Yearn.finance to buyback YFI from open market as YIP-54 passes

Yearn.finance to buyback YFI from open market as YIP-54 passes Yearn.finance to buyback YFI from open market as YIP-54 passes

Photo by Marek Piwnicki on Unsplash

The token that rallied 64,000% in 2020 might see more price spikes ahead after a recent proposal was passed this weekend.

Yearn.finance, the decentralized credit lending, loans, swaps, and yield aggregation protocol, saw its latest proposal — the YIP-54 — passed by its community members on Sunday that allows the protocol to buyback YFI from the open market as part of its plan to “Formalize Operations Funding.”

99.85% of all voters staked a total of 935.4 YFI, $18 million at current prices, to vote “yes” for the operations fund to be established. Only 0.15%, a tiny 1.38 YFI, were on the “no” side.

.@iearnfinance proposal to buyback $YFI has 99% approval!

In the past 4 months, Yearn vaults earned ~$3.4M in fees.

Part of this may now be used to conduct actual buybacks (not just burning supply) to reward contributors ?https://t.co/DbyLTRJADC

— Jason Choi (@mrjasonchoi) November 15, 2020

“As the Treasury does not earn YFI, nor is it able to mint YFI, the straightforward way to acquire YFI is to buy back YFI with part of the Operations Fund,” the YIP’s authors wrote in the proposal.

For a decentralized protocol to operate seamlessly, its workers and contributors must be well rewarded to remain motivated and continue to contribute towards the betterment of the ecosystem. However, as the decentralized space does not involve legal contracts, employee benefits, and similar packages as in the real world, it presents a problem for DeFi apps to manage and run their platforms, especially from a workers’ end.

The YIP-54 solves this. By passing an operations budget, Yearn.finance ensures its security and contributor costs (among other costs) are met and places the platform for long-term success.

The breakdown

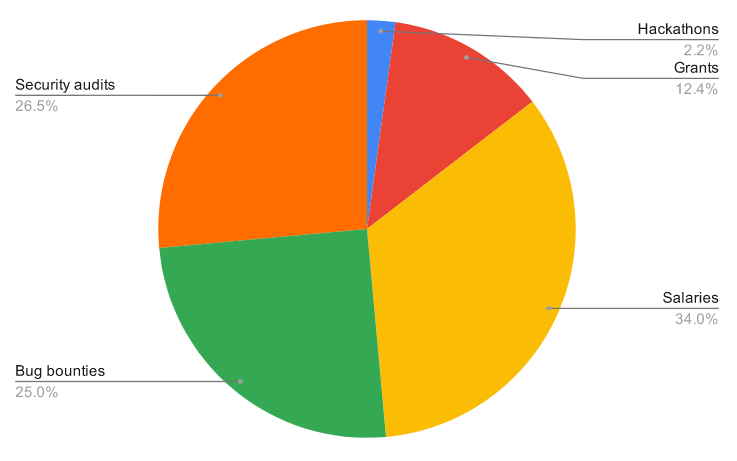

Currently, Yearn’s monthly costs are over $434,000 with half of the operations spending being security related and a greater part of the remainder spent on funding contributors in various forms.

“The proposal is to round this number down to an even 50% and divide the Treasury funds equally between YFI staking rewards and Operations.”

To ensure the funds are trackable and all contributors under scrutiny for the work they do and the rewards they receive, Yearn will maintain a quarterly fund audit to prevent any free riders. This will also allow any inherent issues or miscommunication to be pinpointed to the exact person responsible.

Meanwhile, the YIP authors stated that while the proposal would benefit from increasing buy demand for YFI, “the purpose would not be to manipulate YFI price or to engineer long-term YFI price appreciation.”

They added:

“Rather, the purpose would be to add YFI to the Operations Fund in order to reward contributors through YFI grants.”

Buying YFI is not all either. The proposal has also granted the team to “buy back other assets than YFI” as and when the operations increase and newer products are launched. “The Operations Fund therefore should have the right to buy any asset as required,” the YIP stated.

It’s unlike anything the crypto space has seen before.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass