Yearn.finance (YFI) plunges to “do or die” support despite positive developments

Yearn.finance (YFI) plunges to “do or die” support despite positive developments Yearn.finance (YFI) plunges to “do or die” support despite positive developments

Photo by Jonas Wurster on Unsplash

Yearn.finance’s governance token (YFI) has been hit hard by the recent downtrend seen across the aggregated cryptocurrency market, with the token now trading down nearly 50 percent from where it was at its peak.

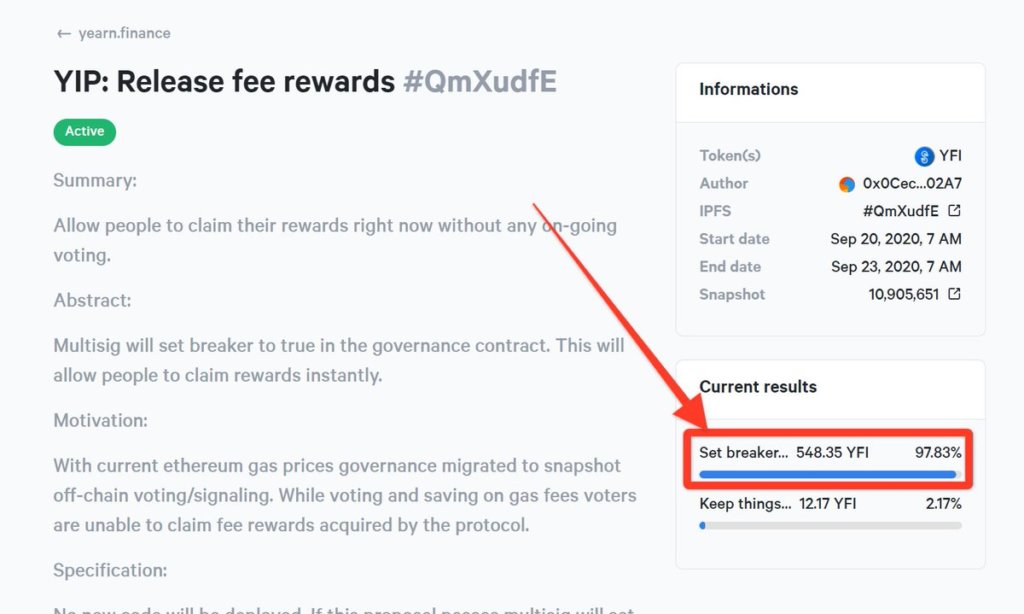

Despite this bearish price action, it is important to note that the Yearn.finance ecosystem is still thriving, and YFI holders may soon be able to receive instant rewards for tokens staked in the governance contract.

This will allow governance participants to claim rewards that have been accumulated throughout the past several weeks.

Although this may not catalyze any shift in the cryptocurrency’s price trend, incentives like this will encourage more users to buy and stake their YFI tokens.

From a technical perspective, one analyst noted that the Yearn.finance token has reached a crucial technical support level. A dip below here would be grim and potentially lead it to see some serious losses.

Yearn.finance governance continues seeing positive developments

Yearn.finance has become a benchmark project within the DeFi ecosystem. Their introduction of yVaults and other projects has been incredibly promising, with the project being one of the largest innovators in the market.

From a governance perspective, the project is also advancing positively, with holders with staked tokens now voting to allow governance participants to claim instant rewards from the pool.

This may incentivize users to be more active in governing the platform, which could, in turn, cause more YFI tokens to be locked within the staking contract.

BlueKirby – an anonymous Yearn.finance advocate – spoke about the governance development in a recent tweet, saying:

“Looks like instant rewards coming in 3 days to YFI staked in governance. – 12,385 YFI addresses – 20.46% in staked in governance.”

YFI price plunges to crucial support

Despite the plethora of positive fundamental developments currently underpinning Yearn.finance, the YFI token’s value has depreciated heavily throughout the past couple of weeks.

After reaching highs of over $40,000, the token’s price has been caught in a strong downtrend that has pushed it down its current price of $23,800.

Cantering Clark, a respected cryptocurrency analyst, explained that the mid-$22,000 region is a critical support level that must be held by buyers.

“If YFI loses this level it likely drags a lot more Defi down with it. I think it has become the benchmark and index much like Bitcoin is. An exit crisis in Defi might only be slowed down by the network congestion. Maybe a built-in safeguard after all.”

A break below this level could arise if the market continues to express immense signs of weakness in the days ahead.

Farside Investors

Farside Investors

CoinGlass

CoinGlass