These 4 notable Ethereum metrics just reached all-time highs

These 4 notable Ethereum metrics just reached all-time highs These 4 notable Ethereum metrics just reached all-time highs

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Investors have been boggled by the recent divergence between Ethereum’s price action and its fundamental growth. The cryptocurrency’s robust on-chain statistics have come about despite it being fully exposed by the downside seen by Bitcoin as of late.

One explanation for this trend is that the explosive growth of the DeFi sector does not immediately lend itself to ETH accruing value, despite driving transaction volume and users to the Ethereum blockchain.

While looking beyond its technical prowess, there are four notable metrics whose value has surged to, or past, their all-time highs.

These metrics indicate that the crypto is well-positioned to see further upside in the long-term.

DeFi sector drives massive Ethereum userbase growth

As CryptoSlate has been reporting, the DeFi sector’s booming popularity has driven massive on-chain growth for Ethereum.

This growth has been gradual over the past several months but went parabolic last week with the highly anticipated launch of Compound (COMP).

COMP’s launch gave rise to a trend called “yield farming” – in which users leverage ERC-20 tokens in order to collect massive DeFi incentives. At one point, these incentives totaled at over 200% on an annual basis.

It is important to note that this trend does not directly lead Ethereum’s price to accrue value. That being said, it has given its fundamental strength a serious boost.

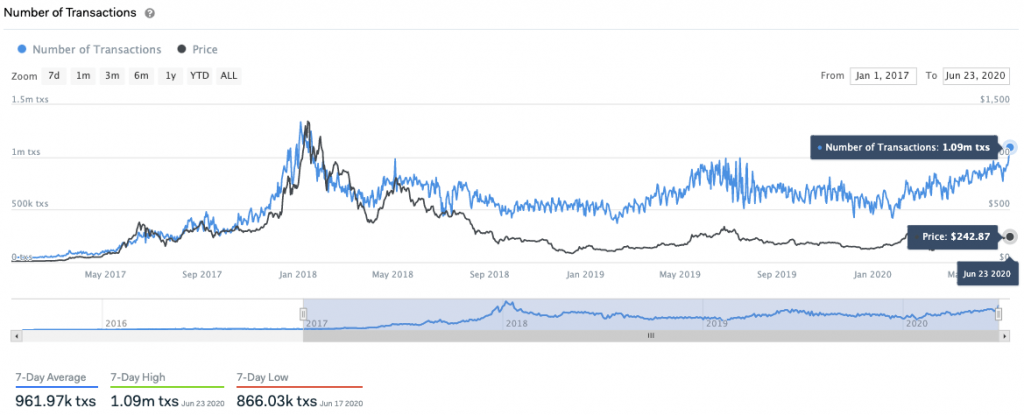

One such metric that shows this is its daily transaction count, which just surged past 1 million for the first time since the peak of the historic bull run in late-2017 and early-2018.

Some individuals – including Ethereum’s co-founder – are concerned that the DeFi trend will come to a harsh end due to it being driven by investors chasing massive returns.

These 4 ETH metrics just reached all-time highs

Daily transaction count isn’t the only fundamental metric that has been surging in recent times.

Spencer Noon – the head of DTC Capital – explained in a recent tweet that the cryptocurrency’s velocity, accounts sending ETH daily, token age consumed, and gas used, have all rocketed higher in recent weeks.

While referencing data from blockchain analytics platform Santiment, he said:

“A growing number of Ethereum on-chain health indicators are at or close to ATHs – Velocity – Accounts sending ETH daily – Token Age Consumed – Gas Used.”

These factors likely won’t be enough for Ethereum to break its incredibly tight correlation with Bitcoin, but they do bolster its macro outlook.

It is also possible that investors making wild gains through various DeFi initiatives will begin cycling these profits into ETH, providing it with some much-needed buying pressure.

Farside Investors

Farside Investors

CoinGlass

CoinGlass