Ethereum breaks $3,000—it’s now valued more than Bank of America

Ethereum breaks $3,000—it’s now valued more than Bank of America Ethereum breaks $3,000—it’s now valued more than Bank of America

Demand for the world’s most-used blockchain seems to be growing each day.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Ethereum, the world’s most-used blockchain by daily transactions and the second-largest by market cap, broke the $3,000 price level in the early hours Monday, data from multiple sources shows.

Its native token, ETH, powers the network and facilitates millions of other decentralized applications (dApps) and protocols that run atop. With the rise of decentralized finance (DeFi)—over $70 billion is now locked in such apps—and other ground-breaking innovations in the past year, demand for ETH continues to grow.

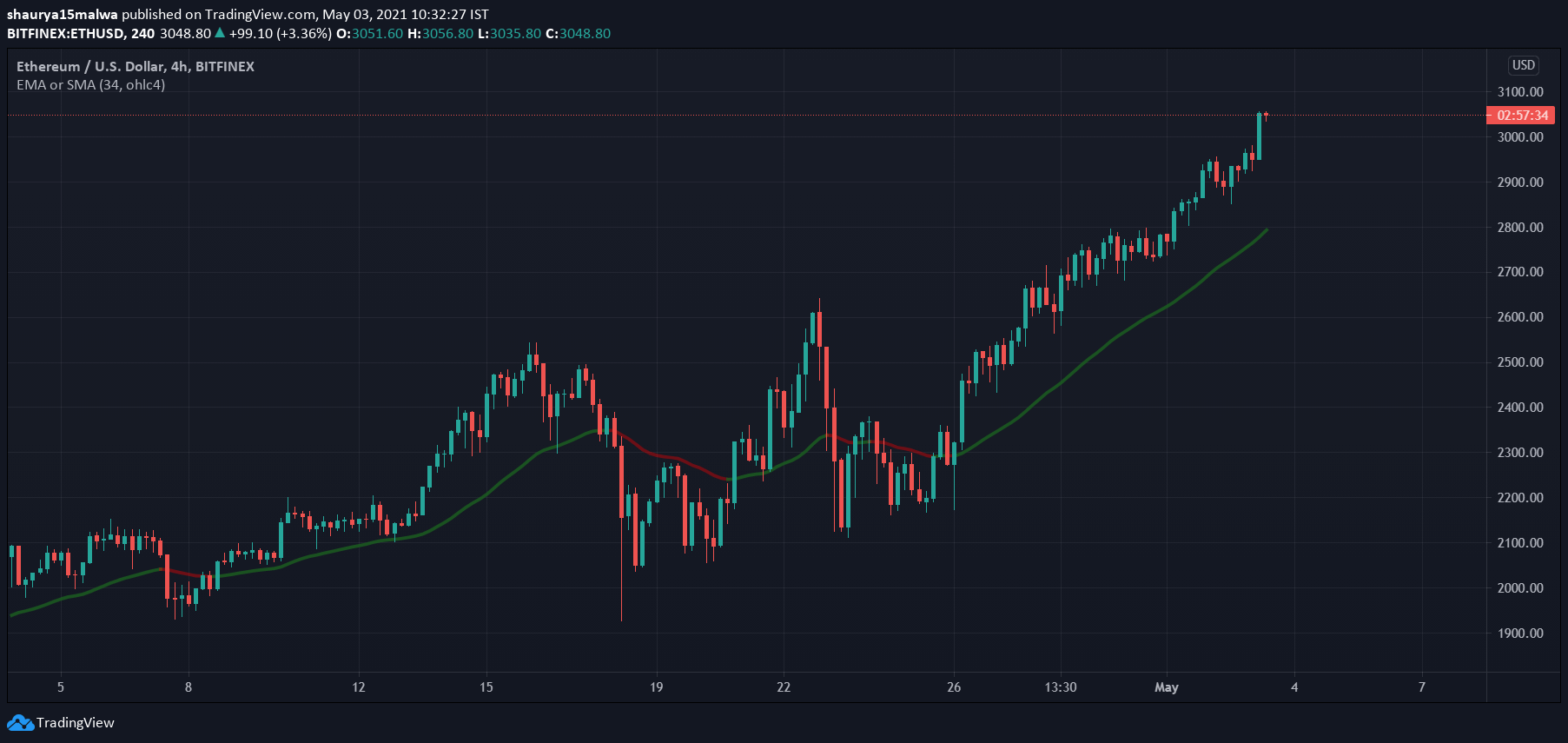

As the below image shows, ETH broke out of its $2,600 resistance zone last week and inched upwards steadily. It saw some resistance at the $2,950 level, but saw massive buys in the Asian hours today. As such, ETH remains in a strong uptrend, as the exponential moving average, a popular tool used by traders to determine market trend based on previous average prices, shows.

The rally means ETH is up over 300% for the year so far, and up by over 1,300% in the past year (even trading at $90 in mid-March after a broader market plunge).

Institutional games and surpassing BoA

Some wealth managers say the move is “catch-up” to Bitcoin’s price action over the past year. “At first, the rally was really led by Bitcoin because like a lot of the institutional investors came into the space, that would be their natural first port of call,” said James Quinn, managing director at crypto fund Q9 Capital.

He added:

“But as the rally has matured over the last six months, you have DeFi and a lot of DeFi is built on Ethereum.”

Several Ethereum-based exchange-traded funds (ETFs) and products (ETPs) have launched in the past year, suggesting there was a significant amount of institutional inflows into the asset apart from Bitcoin.

Meanwhile, some on Twitter pointed out Ethereum’s total market cap, a measure of price and the total supply (115 million at press time) now surpassed those of the Bank of America, one of the world’s biggest financial institutions.

#Ethereum has a bigger market cap than Bank Of America ?? historical moment in history pic.twitter.com/R29QJDBpWc

— BAE (@Dougy_buller) May 3, 2021

An iconic day for many in the crypto space.

Ethereum Market Data

At the time of press 1:07 pm UTC on May. 3, 2021, Ethereum is ranked #2 by market cap and the price is up 7.69% over the past 24 hours. Ethereum has a market capitalization of $365.48 billion with a 24-hour trading volume of $34.3 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 1:07 pm UTC on May. 3, 2021, the total crypto market is valued at at $2.31 trillion with a 24-hour volume of $133.38 billion. Bitcoin dominance is currently at 47.62%. Learn more about the crypto market ›

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass