A simple guide to DeFi vs. CeFi crypto lending and borrowing

A simple guide to DeFi vs. CeFi crypto lending and borrowing A simple guide to DeFi vs. CeFi crypto lending and borrowing

Image by Andreas Breitling from Pixabay

The last two months in crypto have been heavily influenced by passive investing and lending. And given the massive interest from both retail and institutions, it’s not going away anytime soon.

But what most seem to miss is that crypto-lending platforms have been around for years. DeFi projects may have taken the cake now; despite not pioneering the trend.

Firms like Celsius, Crypto.com and Nexo have been offering lending services since last year or even before. While they are more decentralized than banks and traditional methods, the DeFi narrative does not fully capture the range of all crypto-lending options.

In this guide, we explore the various crypto-lending platforms out there; look at risks that the so-termed centralized lending (CeFi) might prevent; and dole out some examples of these.

But first, DeFi.

DeFi what?

DeFi is short for decentralized finance. There’s a very thin line between what’s truly DeFi and what becomes centralized crypto, but the former usually refers to complete peer-to-peer financial systems ranging from lending to flash loans to identity tools.

No middlemen (a crypto firm in this case) or personal information required at all. DeFi also calls for trusting the protocol instead of the project.

It’s booming. Tokens for projects like Compound rose 500 percent three days after launch, while Kyber Network pools locked up $15 million in ETH hours after opening to the public.

Less than 24hrs after launch and 10M+ KNC has been staked ??? pic.twitter.com/AX22Sq9WjG

— Loi Luu (@loi_luu) July 8, 2020

As per CryptoSlate’s DeFi trackers—only eight of the top-40 sector tokens are based on blockchains other than Ethereum. Six of those run on Binance Chain, NEO, or a mainnet, and EOS and Tron dapps boast one project each.

As to why Ethereum dominates. ConsenSys—an ETH venture lab— touts the protocol as one that unlocks liquidity and growth opportunities, increases financial security and transparency, and supports an integrated and standardized economic system.

Overall, $3.3 billion is locked in DeFi projects. 95 percent of that is in Ethereum chains. However, of these, Compound accounts for $2 billion alone, so the metric is not wholly indicative of a strong DeFi ecosystem.

Circling back to lending; next up are a few DeFi projects that offer such a service.

DeFi lending club

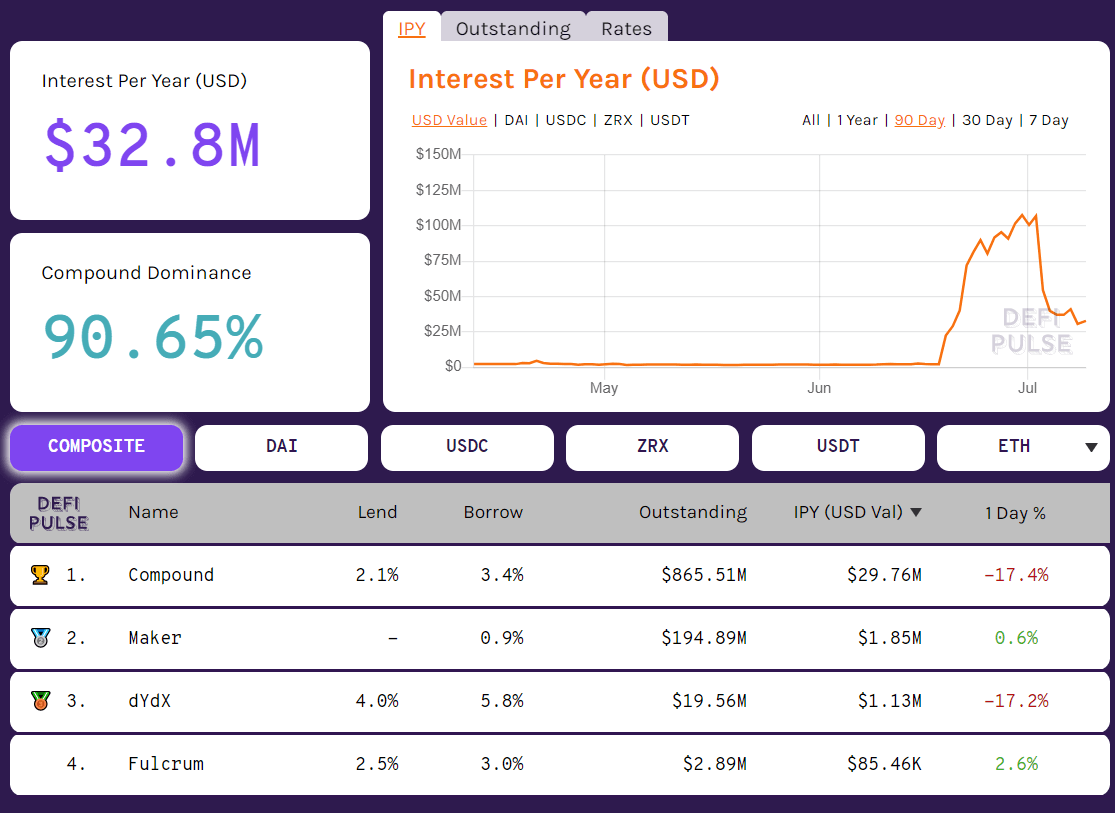

First up is Compound, the arguable posterchild for all things DeFi. The firm stole Maker’s long-held dominance in the DeFi sector.

Compound is non-custodial and allows crypto funds, VCs, NGOs, basically anyone with some crypto to borrow tokens by putting some money upfront.

MakerDAO, offers 0.9 percent interest on holdings, DeFi Pulse notes. This differs from platform to platform—DAI on dy/dx, for instance, pays out a little more than 9 percent a year.

Balancer, Synthetix, and Aave all offer non-custodial lending at variable rates. This makes for attractive, “riskless” profit-making strategies.

CeFi lending

This set is firms like Crypto.com, Nexo, and many others. They operate similarly to neo-banks, calling for a mandatory KYC procedure before any service is offered. While crypto-purists think giving up their identity is anti-ethos, there are some stellar benefits.

Nexo and BlockFi are other such businesses; paying out between 9-11 percent. Gemini custodies the latter.

The highest interest payee is Crypto.com. Site information shows 12 percent on stablecoin deposits with a three-month lockup, and whooping 18 percent if one stakes CRO tokens.

Terror-risks

Even though both CeFi and DeFi are new sectors and have and will be battle-tested in the years to come; risks are present and investors must proceed with caution.

With CeFi, it’s the bank problem again. Holders trust Gemini or Coinbase Custody or BitGo with their assets. All firms have strict audits and security measures in place, but no system is fully-shielded against hackers.

Some may not want to give up their personal details to access money, while some observers think institutionalization in cryptocurrencies is a step backward.

With DeFi, loopholes and a lack of addressing all possible risk measures is a moot point. As seen in April, Maker holders lost $4 million in minutes when ETH prices dropped 20 percent.

There was no technical glitch or software issue on Maker’s part, just a lack of oversight on a very specific collateralization issue.

Another example occurred earlier this month after hackers drained Balancer of $500,000 after exploiting a loophole.

Our investigation of $500k hack from @BalancerLabs multi-token pools with deflationary tokens ?️♂️ https://t.co/yCuYWpBAzM #DeFi

— 1inch.exchange (@1inchExchange) June 29, 2020

Besides, there’s always the fear of terrorists or criminals using up the funds to conduct their illicit activities. This may go against the narrative of everyone accessing financial services, but creates a rather difficult ethical problem.

The Verdict

At this point, it’s difficult to pinpoint one sub-sector over the other. Both DeFi and CeFi offer stellar benefits and some equal disadvantages.

Those understanding and providing money algorithmically might favor DeFi apps. The other might appeal more to the everyday audience who seek a simple, intuitive UX experience and look for ways to earn on their crypto-holdings.

However, one thing’s for sure — the two have unlocked a new paradigm in finance, setting the tone for decades to come and the possibility of a truly open, accessible financial market.

Farside Investors

Farside Investors

CoinGlass

CoinGlass