Yearn.finance (YFI) fell to four digits—but are whales accumulating?

Yearn.finance (YFI) fell to four digits—but are whales accumulating? Yearn.finance (YFI) fell to four digits—but are whales accumulating?

Photo by amanda panda on Unsplash

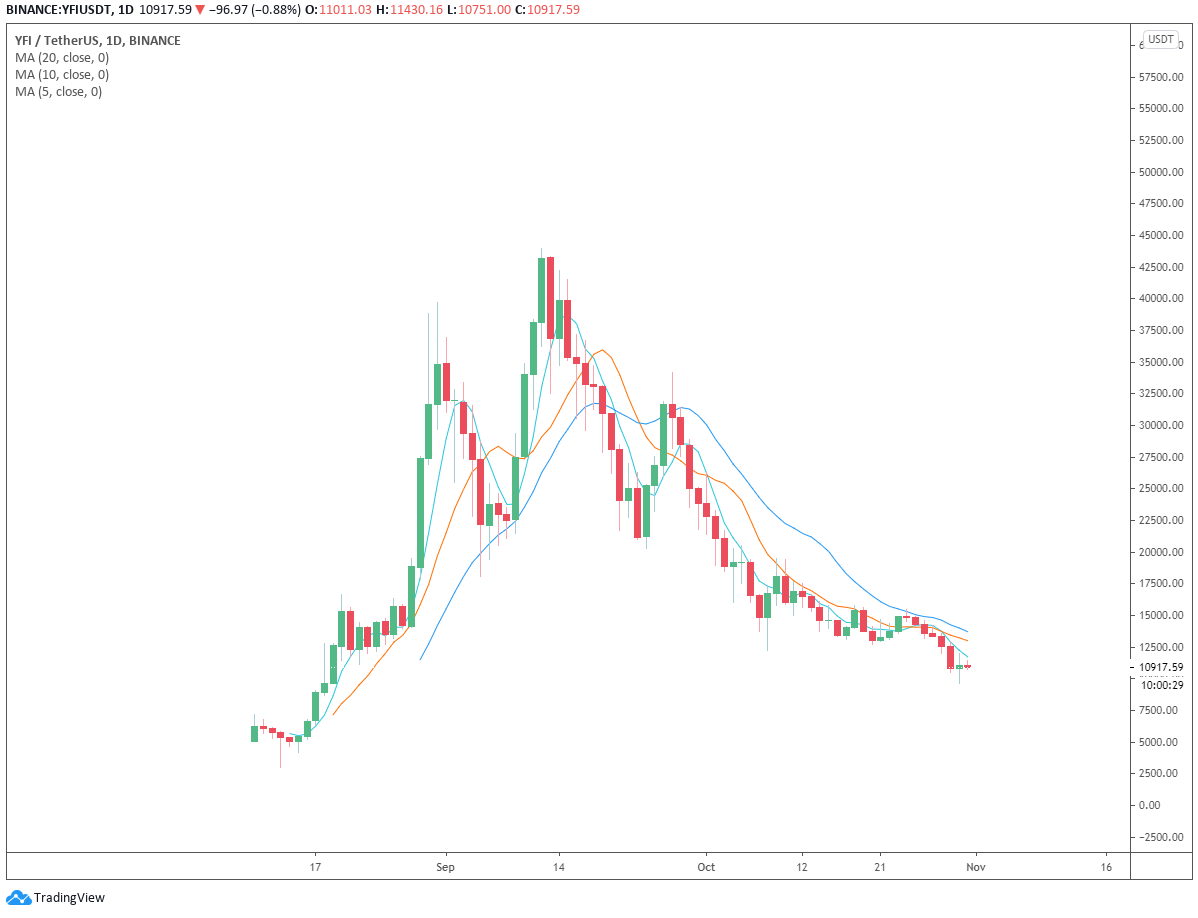

The price of YFI, the native token behind the decentralized finance (DeFi) giant Yearn.finance dropped to double-digits. It has started to recover as the market sentiment around Yearn.finance started to show signs of improvement.

On October 30, the price of YFI dropped to as low as $9,631 on Binance. The DeFi space saw a marketwide pullback, causing many major tokens to plunge.

But in the medium term, there are positive factors that could buoy the sentiment around YFI. They are the potential reaccumulation of whales, new product launches, and post-capitulation recovery.

Whales might start to reaccumulate YFI

Earlier this week, a pseudonymous DeFi investor known as “Future Fund” said Sam Bankman-Fried is the biggest holder of YFI.

Bankman-Fried, who is better known as SBF, is the head of Alameda Research and the CEO of FTX. The investor wrote:

“For everyone that’s mad at SBF for shorting YFI. He is also now the largest holder of YFI at a total of nearly 1800 YFI.”

On October 11, SBF confirmed on social media that he placed a net 200 YFI short. At the current price of $11,000, that is equivalent to $2.2 million. But, a reported 1,800 YFI position is equivalent to $19.8 million, which far exceeds the initial short position.

The reported spot holding could indicate that some whales might be showing signs of reaccumulation.

But, some investors questioned whether reading too far into the trades of whales, like SBF, is important.

“Maybe, just maybe, we are reading too much on all the trades done by Alameda, who has a MARKET NEUTRAL mandate and is an arbitrage-focused trading shop,” a pseudonymous private fund manager said.

A new Yearn.finance product launch

According to “banteg,” a developer at Yearn.finance, the protocol is considering enabling buyback on the v2 vaults. He said:

“Can confirm that buying back YFI is how v2 is currently being structured. Treasury automation needs much more work though.”

Due to the limited supply of YFI, a buyback feature as a part of the v2 vaults could strengthen the value proposition of Yearn.finance over the longer term.

Post-capitulation recovery

Since its peak on September 12, the price of YFI plunged by more than 77%. The price trend demonstrates a capitulation-like phase, where it crashed strongly in a short period.

Santiment, an on-chain market analysis firm, said YFI is showing signs of bullish divergence following the correction. It wrote:

“It appears that YFI is showing some signs of some bullish divergences, based on our research. An increase in whale activity is a good sign, and there appears to be an uptick in active addresses as well.”

Whether Yearn.finance would recover in the near term primarily depends on the overall sentiment around DeFi. So far, the DeFi market is lagging behind Bitcoin, alongside Ethereum.

yearn.finance Market Data

At the time of press 2:17 pm UTC on Nov. 7, 2020, yearn.finance is ranked #46 by market cap and the price is down 5.32% over the past 24 hours. yearn.finance has a market capitalization of $316.18 million with a 24-hour trading volume of $196.46 million. Learn more about yearn.finance ›

Crypto Market Summary

At the time of press 2:17 pm UTC on Nov. 7, 2020, the total crypto market is valued at at $402.59 billion with a 24-hour volume of $81.28 billion. Bitcoin dominance is currently at 63.63%. Learn more about the crypto market ›