What’s really going on with Tether’s exploding supply? Crypto exec tells all

What’s really going on with Tether’s exploding supply? Crypto exec tells all What’s really going on with Tether’s exploding supply? Crypto exec tells all

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Despite the strong downturn seen in the crypto markets, epitomized by Bitcoin’s 50 percent decline that transpired on Mar. 12, the amount of Tether’s USDT stablecoin in existence has exploded.

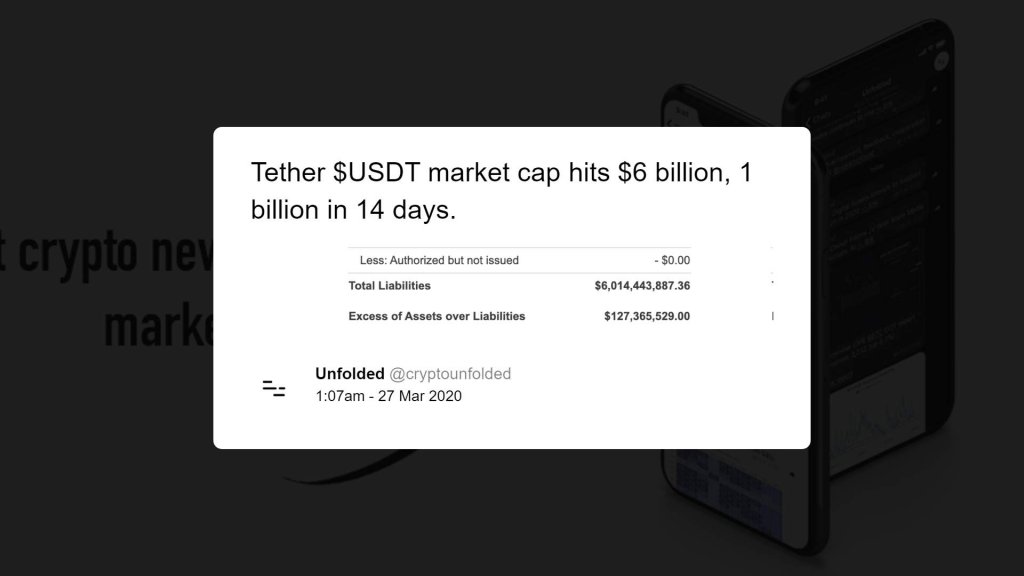

In fact, according to industry news aggregator Unfolded, the market capitalization of the asset recently surpassed $6 billion, with $1 billion added to this metric in the past two weeks alone. In an industry valued at under $200 billion, such inflows are clearly dramatic.

Furthermore, alternative stablecoin solutions — Paxos Dollar, USD Coin, Binance USD, etc. — have been printing dozens of millions of coins, too.

This begs two questions: 1) what is driving this demand for stablecoins? 2) How will the increase in stablecoin supply affect Bitcoin moving forward?

Why has Tether’s market cap gone vertical?

Sam Bankman-Fried, a former institutional investor turned CEO of both derivative exchange FTX and Bitcoin quant fund Alameda, recently chalked up the phenomenon of the rapidly-increasing stock of USDT to three factors:

- Over-the-counter traders, “primarily from Asia,” are looking to acquire USDT. Although Bankman-Fried did not elaborate on this assertion, it is a known fact that Chinese traders use Tether’s solutions because they can’t access the crypto markets in any other way. Some have also suggested that USDT is a good way to move money around the world, even if one doesn’t want to interact with Bitcoin.

- People are selling Bitcoin for USDT to “hedge positions.”

- People are selling Bitcoin for USDT to “reduce risk.”

1) Alright, time for some answers!

My brief explanation is roughly:

There's huge buy-side demand for USDT. It's coming from:

a) OTC flow, primarily from Asia

b) People selling BTC –> USDT to hedge positions

c) People selling BTC –> USDT to reduce risk https://t.co/cFWSQhhAVl— SBF (@SBF_Alameda) March 31, 2020

All this, he wrote, is “drives up [the price of USDT] and in turn supply, so people create.”

Bullish for Bitcoin

Although a majority of the USDT demands being sparked by sell-side demand rather than investors looking to buy BTC with the stablecoin, the strong increase in blockchain dollars could be a boost to the crypto market in the future.

As reported by CryptoSlate previously, Charles Edwards, a digital asset manager, remarked in January that “major changes in Tether’s market capitalization have led Bitcoin’s price over the last 1.5 years.”

This was seemingly proven true when BTC rallied as high as $10,500 by mid-February, following the pseudo-indicator he spotted just a month prior to that.

Also, prior to the nearly 50 percent crash in November 2018 that saw BTC plunge from $6,000 to $3,150, the amount of USDT circulating fell by hundreds of millions; also, prior to the majority of 2019’s 330 percent rally was the printing of hundreds of millions worth of the coins.

Major changes in Tether's Market Cap have led Bitcoin's price over the last 1.5 years.

5 January 2020 was no different.

A healthy signal.

Keep it printing ?️ pic.twitter.com/dfe0dBJzwh

— Charles Edwards (@caprioleio) January 13, 2020

The record-level USDT printing we’re seeing would suggest that Bitcoin is soon going to see a record rally.

Fundamentally, this makes sense; although there are few details as to how one can deposit U.S. dollars and receive USDT in return, the introduction of fiat into this industry through stablecoins should eventually act as a catalyst for Bitcoin’s growth when USDT holders sell their coins for BTC or other digital assets.

CoinGlass

CoinGlass

Farside Investors

Farside Investors