World’s Biggest Crypto Exchange Binance Reports 7,000 Bitcoin Hack

World’s Biggest Crypto Exchange Binance Reports 7,000 Bitcoin Hack World’s Biggest Crypto Exchange Binance Reports 7,000 Bitcoin Hack

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

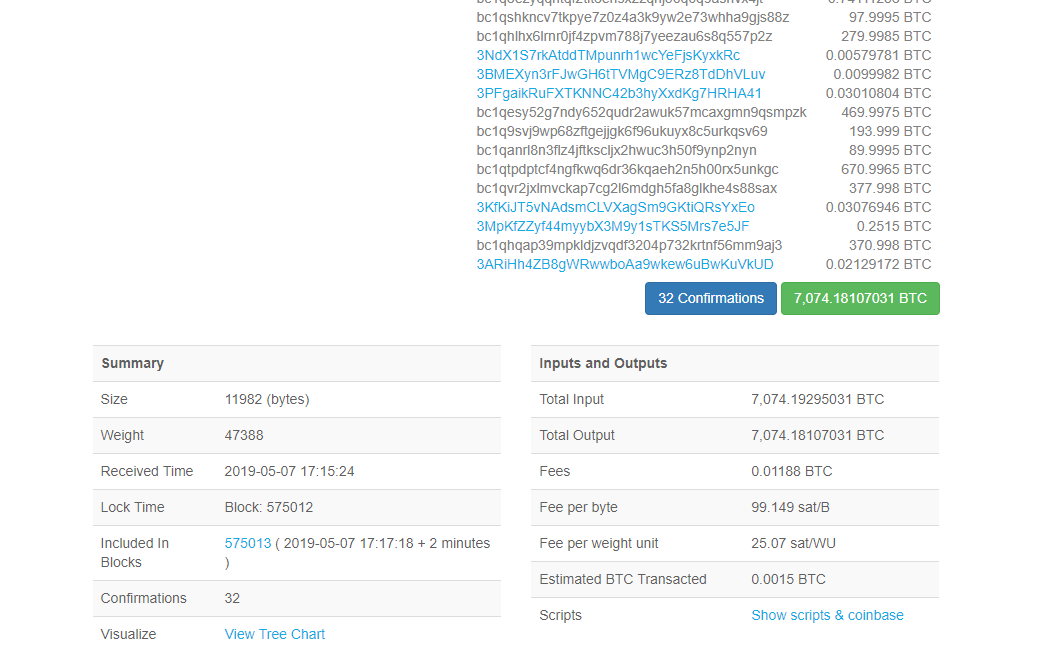

Binance, the world’s largest crypto asset exchange in daily volume, has experienced a security breach involving some 7,000 bitcoin valued at around $40 million.

In an official update released by, Changpeng Zhao, the CEO of Binance better known to the community as CZ, the Binance team said about 2 percent of Binance’s bitcoin holdings were affected.

All other wallets of Binance including cold wallets remain safe the Binance team said, reassuring investors that the 7,000 bitcoin loss will be fully covered by the exchange. The team said.

“Binance will use the #SAFU fund to cover this incident in full. No user funds will be affected. We must conduct a thorough security review. The security review will include all parts of our systems and data, which is large. We estimate this will take about ONE WEEK. We will post updates frequently as we progress.”

Until the investigation comes to an end, the Binance team said that all deposits and withdrawals “will need to remain suspended,” asking users to be understanding of the situation.

Sophisticated Attack Hits Binance, Importance of Backup and Security

Since its inception, Binance has emphasized the importance of security, cold storage backup, and transparency.

The funds reportedly stolen by hackers were withdrawn from Binance’s hot wallet, which is referred to a crypto asset wallet that is connected to the internet.

Not the best of days, but we will stay transparent. Thank you for your support!https://t.co/Y1CQOatEpi

— CZ Binance (@cz_binance) May 7, 2019

Cold wallets–crypto asset wallets that are kept offline out of reach of potential hackers–of the exchange remain secure.

Any storage of information of data that is connected to the internet is vulnerable to a security breach and as such, despite strict protocols and high standard security measures in place, hot wallets can fall victim to sophisticated hacking attacks.

As the Binance team explained:

“We have discovered a large scale security breach today, May 7, 2019 at 17:15:24. Hackers were able to obtain a large number of user API keys, 2FA codes, and potentially other info. The hackers used a variety of techniques, including phishing, viruses and other attacks. We are still concluding all possible methods used. There may also be additional affected accounts that have not been identified yet.”

Major exchanges often store the majority of user funds in cold wallets to ensure that user funds remain safe and that in an unlikely event of a hacking attack, exchanges can compensate users.

Will it affect Bitcoin?

Over the long run, as the infrastructure supporting crypto assets improves, the tools used by hackers will also become more sophisticated, advanced, and complex.

A proactive approach of exchanges to prioritize security and transparency would be the only way to prevent large-scale hacking attacks or minimize the effect of security breaches on users.

Following the security breach, the bitcoin price has slightly declined by 0.16 percent while other major crypto assets in the likes of Bitcoin Cash (BCH), Litecoin (LTC), and Binance Coin (BNB) recorded losses in the range of 4 to 10 percent.

Bitcoin Market Data

At the time of press 4:10 pm UTC on Dec. 7, 2019, Bitcoin is ranked #1 by market cap and the price is up 0.63% over the past 24 hours. Bitcoin has a market capitalization of $103.02 billion with a 24-hour trading volume of $17.63 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 4:10 pm UTC on Dec. 7, 2019, the total crypto market is valued at at $182.25 billion with a 24-hour volume of $54.76 billion. Bitcoin dominance is currently at 56.24%. Learn more about the crypto market ›

CoinGlass

CoinGlass

Farside Investors

Farside Investors