$540 million worth of Ethereum (ETH) liquidated as ‘shorts’ punished

$540 million worth of Ethereum (ETH) liquidated as ‘shorts’ punished $540 million worth of Ethereum (ETH) liquidated as ‘shorts’ punished

Traders are piling in on the world’s second-largest cryptocurrency. But leverage is costing them millions of dollars.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Over $542 million worth of Ethereum (ETH) positions were liquidated last night on the back of the asset reaching all-time highs, data from markets tool Bybt showed.

139,079 traders were liquidated in all, while the largest single liquidation order happened on was an ETH trade for $74.5 million on crypto exchange Huobi.

Inside the Ethereum rampage

‘Liquidations,’ for the uninitiated, occur when leveraged positions are automatically closed out by exchanges/brokerages as a “safety mechanism.”

Futures and margin traders—who borrow capital from exchanges (usually in multiples) to place bigger bets—put up a small collateral amount before placing a trade. If the market moves against them, the collateral is fortified and the position said to be ‘liquidated.’

Yesterday, ETH traders took the brunt of these liquidations. Bybt shows over $542 million (159,000 ETH) was liquidated as traders bet on even higher prices. Of that chunk, traders “short” on the asset (meaning those betting on lower prices) accounted for $275 million while traders “long” on the asset (those betting on higher prices) accounted for the remaining.

How did both longs and shorts get liquidated you ask? That’s likely because traders used high leveraged with a very close liquidation price. As the notoriously volatile crypto market ranged, both longs and shorts were obliterated.

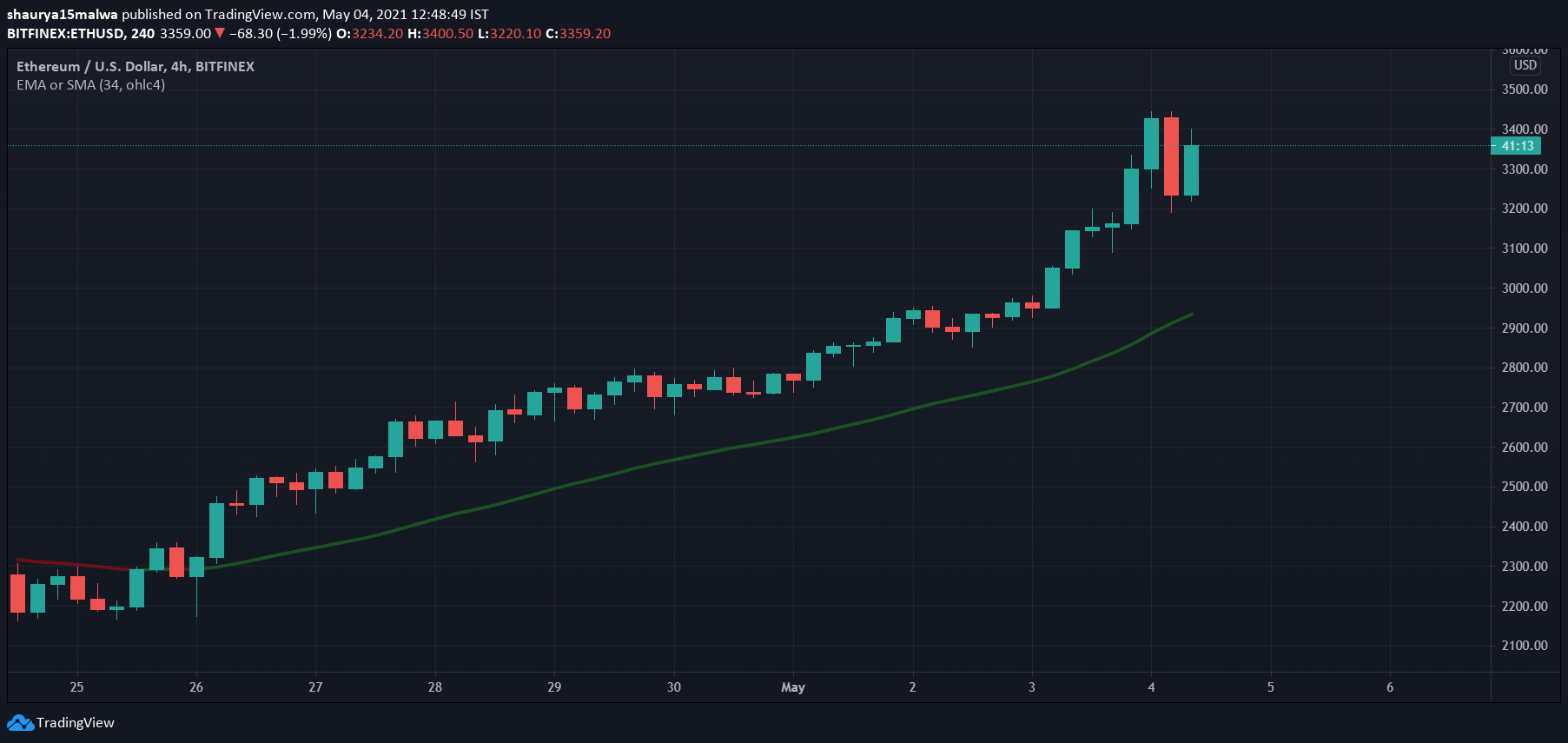

And range it did. As the below image shows, ETH reached a high of $3,440 before falling over $350 in the US hours, reaching as low as $3,100 on some exchanges. It has since regained the $3,370 level in the Asian hours.

As such, the asset crossed the $3,300 mark yesterday to set a new all-time highs—becoming more valuable than the US financial institution Bank of America in the process. The move also made Ethereum creator and co-founder Vitalik Buterin one of the world’s youngest billionaires yesterday.

Congratulations @VitalikButerin ?

How it started How it's going pic.twitter.com/KLf18O6jtx— wolfofethereum.eth? (@LUKACACIC) May 3, 2021

Meanwhile, traders of other cryptocurrencies saw big capital losses as well. Bitcoin, the world’s largest crypto asset by market cap, saw $449 million in liquidations, followed by XRP traders ($136 million), Dogecoin traders ($85 million), and Ethereum Classic traders ($22 million).

Over $1.45 billion was liquidated in all. But for some, it was just another day in crypto land.