurrency sent from illicit addresses to addresses hosted by services, cybercriminals laundered $8.6 billion worth of cryptocurrency in 2021. That represents a 30% increase in money laundering activity over 2020, though such an increase is unsurprising given the significant growth of both legitimate and illicit cryptocurrency activity in 2021.

Fiat money laundering 5% of global GDP

Cybercriminals have laundered over $33 billion worth of cryptocurrency since 2017, with most of the total over time moving to centralized exchanges. For comparison, the UN Office of Drugs and Crime estimates that between $800 billion and $2 trillion of fiat currency is laundered each year — as much as 5% of global GDP.

Addresses associated with theft sent just under half of their stolen funds to DeFi platforms – over $750 million worth of cryptocurrency in total. North Korea-affiliated hackers in particular, who were responsible for $400 million worth of cryptocurrency hacks last year, used DeFi protocols for money laundering quite a bit.

This may be related to the fact that more cryptocurrency was stolen from DeFi protocols than any other type of platform last year. Chainalysis also sees a substantial amount of mixer usage in the laundering of stolen funds.

Scammers, on the other hand, send the majority of their funds to addresses at centralized exchanges. This may reflect scammers’ relative lack of sophistication.

CoinGlass

CoinGlass

Farside Investors

Farside Investors